Components of the market flow trading system

There are four major components that make up this trading system. These components are very common but when used properly, it offers a combination of codes that unlocks the profitable side of the forex market. These components are:

Trendlines

Fractal(Market) Flow

Support and Resistance and

Candle Stick Patterns

Since most of you are already familiar with these individual components, I would just discuss briefly about them and then proceed to explaining more about the Market Flow trading system.

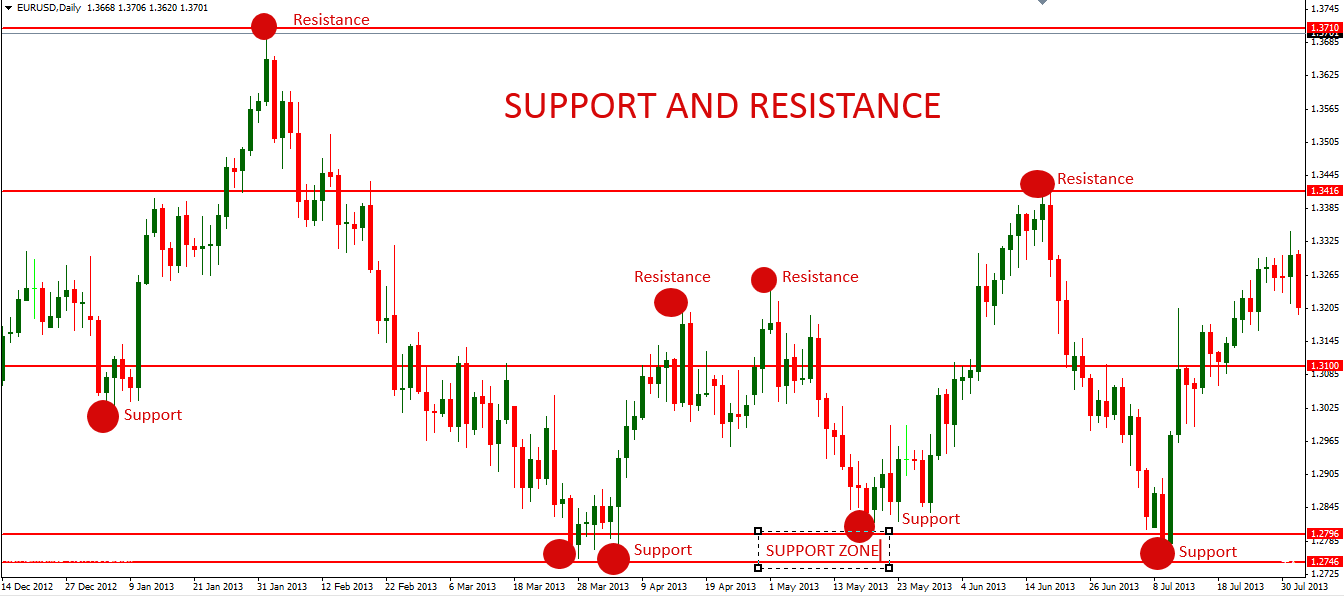

SUPPORT AND RESISTANCE

The subjects of support and resistance are two of the most high discussed concepts of technical analysis and the reason for this is not far fetch. They are very important because price tends to react around that zone and so they are important levels most trade focus their attention on during the course of trading.

If you want to be successful with technical analysis, then it is quite expedient to factor in support and resistance into your trading method as this would guide you in trading safely.

What is support and resistance?

Support and Resistance can be defined as points or areas in the market where price experiences repeated upward or downward pressure. For example, when price approaches a region of support, buying pressure tend to set into the market and if this pressure is strong enough, it would prevent the price from going lower.

The opposite is true in the case of resistance.

Once a support level is broken, it tends to become resistance and when a resistance level is broken it tends to become support.

See the chart below for proper understanding of what I mean.

Hey Ochuko, any results with the system so far?

This sounds interesting

Of course, I have had outstanding performance with this system. And as I progress with this thread, I will be posting them here to motivate all who are interested in it.

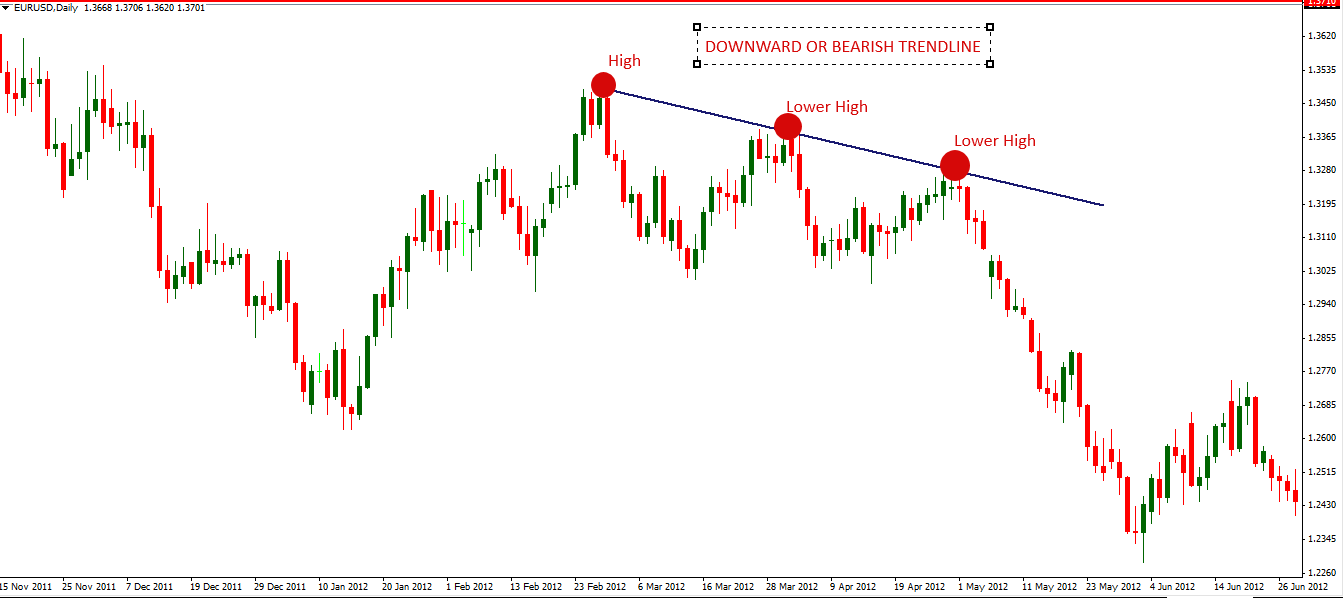

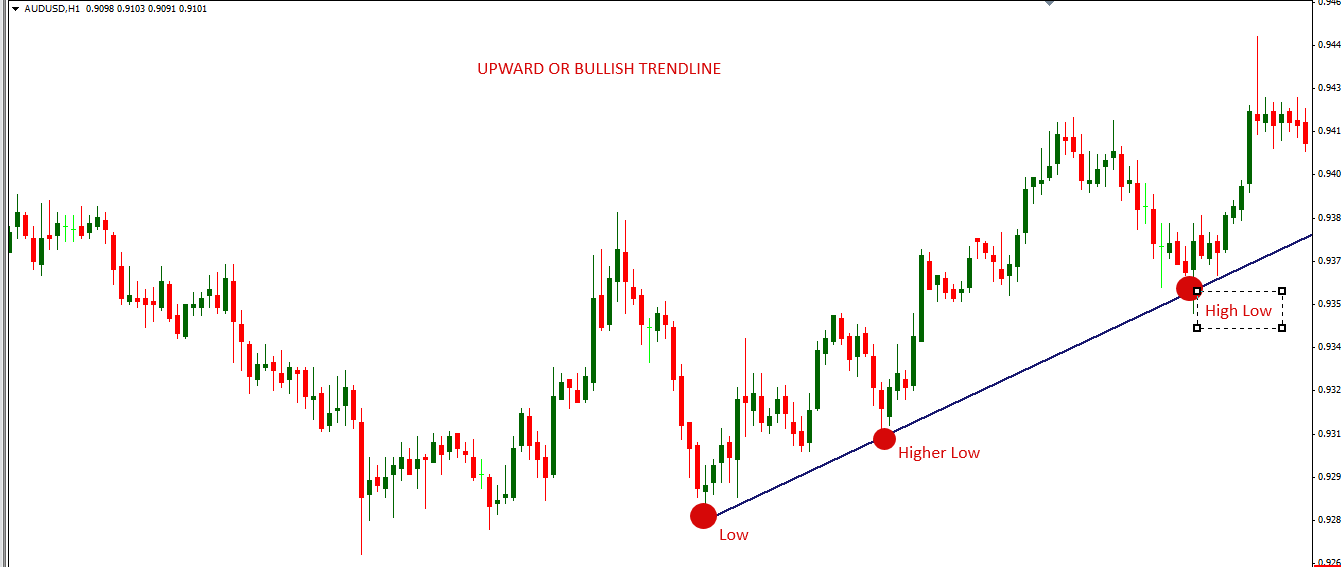

Trendlines:

Trendlines are diagonal lines draw from left to right connecting two swing points.

There are two major types of trendline and they are:

The downward trendline and

The Upward trendline.

In the Downward trendline, the diagonal line which also serves as a resistance line is drawn by connecting a Swing high and the most recent LOWER swing high. Or it can be draw by connecting a lower swing high to a most recent lower swing high. This represents the fact that the market is bearish.

In the Upward trendline, the diagonal line which also serves as support is drawn connecting a swing low, to a most recent higher swing low. Or a higher swing low to a most recent higher swing low. In this case, the market tends to be bullish.

We would be making use of trendlines in this strategy to determine where to place our entry on the 1H time frame.

Of course, I have had outstanding performance with this system. And as I progress with this thread, I will be posting them here to motivate all who are interested in it.

So you must have been trading this system for a while if you have outstanding results. At the moment you are showing really nothing.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I am here to offer a strategy that if traded properly would always keep you in the right side of the market. This strategy is a trend trading system that offers high probability win. The best part of it is that this system is very simple and I would do my best to post charts and videos in this thread to further deepen your understanding of how to apply it. The key to winning with this system is consistency in apply the step by step processes that constitute the method involved.

Since we are always going to be trading in the direction of the trend, we are sure to always be at the right side of the market.

One interesting fact about this unique system is that it helps you determine the direction of the trend which is one of the prime factors you must consider as a trader. Inability to determine the trend is one of the reasons most traders are not consistent in following their trading system because most time they trade against the market.

Once you have been able to determine the direction of the trend and you have no challenge with that, the next thing you must consider in your arsenal of trading knowledge is how to accurately determine your entry. This is where many traders find forex trading tough. Knowing where to place your trade is very important, just as knowing how to determine the direction of the trend is very crucial to success in any particular trade set up. If you can successful master this concept of trade entry, then you are on your way to becoming a successful trader.

One thing you must also put into consideration is how to manage your trade until you eventually exit the market. Trade management is something you must consider because, until you exit your trade, you cannot claim that your trade set up is going to be a winner even when the trade is successfully moving in your favour.

The reason is this; market may eventually move against you and hit your stop loss.

What I am saying in other words is that, knowing where to place your stop loss and your profit target matter so much. If you do this properly, this would mark the difference between a streak of winning trades and a streak of losing trades.

So if you want to always be in the winning side of the market, you must develop a system that always put you in a situation whereby you are always at a great advantage with the market.

If proper trade management is factored into your trading system, then you will certainly overcome the challenges I discussed above because proper trade management would ensure that you always cut your losses and make your profit run. Also your stop loss is small compare to your profit target. One of the formula of a successful trading style is small loss big profit.

These three major factors; that is Trend determination, Trade entry and Trade management are all factored into the MARKET FLOW trading system.

In each step of the live trade set ups I would be posting, I will be describing how to determine the trend direction, trade entry and trade management. This would enable us to fully take advantage of these factors as enshrined in this winning system.

Trade entry, stop loss and trade management with this system is straight forward. The easier a system, the better it is applying it for maximum profit. This strategy completely falls into the category of simple systems that yield maximum gain.