Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.18 10:38

EURUSD possible double top (adapted from this article)

- On December 27th, the EURUSD failed at the line that extends off of the 2008 and 2011 highs.

- The failure also raises the possibility of a double top with the October and December highs. The pattern would trigger below 1.3294 and yield a 1.2757 objective. This level is in in line with the 2013 low.

- 1.3400 is a possible reaction area ahead of 1.3294.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.19 14:09

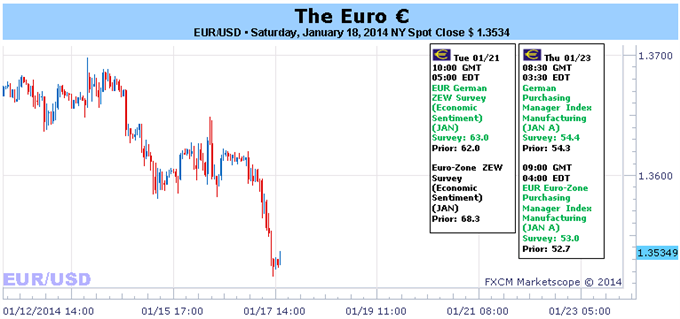

Fundamental Forecast for Euro: Neutral

- The Euro was smacked with reality this week when 2013 German GDP came in at +0.4%.

- Incoming January PMI figures offer little reason for enthusiasm.

The Euro was the second worst major performer this past week, losing -0.95% to the top US Dollar, while gaining only against the beleaguered Australian Dollar, by +1.44%. By no means was this severely negative for the Euro, but no longer are the positive fundamental drivers providing the same spark – namely speaking sustained low Italian and Spanish yields and a lack of deflation appearing in regional CPI readings.

The past week showed signs of the hope and optimism that has helped carry the Euro starting to crack. It was a stark reminder that the Euro-Zone remains mired in a period of stagnation when the final 2013 German growth reading showed that the Euro-Zone’s largest economy only grew +0.4%. Euro-Zone inflation remained near multi-year lows in December (core at +0.7% (y/y) unch), showing that demand across the region remains weak. Neither screamed “buy the Euro.”

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.20 10:26

2013-01-20 02:00 GMT (or 03:00 MQ MT5 time) | [CNY - GDP]

- past data is 7.8%

- forecast data is 7.6%

- actual data is 7.7% according to the latest press release

if actual > forecast = good for currency (for CNY in our case)

==========

China's Economic Growth Slows to 7.7%

The nation's economy grew 7.7% in the fourth quarter from a year ago, slower than the 7.8% it posted in the third quarter, according to data released Monday by China's National Bureau of Statistics. For the year it also posted 7.7% growth, matching the revised pace it recorded in 2012.

"There was steady economic progress [last year] and this was no small achievement," the bureau said in a statement. But it added that the Chinese economy still faces imbalances, while "fundamentals of the economic recovery are still not stable."

The fourth-quarter increase was higher than a median 7.6% gain forecast by 13 economists in a Wall Street Journal survey.

"We don't see any areas that would support an economic rebound in the first quarter," said Ma Xiaoping, economist with HSBC Holdings PLC.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 10 pips price movement by CNY - GDP news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.21 19:55

EUR/USD holds steady on optimistic IMF forecast

The dollar strengthened against the euro earlier Tuesday after the International Monetary Fund hiked its 2014 global growth forecast, while expectations for further cuts to Federal Reserve stimulus programs this month also bolstered the greenback before profit taking wiped out its gains.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.22 16:16

ECB's Coeure Seeks Earlier Launch Of Bank Resolution Mechanism

European Central Bank Executive Board member Benoit Coeure said on Wednesday that the proposed mechanism to deal with bank failures must be implemented earlier than planned.

In a speech delivered in Brussels, Coeure said the Single Resolution Mechanism (SRM) should allow for lean decision-making during emergencies. He also sought "robust and common" resolution financing arrangements.

"In this regard, the period of ten years for moving towards a genuinely common Single Resolution Fund (SRF) is too long and should be shortened, possibly to five years," Coeure said.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The price on D1 timeframe crossed Sinkou Span line, and 1.3548 support on open D1/W1 bar from above to below for the trend to be reversed from bullish to bearish on D1 timeframe. On H4 timeframe - the price is trying to cross 1.3516 support.

If the price will break 1.3548 support on D1 timeframe close bar so we may see good downtrend breakout with possibility to open sell trade for example.

If not so the price will be ranging between 1.3699 resistance and 1.3548 support with risky trading possibility for both sides.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2013-01-20 02:00 GMT (or 03:00 MQ MT5 time) | [CNY - GDP]

2013-01-20 07:00 GMT (or 08:00 MQ MT5 time) | [EUR - German PPI]

2013-01-21 10:00 GMT (or 11:00 MQ MT5 time) | [ EUR - German ZEW Economic Sentiments]

2013-01-23 01:45 GMT (or 02:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]2013-01-23 08:00 GMT (or 09:00 MQ MT5 time) | [EUR - Spanish Unemployment Rate]

2013-01-23 08:30 GMT (or 09:30 MQ MT5 time) | [EUR - German Manufacturing PMI]

2013-01-23 09:00 GMT (or 10:00 MQ MT5 time) | [EUR - Manufacturing PMI]

2013-01-23 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Existing Home Sales]Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bearish

TREND : ranging

Intraday Chart