Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.05 09:41

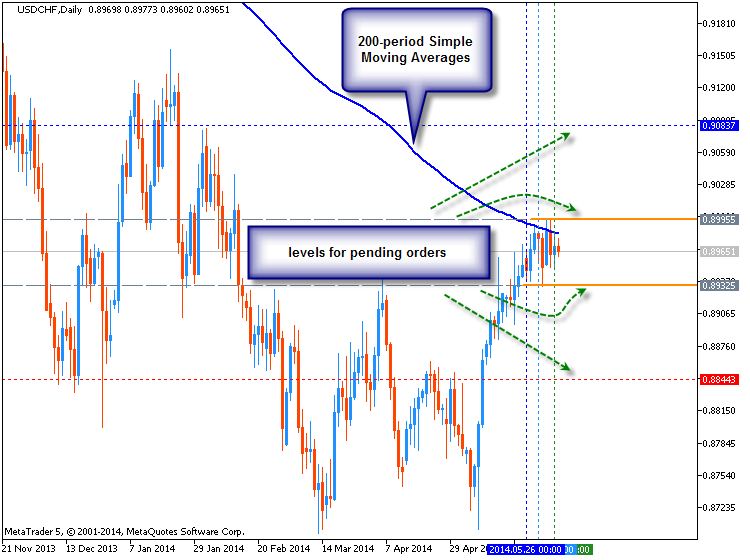

USDCHF Breakout Hindered by 200-Day Moving Average (adapted from dailyfx article)

- The USDCHF break has run into the 200 Day Moving Average.

- Potential buyers could enter upon a confirmed break above the 200 Day MA.

The 200-Day Simple Moving Average

The 200-Day Simple Moving Average is one of the most popular indicators

in the world. When price breaks through a 200 MA on a daily chart, it

can often be seen as a topic of conversation on financial news stations,

websites and newspapers.

It is primarily used to give traders and investors an overall sense of how strong or weak a currency pair is.

Typically, when a currency pair’s price falls below the 200 Day MA, it

is a sign of weakness with a potential for further price decline. And

when a currency pair’s price breaks above the 200 Day MA, it is a sign

of strength with a potential for further price increases.

The chart above shows the recent price action surrounding the 200 Day

MA. We see a large run up in price breaking through multiple resistance

levels until it met this powerful MA line. We have had 6 consecutive

days where price has temporarily broke through the 200 Day MA or price

has come within 10 pips of the line before retreating lower. So this

level is acting as strong resistance.

If price were to remain below the MA, it could propel it lower back into

the pair’s price channel. However, a breakout to the upside could add

yet another reason to buy the USDCHF. Until we witness a larger price

move, we are in a state of limbo.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

3 EMA Crossover:

Author: Simphiwe Ncube