You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Overview of the main economical events of the current day - 17/07/2013

Markets wait for Bernanke’s testimony to Congress

The dollar was traded downwards on Tuesday against all major currencies before the Fed Chairman Ben Bernanke's Monetary Policy Report to U.S. Congress on Wednesday. Even good US data and slightly weak data on New Zealand, Great Britain and Germany didn’t help the dollar. The markets made an allowance that Bernanke would probably demonstrate the same tendency to loose monetary policy as he did it last week.

According to the US Labor Department consumer prices grew by 0.5% in June having shown the most significant growth for five months. The price growth was mainly caused by a petrol price hike. NAHB Housing Market Index reached 57 in July, the highest reading since January, 2006 having been growing for the third month in a row. The US industrial production increased by 0.3% m/m in June, which coincided with the expectations.

The euro has risen despite a sudden fall of Germany’s economic sentiment in July. German ZEW Economic Sentiment for the nearest six months dropped by 2.2 points to 36.3 points in July (expected growth to 40 points) although German ZEW Current Situation rose to 10.6 points (expected growth to 9 points). Economic sentiment worsening reflects a negative attitude towards the world economy, said ZEW president.

Meanwhile Euro-Zone ZEW Economic Sentiment rose by 2.2 points in July up to 32.8 (a moderate growth to 31.8 was expected). The euro-zone trade surpluce decreased to 14.6 bln euros in May from 15.2 bln euros in April due to the exports fall by 2.3% compared with the prior month. The exports have been falling sharply for the second month in a row.

The pound recovered the losses of the first part of the day after weak inflation data and even managed to close the day by growth. According the Office for National Statistics (ONS) the inflation accelerated in the UK to 2.9% in June at an annual rate, which, however, didn’t reach the forecasted growth by 3% y/y. Some expected 3% level to be exceeded. At a monthly rate consumer prices dropped by 0.2% offsetting a prior month growth by 0.2%. Meanwhile according to the ONS data released on Tuesday housing prices in Great Britain in May reached its record high since 2002.

The Australian dollar rocketed after the publication of the Reserve Bank of Australia Meeting Minutes. They specifically said that the sharp decline of the Australian currency could push up the inflation a little in time as import prices would grow. It was also mentioned about a positive effect of low rates to all economy sectors. It was the first time the RBA acknowledged that the national currency lowering could increase inflation risks. Market participants used those words as a motive for reducing of excessive number of short positions on AUD.

New Zealand dollar also has risen despite a weaker quarterly report on inflation than expected. According to the Bureau of Statistics of New Zealand quarterly growth rates of consumer price index in the second quarter accounted for 0.2% while a growth by 0.3% was expected. In comparison with the same period last year the index has risen by 0.7% (expected growth by 0.8%) – it was the slowest annual growth for 14 years.

By MasterForex Company

Overview of the main economical events of the current day - 18/07/2013

The US housing market shows weakness

The dollar had risen slightly by the end of the volatile trading on Wednesday against all major currencies despite the initial momentum of decline which happened after the release of a weak housing market report and the publication of the Fed chairman Ben Bernanke’s speech to the Congress that was published 1.5 hours before his testimony.

The housing market report turned out surprisingly weak. Building Permits decreased by 7.5% m/m in June to 911 thousand at an annual rate against 1000 thousand forecast. Housing Starts decreased by 9.9% in regard to the prior month and amounted to 836 thousand at an annual rate against the forecast of 950 thousand.

Speaking in the House of Representatives of the U.S. Congress Bernanke didn’t say anything new on the whole; and just an increased volatility was observed. At first the dollar fell during the publication of the statement and then it grew during Bernanke’s speech and his answers to the questions. Bernanke again said about the FOMC’s intention to gradually reduce QE3 in the first part of 2014 and scale back the program absolutely by the middle of the next year if the situation in the American economy would develop according to the current forecasts.

However QE3 will last till the situation at the labor market shows a significant improvement. Bond purchase program doesn’t follow a predetermined plan and its volume can be decreased or increased depending on the economic terms. If they worsen, bond purchase in its current volume can be kept further, said Bernanke.

The pound rocketed on Wednesday after the release of a strong labor market report and the publication of Bank of England Meeting Minutes. According to the Office for National Statistics (ONS) of Great Britain Claimant Count Change fell by 21.2 thousand in June (a drop by only 8 thousand was expected) against -16.2 thousand in prior month, which became the strongest decline for three years. Unemployment rate fell by 0.1% to 4.4%, while no changes were expected. Average Weekly Earnings (3M/y) have risen by 1.7% within three months against the prior reading 1.3% and the forecast of 1.4%.

The published Meeting Minutes of Monetary Policy Committee of the Bank of England in July showed that all the members of the Committee had voted unanimously for keeping asset purchase program unchanged. Such unanimity has been shown for the first time since October, 2012. Last meeting David Miles, Paul Fisher and the Central Bank governor King voted for an increase of QE.

Bank of Italy decreased on Wednesday the forecast on economic growth for current 2013 and Bank of Portugal lowered the economic growth outlook for the next year. Meanwhile the Goldman Sachs experts believe that EURUSD may rise up to 1.34 within three months and up to 1.40 during 12 months.

The Canadian dollar dropped amid the announcement of the results of Canadian Central Bank meeting which was headed by a new governor Stephen Poloz for the first time. As it was expected the Bank of Canada kept the interest rate unchanged at the level of 1.00% and declared that such level and the current considerable monetary policy stimulus would remain appropriate. The Central Bank lowered inflation and GDP forecasts for 2014. At the press conference Poloz announced that the economic growth in Canada was expected to be uneven that’s why the stimulus of economy was still appropriate. And the increase in rates would not be tied to any terms.

By MasterForex Company

Overview of the main economical events of the current day - 19/07/2013

Philadelphia Fed Manufacturing Index exceeded 2-year high

The US dollar was traded slightly upwards on Thursday against most major currencies amid the second speech of the Fed chairman to the Congress and positive US statistics data on the labor market and manufacturing PMI. Replying to the questions in the U.S. Senate Banking Committee Bernanke said that QE reducing at the Fed meeting in September was not a settled issue and it was too early to say when the first QE3 reducing would take place as the data released after the meeting in June turned out contradictory.

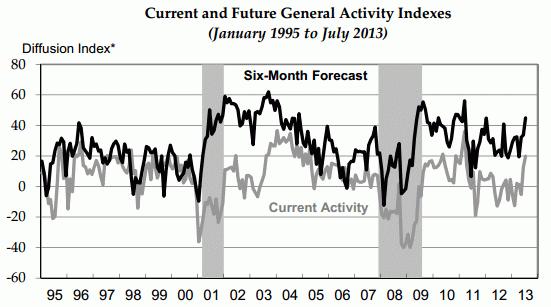

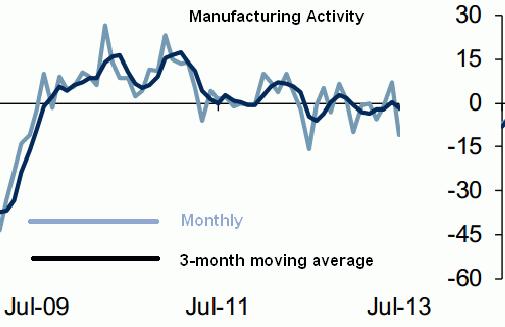

Unemployment Claims decreased by 24 thousand to 334 thousand last week while a drop to 345 thousand was expected. Philadelphia Fed Manufacturing Index grew up to 19.8 in July while it was forecasted to fall to 6.8 – and it reached the highest reading since March, 2011.The Number of Employees, Shipments and Delivery Times have risen. Future General Activity Index in 6 months also has risen from 33.7 to 44.9.

Source: phil.frb.orgThe pound recovered after the release of retail sales report for June. The growth of the reading by 0.2% at a monthly rate coincided with the expectations but at an annual rate the data turned out much higher than the forecasted estimates: 2.2% compared with the expected 1.7% - mainly due to the revised upwards data for May from 1.9% to 2.1%. Besides, retail sales for the second quarter rose by 0.9%, which can add 0.1% to the GDP growth for the second quarter – according to the representative of the Office for National Statistics (ONS).

The euro was traded downwards; the pressure was put by the surplus decrease of the euro-zone current account which seasonally adjusted dropped to 19.6 bln euros in May from the revised upwards reading of 23.8 bln in April. The decrease was mainly due to a higher deficit in current transfers and income decline, the European Central Bank declared.

The yen weakened significantly before the G-20 meeting which will take place on Friday and Saturday in Russia and also before the elections to the upper house of Japan's parliament on Sunday. At the meeting of G-20 finance ministers ultra-loose monetary policy is not expected to be criticized as a competitive devaluation. According to the opinion poll the ruling coalition of Prime Minister Shinzo Abe is expected to win at the elections to parliament, which will allow it to get the control over both houses of parliament and to increase its chances for the economic policy promotion.

AUD and NZD were traded downwards on Thursday amid the concerns about economic growth rates in China. International Monetary Fund marked increasing risks that Chinese economic growth rates would fall short of the forecasts this year, having called on the government of China to continue reforms to support economic development.

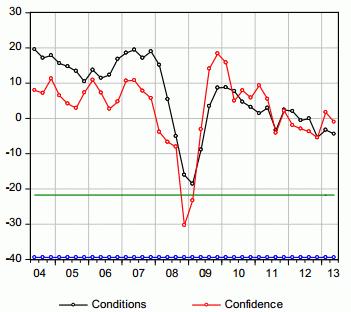

Source: business.nab.com.auBesides, NAB Quarterly Business Confidence of Australia dropped to a negative reading in the second quarter while in the first quarter it was positive. ANZ Consumer Confidence fell by 3.3% in July. At the same time CAD grew after the wholesale sales which showed the highest growth rates in May for two years.

Overview of the main economical events of the current day - 22/07/2013

The main events of the week

The dollar was traded downwards on Friday against the yen and commodity currencies amid a sharp decline of Japanese stock market and the decision of the People’s Bank of China to abandon restrictions concerning lending rates. Japanese stock index Nikkei 225 dropped by 1.48% on Friday before the elections to the parliament on Sunday, which has become the largest decline for the month. The People’s Bank of China canceled its floor limit for lending interest rates. This measure is considered a key step in liberalizing its national interest rate regime.

By the end of the week the dollar had decreased against all major currencies except yen and lost 0.5% according to the dollar index after 2-day testimony of the Fed chairman to the US Congress which led the market participants to the conclusion that QE3 tapering off shouldn’t be waited in the nearest time. The largest growth against the dollar was shown by the New Zealand dollar (+2.11%), Australian dollar (+1.61%) and British pound (+1.11%). Then it is followed by the euro (+0.60%), Swiss franc (+0.58%) and Canadian dollar (+0.23%).

There won’t be so much macrostatistics data this week – the first two days of the week and Friday are almost empty. On Wednesday there will be a release of Flash Manufacturing PMI & Flash Services PMI of France, Germany and euro-zone. A weak indices growth is expected, which indicates a slow recovery although they are still below the level of 50 which separates economy’s expansion from its contraction. On Wednesday the same HSBC Flash Manufacturing PMI of China will be released. On Thursday IFO indices will be released and also there is an expectation of a slight growth connected with the improvement of the current situation.

The main event of Great Britain will be the publication of preliminary GDP for the second quarter on Thursday. A slight speedup of economic growth is expected up to 0.6% compared with the prior quarter due to the retail sales increase and construction sector recovery. On Tuesday there will be a release of BBA Mortgage Approvals and on Wednesday - CBI Industrial Order Expectations.

In Australia second quarter inflation survey will be published on Wednesday. The data are expected to be tempered, which meets a recently announced Central Bank’s position which says that the bank has enough room to reduce interest rates if it is necessary for the economy. On Thursday a meeting of the New Zealand Central Bank will take place, no policy changes are expected; On Wednesday trade balance will be published. In Canada retail sales will be published on Tuesday. In Japan trade balance will be published on Wednesday and consumer inflation data – on Friday.

In the USA Existing Home Sales (Monday) and New Home Sales (Wednesday) will be released. On Thursday Durable Goods Orders will be published. On Monday Chicago Federal National Activity Index will be released, on Tuesday - Richmond Manufacturing Index and on Friday - Revised U. of Michigan Consumer Sentiment.

By MasterForex Company

Overview of the main economical events of the current day - 23/07/2013

The US existing home sales rate dropped unexpectedly

The dollar was traded downwards on Monday against all major currencies on the back of weak housing market and economic activity data. The dollar was negatively influenced by the statement of the head of the largest bond fund PIMCO Bill Gross who announced on Sunday that he was sure that Fed wouldn’t start tightening its monetary policy at least until 2016.

Meanwhile according to the Bloomberg poll held among economists last week – half of the respondents expect QE3 tapering off already in September. It is more than 44% in June opinion poll. According to the opinion poll held by Reuters 38 from 56 economists expect Fed to reduce bond purchases in September.

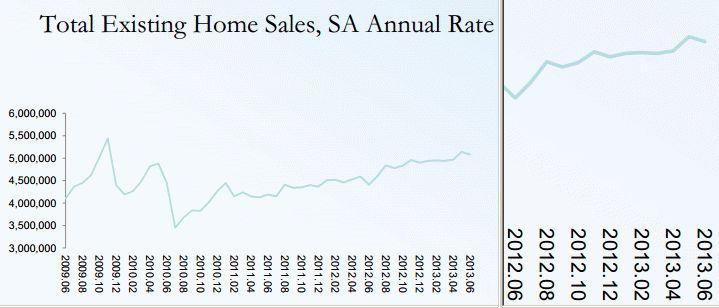

The report of the National Association of Realtors, published on Monday, showed that the USA Existing Home Sales dropped by 1.2% in June to 5.08 million houses at an annual rate compared with the revised downwards reading for May 5.14 million houses. Sales growth by 1.4% up to 5.25 million was expected. The sales are falling due to supply decrease and price growth. The number of homes for sale in June is the lowest since 2001. A median existing-home price in June has grown by 13.5% for a year up to $214.2 thousand.

Source: realtor.orgThough Chicago Federal National Activity Index rose in June to -0.13 in comparison with -0.29 in May – yet it didn’t reach forecasted zero and remained in the negative territory for the 4th month in a row. A negative reading indicates below-trend economic growth. Employment and production subindices have grown while consumption, housing, sales, orders and inventory dipped.

The euro reached its monthly low against the dollar. Portuguese President backed the centre-right coalition past weekend, having rejected the opposition’s demand to dissolve the parliament and call snap general election thus ending the political uncertainty in the country. Meanwhile according to the Bundesbank June survey published on Monday economic growth in Germany seems to slow down by the end of the third quarter of the year.

The pound has grown higher 1.53 against the dollar for the first time since the end of June. Export activity in Great Britain grew to 6-year high in the second quarter – according to the British Chamber of Commerce and logistics company DHL. Export sales and orders growth is marked. According to the Markit report the UK household sentiment in July reached its highest reading since February, 2009.

The yen rose on Monday after the ruling Liberal Democratic Party of Japan had won a landslide victory in last Sunday elections to the upper house of parliament, thereby getting the control over both houses of parliament, which significantly facilitates reforms promotion. However this victory was widely expected and in fact led to profit taking.

By MasterForex Company

Overview of the main economical events of the current day - 24/07/2013

Retail sales in Canada exceeded expectations

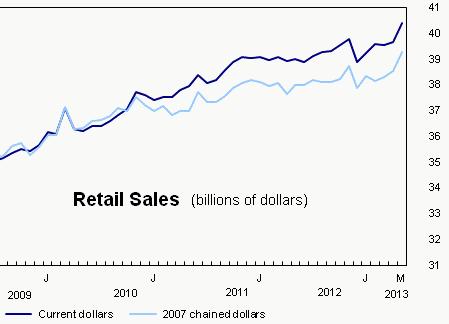

The Canadian dollar rocketed after the release of retail sales report which turned out much better than expected. Retail sales grew by 1.9% in May compared with the prior month, which is almost 5 times more than forecasted and it has become the largest monthly growth since March, 2010. Core Retail Sales have grown by 1.2% against the forecasted growth by 0.1%. Besides, April data were revised upwards by 0.1%.

Source: statcan.gc.caThe US dollar continued falling on Tuesday against almost all major currencies on the back of weak manufacturing index and not enough strong data from the housing market – although at the beginning of the day it made attempts to grow. FHFA House Price Index though grew by 0.7% m/m in May yet didn't reach forecasted growth by 0.8%. Besides, April data were revised downwards to +0.5% from +0.7%.

The report of the Federal Reserve Bank of Richmond, one of the five major Federal Reserve Banks reports for the month, showed that manufacturing index significantly decreased in July and again moved to the negative territory.

Source: richmondfed.orgThe index plunged to -11 compared with +7 in June. There was a significant decrease of shipments, volume of new orders, and backlog of orders. Index above zero means activity growth. Manufacturing indices in other US regions show signs of improvement in July.

The euro grew on Tuesday amid the growth of consumer and business confidence in the euro-zone. Euro-Zone Flash Consumer Confidence grew up to -17.4 in July against -18.8 in June (with the forecast of -18.3), which is the highest reading since July, 2011. The index has been growing for the 8th month in a row. French Business Confidence Indicator rose to 95 in July against 93 in June, which also exceeded the forecasted reading 94.

The pound recovered from the early day decrease and even had grown by the end. According to the British Bankers' Association BBA Mortgage Approvals grew to 37.3 thousand in June (against 36.3 in May) having reached the highest reading since 2012 although they turned out less than forecasted 38.3 thousand.

By MasterForex Company

Overview of the main economical events of the current day - 25/07/2013

US New Home Sales Jumped to 5-year High

The Australian dollar fell significantly on Wednesday after the release of quarterly inflation data that turned out lower than forecasted. According to the Australian Bureau of Statistics consumer prices in the second quarter of this year grew only by 0.4% against the forecasted growth by 0.5%. At an annual rate inflation has risen by 2.4%, which also turned out lower than expected 2.5%. The BlackRock analysts believe that in the nearest six-nine months AUDUSD could fall to $0.80.

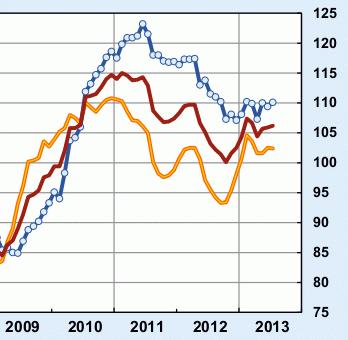

Extra pressure on AUD was put by the decrease of manufacturing index in China. HSBC Flash Manufacturing PMI dropped to 11-month low 47.7 in July against 48.2 in June. The index has been lower 50 points for the third month already, which proves activity decrease and indicates further slowdown of the world’s second largest economy. Almost all sub-indexes fell, especially new orders, inventories and employment components.

Source: markiteconomics.comThe US dollar was traded upwards on Wednesday against all major currencies amid strong housing market and manufacturing index statistics and also PMI decrease in China, which led to commodity and stock assets fall. The U.S. Markit Flash Manufacturing PMI rose to 53.2 in July compared with 52.2 in June.

According to the Commerce Department new home sales reached 5-year high in June, which increases the chances of American policy stimulus program prompt possible reduce. New home sales grew by 8.3% in June compared with May (497 thousand homes at an annual rate) while a sales growth only by 1.7% (to 484 thousand) was expected.

The euro was traded upwards at the beginning of the day after the release of strong Manufacturing and Services PMI but then lost all the growth. The Euro-Zone Markit Flash Composite PMI rose to 18-month high 50.4 in July from 48.9 in June having exceeded the expectations at 49.1. It is the first time in 1.5 years the indicator has exceeded the key level of 50 points which demonstrates PMI increase in the economy.

PMI of Germany and France, the euro-zone largest economies, have also exceeded the expectations. German Composite PMI has reached 5-month high and in France – 17-month high. Despite the situation improvement Commerzbank’s poll showed that 70% of German companies forecasted the euro’s fall against the dollar during the nearest three months.

The pound also fell before the release of the UK preliminary GDP for the second quarter on Thursday despite CBI Industrial Order Expectations growth to 7-month high. The companies wait for further orders growth in the nearest months - according to the Confederation of British Industry poll. CBI Industrial Order Expectations increased to -12 in July compared with -18 in June. The result, however, coincided with the expectations.

By MasterForex Company

Overview of the main economical events of the current day - 26/07/2013

The Dollar Falls before Fed Meeting

The dollar weakened significantly on Thursday amid the release of contradictory US statistics. Despite a considerable growth of durable goods orders which exceeded the forecasts - Durable Goods Orders Ex Transportation remained unchanged. Besides, unemployment claims rose by 7 thousand for a week. Market participants seem to regain beforehand the results of the Fed meeting which will take place July, 30-31 and probably weaker US GDP data and Non-Farm Payrolls which will be also released next week.

Dollar sales increased at the end of the American session, which was caused by the article in Wall Street Journal which said that according to the results of the meeting next week the Fed would probably keep unchanged its asset purchase program of 85 bln dollars at a month. And Fed can lower unemployment and inflation threshold to predict rates and indicate that the rates can stay at a record low level longer than it was supposed earlier.

According to the U.S. Department of Commerce Durable Goods Orders grew by 4.2% in June compared with the prior month against the forecasted growth by 1.1%. However, Durable Goods Orders Ex Transportation didn’t change although a growth by 0.5% was expected. Almost all the orders increase was due to the growth of civilian aircraft orders and orders for defense.

The euro again approached 1.33 against the dollar for the first time since June, 20 amid the growth of German business climate, consumer confidence in Italy and unemployment decrease in Spain, which indicates an acceleration of economic growth rates in the second half of the year. According to the German institute IFO, IFO - Business Climate grew in July to its high 106.2 from March compared with 105.9 in June having shown the third monthly growth in a row and having slightly exceeded the expectations. IFO - Current Assessment rose more than forecasted but IFO – Expectations fell a little.

Source: cesifo-group.deConsumer Confidence Index in Italy grew to 97.3 in July against 95.8 in June, which is the highest reading for two years. In Spain for the first time in two years an unemployment decrease was recorded. By the end of the second quarter the reading dropped to 26.3% compared with 27.1% in the prior quarter.

The pound grew amid the release of preliminary GDP for the second quarter although the first reaction was a decrease as the data coincided with the expectations. The UK GDP has risen by 0.6% in comparison with the past quarter when its growth only by 0.3% was recorded. And at an annual rate the growth accounted for 1.4% (the largest increase since the first quarter of 2011) against 0.3% growth in prior quarter.

New Zealand dollar rocketed after the Reserve Bank of New Zealand meeting where the policy was kept unchanged but RBNZ Rate Statement turned out tougher. The head of RBNZ Graeme Wheeler announced that the economic growth of New Zealand had increased and removal of monetary stimulus would likely be needed in the future although he expected the rate to be kept unchanged through the end of the year. Monetary stimulus will depend on inflation in housing and construction sectors but an annual inflation is expected to rise during the nearest year. After that statement the probability of rate increase by March, 2014 rose to 92% against 76% earlier.

By MasterForex Company

Overview of the main economical events of the current day - 29/07/2013

The main events of the week

The US dollar was traded almost unchanged on Friday against the euro and the pound but it fell against the yen and commodity currencies despite the US consumer confidence growth that reached its high for 6 years. Revised U. of Michigan Consumer Sentiment rose to 85.1 in July against 84.1 in June and preliminary reading 83.9 for July having exceeded the expectations at 84. The dollar lost almost 1.2% according to the dollar index for a week. A slight growth against the dollar was shown by the yen and New Zealand dollar.

This week falls on the start of the month and may become the most important one in the whole coming month and set the direction of trading till the end of the summer. This week meetings of three most important central banks of the world will be held and the US labor market report will be published. On Wednesday the results of 2-day Fed meeting will be released and on Thursday – the results of the European Central Bank and the Bank of England.

On Wednesday all the attention will be drawn to the FOMC Statement. Last week there appeared rumors that the Fed would probably lower unemployment and inflation thresholds to start tightening monetary policy. If they are lowered, QE tapering off may be delayed for a longer term. No changes in the policy of the ECB and the BoE are expected but the attention as always will be drawn by the press conference of Mario Draghi by the end of the meeting. The Bank of England can again publish a rate statement as at the previous meeting.

In the euro-zone Spanish Flash GDP for the second quarter and confidence indexes from the European Commission will be published on Tuesday. Euro-zone business confidence is expected to rise a little in July again. On Wednesday the euro-zone unemployment data and inflation preliminary data will be released. On Thursday there will be a release of manufacturing PMI of Spain and Italy and the final readings of these indexes of France, Germany and the whole euro-zone.

In Germany GfK Consumer Climate and preliminary inflation data will be released on Tuesday; retail sales and Non-Farm Payrolls – on Wednesday. In Great Britain Manufacturing PMI & Construction PMI will be released on Thursday and Friday respectively. On Monday there will be a release of BoE lending report and CBI Realized Sales. On Tuesday - GfK Consumer Confidence.

In Australia Building Approvals data will be released on Tuesday and Private Sector Credit data - on Wednesday. Quarterly reports of import prices, export prices and producer price index will be released on Friday. In Canada GDP data will be released on Wednesday. In Japan preliminary industrial production data will be released on Tuesday. In China official Manufacturing PMI will be released on Thursday and Non-Manufacturing PMI – on Saturday.

There will be a release of a lot of US important data. Pending Home Sales are released on Monday. CB Consumer Confidence and S&P/Case-Shiller Composite-20 HPI – on Tuesday. Preliminary GDP for the second quarter and ADP Employment Change – on Wednesday. ISM Manufacturing PMI – on Thursday. And very important Non-Farm Payrolls statistics data will finish the week on Friday.

By MasterForex Company

Overview of the main economical events of the current day - 30/07/2013

FOMC meeting starts on Tuesday

FOMC meeting starts on Tuesday and its results will be announced on Wednesday. Meanwhile, the dollar was traded quietly on Monday with a slight growth against almost all major currencies except the yen. Further growth was prevented by rather weaker housing market data. Although Pending Home Sales dropped less than expected – previous month data were revised downwards.

According to the National Association of Realtors the Pending Home Sales Index fell slightly in June by 0.4% compared with the prior month to 110.9. However, the reading for May was revised most of all – from 112.3 to 111.3 – when the index reached 6-year high. Dallas Fed Manufacturing Index also decreased to 4.4 in July against 6.5 in June and forecasted 7.3 – new orders and production have dropped.

The pound was traded downwards amid the Bank of England lending report release. Despite the Central Bank efforts to facilitate lending conditions, mortgage approvals suddenly dropped to 57.7 thousand against the forecast of 59.7 thousand and May reading of 58.1 thousand. Despite mortgage approvals growth, consumer credits were rising at a slower rate in June to ₤0.5 bln compared with ₤0.8 bln in May.

The yen has risen to its monthly high on the back of the Japanese stock market decrease after the release of a weak Japanese retail sales report. Japanese Nikkei 225 lost 3.3%, which has become the sharpest decline since June, 13. Retail sales in Japan dropped by 0.2% in June compared with May with the forecasted growth by 0.8%. At an annual rate the sales have risen by 1.6%, which turned out lower than the expected growth by 2.1%.

The yen growth was also supported by the speech of the Bank of Japan Governor Haruhiko Kuroda where he said that achieving 2% inflation goal would take more time than expected. According to the experts of the ING bank USDJPY may drop to Ұ92 as the outlook of this pair has worsened to bearish one.

The Australian dollar was traded downwards on Monday amid the concerns about the unstable situation in China. According to the National Bureau of Statistics of China Industrial Profits (y/y) grew only by 6.3% in June having slowed down after the upturn in May by 15.5%. Industrial Profits (year to date) also slowed down to 11.1% compared with 12.3% prior month. A negative effect was also made by the decision of the Chinese government to oblige more than 1.4 thousand companies of various industries to reduce excess capacity by the end of this year to achieve a more stable and sustainable economic growth.

By MasterForex Company