Discussion about the signals is prohibited on the forum so I can only remind the following -

From this thead: MetaTrader 5 Trading Signals Redefined -

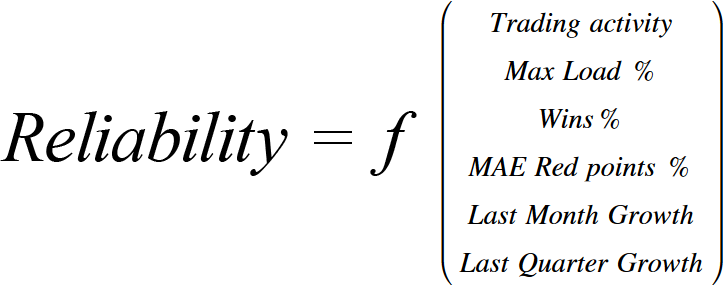

A new reliability parameter has been added to the MetaTrader 5 Signals Showcase for a quick evaluation of a signal. This aggregate value measures multiple parameters to simplify the comparison of signals in terms of investment reliability.

For example, in case of a large load on the deposit (Max Load %) or a huge increase in the monthly growth, this value is reduced. Conversely, a moderate monthly growth and deposit load normally reduce investment risks, so reliability is higher in this case.

Are there any reliable signals providers?

Any recommendation of the signal provider is prohibited on the forum.

You can go to the Signals page and sort the signals based on reliability for example.

Discussion about the signals is prohibited on the forum so I can only remind the following -

From this thead: MetaTrader 5 Trading Signals Redefined -

Sergey,

many thanks - I understand why a discussion could be banned - my apologies.

The above 'function' means little without an explanation of how it is calculated and I didn't find that.

Seems like a profitable SIGNAL is defined as less reliable - but in my brief look at the results this doesn't seem to apply.

Sergey,

many thanks - I understand why a discussion could be banned - my apologies.

The above 'function' means little without an explanation of how it is calculated and I didn't find that.

Seems like a profitable SIGNAL is defined as less reliable - but in my brief look at the results this doesn't seem to apply.

I provided the information I found (information from the thread opened by MQ).

As to "profitable signals may become less reliable" ... There are some limitation concerning it -

- abnormal monthly growth (some people told about 50% in a month, some of them told about 80%; means: if the signal is making more than 50%in a month so the results/stats from this month will not be considered for this signal);

- the signal will not be available for subscription if drawdown on open trades were more than 30%;

- and some more ...

many information is not disclosed ... and we do not know exact numbers and so on.

"abnormal monthly growth .." - it is reply from admin:

Forum on trading, automated trading systems and testing trading strategies

Rashid Umarov , 2017.05.04 17:53

You should understand that Signals with such a huge growth do not live long. Therefore, such growths are ignored to protect potential subscribers.about drawdown - reply from admin:

Forum on trading, automated trading systems and testing trading strategies

Rashid Umarov , 2015.05.27 12:42

The subscription is prohibited if the current drawdown exceeds 30%.Forum on trading, automated trading systems and testing trading strategies

Marsel , 2019.06.24 07:29

Equity drawdown is available for the entire equity history, the history volume is available on the corresponding chart.

The drawdown on the balance is determined for the entire history of trading.

More -

Forum on trading, automated trading systems and testing trading strategies

Rashid Umarov , 2018.10.03 07:47

You say that, as if averaging is not evil, but good. This indicator (for what period of life of the account in percents 80% Growth was achieved) was introduced to clearly show the accounts on which the acceleration tactics are used. A potential subscriber should understand that he has an account that was dispersed in a few days (and perhaps it was one only lucky account of 10-30 accounts) in order to post it later and show a beautiful chart.

A side effect was that it also detects accounts well with averaging tactics that ruined so many deposits. So this warning fulfills its role.

----------------

That is why the very profitable signals can be less reliable for subscribers

More:

Forum on trading, automated trading systems and testing trading strategies

Rashid Umarov , 2018.10.27 16:45

You can count as you like for yourself. But the algorithm for calculating the growth in the Signal service will not be changed - any balance transactions in the presence of open positions will be interpreted negatively. Precisely in order not to play these games, "let's count like this." The question is closed.

"abnormal monthly growth .." - it is reply from admin:

about drawdown - reply from admin:

----------------

More -

----------------

That is why the very profitable signals can be less reliable for subscribers

Many thanks - presumably watch carefully the high end results to see if the continue

Thanks to all

Using Max Deposit Load % in the Reliability formula calculation is wrong, since MDL% depends on the account leverage. Just because one uses the safer 1:50 and even small bet sizes can show high deposit load - this should not be a negative factor. Use the max DDown % instead.

I think - all those calculations and so on are made to protect potential subscribers from the actions made by the signal providers.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

How do I understand the Reliability Index for Signal providers.

I have seen two recently that give HIGH returns but 1 is High Reliability and the other (better performing) is very Poor.

The Poor provider has more followers than the Good performer.

The Poor performer is 94% algo whilst the good performer was 36% algo

I have watched the videos and seen the formulae referred to but don't really grasp why one is rated Poor and the other Good.

Appreciate any extra guidance