You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.08 10:01

EUR/USD forecast for the week of June 9, 2014, Technical AnalysisThe EUR/USD pair fell drastically during the course of the week as we slammed into the 1.35 handle. All things being equal though, the buyer stepped in and formed a bit of a brick wall. With that, it’s obvious that the market has a “floor” in this area, and it’s quite likely that it will be the lowest print that we will see over the course of the summer. In fact, we are starting to believe that we are finding the summer range between the 1.35 handle, and the 1.40 handle. The 1.37 handle does cause some type of reaction though, and that must be paid attention to.

The fact that the European Central Bank went into real negative interest rates, and that the Euro still managed to find its footing suggests to us that the market will not sell off below that level. With that being the case, we feel the longer-term traders can play this more or less is a range bound market, but pullbacks should be thought of as buying opportunities. In fact, we would even suggest going to shorter timeframe charts to find a decent entries based upon supportive candles. Anytime this market pulls back, we would be very interested in what the 4 hour chart is doing. A nice 4 hour supportive candle within the context of the longer-term chart might be a nice way to play this market. Buying a supportive candle on the 4 hour chart while using the backdrop of the weekly chart as your guidelines, might just be the way to go.

We find it very difficult to imagine that this market is going to go above the 1.40 handle anytime soon. It could possibly down the road, but right now it appears that the market is fairly content to go sideways. This particular market has been very choppy even when it’s “trending” so that’s not a huge surprise truthfully. If we did manage to break down below the 1.35 handle however, we would feel this market was coming undone and would become very bearish.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video June 2014

newdigital, 2014.06.10 17:04

New - Great Financial Reads

Gary Gastineau discusses his favorite financial books and articles.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.10 19:47

Off Topic with Irene Aldridge

Alpha Pages: You took great issue with Michael Lewis’ claim that the market is “rigged.” Why?

Irene Aldridge: On the Michael Lewis topic, I suppose I am most disappointed in the pay-for-play quality of the book. Even the fastest best-selling writers can tell you that they are only capable of writing 15 pages per day, at best. To write a 300-page book, [is] a five-month process, at a bare minimum.

Incidentally, at the time Mr. Lewis’s book was released, the trading venue around which much of the book revolves, has been in existence for, wait for it, exactly five months! In other words, Mr. Lewis began to write the novel about his great protagonists and its creation prior to the launch of this trading venue at the center of this book—I really don’t see how he could have covered this in depth. [It appears to be an] elaborate marketing campaign for this trading venue. In other words, the book is marketing masquerading as a fair markets discourse. For a writer like Lewis, stooping so low is a complete disgrace. Markets have moved a long way toward fairness since then, so most of his criticism is completely unfounded.

AP: Is high frequency trading taking the heat for problems caused market structure or regulations?

IA: From what we are seeing, this HFT pre-hedging that boils down to front-running [may have] unfortunately become common practice following the Volcker and Dodd-Frank rules. There still exists a FINRA rule that encourages brokers to avoid front-running, but FINRA is a self-regulatory organization, and the consequences of not following its rules [may not be so harsh]. While most of ABLE Alpha clients have the permission to access the markets directly and, as a result, avoid front-running, many smaller entities are not so lucky and end up losing money. I do not believe that this is what the regulators had in mind when they designed the laws, but these are the unintended consequences.

AP: There is an ongoing argument over whether HFT is a net liquidity maker or taker as opposed to traditional market makers?

IA: I was just presenting at the Princeton Quant Trading conference, where a fellow speaker, [from a] prominent broker discussed how they are forced to spend money to build systems that monitor the number of zeroes human brokers put at the end of their orders simply because brokers so often come to work hung over and unable to focus. Well, needless to say, hangovers do not happen to computers. Overall, the computers are considerably cheaper, more reliable and less demanding than human brokers, so there is absolutely no doubt in my mind that the computerized trading technology, known as HFT, will replace most of the presently-human trading operation at brokers in continuing the digital revolution observed elsewhere in the society.

AP: Will the size of HFT be self-correcting? Will algorithms exploit inefficiencies until they’re gone?

One of our products is the HFT Index, science, not hear-say, based [on a] real-time estimate of aggressive HFT participation in electronic markets of customer choice. According to our estimates, activity level of aggressive HFTs by volume averages 15% to 20% in most markets, although intraday it may spike up 100%, or drop to 0%.

According to the HFT Index, many highly liquid securities have the lowest HFT participation as a percent of overall volume, seldom exceeding 15%, while some other instruments are dominated by the aggressive HFTs. Painting the entire market with a wide 50% HFT brush gives little insight into what we and our clients are actually seeing.Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read June 2014

matfx, 2014.06.04 15:01

High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading Systems By Irene Aldridge

Financial markets are undergoing rapid innovation due to the continuing proliferation of computer power and algorithms. These developments have created a new investment discipline called high-frequency trading. Despite the demand for information on this topic, little has been published to help investors understand and implement high-frequency trading systems—until now.

Written by industry expert Irene Aldridge, High-Frequency Trading offers the first applied "how to do it" manual to building high-frequency systems.Covering sufficient depths of material to thoroughly pinpoint issues at hand, High-Frequency Trading leaves mathematical complexities to their original publications, referenced throughout the book.

Page by page, this accessible guide:

Discusses the history and business environment of high-frequency trading systems

Reviews the statistical and econometric foundations of the common types of high-frequency strategies

Examines the details of modeling high-frequency trading strategies

Describes the steps required to build a quality high-frequency trading system

Addresses the issues of running, monitoring, and benchmarking high-frequency trading systems

Along the way, this reliable resource skillfully high-lights numerous quantitative trading strategies—from market microstructure and event arbitrage to deviations arbitrage—and puts the creation and management of portfolios based on high-frequency strategies in perspective.

High-frequency trading is a difficult, but profitable, endeavor that can generate stable profits in various market conditions. But solid footing in both the theory and practice of this discipline are essential to success. Whether you're an institutional investor seeking a better understanding of high-frequency operations or an individual investor looking for a new way to trade, this book has what you need to make the most of your time in today's dynamic markets.

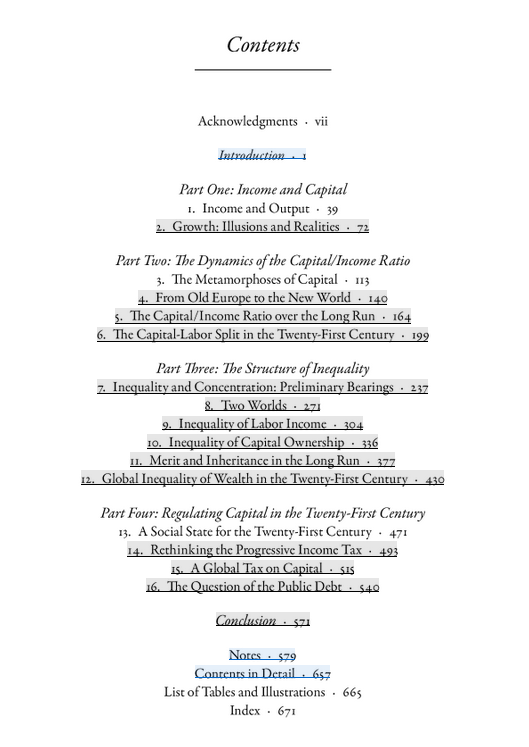

Capital in the Twenty-First Century

What are the grand dynamics that drive the accumulation and distribution of capital? Questions about the long-term evolution of inequality, the concentration of wealth, and the prospects for economic growth lie at the heart of political economy. But satisfactory answers have been hard to find for lack of adequate data and clear guiding theories. In Capital in the Twenty-First Century, Thomas Piketty analyzes a unique collection of data from twenty countries, ranging as far back as the eighteenth century, to uncover key economic and social patterns. His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality.

Piketty shows that modern economic growth and the diffusion of knowledge have allowed us to avoid inequalities on the apocalyptic scale predicted by Karl Marx. But we have not modified the deep structures of capital and inequality as much as we thought in the optimistic decades following World War II. The main driver of inequality--the tendency of returns on capital to exceed the rate of economic growth--today threatens to generate extreme inequalities that stir discontent and undermine democratic values. But economic trends are not acts of God. Political action has curbed dangerous inequalities in the past, Piketty says, and may do so again.

A work of extraordinary ambition, originality, and rigor, Capital in the Twenty-First Century reorients our understanding of economic history and confronts us with sobering lessons for today.

-----

Thomas Piketty on Economic Inequality

"Every now and then, the field of economics produces an important book; this is one of them," writes Tyler Cowen in his Foreign Affairs review of Thomas Piketty's Capital in the Twenty-First Century. "Piketty's tome will put capitalist wealth back at the center of public debate, resurrect interest in the subject of wealth distribution, and revolutionize how people view the history of income inequality."

But Cowen deems Piketty's main prescription, a proposal for the global taxation of wealth, "an unsatisfying conclusion to a groundbreaking work of analysis that is frequently brilliant -- but flawed, as well."

Justin Vogt, deputy managing editor of Foreign Affairs, recently sat down with Piketty to discuss his analysis of inequality and his controversial policy proposals.

The Evaluation And Optimization of Trading Strategies

It would be an understatement to say that the world has changed dramatically in the sixteen years since the first edition of Design, Testing, and Optimization of Trading Systems was published in 1991. With all of the changes in communications, technology, and trading styles, a thorough and comprehensive working knowledge of how to properly design and test strategies has never been more important than it has become in today's extremely competitive markets. Robert Pardo argues that a trading strategy can only be properly evaluated and successfully traded when profit and risk have been measured precisely and accurately—which can only be done through computerized testing. In this updated and revised edition of his classic work, Pardo, a professional money manager and renowned expert in the design and testing of trading strategies and computerized trading applications, provides a clear-cut and specific road map for traders who want to transform a trading idea into a tested, verified, properly capitalized, and profitable automated trading strategy.

Pardo shows that the benefits of correct testing and optimization vastly outweigh the effort required to learn and master their proper application, and sets forth in detail the correct way to formulate, test, and evaluate a trading strategy. He explains how to properly optimize a trading strategy, incorporate out-of-sample data in the testing of a strategy, perform Walk-Forward Analysis, develop a trading strategy profile, and judge real-time trading performance with respect to the trading strategy profile developed via historical testing. In addition, he identifies the symptoms of overfitting—optimization that has "gone bad" and resulting in false conclusions and offers guidelines to avoid it.

The trading game has never been as large or as lucrative as it is today. Nor have the markets ever been more efficient than they are today. Yet traders the world over continue to make profits. Why? They have found an edge. For anyone planning to employ algorithmic or mechanical strategies in their trading, this book presents, in a straightforward and accessible style, the edge that you can use to obtain and enjoy the fruits of profitable trading.

by Michael Duane Archer

How to profit from news that moves the Forex market

Trade the News in Forex shows readers everything they need to know to profitably trade specific Forex news events. It begins with a discussion of what constitutes Forex news, then highlights several common news trading techniques and outlines how broker dealers have worked to counter these measures. The author covers several more sophisticated techniques and systems, directs readers to a multitude of resources available, and outlines how to combine these techniques into a current trading strategy. There is money to be made trading Forex news, and this book will show readers exactly how.

Michael Archer (Golden,CO) has been an active Forex and commodity futures and Forex trader for over 30 years. He is the author of Getting Started in Forex Trading Strategies and coauthor of the first Getting Started in Currency Trading, Second Edition, The Forex Chartist Companion, and Charting the Major Forex Pairs, all from Wiley. He hosts the Forex Web site.

The Mental Strategies Of Top Traders

An honest depiction of the challenges of trading and a clear explanation of what it takes to succeed

Trading tends to be a winner-take-all activity where a small number of traders are very successful, while the majority either lose money or generate relatively small profits. In The Mental Strategies of Top Traders, author Ari Kiev identifies and analyzes the characteristics of successful traders and shows you how to cultivate these same characteristics.

Successful trading, Kiev asserts, requires an unusual and sometimes contradictory blend of intellectual and psychological abilities, including the willingness to take risks, but in a very controlled manner; the discipline to develop high-conviction trading ideas in the face of unpredictable markets and incomplete information; as well as a strong drive to win, but also accept failure. Here, you'll discover how to achieve all this, and much more.

- Provides advice and solutions for traders struggling with today's volatile and stressful markets

- Authoritatively identifies key mental strategies of top traders

- Written by Ari Kiev, a highly respected figure in the professional trading community

- Analysis is supported by comments from contemporary traders and portfolio managers, many of whom struggled with the markets of 2008

Designed with the serious trader in mind, this book will put you in a better position to excel in today's tumultuous markets.

Unlike most technical analysis books, Gerald Appel's Practical Power Tools! offers step-by-step instructions virtually any investor can use to achieve breakthrough success in the market.

Appel illuminates a wide range of strategies and timing models, demystifying even advanced technical analysis the first time.

Among the models he covers: NASDAQ/NYSE Relative Strength, 3-5 Year Treasury Notes, Triple Momentum, Seasonality, Breadth-Thrust Impulse, and models based on the revolutionary MACD techniques he personally invented.

Appel covers momentum and trend of price movement, time and calendar cycles, predictive chart patterns, relative strength, analysis of internal vs. external markets, market breadth, moving averages, trading channels, overbought/oversold indicators, Trin, VIX, major term buy signals, major term sell signals, moving average trading channels, stock market synergy, and much more.

He presents techniques for short-, intermediate-, and long-term investors, and even for mutual fund investors.

by Kathy Lien

Written by Kathy Lien—chief strategist for the number one online currency broker in the world—Day Trading the Currency Market reveals a variety of technical and fundamental profit-making strategies for trading the currency market, and provides a detailed look at how this market actually works. It contains actionable information and strategies, which can help you enter this highly competitive arena with confidence and exit with profits.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read February 2014

newdigital, 2014.02.14 14:53

Millionaire Traders: How Everyday People Are Beating Wall Street at Its Own Game

by Kathy Lien

Trading is a battle between you and the market. And while you might not be a financial professional, that doesn't mean you can't win this battle.Through interviews with twelve ordinary individuals who have worked hard to transform themselves into extraordinary traders, Millionaire Traders reveals how you can beat Wall Street at its own game.Filled with in-depth insights and practical advice, this book introduces you to a dozen successful traders-some who focus on equities, others who deal in futures or foreign exchange-and examines the paths they've taken to capture considerable profits.

With this book as your guide, you'll quickly become familiar with a variety of strategies that can be used to make money in today's financial markets. Those that will help you achieve this goal include:

===============

Other books by Kathy Lien :

===============

Kathy Lien :

Good Saturday, here are some longer form reads for your weekend reading pleasure:

• Bubble, Bubble, Toil and Trouble: The Costs and Benefits of Market Timing (Musings on Markets)

• The Zen of Gen X: How We Went From Jaded to Sated (The Weeklings)

• Only Apple (Daring Fireball) see also Tim Cook, Making Apple His Own (NY Times)

• The House of Mondavi: How an American Wine Empire Was Born (LongReads)

• A Rare Peek Inside Amazon’s Massive Wish-Fulfilling Machine (Wired)

• How a Lawsuit Over Hot Coffee Helped Erode the 7th Amendment (Priceonomics)

• Artificial Intelligence Raises New Hope for Cancer Patients (Re/Code) see also Killing a Patient to Save His Life (NY Times)

• Life Without Sleep (Aeon)

• WTF? How a Science Experiment Led to Sexual Encounters Between a Woman and Dolphin (The Wire) see also The dolphin who loved me (The Guardian)

• World Cup’s World’s Ball (NY Times)