Do not send order on your own or use another EA simultaneously with VF ROBOT within the same account. Enjoy.

So you are sharing garbage ??

We don't see any source code

And it is unknow how you did your testing

52.84% how is that possible Errors in data ??

not enough information about your EA...

fxmath,

Could you please explain its strategy?

Thank you for sharing it.

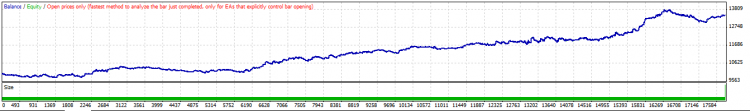

This is a back-test done on M15 EURUSD of MMA_Volume II without market filtration and without money management.

Years 1999-2012.10

It will be available in the code base upon completion if I don't die first. ;)

fxmath,

Could you please explain its strategy?

Thank you for sharing it.

This is a back-test done on M15 EURUSD of MMA_Volume II without market filtration and without money management.

Years 1999-2012.10

It will be available in the code base upon completion if I don't die first. ;)

WhooDoo22:

I really like the interest you have for coding and mostly for sharing. I would love to explain the robot strategy in detail but, i also need to protect my code source. I don't mind sharing the compiled file for people to try the robot out. All I can say is that its strategy is based on Point & Figure logic. Globally identifying support and resistance and making the right decisions at the right time. I'm not saying that we are always right but at least we are trying to be as right as possible (+70%)

WhooDoo22:

I really like the interest you have for coding and mostly for sharing. I would love to explain the robot strategy in detail but, i also need to protect my code source. I don't mind sharing the compiled file for people to try the robot out. All I can say is that its strategy is based on Point & Figure logic. Globally identifying support and resistance and making the right decisions at the right time. I'm not saying that we are always right but at least we are trying to be as right as possible (+70%)

fxmath,

Thanks much for your response. Just by "eyeballin' VF's backtest", I would throw out a wild guess as to the logic behind the strategy. VF appears to be a "grid strategy". I am acquainted with the pair AUDUSD and would consider it a mostly ranging currency pair like eurchf and eurgbp. It must build positions if the orders start going into drawdown (hoping that the market will go back up/down because of audusd's ranging tendency). audusd's personallity is to move within channels. Just my two cents. ;)

Again thanks much for sharing your strategy. I'll give it a spin sometime if I get a chance.

Thank you.

WR on it's own is irrelevant . . . any EA can be made to give a WR of 70% or 80% or 90% . . . or more . . . . you need to be sure that your WR is not a product of your Risk:Reward. The further detached the WR is from the Risk:Reward the better shape you are in.

RaptorUK, you are right. The Sharpe Ratio for this test is 0.0900. About the Risk of Ruin:

- There is a 14.02% chance of losing 10% of the account.

- There is a 1.56% chance of losing 20% of the account.

- There is a 0.13% chance of losing 30% of the account.

- There is less than 0.01% chance of losing more than 40% of the account.

RaptorUK, you are right. The Sharpe Ratio for this test is 0.0900. About the Risk of Ruin:

- There is a 14.02% chance of losing 10% of the account.

- There is a 1.56% chance of losing 20% of the account.

- There is a 0.13% chance of losing 30% of the account.

- There is less than 0.01% chance of losing more than 40% of the account.

From the equity curve it looks like there is a 100% chance of losing at least 10% of the account . . . MT4 said the DrawDown was 30% . . . but anyway, I was talking about Win Rate and Risk vs Reward . . . not Risk of Ruin or Sharpe ratio

RaptorUK

MT4 said the DrawDown was 30% but it'd happened once in almost 4 years that's one of the reason why the chance of losing 30% of the account is 0.13% and that goes also for the chance of losing 10% of the account which is 14.02%. You were talking about Win Rate and Risk vs Reward but the Sharpe Ratio characterizes how well the return of an asset compensates the investor for the risk taken (the higher the value, the better). And as for the Win Rate you can analyze the Profitability (won 1626 which represents 73% and lost 611 which represents 27%). You can also add to that the Average consecutive wins (4), the average consecutive losses (1), the maximum consecutive wins (22) and the maximum consecutive losses (4) and.......

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I want to share this EA (VF ROBOT AUDUSD). The executable file is attached. Of course, I'm the author. It's suitable only for AUDUSD and works a lot better with OANDA with a minimum balance account of $1200 and sufficient for 0.6 lots (it's all about leverage). Attach it to a chart (AUDUSD) and leave it. Make sure that you are well connected to the internet. You can turn it off from Saturday 1AM (server time) to the next day (Sunday) before noon (it got to be back on by then). knowing that no variable will be initialized. Do not send order on your own or use another EA simultaneously with VF ROBOT within the same account. Enjoy.