Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2018.02.11 06:31

U.S. Stock Market: "That's All, Folks!" ... So soon? (based on the article)

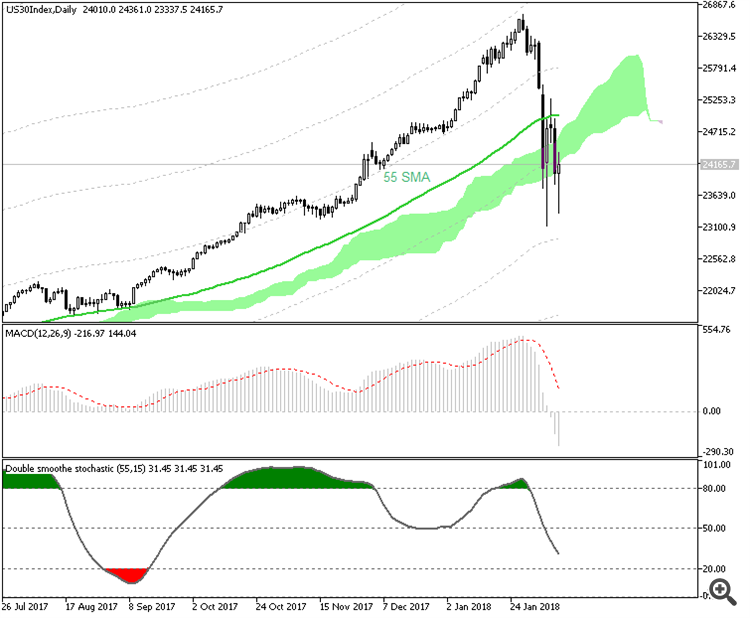

Dow Jones Index daily price broke Ichimoku cloud to be reversed to the primary ebarish market condition as short-term situation for example.

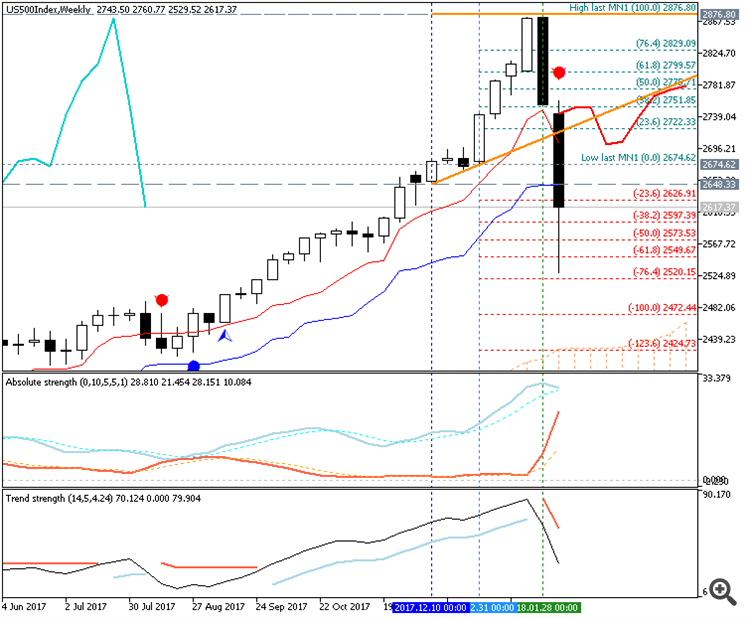

By the way, it is just a secondary correction within the primary bullish trend in medium term (W1), and the strong bullish trend is still continuing in the long-term (MN1).

- "The U.S. stock market had a well-recognized, worry-inducing characteristic: An abnormally smooth ~50% rise over 12+ months. As was widely discussed in mid-2017, something had to give – there had to be a shakeup sometime. Because the common view was that stock prices were “too high,” expectations were that “sometime” was nigh. However, as the stock market is wont to do, the adjustment came months later, after the worries had dissipated and focus had shifted to Tax Bill optimism. “Correction” is the right label, but “entering a correction phase” is not. The U.S. stock market’s unusually fast drop looks to have done the job of curing latent worries and setting the stage for a bull market continuation."

- "But what about rising interest rates and increasing inflation? Yes, we should expect those, but they are not worries for stock investors. Bond investors very much need to be concerned because both erode bond values. Not so with stocks. Rising rates and inflation (excluding “hyper” times) are positive signs of a growing economy and company earnings, thus driving stock prices higher."

- "Regarding interest rates, remember that the Federal Reserve is nottightening credit by raising rates. Rather, it is finally moving away from its abnormally low rate controls and gradually allowing the financial markets to determine the appropriate level of interest rates – the process that has accompanied every other growth period and bull market in the past. ("Tightening" is when the Fed pushes rates higher than the markets have set them.)"

- "The U.S. stock market’s sharp drop appears to be over. Growth fundamentals are intact, the too-steady/too-high worries are gone and the rising interest/inflation rates are positive accompaniments of growth, not reasons for further declines. Therefore, now looks to be a good time to buy/own U.S. stocks."

==========

The charts were made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

- MaksiGen_Range_Move MTF - indicator for MetaTrader 5

- Double smoothed stochastic - indicator for MetaTrader 5

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2018.02.10 15:22

February 2018 Market Crisis (based on the article)

- "The recent downside moves in the US majors did freak a lot of people out. It was something that startled people and pushed a panic button for many. Certainly, the rotation in the VIX and volatility related ETN’s pushed many people over the edge. In fact, recent news is that these volatility related ETN’s exasperated the selloff as the VIX shorts were pushed out of positions and into a protectionist mode with the massive spike in volatility. As the old floor trader saying goes “want to know what causes the markets to crash? Buyers that turn into sellers to protect from unwanted losses”. In fact, the fear and selling were so strong it sent the safe havens tumbling lower, which we took advantage of trading the DUST gold miners ETF for a quick 20% profit."

- "First, we have strong economic and fundamental US and global data that is showing increases in the global economy, GDP, output, employment and more. We are still seeing price appreciation and strong activity in most locations which indicates the top has not formed yet. Therefore, we believe this February market crisis is, as of right now, a unique instance of a “shakeout” after a lengthy period of very low volatility. Almost like the market needed to “breathe” and in order to do that, it needed to roll out of a low volatility range. Now that this is taking place now. We believe the markets are setting up for a very quick FLAG/Pennant formation that will prompt a burst higher towards a March 15th peak."

- "Certainly, there is the risk of further downside price activity. Certainly, some news item could come out in the future that could drive the markets substantially lower. We believe the US and Global markets are strong fundamentally and that the new growth in the economic output will continue to try and push equities higher as expectations of increased global economic activity continues. Immediately, we are targeting the March 15th price peak."

============

The chart was made on weekly timeframe with Ichimoku market condition setup (MT5) from this post (free to download for indicators and template) as well as the following indicators from CodeBase:

- MaksiGen_Range_Move MTF - indicator for MetaTrader 5

- Price prediction by Nearest Neighbor found by a weighted correlation coefficient - indicator for MetaTrader 5

- Fibo Bar MT5 - indicator for MetaTrader 5

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use