You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Overview of the main economical events of the current day - 18/06/2013

The World's most influential bank is to hold meeting on Tuesday

It was yet one more calm day of moderate fluctuations within quite small ranges as no significant events happened. All market players were waiting for FRS meeting to begin on Tuesday. Summarizing the day’s results, dollar’s rate almost didn’t change speak by dollar index, though attempts to increase were made in the beginning and middle of the day after Empire State Manufacturing Index and NAHB Housing Market Index turned out to be exceeding expectations.

According to report of National Association of Home Builders (NAHB) Housing Market Index increased to 52 in June by adding 8 points as compared to May’s value, thus, reaching the highest level since April 2006. It was the largest leap of the index since 2002. For the first time since April 2006 the index exceeded 50-point mark. US housing market’s conditions are getting better and it is still the driving force of economic rehabilitation.

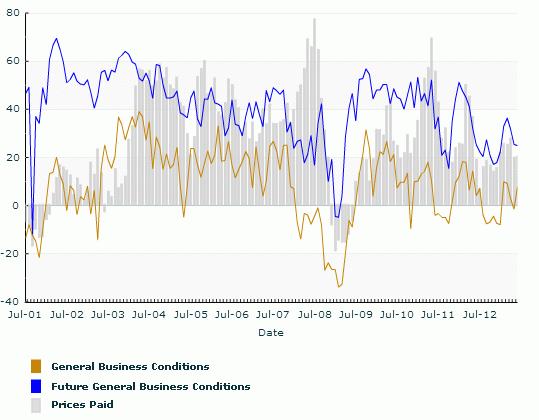

Report of Federal Reserve Bank of New York showed that production index reached the level of 7.84 as compared to 1.43 in May, while the market expected the zero value. Although, merchandise delivery, new orders and employment sub-indexes worsened.

Source: ny.frb.orgEuro's rate increased slightly against dollar backed by Euro Zone’s April balance of trade data. Export surplus happened to be just slightly less than the recorded maximum of this March. This Saturday the Italian government went public with the 3 bln Euro set of measures to revive the economic growth.

Marketable currencies decreased slightly on Monday in spite of decent data. Quarterly Westpac NZ Consumer Confidence index almost recorded the 3-year maximum. Canada’s Foreign Securities Purchases report showed that foreign investors purchased Canadian securities to the total amount of 14.91 bln CAD in April, thus, reaching maximum of the last seven months. Existing Home Sales in Canada increased by 3.6% in May as compared to the previous month.

By MasterForex Company

Overview of the main economical events of the current day - 19/06/2013

The markets wait for FRS meeting’s results

Dollar index actually is standing still for four days on end. On Tuesday dollar slightly increased against pound, yen and marketable currencies, but weakened a little against euro. Market participants wait for FRS to make decisions on Wednesday and will particularly closely analyze FOMC Statement summarizing results of the meeting and following FOMC Press Conference to clarify the Central Bank's intentions regarding terms of potential FRS asset purchase program shutting down.

Housing market and inflation data put some pressure on dollar. Housing Starts increased in May by 6.8% to 914 thousand, though happened to be worse than expected. Building Permits decreased by 3.1% to 974 thousand, which is also slightly worse than expected. Consumer Price Index (CPI) increased in May by a lesser degree than expected – by 0.1% as compared to the last month.

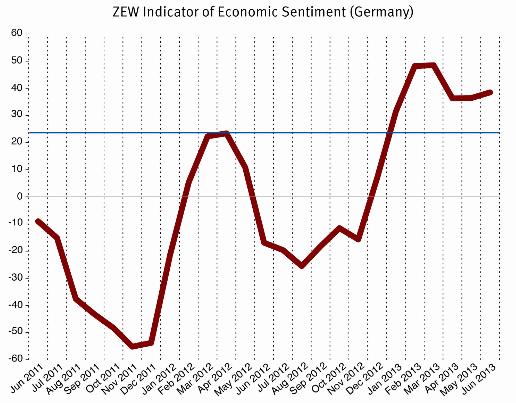

Euro kept on growing gradually to the 4-month maximum, higher than 1.34 backed by German ZEW Economic Sentiment. In June the index increased to 38.5 against 36.4 in May, thus, exceeding expectations by 0.4 point. At the same time, German ZEW Current Situation index decreased slightly in June: 8.6 against 8.9 in May, stopped well short of expected value 9.5.

Source: zew.deMeanwhile, ECB’s Mario Draghi declared on Tuesday that the ECB considers additional unconventional monetary policy measures to be used in case of emergency.

Pound's rate decreased, even though consumer inflation increased in May by a slightly larger degree than expected. Consumer Price Index increased by 2.7% on an annualized basis against 2.4% last month, while increase by 2.6% was expected. At that, production inflation stopped slightly short of expected growth values.

Australian dollar's rate dropped pressed down by RBA’s Monetary Policy Meeting Minutes showing the Central Bank is willing to decrease the key interest rate if necessary. “Australian dollar’s rate is still high, and inflation perspectives might facilitate further rate reduction" as said in the Minutes.

By MasterForex Company

Overview of the main economical events of the current day - 20/06/2013

Dollar gets its power back

Dollar spiked against all majors once results of two-day monetary policy meeting were announced, and accompanying announcement of Federal Open Market Committee (FOMC) made known to public. The Committee left interest rates and bonds purchasing volume unchanged. This meeting’s result was predicted by most analysts.

For the first time since September, 2011 more than one FOMC member opposed the majority decision. James Bullard and Esther George voted negatively. Their argument was that "The Committee should more decisively indicate its intention to ensure the target inflation level in view of recent low index rates” and that “the current high extent of monetary stimulation increases risks of future economic and financial disbalance and eventually might lead to long-term inflationary expectations increase”.

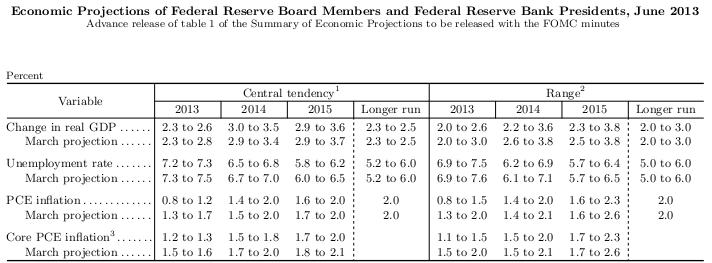

According to the Committee, current monetary policy remains reasonable, at least, as long as the unemployment rate exceeds 6.5%, expected inflation rate for the next two years doesn't exceed 2.5% and long-term inflationary expectations are balanced enough.

In economic and monetary policy forecasts issued on Wednesday FRS stated that the unemployment rate might decrease faster that it was expected earlier. It might reduce to 6.5% by the end of 2014, though before it was expected to stay higher than 6.5% until 2015. Unemployment rate reduction to 6.5% is one of preconditions along with inflation growth to start shutting down the QE-3 program. FRS also appreciated the US economic recovery perspectives and declared the housing market indicates further advance.

Source: federalreserve.govDuring press conference Ben Bernanke announced approximate terms of bonds purchasing shutting down. He said, if economic recovery will continue, FRS will start to cut asset purchasing later this year and might finish by mid 2014. However, monetary policy's direction wasn't determined in advance and will depend on economic data being issued.

The announcement and strain of the press-conference were more optimistic in regards to the economy, and this spoke well for those market players, who think monthly bond purchasing will, probably, reduce further. All these factors increase dollar’s attractiveness.

By MasterForex Company

Overview of the main economical events of the current day - 21/06/2013

Dollar keeps on raising

Dollar continued to raise on Thursday after FRS's Ben Bernanke announced on Wednesday that the Fed might start shutting down its bonds purchasing program later this year and terminate it completely by the middle of next year. Besides of that dollar was supported by housing market data, as well as by business activity data from Philadelphia Fed’s region.

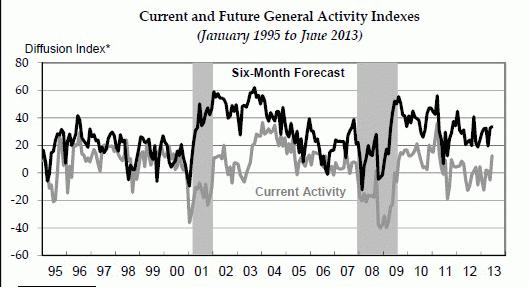

US Existing Home Sales suddenly spiked by 4.2% to 5.18 million houses on an annualized basis in May (it’s maximum since November, 2009), while growth just to 5 million houses was expected. Philadelphia Fed Manufacturing Index reached its maximum since April, 2011 in June after increasing to 12.5 points, while growth from May’s level of -5.2 points to -1 point was expected. Growth of the index was caused by substantial increase of sale and purchasing prices, as well as of new orders. At the same time, delivery terms and inventory reserves reduced.

Source: phil.frb.orgAt the same time some of the data was not so optimistic. Unemployment Claims increased last week to 354 thousand against the expected increase to 340 thousand. Conference Board Leading Index increased just by 0.1% in May, while increase by 0.2% was expected, though the index growth rate in April was reviewed from 0.6% to 0.8% (maximum since March, 2011).

Euro’s rate continued to reduce, and Flash PMIs turned out be slightly exceeding expectations couldn’t support euro. Euro zone’s business activity level decreased to the least extent since the last March. Euro zone’s Flash Composite PMI increased in June to 48.9 as compared to May’s 47,7. At the same time, German Flash Manufacturing PMI reduced suddenly. PMI index dropped to two-month low and amounted to 48.7 against May's 49.4.

Pound was supported by May’s retail sales data revived after faulty April, as consumers willingly took advantage of ad campaigns of super markets. Office for national statistics announced that retail sales increased by 2.1% in May as compared to April's value and by 1.9% as compared to the same period last year, while growth just by 0.8% and 0.2% correspondingly was expected. CHF almost didn't change its rate by the end of the day backed by Switzerland's central bank that left monetary policy unchanged.

Marketable currencies reduced on Thursday to the larger extent than the others, pressed down by preliminary Chinese production industry business activity data in June. HSBC Flash Manufacturing PMI dropped to 9-month minimum of 48.3 points, while growth from May’s 49.2 to 49.4 points was expected. NZD was pressed down by the 1st quarter GDP data. Quarterly GDP growth amounts to 0.3% against expected growth of 0.5%.

By MasterForex Company

Overview of the main economical events of the current day - 24/06/2013

The main events of the week

According to the results of the last week the dollar showed a considerable growth having recovered a half of the 4-week fall. The dollar index growth amounted to 2.39%. The deepest fall against the dollar was shown by the Japanese yen and commodity currencies. The dollar growth started just after the results of the Fed meeting had been announced when the possibility of QE-3 program was confirmed to reduce in the second half of the year and to scale back totally by the middle of the next year.

According to the Bloomberg’s poll, 44% of experts await for the QE-3 volume to reduce by 20 billion dollars a month at the first autumn FOMC meeting in September, 17-18. Two weeks before only 27% were sure of it.

On Friday the dollar growth continued on the back of inflation statistics and retail sales data release in Canada which turned out disappointing for the Canadian currency. Consumer Price Index (CPI) of Canada grew by 0.2% in May in comparison with April and by 0.7% in annual terms, while a growth by 0.4% and by 0.9% respectively was expected. Retail sales in April rose by 0.1% against the forecasted 0.2%. Core Retail Sales suddenly decreased by 0.3% while no changes were expected.

The first half of the current week will not be oversaturated with macrostatistics data. Market participants will continue to “digest” the results of the past Fed meeting which can influence the trade trends during the whole summer. In the euro-zone the main event will be Germany’s IFO index release which is expected to rise slightly. On Thursday Germany’s labor market data and euro-zone confidence index from the European Commission will be released. On Friday there will be a release of German retail sales data and French consumer spending data.

In Great Britain the final GDP data for the first quarter and also current account data will be released on Thursday. On Tuesday inflation report hearings will be held and on Wednesday BoE Financial Stability Report will be published. On Friday GfK Consumer Confidence and Nationwide Housing Prices will be released. A large Japanese data block will be released on Friday: inflation, retail sales, industrial production. There will be no significant data on Australia. On Thursday there will be a release of New Zealand current account data and ANZ Business Confidence.

There will be a lot of significant macrostatistics data on the USA. On Tuesday there will be a release of durable goods orders data, CB consumer confidence and new home sales data. On Wednesday the final GDP for the first quarter will be released. On Thursday consumer income and spending report and pending home sales data for May will be released. On Friday Chicago PMI and Revised U. of Michigan Consumer Sentiment will be released.

By MasterForex Company

Overview of the main economical events of the current day - 25/06/2013

Business confidence in Germany improved only slightly in June

On the first day of the week trade at the currency market was rather calm and the dollar almost had not changed by the end of the day amid poor macrostatistics data. However at the beginning of the day the dollar tried to grow on the back of commodity and stock markets decrease that was caused by the largest for almost 4 years fall of the Chinese stock market because of the liquidity crisis threat in the country and lowering of the Goldman Sachs PRC economic growth forecast.

The dollar was growing at the beginning of the day against the yen amid the landslide victory of the ruling coalition in the municipal elections of Japan in Tokyo on Sunday, which showed a strong support of the country’s Prime Minister Shinzo Abe’s policy. This will be an aid for the ruling party at the election next month to the upper house of parliament, which will help Abe to get a full control over both houses of parliament to enact the necessary legislations to implement his policy.

Also the dollar growth at the beginning of the day was supported by a yield bounce of the US treasury bonds. The yield of 10-year bonds rose up to 2.667% - the highest level for almost 2 years.

The market had almost no reaction towards nearly the only important indicator - IFO Business Climate in Germany – as the index coincided with the expectations. The index grew up to 105.9 points in June in comparison with 105.7 points in May. Besides, IFO – Expectations grew slightly but IFO - Current Assessment decreased.

Concerning the USA not too important Dallas Fed Manufacturing Activity index rocketed in June up to 6.5 against -10.5 in May. And manufacturing index reached its 2-year high. Chicago Fed National Activity Index for May that was released on Monday also slightly grew up to -0.30 against -0.52 in April. However Three Month Moving Average which smoothes out short-term fluctuations and is considered a better indicator fell to -0.43 in May from -0.13 in April.

The statements of some Fed representatives had some negative effect on the dollar at the end of the day. So, William Dudley said that Fed “hasn’t reached its aims yet concerning employment and inflation and in recent years the monetary policy hasn’t been incentive enough”. And Fed representative Kocherlakota said that “if the inflation is still low, the Fed can buy bonds even with unemployment below 7%”.

By MasterForex Company

Overview of the main economical events of the current day - 26/06/2013

Consumer confidence in the USA reached its high for more than 5 years

The dollar grew on Tuesday after the release of statistics data and almost all the data turned out well-matched as only one insignificant FHFA House Price Index of six released turned out worse than expected. But the growth was quite moderate, which can indicate its possible continuation at the nearest time.

Durable Goods Orders grew by 3.6% in May against the forecast of 3%. Durable Goods Orders Ex Transportation rose by 0.7% while its fall by 0.2% was expected. Prior month data were also revised upwards. The reading is a leading indicator of industrial production and can testify of its growth in the nearest months.

S&P/Case-Shiller Home Price Index showed the largest monthly increase since the introduction of the statistics. House Price Index in 20 largest metropolises grew by 12.05% in annual terms and by 1.72% in comparison with the previous month, which turned out well above the expected 10.6% and 1.20% respectively.

New Home Sales in the USA grew by 2.1% compared with the previous month - up to 476 thousand houses in annual terms having reached its high for almost 5 years. All this indicates a gradual housing market recovery which will continue supporting economic growth.

Consumer confidence in the USA in June reached its high for more than 5 years. According to the Conference Board report published on Tuesday consumer confidence well exceeded the forecasted reading of 75.5 and grew up to 81.4 against 74.3 in May having reached its maximum since January, 2008.

The euro dropped on Tuesday, which was supported by the words of the ECB head Mario Draghi who announced that the situation in the euro-zone economy requires preservation of incentive monetary policy. According to him bond purchase program Outright Monetary Transactions (OMT) is needed as never before. Also retail sales in Italy dropped by 0.1% in April in comparison with the previous month although they were not expected to change.

The pound had almost no changes by the end of the day on the back of Inflation Report Hearings and the release of British Bankers' Association (BBA) report which showed that BBA Mortgage Approvals rose significantly in May up to 36.1 thousand against the forecast of 33.1 thousand. Lending scheme helps those who decided to buy a house for the first time to enter the market.

By MasterForex Company

Overview of the main economical events of the current day - 27/06/2013

The dollar grew despite the GDP report

The dollar rose on Wednesday against most major currencies but decreased a little against commodity currencies and the yen. The dollar continued its prior days’ growth despite the country’s first quarter GDP revised downwards in the third final reading. These data reflected already passed period of the beginning of the year while the markets are guided by more recent and advanced data of recent months which have more positive signals from the U.S. economy.

The U.S. Commerce Department lowered its estimate of GDP growth in the first quarter of 2013 to 1.8% at an annual rate from 2.4% while no changes were expected. The estimate worsening shows weaker than expected before rates of consumer spending and corporate investment amid increasing taxes in the USA. The estimate of consumer spending increase was lowered to 2.6% from 3.4%. Consumer spending accounts for two thirds of GDP and it is the driving force of economic growth.

The euro fell considerably on Wednesday and dropped lower than 1.30 against the dollar for the first time in 3.5 weeks after the ECB President’s speech in the French parliament. Mario Draghi said about his intention to follow a soft monetary policy in the nearest future and warned about existing risks for the economic growth in the euro-zone.

Draghi didn’t exclude any tools and said again that the ECB was ready to act in case of necessity. The positions of two CB stand in contrast – while Fed is going to scale back incentive measures, ECB announces its readiness to take them at any quantities.

The pound followed the euro and fell considerably on Wednesday on the back of semi-annual BoE Financial Stability Report and the comments of MPC Member David Miles who said that Great Britain might need a further stimulus and central banks had not made “bubbles” yet. In the semi-annual Financial Stability Report the Bank of England warned its borrowers and financial institutions about the sharp growth of interest rates, which could jeopardize the financial stability.

Commodity currencies grew slightly on Wednesday amid easing tensions in the credit market of China. Interbank rates decreased after the People's Bank of China pledged to provide banks with the necessary liquidity. Chinese CB announced its readiness to provide liquidity to all the banks that have temporal problems; it also said that it had already provided a number of banks with liquidity.

By MasterForex Company

Overview of the main economical events of the current day - 01/07/2013

The main events of the week

The dollar continued to grow on Friday after the release of the U. Michigan Consumer Sentiment in the USA which was considerably revised upwards. Friday finished the month and the whole second quarter of the year. The dollar grew according to the dollar index by 1% for the past week. But the monthly and quarterly growth turned out the lowest: only 0.1% and 0.3% respectively.

Revised U. of Michigan Consumer Sentiment for June, which was released on Friday, was revised upwards up to 84.1 in comparison with the previous 82.7 and expected growth to 83. The index still maintains at its 6-year high although in comparison with the prior month the current conditions subindex has fallen slightly but subindex of expectations has grown. At the same time Chicago PMI, usually well correlated with the national dynamic, considerably decreased in June and fell to 51.6 in comparison with 58.7 in May.

Some statements of the Fed representatives supported the dollar. FOMC Member Jeremy Stein spoke at the US Foreign Relations Council and assumed that the American CB would start to decrease the asset purchase program in September of this year. But the decision to reduce the QE will be based on the data for the period from the last year autumn, and not just the last few months - he said. FOMC Member Jeffrey Lacker announced that the further growth of the American CB balance increased the risks connected with the necessity of QE scaling back as the US economic recovery was limited by structural factors which are not controlled by the Fed.

This week as the first week of the month will be rather saturated with important events. It will be a week of PMI and the US labor market data. There will be scheduled meetings of three central banks: the Reserve Bank of Australia - on Tuesday, the Bank of England and the European Central Bank - on Thursday. No changes of the monetary policy are expected but as always the attention will be attracted by the ECB head Mario Draghi’s press conference by the end of the meeting.

The meeting of the Bank of England will be significant as for the first time it will be headed by the former governor of the Canadian CB, Mark Carney who will replace Mervyn King. During the first three days UK data will be released: industrial, building and service PMI reports. A slight growth of indexes is expected except for the service sector.

Also industrial and service PMI of European countries – Spain and Italy – will be released on Monday and Wednesday. The final readings of the indexes of France, Germany and the whole euro-zone will be also released. On Monday euro-zone unemployment data and preliminary inflation data will be published. Retail sales of the euro-zone will be released on Wednesday and factory orders of Germany – on Friday.

Euro-zone data are expected to testify the continuation of recent trends: the production recovers from the low, the unemployment continues to grow and the inflation will also rise. Unemployment rate in the euro-zone for May is forecasted to reach a new record high.

Concerning the USA there will be also very important indexes of PMI and ISM in industrial and service sectors – on Monday and Wednesday respectively. Factory orders will be released on Tuesday and trade balance – on Wednesday. Thursday is a day-off in the USA – Independence Day. So, all the Thursday data are released on Wednesday. But the main event of the week is the Friday publication of a traditional for the first week of the month US Non-Farm Payrolls for June which can correct investors' expectations for future Fed policy. The preliminary ADP data will be released on Wednesday.

By MasterForex Company

Overview of the main economical events of the current day - 02/07/2013

Decrease of the employment components didn’t allow the dollar to continue to grow

On the first day of the week, month and quarter the US dollar couldn’t continue its growth that was seen before – after the release of ISM report which showed that manufacturing index of the USA grew higher than expected after its sudden decrease in May lower 50 for the first time in six months. Manufacturing PMI rose up to 50.9 in June against 49.0 in May with the forecasted growth up to 50.5.

However employment subindex fell to 48.7 against 50.2 in May. Market participants liked this decline as it can indicate the decrease of key labor market data which are expected on Friday. Employment report is in the center of attention not only because it says about the economy state but also because it signals the Fed’s future decisions concerning monetary policy. More negative data may delay the start of scaling back bond purchases.

The euro growth was supported by similar PMI indexes released in the euro-zones that turned out better than expected (except Germany) and by revised downwards unemployment data in the euro-zone. The final manufacturing PMI in the euro-zone rose to 48.8 points in June compared with the first estimate of 48.7 points.

Manufacturing PMI in Spain rose to its 2-year high in June: 50.0 against 48.1 in May. In Italy the same index grew to 23-month high - 49.1, in comparison with 47.3 in May. April unemployment rate in the euro-zone was revised downwards by 0.2% from 12.2% to 12%. In May it grew to 12.1% not to forecasted 12.3%.

The pound didn’t manage to rise and lost most its positions despite the fact that the British PMI turned out much better than expected and grew up to 52.5 in June – the highest level since May, 2011 against 51.5 in May. Besides the number of mortgage approvals has reached its high since December, 2009 and has grown up to 58.2 thousand from 54.4 thousand in April.

The Australian dollar rose on Monday before the Australian CB meeting and amid the release of June official Chinese PMI that is 50.1 although it was expected to be lower 50. Besides AIG manufacturing PMI grew to 49.6 against 43.8 prior month.

The dollar continued to grow against the yen on the back of the continuing recovery of the Japanese stock index Nikkei, which was supported by the BOJ Tankan survey which showed that the major Japanese manufacturers are more optimistic than ever for the last two years. According to the Bank of Japan forecast the country’s economy will continue to recover till the second quarter of 2014.

By MasterForex Company