Risk management is everything in FOREX

Hi folks, I have come to realize (after six years of being actively involved in spot margin trading) that risk optimization is key.

Every trading strategy works, the only difference is patience.

In 2007, I lost $1000 in 3 minutes; I had a great system, i was so sure of it because it had worked more than 10 times before. The day it had a little twist ( because of a high impact economic release), I watched my account emptied into the FOREX market.

A few years down the line, I still use the same strategy ( with just a slight tweak) and I cant loss more than 5% of my margin.

Still the same old system; just adjusted my volume. Now I trade for a living ( over a year)

RISK OPTIMIZATION IS KEY. What do you think?

RISK OPTIMIZATION IS KEY. What do you think?

I couldn't agree more! What is the single most important factor that can keep us in the market? It's our trading capital. At all times the thought uppermost in our minds has to be protection of the trading equity. If you have capital you can live to trade another day - no capital, no trading! Proper risk management helps us preserve this most valuable asset.

A few years down the line, I still use the same strategy ( with just a slight tweak) and I cant loss more than 5% of my margin.

Still the same old system; just adjusted my volume. Now I trade for a living ( over a year)

RISK OPTIMIZATION IS KEY. What do you think?

Now I'm curious to read about your tweaked strategy...

Hi folks, I have come to realize (after six years of being actively involved in spot margin trading) that risk optimization is key.

Every trading strategy works, the only difference is patience.

In 2007, I lost $1000 in 3 minutes; I had a great system, i was so sure of it because it had worked more than 10 times before. The day it had a little twist ( because of a high impact economic release), I watched my account emptied into the FOREX market.

A few years down the line, I still use the same strategy ( with just a slight tweak) and I cant loss more than 5% of my margin.

Still the same old system; just adjusted my volume. Now I trade for a living ( over a year)

RISK OPTIMIZATION IS KEY. What do you think?

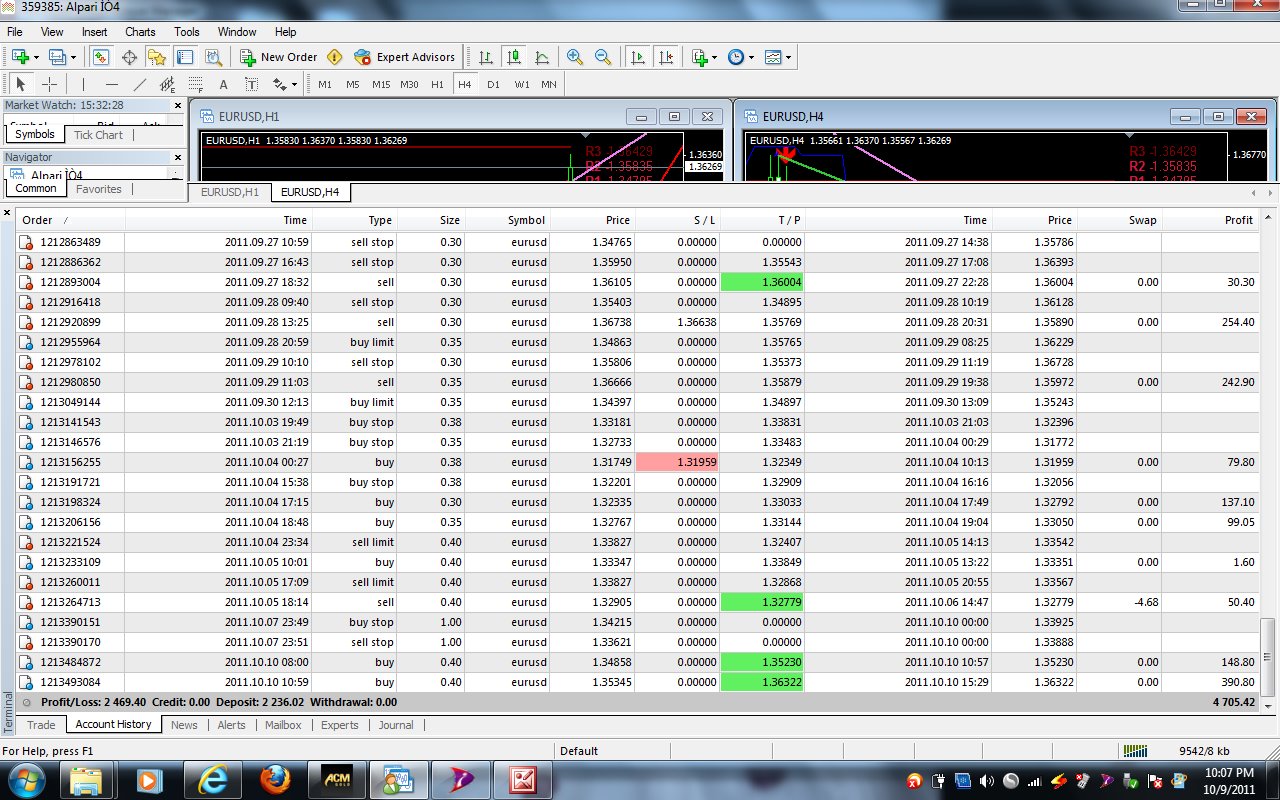

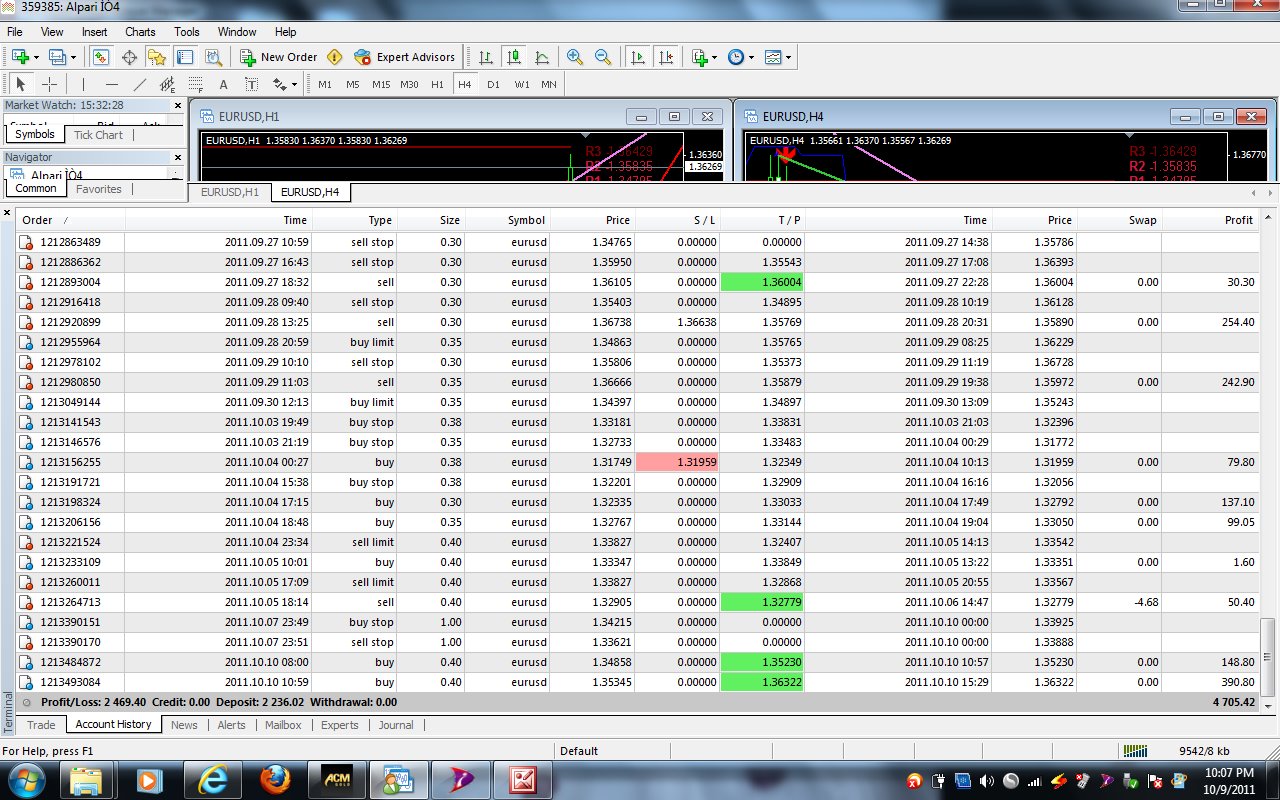

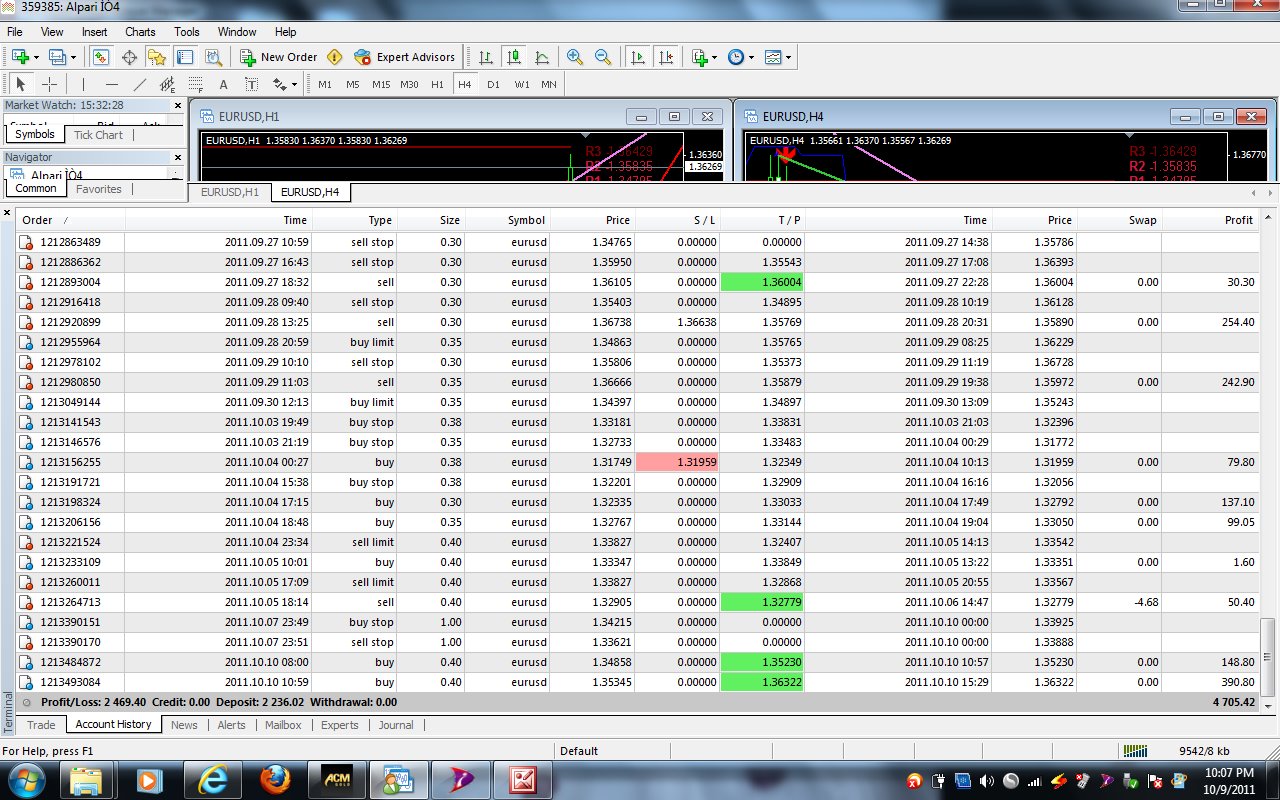

Excellent work. This is why I use a spreadsheet to help determine how many positions and how much of a pip trading range my accounts can handle. The clear distinction between just defining risk arbitrarily as so many people do or handing out one-size-fits-all advice such as "risk no more than xx% per day" does not evaluate the core aspects of a strategy and how it trades. The spreadsheet is best suited for a grid setup, or using a basket of trades.

Glad to be able to see this forum still, I am looking for a very long time, I went home.I've been playing a game, think a lot of fun,

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Risk Management in Forex Trading

Risk Management in Forex Trading is a term that is very important in trading world and at the same time is a major point which mostly gets out of focus when traders start real time trading. The first and foremost difference in trading a demo and a real account is the human psychology. The point is here that how to overcome this problem?

The best way to go is to practice hard and I strongly recommend to practice for at least 3 months as this time period will cover up learning the different time frames as well during that time; a trader can experience all effects of fundamental news and attributes.

Devise and test a risk management strategy over that period without changing it, no matter it is not providing any profits, just keep using it and analyze your strategy after 3 months of so that you can average out all the good and bad runs you had during that time.

Now coming to other part, i.e., devising a good risk management strategy. Originally the market used to not be for the small traders as brokers only allow standard lots or micro lots. Therefore if you are trading a small account, you are risking too much for a trade. In the recent years, there are introduction of new brokers that allows you to trade even 1 unit. This way, you can still apply the same proper risk management strategy or else your account will be blown before you know it.

To devise a risk management plan, first of all figure out what is the risk percentage per trade? For example, how much percentage of the account can be lost in the worst case of a trade?

Usually good traders make 1-2% as a mark to risk per trade. Next you have to set a percentage % of how much can you lose in your forex account (your maximum drawdown). For example, if you lose 30% – 50% of your account using a system. You should stop trading altogether and reflect back on your system. Find out why is it not working and where to tweak it to improve your future trades.

Once the maximum drawdown and the risk percentage per trade is defined, Always keep your stop fix and don’t extend it while you are winning trades.

I have seen traders extending their stops in hope that the market will come back and they won’t have to face loss in that trade. Believe me, often I have seen traders getting them into this situation and loosing out all account. There will also be times when you will be just stopped out and market will reverse, even in those cases don’t get disappointed and keep following the same strategy.

Therefore, even before any one starts trading, one has to devise a proper risk management. With a proper risk management system and combined with a good trading system, you are on the right track to success in forex trading.

Ezekiel Chew

Asia #1 Forex Mentor from Asia Forex Mentor Price Action Forex Course|Free Forex Trading Strategies | System