- True meaning of volume.

- Yet another question about real volume in ticks

- Deadlock

I found the video but it is volume in general -

----------------

Volume and Open Interest

This module is about Volume and Open Interest. When we're trading we look at the price action but we also look at the volume of trading and the open interest which is something we come across in futures and options.

I found the video but it is volume in general -

----------------

Volume and Open Interest

Was trying to work on something and I was stuck because I couldn't really understand what volume on Mt4 platform truly represent . Don't get me wrong, I know volume represents the average trade activities for a particular period of time . But my question, does volume simply represent the number of investors for that period or does it represent the number of investments/trades. To expansiate more, sometimes big players move the market in a direction and inexperienced trades jump into the move thinking it's a new trend , so if volume represents just the number of investors , then it will be easier to spot the divergence between volume and price when the number of investors is not on par with the price spike . But in this scenario if the volume is representing number of investments or trades opened then it will be harder to spot the false moves by big players from volume divergence . I hope I made sense with the explanation, would appreciate any help on this .

Not sure what is not to be understood. In MT4, volume represents tick volume https://docs.mql4.com/predefined/volume .

IMO pretty useless. The only useful thing i can think of to use tick volume is to measure the difference between brokers, because it shows the tick volume only from broker, not the market as whole (impossible, decentralized market).

In MT5 it also represents tick volumes for forex. It can show traded volume on other non-forex assets.

I found the video but it is volume in general -

----------------

Volume and Open Interest

Not sure what is not to be understood. In MT4, volume represents tick volume https://docs.mql4.com/predefined/volume .

IMO pretty useless. The only useful thing i can think of to use tick volume is to measure the difference between brokers, because it shows the tick volume only from broker, not the market as whole (impossible, decentralized market).

In MT5 it also represents tick volumes for forex. It can show traded volume on other non-forex assets.

Enrique Dangeroux:

The only useful thing i can think of to use tick volume is to measure the difference between brokers

That's an interesting thought.

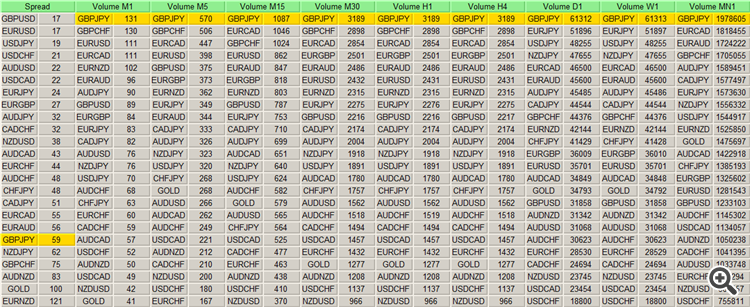

You can also identify the hottest instruments.

Who wants to trade a dead instrument that is barely ticking at all ?

The factors involved are quite large.

But i also agree it could be used to analyze data between brokers.

But one question I haven't figured out is, ' What is a tick ?' . Does a tick represent a new transaction ?

A tick in spot ForEx is just a single price change.

When you think in terms of matching a buyer with a seller, transactions, contracts, etc. — that's related to futures.

Supposedly you can trade futures with MT, but I haven't tried that.

You can also identify the hottest instruments.

Who wants to trade a dead instrument that is barely ticking at all ?

This is the best use for tick volume I have seen thus far. I will give this further consideration. Thanks for the tip.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use