Discussion of article "Forecasting market movements using the Bayesian classification and indicators based on Singular Spectrum Analysis" - page 3

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

One precursor appeared, forecasted, in 3 bars another precursor appeared, and so on ad infinitum... there is no one source influencing prices on the market, so initial conditions for the development of this or that situation arise spontaneously and overlap each other. Suppose we have found some initial conditions that continue to influence the situation, how can we be sure that on the next bar there will not be another influencing information that will again destroy everything? Where are the criteria for assessing the reliability of the forecast?

In this particular case, the criterion is obvious - a correct forecast should be consistently built more often than an incorrect one. The probability of a correct forecast is not 50%, but higher.

Well!!! The article is interesting. Thanks to the author BUT!!!!!!

really goose or CSSA method has been known for a long time. One of the problems was to break the tail of these indicators. But this time, in NSH there appeared a CSSA addon, which was not overshot and with a successful selection of parameters could produce VERY good signals. The selection of parameters with the help of an optimiser, as a rule, did not give proper results in the future. But together with this addon there was one more tool for tuning. I don't remember what it was called, but its task was to build LISAJO figures (if I wrote it correctly) These figures were obtained on the oscillator screen, when there were changes in the signal frequency, both in X and Y coordinates. I don't know who, but we used to make these figures in the lab. And then we had to face it here. So the CSSA parameters had to be selected so that the lisajo figure looked like a CROWN. It means that the current frequency is the reason for the quotation frequency or in other words it is predictive for the given moment of time. The effect is called COINTEGRATION!!!!. Due to the peculiarities of the cointegration indicator, the parameters had to be selected manually. It is not so easy to get a CROWN shape, I will tell you. But once I managed to do it and the result was just crazy. In other words, Cointegration answers the question of what frequency is now the predicted frequency for the kotir. As soon as the circle turned into another figure with time, new parameters had to be found. This is when the market is considered as a frequency oscillation, it is enough to find the right frequency and it will work for some time. Surprisingly, but since then I have never met such systems, but the question is not so complicated for an experienced programmer. So keep in mind if anything :-)

Just what is interesting in the direction of frequency analysis of the market, because when the right frequency is selected. Or rather, the frequency that works now is found, then signals usually have a grail character, though not for a long time. But if there is a tool described above, the search for the next frequency will not be difficult and so on and so forth. It is enough to have stable 10 signals in the future to make money. And in the case of CSSA it is quite real, because I saw with my own eyes how the TS gave signals in the future very well and the signals were much more than ten. So :-)

If you have skilful hands in programming, I can help you with logic, etc.

To the disadvantages of frequency analysis I can attribute a complete lack of understanding of what is happening on the market. We just trade the frequency. This method works well on a calm, technical or thin market. News as a rule breaks the frequency so much that it is very difficult to find a working pair.......

Mihail Marchukajtes:

The disadvantages of frequency analysis include complete lack of understanding of what is happening on the market. We just trade the frequency. This method works well on a calm, technical or thin market. News as a rule breaks the frequency so much that it is very difficult to find a working pair.......

Have you thought about the fact that these "frequencies" can be repeated?

Accordingly, the solution of the problem is to find profitable frequencies for this TS on the history. Identifying in some way the market state (price and all available data) corresponding to the profitable frequency.

Have you thought about the fact that these "frequencies" may be repeated?

Accordingly, the solution to the problem is to find profitable frequencies for a given TS in the history. Identifying somehow the market state (price and all available data) corresponding to the profitable frequency.

I didn't really think about it, I studied frequency analysis at one time, but then I gave it up. And you know why???? Market is not only non-stationary frequency series. The market is something else :-))

Very interesting article and the results definitly warrant further investigation; however, the attached EA has a problem with the library so it is unable to be loaded. Are you sure you have the correct library included in the zip file?

SSABayesLib.ex5 also does not load for me.

The article is interesting. So are the comments in the Russian section https://www.mql5.com/ru/forum/190847

Hello, is there an MT4 version of SSA? I want the MT4 version

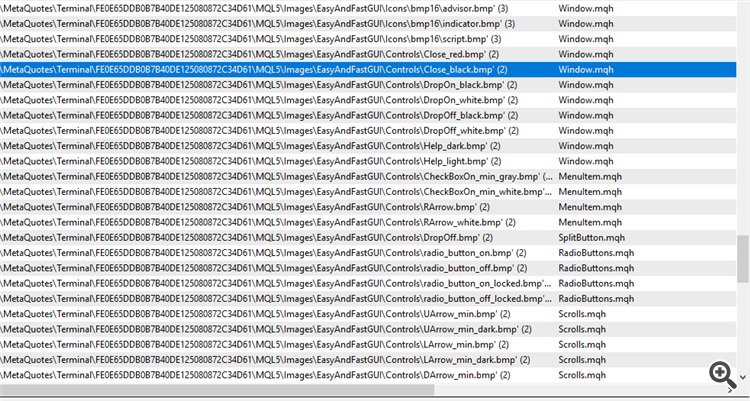

привет Я прочитал вашу статью, поздравления. У меня возникли проблемы при компиляции исходного кода, приведенные растровые изображения подкаталоги не вместе файл. Как я могу получить недостающие файлы? Я отправлю картину в журнал ошибок. спасибо

Dear Roman.

I want to learn as you write your strategy method, except that you give the source is not complete, hope to receive your source code to learn deeply.Hope to Hope to receive your reply, thank you very much.

Hello Mr Korotchenko,

I found your article very interesting and tried to run the EA (from download SSABayesObserver.zip).

But everytime when I run the EA, immediately after filling the parameter-dialog and click on 'Enter' to continue, the EA is removed.

Terminal/Experts shows a library error:

1st line:"Cannot find 'GetSSATrendPredictor' in 'SSA\SSABayesLib.ex5'"

2nd line:"unresolved import function call"

Terminal/Journal shows the following:

1st line:"initialising of SABayesObserver (EURUSD, M15) failed"

2nd line:"expert SSABayesObserver (EURUSD, M15) removed"

It seems I'm working with a wrong version of 'SSA Trend Predictor'?

I'm sorry, but the translations are sometimes so bad that I can't follow.