As a short term fundamental indicator it could work. I would add some technical indicators like MACD, BB and Stochastic for more confluence. You could check also Henry Liu's news meter (c.s.m306) before entries. On what time frame do you want to trade it?

Cheers Hermes

Here is a update:

i have made an EA for this System and here is the Results of 2013

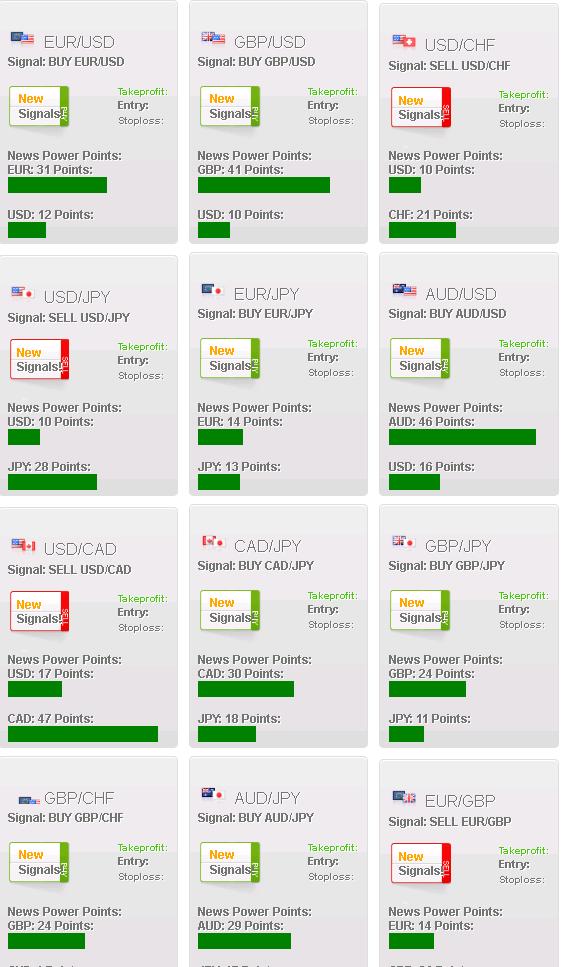

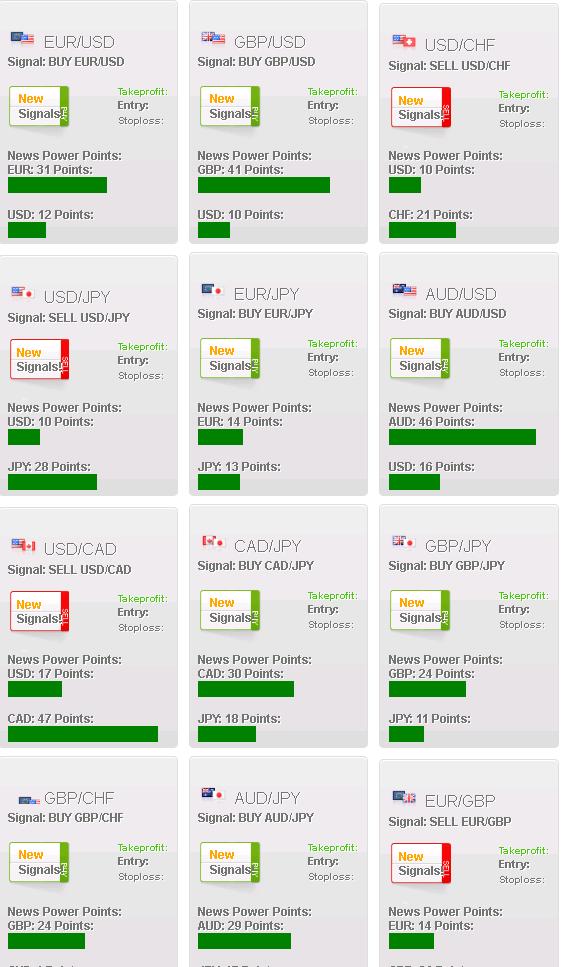

This are online the Weekly Signals, daily Signals will come later.

Enjoy..

Best regards

Hello forex-tsd,

here is the signals from the system for coming week. And will be opened on market open:

enjoy.

Best regards

Weekly Forex signals - Sundays! - Expected Forex Eco News Trading

Hello Forex-TSD Traders,

here i want to share my signals that i get from my selfmade signalgenerator, which looks for the upcoming economic news... seen here: https://www.mql5.com/en/forum

It looks for the Forecast number and Previous number. Then it make some calculations and pulls out signals, i dont want to go to deep in the formula.

The benefit of this system is that you didnt have to watch the market all day long...

Place your Trades on Sunday on Market open or Monday if there wasnt much changes in the Market... and come back on Friday to close your trades or see your results.

Iam going to post every Sunday the Signals.

This Signals should be traded only on Market open!

TakeProfit: 100 - 150

StopLoss: 80 - 100

The exact number of the TP and SL is related to the pair. The open trades and signals can be watched in live mode here:

Trading Signals: 03.02.2013

Best regards and much Profits!

Are There Any Problems With My Trading Strategy?

Hi everybody,

I have been practising forex trading withdemo account for some time. Generally, i am tradingby referring to the news in forex calendar. When the released economic data is shown in green color i will buy the related currency and when the data is shown in red color i will sell the currency. I found out that i lose quite frequently and my total money is keep on reducing. Anybody can point me to the right direction on how can i reverse this losing situation?

Thank you

Most news is already priced in, as some know far too far in advance what the numbers will be

so the Market Makers and those in the know then take the opposite trade

(imo) best to just trade the overall trend - on non major news days

and then only trade very select news

its also alot less hassle, and you can take the day off on major news days

which after a while trading is always a bonus

Possibly best to avoid trading on the days of 1-4

unless you have a very clear strategy to trade them

1. Non Farm Payrolls. Released every first Friday of the month by the Bureau of Labor Statistics, the Non-Farm Payrolls release includes the change in number of employed people during the previous month excluding the farming industry, the unemployment rate, and the average of hourly earnings. This lagging indicator is highly regarded as an important signal for overall economic health since consumer spending is highly correlated with labor conditions.

2. GDP. Gross domestic product is the broadest measure of economic activity and the primary gauge of a nation's economic health. It measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. GDP is reported in three ways: advance, preliminary, and final. Since the Advance GDP is released first, it tends to have the most impact on the markets. It is released by the Bureau of Economic Analysis.

3. Fed funds rate/FOMC statement. Released by the Federal Reserve eight times per year, it is the interest rate at which banks lend balances held at the Fed Reserve to other banks overnight, and the paramount factor in currency valuation. Often the rate decision is priced into the market so it tends to be overshadowed by the accompanying FOMC statement which focuses on the future.

4. Euro and GBP interest rate decisions

5. Retail sales. This is the broadest and earliest look at vital consumer spending data, which accounts for a majority of overall economic activity. The Census Bureau releases this monthly.

6. CPI/PPI. Consumer price index and the producer price index are considered leading indicators of consumer inflation. Both are released by the Department of Labor.

7. ISM non manufacturing/ISM manufacturing. These indexes are leading indicators of the health of the economy too, measuring a survey of 400 businesses each month, a value above 50 indicates industry expansion, below 50 indicates contraction. Released by the Institute for Supply Management.

8. Pending home sales/new home sales/existing home sales. The National Association of Realtors release the data about the U.S. housing market each month. Both new homes sales and existing homes sales can be leading indicators about economic health because a sale triggers a wide-reaching ripple effect.

9. Trade Balance. The Bureau of Economic Analysis releases this data, the difference in value between exported goods and imported goods. A positive number indicates that more goods and services were exported than imported.

10. Long term purchases (TIC). This data released by the Department of the Treasury each month represents the balance of domestic and foreign investment. Demand for domestic securities and currency demand are directly linked because foreigners must buy the domestic currency to purchase the nation's securities, thus it can be a market mover in the US dollar, for example.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hello traders,

i want to share a method, that i came myself and studied it. It is trading on expected forex news. The Forecast news did hit 90% if you watch previous news.

Lets say i want to trade EURUSD on monday.

Use the Filter option from Forex-tsd Forex TSD - forex forum - Calendar on the top of the calender and Filter a currency.

Then count the expected good news by looking of forecast and previous number.

IF Forecast > Previous = its good for the currency

IF Forecast < Previous = its bad for the currency

1. Filter EUR

AS YOU CAN SEE THERE IS:

8 Good News and 4 Bad for EUR

2. Filter USD

Here we have:

3 Good and 7 Bad News.

So how can we get a signal now?

i just came to the idea that bad news for the EUR is good for USD, and bad news from USD is good for EUR so the math is:

EUR POINTS: EUR Good News 8 + USD Bad News 7 = RESULT 15 GOOD

USD POINTS: USD Good News 3 + EUR Bad News 4 = RESULT 7 GOOD

So there is more good news for EUR then for USD, and the signal would be EURUSD long this week.

I hope you understand.

Please send me what you think about this and if it make sense or not?