Congratulations Ubzen !!!!!!!

Seems very interesting...

Why the need to delete the modelling quality.........is it because it is anything less than 99%?

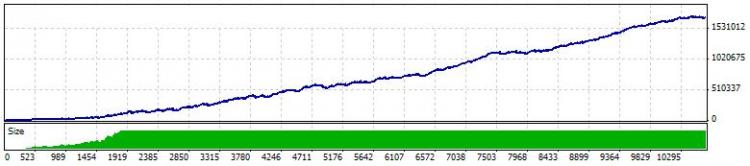

So, without any information, except the obvious, you probably started the back test with 5.000 and ended with about 24.000 in over 10 years ... that's almost 17% per year (compounded interest).

Not very impressive.

Sure thing lol - I haven't done it yet so I'll be the first to see it. Come on baby..make daddy proud.

Bars in test 3757843

Ticks modelled 7348544

Mismatched charts errors 0

Initial deposit 5000.00

Total net profit 1709821.30

Gross profit 8587085.90

Gross loss -6877264.60

Profit factor 1.25

Expected payoff 160.86

Absolute drawdown 260.00

Maximal drawdown 60810.00 (10.20%)

Relative drawdown 30.59% (8085.00)

Total trades 10629

Short positions (won %) 5591 (83.13%)

Long positions (won %) 5038 (84.26%)

Profit trades (% of total) 8893 (83.67%)

Loss trades (% of total) 1736 (16.33%)

Maximum

consecutive wins (profit in money) 45 (49440.00)

consecutive losses (loss in money) 5 (-22180.00)

Maximal

consecutive profit (count of wins) 49440.00 (45)

consecutive loss (count of losses) -22180.00 (5)

Average

consecutive wins 6

consecutive losses 1

ubzen,

Nope, 90% modelling quality would not make me a believer. I would like to see 99% before I start getting excited. 90% is not adequate quality to get excited about, let alone whatever quality you did achieve(25%).

This is the basics of backtesting, surely you know this?

I tell you what, come back in 3 months and show us what this has done to your live account..................

Mt4 with 99% model=imposable, cannot install mt5 as I don't have the required processor. Mt5 ticks are still 1-minute bars with more check points than mt4. Bar Open/Close/High/Low are always logged, therefore, if I'm using open prices in ea and testing then model quality shouldn't matter and you should know that.

I just put this out for fun and teasing purposes but in the process I realized something. That is: No One trusts the back-tester and even worse, no one believes in success. If it had 99% quality, everyone would say wait til it fails in forward tests. If it worked for 3 months everyone would say wait for a couple of years then you'll see. If it was good for a couple of years, everyone would say, get your EA out of my face. Hey, I might say the same things too :).

Mt4 with 99% model=imposable

Not impossible, there are work-arounds (gordon has the links) using a prior version MT4 (211 or some such) with tick files that produces the much sought after 99% modeling quality score.

Bar Open/Close/High/Low are always logged, therefore, if I'm using open prices in ea and testing then model quality shouldn't matter and you should know that.

Truth, I make my EA's depend solely on OHLC values and only activate on new candle open. Both for backtest as well as live trade.

I just put this out for fun and teasing purposes but in the process I realized something. That is: No One trusts the back-tester and even worse, no one believes in success. If it had 99% quality, everyone would say wait til it fails in forward tests. If it worked for 3 months everyone would say wait for a couple of years then you'll see. If it was good for a couple of years, everyone would say, get your EA out of my face. Hey, I might say the same things too :).

Perhaps to phrase it differently...anyone who knows better knows to not rely on the backtester for producing meaningful metrics of analyses in regards to a trade strategy's success and failure.

Strategy tester is a great tool, but I wouldn't use it to produce produce a profit/loss result for 10yrs historical data based on which I put the strategy into live testing.

But I do use, and do trust the results of, strategy tester to generate histograms of the resultant data for characterizing the metrics of interest to me (MAE, MFE, trade-open time, time to MAE, etc) for a given filter combo and trade strategy. You need to checkpoint this data during the backtest if you want to test stationarity of the metrics and so on. All very useful to do with strategy tester.

But running a backtest to just pop out a number like Profitloss or maximal drawdown (or pretty much any metric computed by the generic strategy tester report) is definitely pointless for analysis purposes. Even if you don't know why this is the case you definitely have an inkling this is the case because absolutely no other segment of the financial industry computes nor publicizes their metrics of success in the terms and characterization that Strategy tester does.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Just can't resist :). Lil eye candy for you.