in my personal experience you can throw away all of the indicators in times where news/political situations are dominating the market. this whole drop of the Euro was price action generated by greece/spain/italy and the fear customers/banks. now you can't hear anything about the crisis in tv/radio so in my opinion the market has to adjust its price.

and in this times all of the standart indicators seems to fail. one more one less.

//my 2 cents.

Yep lol... This market does not follow common sense. Nor does it follow common numbers. What I realize is that the movers and shakers of this marker is playing a Hard Numbers game. And what I mean by that is Interest Rates. There's another group of movers and shakers playing the Fundamental Game. And what I mean by that is Crisis, Geo-Political Issues, Natural Disaster, National Trade Deficiency, etc.

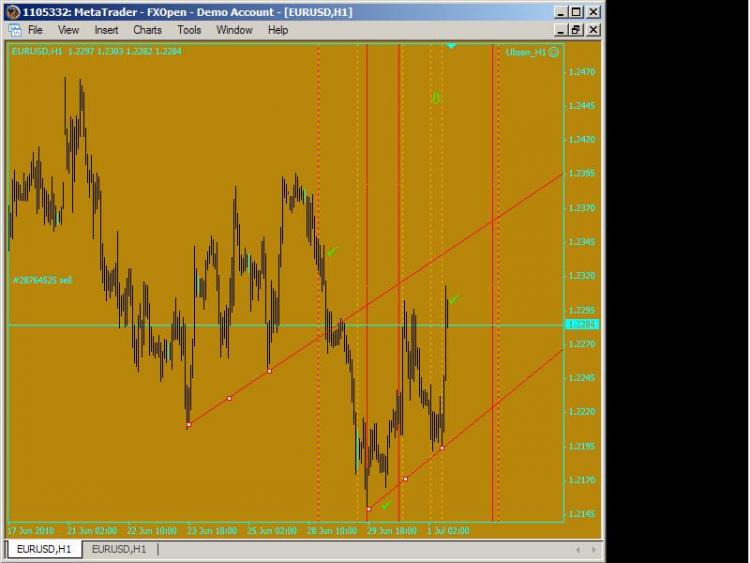

Here's my analysis of what happened to the EUR/USD last couple of days leading to this point:

Going from left to right, where the first green check mark is, my EA executed 3 orders a heavy news trade based on the vertical line leading to it, macd short and cci short. The cci short came after the first trend line you're looking at with the 3 dots. Then the market started showing weakness around the second trend line and my macd orders reversed there. The news order is close by this point but the cci is still open as it shoots for bigger profits. Also where the second green check mark is my Counter system jumps into action and places a buy. No news gets traded during near that second green check mark as the numbers didn't meet my requirement. Now where that third check mark is, thats where my news system failed good thing I have very tight stop-loss on news orders. It tried to short the retail sales news but left the LTRO Expiration news un-checked because my news source does not provide the numbers for that release. Turns out the Interest Rates boys taught that was more important. By this time my macd and counter orders are closed but the cci is still opened. Now see where that 3rd green check mark is. Thats your industry fishing for orders by going slightly above the previous resistance high. I'm tempted to close my cci order but I'm not gonna do that. I don't interfere with my ea. I may want to take the lessons here and re-write the rules of the ea. This interest rate double meaning is what I'm trying to figure out. There are alot of news releases trying to judge inflation numbers but for what. If an inflation indicator goes up, does that mean price will rise because the Country is doing better now ---- Or ---- does it mean price will go down because interest rates are likely to go down. I guess the key here is knowing if a currency is artificially balanced on interest rates.

Is this market perverse, or what?

Is only perverse if you expect patterns - at the present time

We have relatively little trading volume in the Forex at present, so that patterns appear to be forming but then have no follow through

Also news and central bank interventions have undue effects at this time

Since Greece, I believe the perception is that EURUSD was oversold, so this pair is currently well supported (but just wait til Spain kicks of, maybe in September...?)

IMHO, you have 5 lagging indicators, all geared towards significant trend starts/ends (not common, especially since Q3 08) and the EA is allowed to trade the (even) lower volume Asian session

As is well known, I wont use SAR in Forex for anything and... I too have had indicator sets that gave positive results for some time, months even, before revealing that the were fundamentally flawed :(

FWIW

-BB-

At 2010.07.01 GMT 04:15 my system gave me no less than FOUR sell signals and one filter confirmation, as follows:

- OsMA classic bearish divergence, usually very reliable;

- AC+AO aligned for selling;

- MA cross down;

- Heiken Ashi Zone Trade two bear bars after three grays, another usually very reliable signal; and

- SAR bearish above current prices.

I was away from the computer at the time but “myHAZTea” took the short position with perfect timing. If I had been there, I would not have overruled my EA. Guess what – the market went up, took out my SAR stop on the entry bar, and is still going up strongly five bars later. WTF gives with this market? Do we throw away the book of signals? Or do we perversely turn them around and buy when five of them say “sell”?

PS: trading EURUSD M15

The market has been unpredictable since the past week up until now. After about 5 or 6 consecutive loosing trades, I decided to stay out of the market and switch to my demo account while I wait for some form of sanity to return to the markets (I trade only GBPUSD). The instant I switched to demo, I got a new signal (same system I use for my live), I got about 70 pips from the trade and I was like WTF?

This is where money management comes in.

We have relatively little trading volume in the Forex at present, so that patterns appear to be forming but then have no follow through

Thanks, everybody, for your contributions.

BB, you are right. If I had kept my eye on the VPC indicator (volume price confirmation, https://www.mql5.com/en/forum/126886) I would not have taken the trade.

Fortunately, I put my pride aside and went long for a perfect ride up.

For more on VPC see https://www.mta.org/eweb/docs/2007DowAward.pdf

I think its just the current uncertainty that is adding to the volitility. I'm doing more optimisations to see if my stop needs to be larger in these conditions although its been foward testing fine up until the start of last month (june) where it is now taking some drawdown.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

At 2010.07.01 GMT 04:15 my system gave me no less than FOUR sell signals and one filter confirmation, as follows:

I was away from the computer at the time but “myHAZTea” took the short position with perfect timing. If I had been there, I would not have overruled my EA. Guess what – the market went up, took out my SAR stop on the entry bar, and is still going up strongly five bars later. WTF gives with this market? Do we throw away the book of signals? Or do we perversely turn them around and buy when five of them say “sell”?

PS: trading EURUSD M15