Thank you very much for the article!

P.S. In the description of strategy #8, please correct the link to the indicator "Schaff Trend Cycle"(https://www.mql5.com/en/code/486), now both links lead to the Tyrone indicator.

I also noticed that in the description of strategy #2 the links to indicators are mixed up.

- votes: 16

- 2011.09.09

- Nikolay Kositsin

- www.mql5.com

Thank you very much for the article!

P.S. In the description of strategy #8, please correct the link to the indicator "Schaff Trend Cycle"(https://www.mql5.com/en/code/486), now both links lead to the Tyrone indicator.

I also noticed that in the description of strategy #2 the links to indicators are mixed up.

Thank you. We will fix it.

Published article Comparative analysis of 10 trend strategies:

Author: Alexander Fedosov

It would be much more convenient to analyse the overall situation using a summary table showing all the strategies and their indicators.

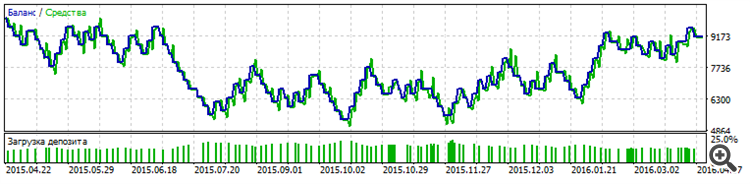

It's a little dodgy, isn't it? All right. Most of the strategies have bad results and you don't have to look at them. But let's say strategy #9 has more or less satisfactory results. Let's try it with earlier data. Let's say a year before. For example, 16.04.2015 - 16.04.2016. As a result - no profit.

Conclusion - most likely, it is a tweak and is not suitable for practical trading.

It's a little dodgy, isn't it? All right. Most of the strategies have bad results and you don't have to look at them. But let's say strategy #9 has more or less satisfactory results. Let's try it with earlier data. Let's say a year before. For example, 16.04.2015 - 16.04.2016. As a result - no profit.

Conclusion - most likely a fitting and for practical trading is unsuitable.

Most likely, all these strategies on 2 twists - it's like the Stone Age - well learnt to write something, well learnt to test something. But it does not add any money. The market is a rather complex system - wave and trend-flattening. With 2 twists you can roughly estimate what was there before. But there is no probability that it will be like that in the future. Conclusion - this approach is primitive and requires more advanced methods.

From the introduction:

The purpose of this article is to give the reader the broadest possible understanding of the strengths and weaknesses of trend trading.

From the Introduction:

At first I didn't want to reply as you are starting to defend your article, but then I decided to write. It seems to me that the main purpose of the article is to get a fee. There is a mistake in the approach to the task. It looks like an exercise in programming. On period-dependent filters as on a child's constructor by the method of fitting to find on the tester an overweigh in the plus. With profitability less than 2 - these are all unworkable options. This article shows, not even strategies, but how not to do. Since it does not only does not lead to the goal of earning money, and that is what people come to Forex for, but there is not even a hint of the correctness of the decision. Usually those who trade and earn money do not write articles. But those who have been trying and trying themselves, but nothing has worked out and they hope that someone will give them a hint or guide them to the right decision. Or at least some money, at least for an article, to get from Metaquotes, for the labour done earlier. But as a learning material for beginners - it is not that.

If you get angry at what I wrote, that's good. Perhaps then it will bring you closer to wanting to find the right solutions.

At least that's my opinion. I may be wrong.

At first I didn't want to reply since you are starting to defend your article, but then I decided to write anyway. It seems to me that the main purpose of the article is to get a fee. There is a mistake in the approach to the task. It looks like an exercise in programming. On period-dependent filters as on a children's constructor by the method of fitting to find on the tester the overweight in the plus. With profitability less than 2 - these are all non-working options. The initial error in the future tends to accumulate and lead to severe consequences. A bad foundation of a house is a probability that the house will collapse. This article shows not even strategies, but how not to do. Since it not only does not lead to the goal of earning money, but even there is no hint on the correctness of the decision. Usually those who trade and earn money do not write articles. But those who have been trying and trying themselves, but nothing has worked out and they hope that someone will give them a hint or guide them to the right decision. Or at least some money, at least for an article, to get from Metaquotes, for the labour done earlier. But as a learning material for beginners - it is not that.

If you get angry at what I wrote, that's good. Perhaps then it will bring you closer to wanting to find the right solutions.

At least that's my opinion. Maybe I'm wrong.

Well, if these 10 strategies just show you what not to do. Then that's fine.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

New article Comparative Analysis of 10 Trend Strategies has been published:

The article provides a brief overview of ten trend following strategies, as well as their testing results and comparative analysis. Based on the obtained results, we draw a general conclusion about the appropriateness, advantages and disadvantages of trend following trading.

Strategy #3 is represented graphically in Fig. 4. When searching for signals, it is necessary to monitor an early growth of the histogram. In other words, we need to find the moment when bulls are replaced by bears or vice versa, and then we wait for the signal to be confirmed by the oscillator.

Fig.4 Entry conditions for the trend strategy #3

Author: Alexander Fedosov