Are you sure you have done your ECN demo homeworks ?

Put it backward - for simplicity sake - brokers buy/sell from banks and then re-sell/re-buy to/at you at higher/lower prices. Broker's ask price is usually higher than bank's ask price and broker bid's price is usually lower than bank's bid price - read that again.

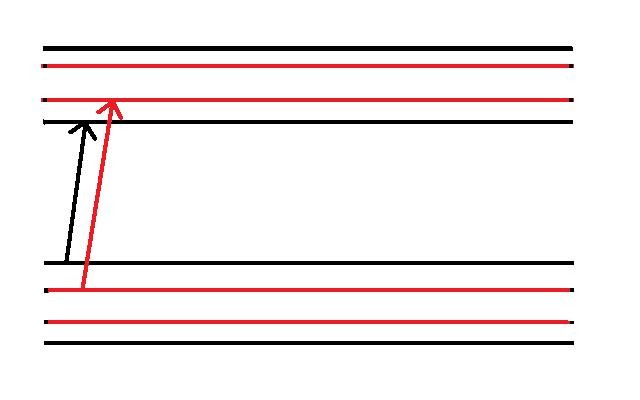

See picture above. When you buy from broker (black line bottom), broker buys from banks at lower price (red line bottom) then sell it to you at higher price than banks price (that black line bottom i just mention).

When you close your position - it mean you sell to broker and broker buys from you (black line top) . However broker close their position by selling to banks at higher price than you (red line top), and buy from you at much lower than bank price (that black line top).

With just 10 point profit (correction : moves, not profit, see explanation below) on a 1 standard lot EURUSD, you made $ 100 profits. An ECN cost you $6 commission and $ 10 spread cost (10 point profit * $ 1* 1 point spread), total of $ 16, a conventional broker with 2 point spread will cost you $ 20 (10 point profit * $ 1* 2 point spread).

Your final profit at ECN broker is $ 84 ($100 - $16), at conventional broker is $ 80 ($100 - $20) Those are not correct, see explanation below or click here.

Brokers just middlemen between traders and bank. They made money from spread.

Of course on much lower profit/loss, ECN is more costly.

But, do the calculate first, plenty ECN out there are really costly as ECN.

:)

OK, thanks for you explanation.

Some things of your calculation i don't understand:

with 10 Pips Profit on 1 Std Lot you make 100$ profit. With 10 Points = 1 Pip you would make 10$ profit on 1 Std Lot.

You buy ond ask price and you sell on bid price which both already include the subtracted spread. So the amount of pips you gain profit does not influence the amount you pay spread or commission at all.

Because the reference for you trading desicions is the chart which shows only the bid price, it seems for you, that you only pay spread once ... but in reality you pay it twice (nearly half a pip) ... on opening and on closing.

The only factor that influences the loss on comissions and spread is the Lotsize.

So if you want to compare a std fx broker with a ECN you would have to calc:

For spreads in pips on EURUSD

((spread stdBroker - spread ECN) * LotVolume * 10) - (Commission/Lot * LotVolume) = Differenz between Std Broker and ECN Broker

so for my Broker with spread 1.5 Pips (most time below ~1.1) that would be:

(1.5-1 * 1 * 10) - (6 * 1) = -1 USD

So my Std Broker would be cheaper regardless of the Order Volume and the Profit.

Correct me if i'm wrong!

Some things of your calculation i don't understand:

with 10 Pips Profit on 1 Std Lot you make 100$ profit. With 10 Points = 1 Pip you would make 10$ profit on 1 Std Lot.

I think we have miss-communication here. I don't understand what you mean by "10 Points = 1 Pip ", because a point is a pip. But whatever it is, since there's brokers who does not use fractional point, 1 point mean 10 point in fractional broker. This is all to avoid miss-communication between trader/banks/etc. For example is someone from non-fractional broker said that EURUSD moves 1 point, what they mean is 10 points in fractional points. Another example is spread from your broker is 1.5 points, that mean 15 in fractional broker. Non-fractional broker does not have 1.5 in their spread.

My reply there based on 1 standard lot equal with 100,000 units. Since 1 fractional point in 1 standard lot EURUSD is equal with $1, when I said 10 points move, that mean 10 points moves in non-fractional broker, or 100 points move in fractional broker, there's your $ 100 moves.

I'm guessing you using broker who offer 1 lot equal with 10,000 units, in this case 1 standard lot is equal with 10,000 units, that mean 1 point is equal with $ 0.1, so 10 point moves is equal with 100 points moves in fractional broker and equal with $ 10 moves.

Might be good idea if you try Alpari UK MT4 demo, they offer only standard lot which is equal with 100,000 units. Use the attachment below and look for, spread, tick value and tick size.

If I'm wrong, that turn out you actually use fractional broker that utilize 1 lot = 100.000 standard unit, then we have silly miss-comm here.

I say 1 point while you say 10 point.

I say 0.1 points and you say 1 point.

Then I say your spread is 1.5 and you ... aren't you suppose to say 15, ... but I though you said that your spread is 1.5 ???

You buy ond ask price and you sell on bid price which both already include the subtracted spread. So the amount of pips you gain profit does not influence the amount you pay spread or commission at all.

Because the reference for you trading desicions is the chart which shows only the bid price, it seems for you, that you only pay spread once ... but in reality you pay it twice (nearly half a pip) ... on opening and on closing.

You are right there, I should say 10 points moves not 10 points profits, because 10 points profits is what we have after calculating spread, swap, commission, etc, etc.

I have correct my self up there, hope you don't mind.

Correct me if i'm wrong!

Your are not wrong, your calculation is based on spread 1.5, mine at 2. You see, ... correct me if I'm wrong !!! ... :)

I think you should read few last sentence of my previous answer.

Of course on much lower profit/loss, ECN is more costly.

But, do the calculate first, plenty ECN out there are really costly as ECN.

By the way, I made mistake calculating the commission above. I learnt about ECN from MBTrading, that was long time ago, so I forget a few stuff, I check, and looks like they still have it here.

BTW, MBTrading ECN is based on 10,000 units, Alpari UK is based on 100,000 units. And last time I open demo with MBTrading, I have to wait for 24 hours, because they have to connect my account with their server, I don't if still like that, though.

Talk to you later.

ok i see the point ;-)

i thought, that there are old brokers, that still use 4 point notation like 1,3124 there are only 4 places! As the last and fourth place was the minimal amount that the price could move this was called a "Pip" ... as for now most brokers use 5 decimal place notation like 1.31251 and the fouth decimal ist still called "Pip" ... the last and fifth place is called "Point" (for non-fraktional point brokers in your words) ... for EURJPY 103.842 ... "2" would be the point and 4 the pip.

I've learned it so and read in hundreds of forum posts ;-) But at least we understand us right now ;-) and thank you for the good explanation about ECNs!

... there are only 4 places!

Ah, not really. There's some brokers that doesn't come out on google search, they still using 4 digits and not 5. You know why, it is more profitable.

Look into forums from different nations and language, you'll be surprised. I know that, because once I was searching for brokers that offering MetaTrader, as trading platform. Boy, MetaTrdaer is everywhere.

Do you know any brokers from Japan and South Korea ?, don't tell me they don't have forex broker, cause they are not third world countries. We have Chinese MQL4, I think they have brokers too, don't you think ?, but do we heard them often ? .

All I know they don't advertise heavily. I once saw Japanese broker ads on google, offering MetaTrader, but that the only ads I saw from "foreign country" (lol) broker. Come in mind, Interbank FX is actually belong to Japanese firm.

...

Well, yesterday I saw your post and so I tried to answer, thought maybe I can help.

My mistake was, that I did not look into MBTrading site again, and then reply back to you with the link, instead I was being such a wise guy. This is my second lesson to me - think before open my mouth - so I won't edit my previous post there - again.

I said I first learn ECN from MBTrading, and began comparing ECN. Another thing that I learnt were :

1. Since there's no rules in calculating commission, each broker has different commission structure. Some broker change its commission size on Friday, some charge commission on positive swaps, etc. Best way is ask each broker on how they calculate their commission, see if there's hidden fees, cost, or whatever it is that they don't tell you on their web site or their agreement. Isn't in agreement, we agree that they can change things and stuffs, without asking our agreement first ?, that's the agreement.

2. All ECN brokers is market orders, meaning that when we open position, we get our position price when our order reach broker, later we set our TP and SL. I thought that was good, until several times a friend of mine got caught. He opened position and was accepted but when he tried to set SL TP, price well already went beyond his SL, so his SL was rejected. Either he cut some losses or set lower SL. To work around this, he sent pending orders instead (Buy stop or sell stop, instead of open buy or sell). Since there's no freeze levels and stop levels, he opened his pending order few points near the prices. I thought and still think that is silly, because if ECN broker has 10 points spread (or 1 pips like you said), and I send my pending at 5 points distance, that equal 15 point "spread". So there's almost "no different" with conventional brokers.

3. Spreads !, many ECN broker offer lower spread. Yeah right. I trade EURUSD, and during low volume. their spread is near close encounter with conventional brokers. On average, their average spread is not far from conventional brokers. Of course, on high volume, their spread is much more smaller compare to conventional broker.

4. I asked MBTrading, how do I know that they are really ECN broker. Their answer kinda surprised me. They said that there is no way to tell if a broker is really ECN or not. Many claims ECN, but when we open live account, they are no different with conventional broker - especially when we calculate and go through their fees and commission structure. So MBTrading suggest me, that the best way to find out whether one broker is a ECN or not, is to ask how their commission is calculated (#1 above) and open live account. There's no need to fund and deposit money to this live account, broker can't do anything about that, and then begin live comparing with other ECN broker. MBTrading emphasize on "comparing with other ECN brokers", but nowadays I think we should compare with conventional broker as well.

5. I forget the fifth. :)

I still don't use my ECN accounts, It's the leverage. I prefer higher leverage than 1:100 leverage most ECN can offer. It cost me small to open 1 lot with higher leverage than with 1:100, and much more far and safer from margin call.

Though, friends (and you probably) call me greedy playing higher leverage, which I will reply "Greed is, good goody god".

...

I just wanna help, and hopes that helps. Me apologize for being such a wise guy.

EXACTLY !!!.

Many traders abuse higher leverage because they don't calculate the risk properly. They only calculate rewards. Non-realized rewards.

@haemse High leverage can be risky if the trader does not use a properly regulated broker or is overconfident just due to a few winning trades.

Since the forex market is large, there are several new brokers, and most of them are scammers, [broker recommendation are not allowed, removed by moderator].

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hello Cummunity,

the last days i have been wondering what ECN Brokers are and why people use them.

What i found and read gave me this picture:

ECN Brokers don't charge you a high spread but they charge you a commission depending on the lotsize you trade - approx. 6 Dollars/Std. Lot

They handle your request to interbanking market and not to a market place normal brokers have a trading licence (f.i. London, NY ...)

By doing so, they can keep the spread low.

But what i cannot understand: Where is their advantage? At a common broker nowadays at forex market i have spreads in the majors that are not bigger than 1-2 pips.

I tested a few ECN demos and the have approx 0.9 pip spread and 6 Dollar comission per 100K Lotsize. Where is the advantage?

Please correct my image if its wrong! ;-)