Use search in CodeBase (this link) to download (and to use) them for free.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2018.01.29 15:21

The Definitive Guide to Point and Figure: A Comprehensive Guide to the Theory and Practical Use of the Point and Figure Charting Methodby Jeremy du Plessis

Point and Figure charts are one of the great secrets of the Technical Analysis world. Highly sophisticated and with a thoroughbred pedigree, they can, however, be overlooked by traders today.

Jeremy du Plessis - one of the foremost Point and Figure experts in the world - returns with a fully updated second edition of this definitive guide in an effort to redress this imbalance. This second edition, with an extensive revision to the text and introduction of brand new techniques, demystifies the world of Point and Figure charting. It includes a detailed explanation of the history and development of the technique from its invention to the modern day, and covers the makeup of the chart patterns, why they are created, and how to interpret them.

Throughout, readers are encouraged to understand Point and Figure charts from first principles, rather than just remember the names of a series of patterns. It is the first major work for 50 years to discuss in depth the original 1-box reversal method of Point and Figure charting and contrast it with the more popular 3-box reversal method.

Further, the explanation of how to use Point and Figure charts to project targets and calculate risk-reward ratios is the most comprehensive ever seen. Also featured in the second edition are:

- A step-by-step analysis of the FTSE 100 Index using the 3-box method, as well as the NASDAQ Composite Index, using the 1-box method

- A detailed discussion of optimising techniques

- An in-depth chapter on Analysing Point and Figure charts, extensively rewritten from the first edition

- A new explanation of how Point and Figure parameters are chosen and the implications of choosing them

- Two new Point and Figure construction methods never seen before

- Point and Figure's contribution to market breadth, with a look at bullish percent and two brand new indicators

- Full discussion of Point and Figure gaps and how they provide valuable information about the chart

- Lesser known, more advanced techniques such as the use of moving averages, parabolic SAR and Bollinger Bands on Point and Figure charts

- Price and volume activity histograms and how they provide information about support and resistance

All this is illustrated with numerous colour charts and observations from years of trading experience. According to du Plessis, Point and Figure charts are the 'voice of the market'. This book helps you listen to, and understand, that voice. Part of the Market Technicians Association (MTA) Required Reading list.

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

Sergey Golubev, 2014.03.28 19:22

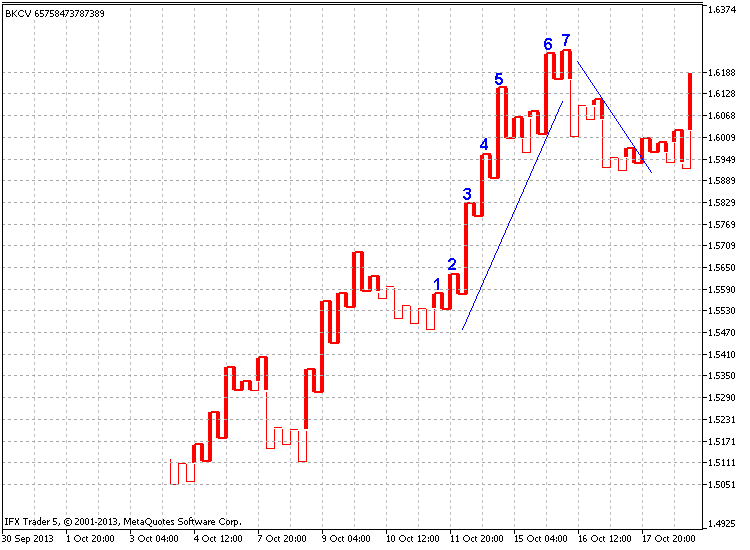

The article "Indicator for Point and Figure Charting" has described one of the programming ways of creating Point and figure chart. This chart is known since the 19th century. However, this is not the only chart from the remote past. Another notable representative of the early types of the financial market representation is Kagi chart. This chart will be discussed in the present article.

The stock exchange – financial institution unfamiliar to the 19th-century Japan – has been established in May 1878. It is known as Tokyo Stock Exchange nowadays. This event played a vital role in creating and subsequent development of Kagi charts. Europe and USA came to know Kagi charts after the publication of Steve Nison's "Beyond Candlesticks: New Japanese Charting Techniques Revealed" in 1994.

The Japanese words "Kagi" means an L-shaped key that was in use at the time of the chart development. Also, there is a modified version of the name – "key chart". In Steve Nison's "Beyond Candlesticks", you can also find alternative names of the chart: price range chart, hook chart, delta or chain chart.

What is so special about this chart? Its main feature is that it ignores the time scale leaving only the price one (unlike Japanese candlesticks, bars and lines). Thus, the chart hides inconsiderable price fluctuations leaving only the most significant ones.

The chart represents a set of thick Yang and thin Yin lines replacing each other depending on the market situation. In case the market moves in the same direction, the line is extended reaching a new price range. However, if the market turns back and reaches a predefined amount, the Kagi line is drawn in the opposite direction in the new column. The predefined amount is set either in points (usually used for currency pairs), or in percentage value of the current price (usually used for stocks). The line thickness varies depending on the closest High or Low breakthrough.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2014.03.15 18:36

Point & Figure Part I (based on dailyfx article)

- The History of Point & Figure Charts

- Why Traders Use Point & Figure Charts

- The Construction of Point & Figure Charts

The History of Point & Figure Charts

Unlike other charting methods, there is no one person credited for creating Point & Figure charts. Before computers, Point & Figures were adapted from a method used by floor traders in the 19th and pre-computer 20th century. The basic premise that caused P&F to be born is that there needed to be a simple method for floor traders to record price action to analyze price without unnecessary noise. Over a handful of years, two charts converged into one type of chart known as Point & Figure Charts.

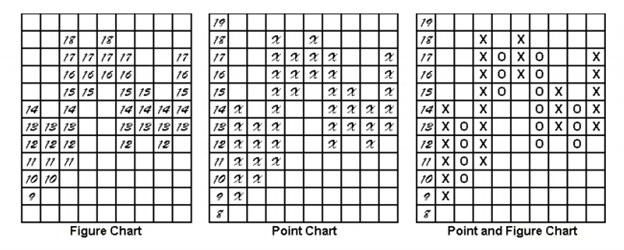

To make sense of the far-right chart above, it may be helpful to know

what creates a new column which will be explained in detail later in the

article. The chart on the right requires a reversal of 3 boxes of $1

each or $3 move against the prior trend to print a new column. As you

can see, instead of price being printed, a column of X’s or O’s will

occupy the chart.

The first method on the left was simply recording prices up and down without fractions which, you can imagine would become mind-numbing overtime. To make analysis less tedious and thus trading easier, a point chart above was constructed with price marked once on the y-axis and then marked an “X” or “point” for either direction when any whole figure was crosses. The Forex equivalent of this would be an Average True Range equivalent or 1XATR or 100 Pips.

Why Traders Use Point & Figure Charts

Due to technology, Point & Figure charts have fallen out of favor due to the likely fact that Point & Figure charts do not update in real-time, for a reason you’ll soon learn, and they may not appear as exciting as a short-term scalping chart. Point & Figure charts do not utilize time but only price. Therefore, you will not see a new candle print because there is a new day or time period like you do with candlestick charts. If price has not reversed or broken out from your predetermined levels discussed below, then there will be no change to the chart. In other words, the Point & Figure charts are famously objective.

The Construction of Point & Figure Charts

Constructing the Point & Figure chart takes some decisions on your

part that we’ll discuss shortly. Another great advantage to Point &

Figure charts as you’ll see is that you have control over how much

action you see.

There are 3 main components that will be needed to construct a Point & Figure charts. The components are:

- Reversal Size Parameter

- Box Size Parameter

- Price Data used for Chart Construction

Once these three components are determined, you will come up with a

specific name for your Point & Figure chart like a 10X3 chart or

1ATRX3 chart for example. This name type comes from Box size X Reversal.

Also, please note that higher prices will be marked by X’s and O’s for

down-columns.

The reversal size will determine how sensitive your charts are. This will be determined by how many X’s or O’s the price must reverse before changing columns. The most common choices are 1-box reversals and 3-box reversals. A 3-box reversal chart will require 3x the amount of price action against the prior trend before reversing than a 1-box reversal.

Closing Thoughts

Today’s introduction to Point & Figure opens up an exciting avenue

of analysis for your trading. It may be helpful for you to see Point

& Figure as a new objective way of identifying price action but not

necessarily a chart that you will enter trades on.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2013.09.12 16:29

Point & Figure Charting reduces the importance of time on a chart and instead focuses on price movements. Point & Figure charts are made up of X's and O's, X's being new highs and O's being new lows. There are two inputs to a Point & Figure chart:

- Box Size: The size of movement required to add an "X" or an "O". For example, a stock at a price of $20 may have a box size of $1. This means that an increase from $20.01 to a high of $21.34 means another "X" is added. If the high price only increased to $20.99, then another "X" is not added because the stock didn't close another box size ($1) more.

- Reversal Amount: The size of reversal before another column is added to a Point & Figure chart. To illustrate, if the reversal amount is $3, then the $20 stock would have to fall down to $17 before a new column (in this example of O's) would be started.

One of the main uses for Point & Figure charts, and the one emphasized in this section, is that Point & Figure charts make it easier for traders to see classic chart patterns. In the chart below of the E-mini S&P 500 Future, the Point & Figure chart emphasized support and resistance lines as well as areas of price breakouts:

Again, the Point & Figure chart makes it easy for traders to see the double bottom pattern below in the chart of the E-mini S&P 500 Futures contract:

The e-mini chart above illustrates the two bottoms of the double bottom pattern, as well as the confirmation line that is pierced, resulting in a buying opportunity.

Point & Figure is a very unique way to plot market action. The strongsuit of Point & Figure charting is that it eliminates the element of time and focuses on what is truly important - priceI wouldn't call $1000+ phone cheap when median per-capita household income is $2,920 (per year.)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi, I am new to the forum and havejust bought a Windows machine and converted my broker account to using MT4 on it.

Could anyone tell me where I can find Point and figure for MT4?

Cheers,

gram.