Hi all,

If you have broad stoploss, reversals can easily ruin your account.

Therefore I am afraid of them.

However as traders we only can earn good money from retracements.

How can I get rid of my reversal fear, use a good stoploss, keep myself stand against "the wind of opposite stream"

or just "give up (close position) and pay some due" and come-back and contiune the trend.

Which tactic is good?

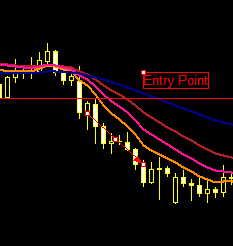

Try trading on a higher timeframe in order to use larger take profit and stop loss targets.

If you trade for example on H1 or H4 or even higher timeframes, your stop loss can be quite large, having at the same time expectations to achieve solid gains.

Also don't forget that there are trend following strategies, apart from the reversal ones that we all would like to catch, but its not always possible.

Can anyone simply answer this question,

if I enter to the trend from the point below (H4) what stoploss should be as points, 500? or 250? or 2xATR or what?

You should put the SL in a price/zone where your strategy says your trade/logic is no longer valid.

thanks but what about huge candles,

huge candles sometimes kill all of your logic and strategy

thanks but what about huge candles,

huge candles sometimes kill all of your logic and strategy

Are you trying to control the market? If yes, your approach is not right.

You should be able to take losses and if you aren't, it means that you are risking too much. This is the reason you can't gain 20% at month over the long period, neither 10%, neither 5% (in average terms)

Hi all,

If you have broad stoploss, reversals can easily ruin your account.

Therefore I am afraid of them.

However as traders we only can earn good money from retracements.

How can I get rid of my reversal fear, use a good stoploss, keep myself stand against "the wind of opposite stream"

or just "give up (close position) and pay some due" and come-back and contiune the trend.

Which tactic is good?

After reversal you can open your trade , a good wait always rewards more instead to open trades everyday

Can anyone simply answer this question,

if I enter to the trend from the point below (H4) what stoploss should be as points, 500? or 250? or 2xATR or what?

You should put your SL right above the last swing high and be ready to achieve at least the same pips as take profit.

You should put your SL right above the last swing high and be ready to achieve at least the same pips as take profit.

thanks

You should put your SL right above the last swing high and be ready to achieve at least the same pips as take profit.

another question can I use this approach, lets say my SL is 500 (because of the swing high) and I aim to get 500 point can I get profit gradually?

like get 100 and re-enter get 100 and re-enter until you get 500 or if detect some kind of reversal and get-out.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi all,

If you have broad stoploss, reversals can easily ruin your account.

Therefore I am afraid of them.

However as traders we only can earn good money from retracements.

How can I get rid of my reversal fear, use a good stoploss, keep myself stand against "the wind of opposite stream"

or just "give up (close position) and pay some due" and come-back and contiune the trend.

Which tactic is good?