Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.18 22:34

Forex Fundamentals - Weekly Outlook Apr. 21-25The pound and the dollar emerged as winners in a week that saw the euro and the yen retreat. US housing data, the rate decision in New Zealand, German business sentiment, US Durable Goods Orders and Unemployment Claims are the main highlights on Forex calendar. Here is an outlook on the market-movers for this week.

The US economy emerged from the cold winter registering gains in retail sales and manufacturing activity as well as continuous improvement in the labor market. . The Philly Fed Index exceeded expectations in April, providing more evidence of a spring bounce. Overall, the US economy is steadily advancing. In the euro’zone, Mario Draghi managed to send the euro down in a Sunday gap, and the common currency never recovered. GBP enjoyed a sharp drop in the UK unemployment rate to reach new multi year highs. The kiwi stayed behind after weak inflation figures and the loonie took the other direction on positive ones

- US Existing Home Sales: Tuesday, 14:00. U.S. existing home sales declined slightly in February to a 19 month-low reaching an annual rate of 4.60 million units, following 4.62 million in January. A combination of cold weather and dwindling inventory of homes for sake, discouraged potential buyers. Economists expected a higher figure of 4.65 million. However, as the cold winter is over, analysts believe the pace of sales will accelerate this time. U.S. home sales are expected to rise to 4.57 million.

- Chinese HSBC Flash Manufacturing PMI: Wednesday, 1:45. The independent purchasing managers’ index is considered one of the most reliable gauges for the Chinese economy, the world’s no. 2 economy. After a disappointing drop to 48 points, a small rise to 48.4 is expected. Note that this is below the 50 point mark separating growth and contraction.

- US New Home Sales: Wednesday, 14:00. The number of transactions for buying new U.S. homes in February declined to 440,000 (annualized) due to the unusually cold winter. Sales of new homes declined 3.3% from a revised rate of 455,000 in January. Nevertheless, economists forecast a pick-up in sales this spring. A further improvement in the US job market and a better consumer confidence will help boost numbers in March. New home sales are expected to reach 455,000.

- NZ rate decision: Wednesday, 21:00. The Reserve Bank of New Zealand raised its official cash rate by 25 basis points to 2.75%, in line with market forecast. RBNZ Governor Graeme Wheeler said in a statement that inflation pressures have increased and expected to continue doing so over the next two years. Raising rates was important to keep inflation under control. Wheeler left the door open for further rate hikes within the next two years. The Reserve Bank of New Zealand is expected to raise its benchmark rate to 3%. Recent weak inflation data suggests that the RBNZ may become somewhat more dovish.

- German Ifo Business Climate: Thursday, 8:00. German business sentiment declined for the first time in five months in March reaching 110.7 from 111.3 in February, amid the Russian- Ukraine conflict. Businesses are worried that this ongoing crisis might affect Germany’s economic recovery since Germany receives more than a third of its gas and oil from Russia. In case of conflict escalation, many German firms are at danger. German business sentiment is expected to edge down to110.5.

- Mario Draghi speaks: Thursday, 9:00. ECB President Mario Draghi will speak at a conference in Amsterdam. He may comment on the low inflation in the Eurozone. Market volatility is expected. We have seen his heavy hand on the euro and we might see this happen again.

- US Core Durable Goods Orders: Thursday, 12:30. Orders for long-lasting U.S. manufactured goods regained strength in February with a 2.2% increase following a 1.3% decline in the previous month. Meantime, Core durable goods orders increased by 0.2% after posting a 0.9% rise in January, falling below expectations of a 0.3% rise. Economic growth in the first quarter is expected to be weaker than the fourth quarter’s annualized 2.4% rise, due to the cold weather. Orders for transportation equipment increased 6.9% while transportation orders had declined 6.2% in January. Durable goods orders are expected to climb 2.1%, while Core durable goods orders are expected to edge up 0.6%.

- US Unemployment Claims: Thursday, 12:30. The number of new jobless claims registered last week remained low at 304,000, near their pre-recession levels, following 302,000 posted in the previous week. Manufacturing activity has accelerated in April, indicating growth momentum after the cold winter. Economists forecasted jobless claims to reach 315,000. The four-week moving average for new claims, dropped to its lowest level since October 2007 with a 312,000 claims. Jobless claims are expected to increase by 5,000 to 309,000.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.19 17:13

USD/CAD forecast for the week of April 21, 2014, Technical AnalysisThe USD/CAD pair rose during the course of the week, breaking the top of the hammer that we had form the previous week. This is a classic positive sign as far as technical analysis is concerned, and we believe that this market is going to reach towards the top of the recent consolidation area which we see as the 1.13 level. Nonetheless, we think that it could be a bit of a choppy move, which of course is very common for the USD/CAD pair. The two economies are completely interconnected so it makes sense that the market will go back and forth and micro-movements most the time, with the occasional impulsive movement giving the actual profits.

We feel that selling is impossible until we get down below the bottom of the hammer from last week, which would signify that we could get down to the 1.07 handle immediately, and then perhaps look for real supports or closer to the 1.06 handle. We doubt that’s going to happen though, because quite frankly the Canadian dollar has been beat up even while the oil markets have gotten a bit stronger over time. With that, we are looking to start buying this market now, and will continue to buy as we serve to grind higher, probably heading to the 1.15 level given enough time. We do like the US dollar in general, because after all the US dollar index is starting to look very positive, and on top of that the Federal Reserve is much closer to tightening monetary policy than the Bank of Canada is. After all, the Canadians have stated recently that the market shouldn’t be expecting any type of monetary tightening anytime soon. They were pretty explicit in that, so it appears the Canadians will continue to keep a very loose monetary policy, which of course will continue to affect the value of the Canadian dollar in a negative way. It doesn’t mean they were going to break out right away, but we most certainly think that it’s coming fairly soon.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.22 07:16

USDCAD Technical Analysis (adapted from dailyfx article)

USD/CAD nearing key resistance zone

- USD/CAD has moved steadily higher since finding support at the 4th square root relationship of the year’s high in the 1.0855 area earlier in the month

- Our near-term trend bias is higher in Funds while above 1.0910

- Interim resistance is eyed around 1.1030, but a more important pivot come into play at a key Gann/Fibonacci convergence in the 1.1055/65 region

- Minor cycle turn windows are seen tomorrow and at the end of the week

- A move under 1.0910 would turn us negative on the exchange rate

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| USD/CAD | 1.0910 | 1.0960 | 1.1015 | 1.1030 | 1.1065 |

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.20 17:35

Forex - Weekly outlook: April 21 - 25The dollar ended the week higher against the yen on Friday as market sentiment was boosted by easing tensions over Ukraine, while upbeat U.S. economic reports also supported the dollar.

USD/JPY touched highs of 102.57 on Friday, before ending the session at 102.40, rising 0.49% for the week. Trade volumes remained thin on Friday, with most markets closed for the Easter weekend, although markets in Tokyo were open.

Concerns over the crisis in eastern Ukraine eased on Thursday after Russia, Ukraine, the U.S. and the European Union said an agreement on steps to "de-escalate" the crisis had been reached.

The dollar also received a boost after upbeat U.S. data on manufacturing and employment on Thursday pointed to underlying strength in the economy.

The Labor Department reported the number of people filing for unemployment benefits edged up to 304,000, below analysts’ forecasts and not far from the six-and-a-half year low of 300,000 touched the previous week.

GBP/USD edged up 0.06% to 1.6798 at Friday’s close, and ended the week 0.45% higher. The pair rose to highs of 1.6840 on Thursday, the strongest since November 18 2009. Sterling strengthened broadly after data earlier in the week showed that the U.K. unemployment rate fell to a five year low of 6.9% in the three months to February.

The upbeat data bolstered expectations that the Bank of England could raise interest rates as soon as the first quarter of 2015.

The euro was little changed against the dollar on Friday, with EUR/USD settling at 1.3810.

The euro’s gains were held in check after recent comments by European Central Bank officials flagged concerns over the impact of the strong currency on the inflation outlook.

On Thursday, ECB Executive Board member Yves Mersch said that if foreign exchange developments with an impact on inflation continue it would trigger a reaction by the central bank.

Elsewhere, the New Zealand dollar posted its largest weekly decline against the greenback since January, with NZD/USD ending the week down 1.24% to 0.8576, ahead of the Reserve Bank’s rate review on Thursday.

In the week ahead, market watchers will be focusing on U.S. data on housing and manufacturing activity, while manufacturing data from China will also be closely watched. The euro zone is to release data on private sector activity, while the U.K. is to produce a report on retail sales.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, April 21

- Markets in Australia, New Zealand, the U.K. and the euro zone are to remain closed for Easter Monday. Meanwhile, Japan is to release data on the trade balance.

- Australia is to publish an index of leading economic indicators.

- Canada is to produce data on wholesale sales.

- The U.S. is to release private sector data on existing home sales.

- Australia is to publish data on consumer price inflation, which accounts for the majority of overall inflation.

- China is to release the preliminary estimate of the HSBC manufacturing index, a leading indicator of economic health.

- The euro zone is to release preliminary data on manufacturing and service sector activity, a leading indicator of economic health. Germany and France are also to release individual reports.

- The U.K. is to release data on public sector borrowing, while the BoE is to publish the minutes of its April meeting. The nation is also to publish private sector data on industrial order expectations.

- Canada is to produce official data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity.

- The U.S. is to publish reports on new home sales and manufacturing activity.

- The Reserve Bank of New Zealand is to announce its benchmark interest rate and publish its rate statement, which outlines economic conditions and the factors affecting the monetary policy decision.

- In the euro zone, Germany is to release the Ifo report on business climate.

- ECB President Mario Draghi is to speak at an event in Amsterdam; his comments will be closely watched.

- The U.S. is to publish data on durable goods orders and the weekly report on initial jobless claims.

- Markets in Australia and New Zealand will be closed for the Anzac Day holiday.

- Japan is to release data on consumer inflation.

- The U.K. is to produce data on retail sales.

- The U.S. is to round up the week with revised data on consumer sentiment.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.23 06:17

2014-04-23 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

- past data is 48.0

- forecast data is 48.4

- actual data is 48.3 according to the latest press release

if actual > forecast = good for currency (for CNY in our case)

==========

China HSBC Flash PMI For April Is 48.3, Up From 48.0 In March As Slowdown ContinuesChina's factory activity shrank for the fourth straight month in April, signaling economic weakness into the second quarter, a preliminary survey showed Wednesday. But the pace of decline eased, helped by policy steps to arrest the slowdown.

Analysts see initial signs of stabilization in the economy due to the government's targeted measures to underpin growth, but believe more policy support may be needed as structural reforms put additional pressures on activity.

The HSBC/Markit flash Purchasing Managers Index for April rose to 48.3 from March's final reading of 48.0, still below the 50 line separating expansion from contraction.

"It's generally in line (with expectations), reflecting that the growth momentum is stabilizing," said Zhou Hao, China economist at ANZ in Shanghai, who expected economic growth to pick up slightly to 7.5 percent in the second quarter.

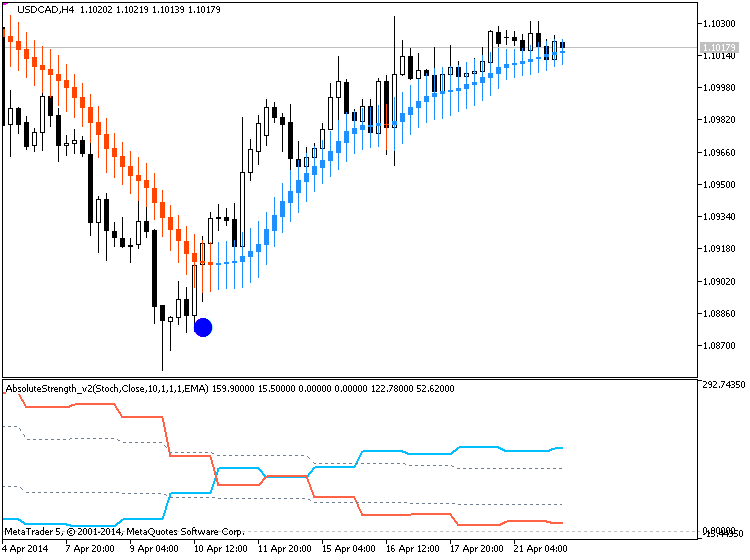

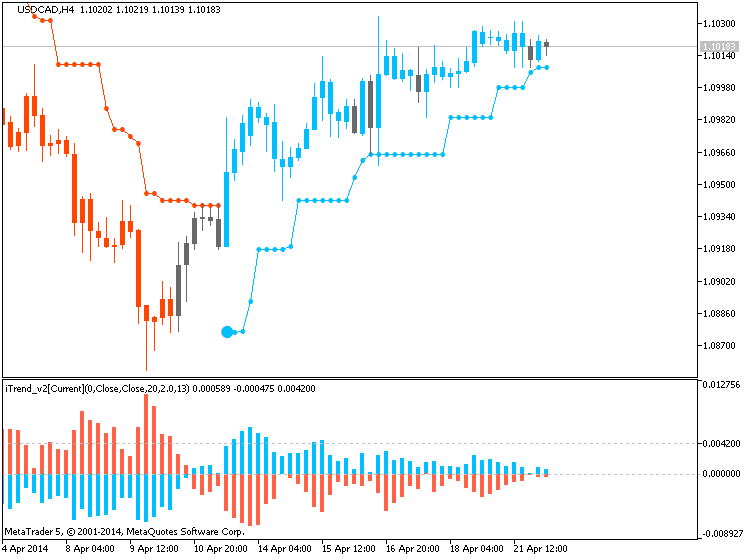

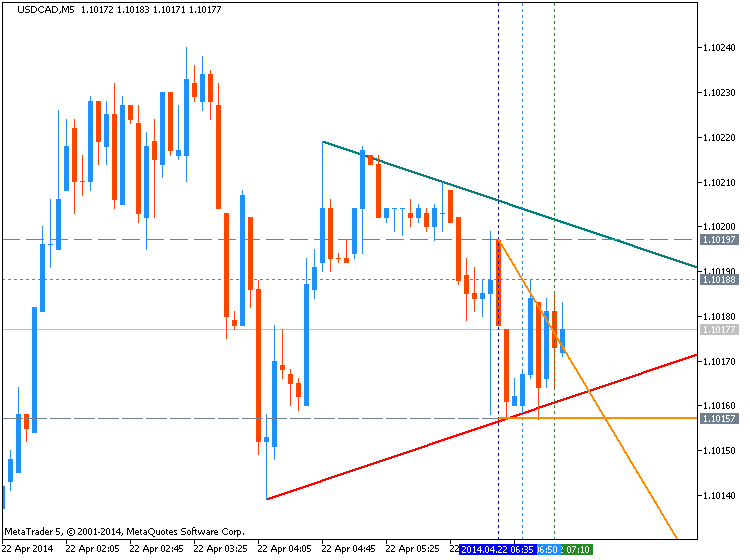

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 8 pips price movement by CNY - HSBC Manufacturing PMI news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is inside Ichimoku cloud for market rally inside primary bearish market condition. The nearest resistance level is is 1.1033 which is inside the cloud; 1.1053 is next resistance which may be the border between bearish and bullish on D1 timeframe for now.

W1 timeframe: price is ranging between 1.1278 resistance and 1.0857 support levels within primary bullish.

If D1 price will break 1.1053 resistance level on close bar so we will get the reversal from bearish to bullish (good to open buy trade).If not so the ranging market condition will be continuing.

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDCAD price movement for this coming week)

2014-04-22 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Existing Home Sale]

2014-04-23 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2014-04-23 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Retail Sales]

2014-04-23 14:00 GMT (or 16:00 MQ MT5 time) | [USD - New Home Sales]

2014-04-24 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]

2014-04-25 13:55 GMT (or 15:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on USDCAD price movement

SUMMARY : ranging

TREND : ranging

Intraday Chart