You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Gold Trades Below 2-Month High as Investors Weigh U.S. Recovery

Gold traded below a two-month high as investors assessed the U.S. economic recovery and the impact on borrowing costs amid signs of slowing physical demand.

Bullion for immediate delivery lost as much as 0.3 percent to $1,313.98 an ounce, and traded at $1,314.94 at 2:01 p.m. in Singapore, according to Bloomberg generic pricing. Gold rose to $1,322.12 on June 20, the highest level since April 15, after the Federal Reserve said it will keep interest rates at almost zero for a considerable time even as the economy improved.

Gold is on course for the first back-to-back quarterly gain since 2011, in part as violence in Iraq and tension in Ukraine spurred haven demand. The metal ended a 12-year rally in 2013 on expectations that the Fed would scale back stimulus put in place to help the economy recover from the worst recession since the 1930s. In China, the largest consumer, volumes for the benchmark spot contract in Shanghai fell for a third day yesterday.

“The U.S. has entered the monetary tightening cycle and will continue to reduce stimulus as economic data improves,” said Zhang Lin, a Hangzhou-based analyst at Yongan Futures Co. “Interest rates will rise at some point, so the longer-term outlook for gold remains bearish.”

Data today may show growth in new home sales slowed after a report yesterday said that existing home sales in May had the biggest monthly increase in almost three years.

Gold for August delivery lost 0.2 percent to $1,315.50 an ounce on the Comex in New York.

Strike EndsPlatinum rose 0.2 percent to $1,459.07 an ounce, and palladium increased 0.5 percent to $826.65 an ounce.

In South Africa, the largest platinum and second-biggest palladium producer, the main union at the mines of the three largest platinum companies will today sign a deal to end the five-month stoppage that’s crippled output.

Platinum has risen 2.9 percent since the end of March, heading for two quarterly increases that’s the best run since 2010. Palladium is also heading for a second quarterly rise.

Silver for immediate delivery declined 0.3 percent to $20.8210 an ounce, poised for its first back-to-back quarterly gain since 2011.

2014-06-24 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Consumer Confidence]

if actual > forecast = good for currency (for USD in our case)

[USD - Consumer Confidence] = Level of a composite index based on surveyed households. Financial confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity

Acro Expand : The Conference Board (CB).

==========

U.S. Consumer Confidence Shows Significant Improvement In June

Reflecting a notable improvement in consumers' assessment of current business conditions, the Conference Board released a report on Tuesday showing that its reading on U.S. consumer confidence rose by much more than expected in the month of June.

The Conference Board said its consumer confidence index jumped to 85.2 in June from a revised 82.2 in May, reaching its highest level since January of 2008.

Economists had expected the consumer confidence index to edge up to 83.5 from the 83.0 originally reported for the previous month.

Amna Asaf, an economist at Capital Economics, said the jump by the index "suggests that the positive effects from an improving labor market and record high equity prices trumped the negative effect from rising gasoline prices."

"Overall, a welcome improvement in sentiment," Asaf said. "Admittedly, the level of confidence is still below the historical average of 92.6, but we think that level is not far from achieving given that the labor market is on the mend and income prospects are bright."

The report said the present situation index climbed to 85.1 in June from 80.3 in May, reflecting the improvement in consumers' appraisal of current conditions

Consumers saying business conditions are "good" increased to 23.0 percent from 21.1 percent, while those saying business conditions are "bad" fell to 22.8 percent from 24.6 percent.

The Conference Board said the assessment of the job market was also more favorable, as consumers claiming jobs are "plentiful" edged up to 14.7 percent from 14.2 percent, while those claiming jobs are "hard to get" dipped to 31.8 percent from 32.2 percent.

Additionally, the expectations index ticked up to 85.2 in June from 83.5 in May, as consumers' expectations were generally more positive.

The percentage of consumers expecting business conditions to improve over the next six months rose to 18.8 percent from 17.7 percent.

At the same time, the report said the percentage of consumers expecting business conditions to worsen also edged up to 11.4 percent from 10.7 percent.

The Conference Board said consumers were more positive about the outlook for the labor market. Consumers expecting more jobs in the months ahead climbed to 16.3 percent from 15.2 percent, while those anticipating fewer jobs slipped to 18.7 percent from 18.9 percent.

Meanwhile, the report also showed that the percentage of consumers expecting their incomes to grow fell to 15.9 percent from 18.0 percent, but those expecting a drop in their incomes also fell to 12.1 percent from 14.5 percent.

Euro Rate Today: Forecasting a Lower EUR/USD Exchange Rate in 2014 Remains Intact at Bank of America

Currency analysts at Bank of America Merrill Lynch are standing by their 2014 forecast that sees a lower euro dollar exchange rate.

The euro dollar rate has been heading lower since the ECB rate cut in early June, however following a less-than-hawkish FOMC minutes released mid-month dollar weakness has allowed the euro a recovery.

On Tuesday the following euro exchange rates are on offer:

Please be aware that the above mid-market quotes are subject to a discretionary spread levied by your bank. An independent FX provider will however seek to undercut your bank's offer and in some instances can deliver up to 5% more currency on execution.

2014 forecast for lower euro, higher dollar

The latest currency forecast at Bank of America Merrill Lynch Global Research has had to account for an under-performing USD thus far in 2014.

However, analysts are confident the move higher will eventual start once again:

"We continue to look for lower EUR-USD & higher USD-JPY in 2014, on the back of a sustained US recovery.

"However, we recently modified our expectations to reflect the lower USD YTD. The USD continues to be range bound with Treasury yields failing to break higher.

"As a result, we see a diminished likelihood of a significant near-term USD rally.

"But, we still see the risks in our outlook to the upside believing stronger growth and continued upside employment surprises could lead to higher inflation, which would imply a faster, USD-positive reduction in Fed stimulus."

US Federal Reserve undermines the USD bulls

June had been rather kind to the USD until the 18th.

As expected, the Fed kept on tapering its monetary stimulus at a $10 bn thanks to the persistent decline in unemployment.

But, why did the dollar exchange rate slump? According to Swissquote Research, "the hawkish bias implied by the FOMC forecasts was eclipsed by the dovish comments of Fed Chair Yellen during the press conference.

"By qualifying the recent rise in inflation as "noise"and by backing away from her six months estimate for the "considerable time" Fed funds would stay unchanged after the end of the tapering process, Yellen showed no hurry to start hiking rates."

Analysts reckon that as tapering should be over close to the end of the year, Yellen's comments imply that June 2015 is the earliest time window for a potential raise in rates.

The short-term effect of Yellen's speech should act as a drag for the US dollar.

"However, even if the Euro could strengthen temporarily against the greenback, the strength in British pound looks more sustainable as the Bank of England will likely be the first major central bank to raise rate," say Swissquote.

EUR/USD: Where's Sell-Zone; USD/CHF: Where's Buy-Zone - BofA Merrill

EUR is beginning it squeeze higher, with EUR/GBP breaking near term resistance at 0.7999, notes Bank of America Merrill Lynch.

"In the sessions ahead we look for gains to extend to 0.8090/0.8107 area before renewed topping and a resumption of the larger bear trend for the Jul’12 lows at 0.7765," BofA projects.

"This should help push EUR/USD into our 1.3676/1.3735 sell zone and even push USD/CHF into our 0.8910/0.8865 buy zone," BofA argues.

Specifically in EUR/USD, BofA looks to sell there for a resumption of the larger downtrend.

"We continue to target the 1.3479 Jan-31 low, ahead of the 1.3295 Nov-0v low. Bigger picture, we target 1.3104 ahead of 1.2777/1.2685 and eventually below. We would bite the bullet and go short on a break of the 1.3505, May-05 low," BofA advises.

In USD/CHF, BofA notes that from the highs of 0.99038 the pair has been consolidating /correcting into the 0.8910/0.8865 zone.

"We look for the basing & a resumption of the long term bull trend. The May-09 closing break of 9m wedge resistance confirmed that the medium, potentially long term uptrend is underway," BofA argues.

"We target 0.9208/0.9266 ahead of 0.9457/0.9987 and eventually a test and break of the 2013/2012 highs at 0.9841/0.99974. Pullbacks should be limited to the 100d (now at 0.8881)," BofA projects.

2014-06-25 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - GfK German Consumer Climate]

if actual > forecast = good for currency (for EUR in our case)

[EUR - GfK German Consumer Climate] = Level of a composite index based on surveyed consumers. Financial confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity

==========

German GfK Consumer Confidence To Improve In July

German consumer confidence is set to improve in July, survey data from market research group GfK showed Wednesday.

The forward-looking consumer sentiment index rose to 8.9 in July from a revised 8.6 points in June, as economic expectations rose to a three-year high. Economists had forecast the indicator to rise to 8.6 points from June's original estimate of 8.5.

The economic expectations index rose 7.7 points to 46.2 in June. Willingness to buy gained 3.7 points to reach 53.2. Meanwhile, income expectations fell by 0.6 point to 47.2 in June.

The survey suggests that private consumption will rise 1.5 percent in 2014.

Trading the News: U.S. Gross Domestic Product (GDP) (based on dailyfx article)

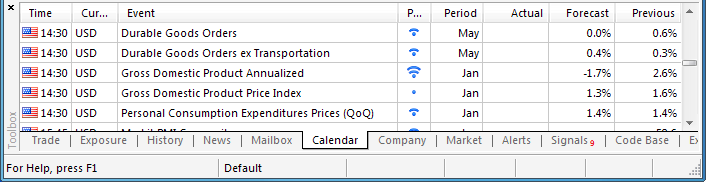

The final 1Q Gross Domestic Product (GDP) report may heighten the bearish sentiment surrounding the U.S. dollar as market participants anticipate another downward revision in the growth rate.

What’s Expected:

Why Is This Event Important:

A more meaningful decline in the growth rate may spark a bearish reaction in the greenback (bullish EUR/USD) as it gives the Federal Reserve greater scope to retain its highly accommodative policy stance, and the reserve currency may face additional headwinds throughout the summer months as central bank Chair Janet Yellen continues to endorse a dovish tone for monetary policy.

The ongoing slack in business outputs paired with the slowdown in housing activity may prompt a larger-than-expected decline in 1Q GDP, and a dismal print may generate a more meaningful rebound in the EUR/USD as the data drags on interest rate expectations.

However, stronger job growth along with the pickup in private sector credit may have helped to limit the downturn in economic activity, and a positive development may generate a bullish outlook for the greenback as it puts increased pressure on the Fed to normalize monetary policy sooner rather than later.

How To Trade This Event Risk

Bearish USD Trade: U.S. 1Q GDP Contracts 1.8% or Greater

- Need green, five-minute candle following the GDP print to consider a long EUR/USD trade

- If market reaction favors a bearish dollar trade, long EUR/USD with two separate position

- Place stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish USD Trade: Growth Rate Exceeds Market Expectations- Need red, five-minute candle to favor a short EUR/USD trade

- Implement same setup as the bearish dollar trade, just in opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

Impact that U.S. GDP has had on EUR/USD during the last quarter

(1 Hour post event )

(End of Day post event)

The final 4Q GDP report showed an upward revision in the growth rate as the U.S. economy expanded an annualized 2.6% amid an initial forecast of 2.4%. The greenback struggled to hold its ground following the release as the EUR/USD climbed towards the 1.3775 region, but the dollar regained its footing during the North American trade, with the pair ending the day at 1.3739.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.06.25

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 27 pips price movement by USD - GDP news event

EUR/USD Stays Motionless

'We've kind of traded sideways a little bit. It's largely technical, but there's some geopolitical headlines that may be weighing on risk appetite.' - Commonwealth Foreign Exchange (based on Bloomberg)

Pair's Outlook

There are still no consistency among the technical indicators, as they are pointing in different directions on the weekly an monthly time-frames. Nevertheless, the currency pair is considered to be capable of rising up to 1.37 before coming under selling pressure and subsequently re-challenging a key support level at 1.35, which is reinforced by the monthly S1 and 2014 low. A breach of the latter level may potentially open a way towards 1.28—2013 lows.

Traders' Sentiment

The bears are starting to gain an upper hand over their counterparts, as the former now constitute 56% of the market (54% yesterday). As for the orders, 63% are set to sell the Euro against the greenback.

How Long Can the Euro Stay on Top?

Questions about how long the euro can remain on top in Forex trading are being raised today as the 18-nation currency continues to hold its own against some of its major counterparts. While the euro is down against the yen, it is higher against the dollar and the pound.

Even with the disappointing data recently released in the eurozone, the euro is heading higher against some of its major counterparts today. Sterling is weak on dovish comments, and the dollar continues to struggle as the Fed refuses to commit to an interest rate timetable.

Some economists and analysts are concerned that the eurozone will find itself in a situation of long-term deflation, like that experienced by Japan. Japan is still going through its “lost decade” — a decade that has stretched out to nearly 15 years. However, other analysts point out that the eurozone is in recovery, even though it is a slow recovery. Plus, they say, deflationary pressure hasn’t been at the same level.

Even though many analysts think the eurozone will avoid a Japanese-style economic problem, future euro weakness is assumed because the ECB will likely have to adopt even looser monetary policy.

At 13:21 GMT EUR/USD is up to 1.3635 from the open at 1.3606. EUR/GBP is up to 0.8023 from the open at 0.8010. EUR/JPY is down to 138.7150 from the open at 138.7455.

The Best Investment Advice Of All Time

Five billionaires. A miser. A Nobel laureate. A Founding Father. We’ve rounded up the 20 finest market minds—dead or alive—and distilled their timeless wisdom into specific suggestions for stocks, bonds and funds you can buy today. Be warned: You just might get rich.

Investor profiles by: Tom Anderson, John Dobosz, Maggie McGrath, Janet Novack, Steve Schaefer, Matt Schifrin, Samantha Sharf, Brian Solomon, Nathan Vardi, John F. Wasik

---

Jack Bogle

Age: 85

Founder, Vanguard

Indispensible Wisdom: It's the fees, stupid

Nicknames: Jack, Saint Jack (used by supporters and detractors alike)

Money Quote: "Don't let the miracle of long-term compounding of returns be overwhelmed by the tyranny of long-term compounding of costs."

---

Sir John Templeton

1912-2008

Founder, Templeton Funds

Indispensable wisdom: Buy at the point of maximum pessimism; sell at the point of maximum optimism

Money quote: "If you buy the same securities everyone else is buying, you will have the same results as everyone else."

---

Warren Buffett

Age: 83

Chairman and CEO, Berkshire Hathaway

Indispensible Wisdom: Only invest in what you understand and at the right price

Nickname: Oracle of Omaha

Bestseller: Berkshire's annual letter to shareholders

Money Quote: "Whether socks or stocks, I like buying quality merchandise when it is marked down."

---

Nathan Mayer Rothschild

1777-1836

Founder, N.M. Rothschild & Sons

Indispensable Wisdon: Information is money

Crystal Ball Cred: Thanks to his extensive network of carrier pigeons Rothschild knew that England had defeated France at Waterloo before anyone else in London. As other traders on the stock exchange braced for a British loss, he went long.

Fundamentals: Rothschild's father planted the seeds for the 19th century's greatest banking empire by stationing each of his five sons in different European cities. Nathan got London, but throughout his career he was able to profit from the insights of his brothers in Frankfurt, Paris, Naples and Vienna.

Invest Like Rothschild: Tap into groups with their fingers on the pulse. Consider shares in high-yielding private equity firms like Blackstone Group, Apollo Global Management, Kohlberg Kravis Roberts and Carlyle Group.

---

Sam Zell

Age: 72

Chairman, Equity Group Investments

Indispensible Wisdom: Losers can be lucrative, too

Nickname: The Grave Dancer

Money Quote: "Look for good companies with bad balance sheets and understand your downside."

---

read more here