bear,

Based on your previous post earlier today, it would seem to that if your SL=36 pips and you only have 84 bad trades out of 5618, you should be able to obtain a higher TP that just 5 pips.

I realize that when you optimized your EA in the backtester the one with the highest profit may have been the one with the settings at TP=5 and SL=36, but personally, I would look at the ones with the TP at 10 or higher due to the slippage issue when you start live trading. A 216% average annual ROI certainly gives you a little room to play with.

Cheers,

bear,

Based on your previous post earlier today, it would seem to that if your SL=36 pips and you only have 84 bad trades out of 5618, you should be able to obtain a higher TP that just 5 pips.

I realize that when you optimized your EA in the backtester the one with the highest profit may have been the one with the settings at TP=5 and SL=36, but personally, I would look at the ones with the TP at 10 or higher due to the slippage issue when you start live trading. A 216% average annual ROI certainly gives you a little room to play with.

Cheers,

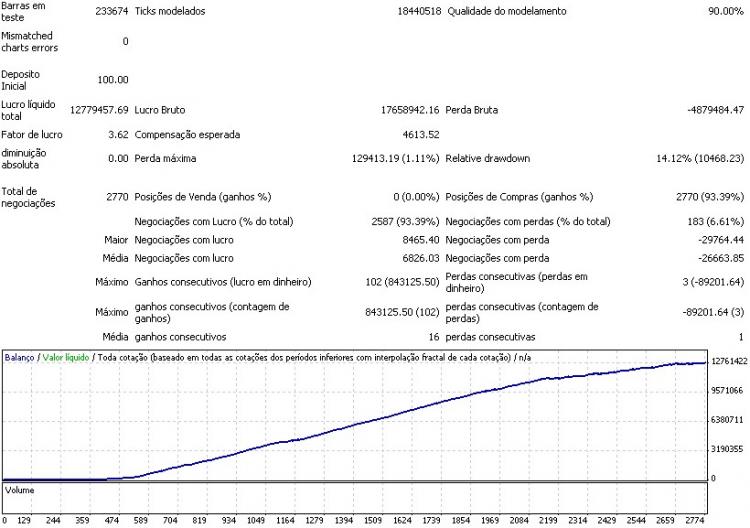

Ok mister.. this time is with 10 pips.. and with continues with 36 stop loss...

i use metatrader from some months and i have understood that the history is different from the real. in particular you can have big differences if you take a little takeprofit becasue the brokers plays with bid-ask......

i work with a TP >30 basis point

guys ...confirm these??

bear,

It appears you have a very good EA. Thank you for taking the time to run another backtest and post the results. You achieved an average annual ROI of 212% when the TP=10 versus 216% when the TP=5, which is not much of an ROI sacrifice for improving the profit margin on individual trades.

You can obviously run the EA at whatever TP setting you prefer. I was simply trying to draw out that there may be some better settings available in your EA. In my opinion you have demonstrated that very fact.

When you start live trading I recommend that you start with a small account and dumbdown the size of trades (say 2% of account balance) for 30 to 60 days to ensure you are obtaining adequate profit margins before increasing the size of the trades.

Good trading my friend ---- enjoy :)

PS One of my EA's runs very nicely with a setting of TP=16 & SL=200 with 97% win percentage, but more importantly it also runs very well when the TP=36 & SL=14 with a 48% win percentage. I prefer the SL=14 setting much better as I consider that stochastic model to be more stable in the long run. Have you tried a wide range of TP & SL settings in the backtester?

Actually, I need to amend my previous statement: The EA that runs nicely on two different settings has a minor adjustment in it. Version 5.0 closes all trades after 40 bars if the TP or SL have not been reached whereas Version 5.1 does not close the trade after 40 bars instead it stays in the trade until the TP or SL has been reached. Version 5.0 is the one that runs on the TP=36 & SL=14 settings.

bear,

It appears you have a very good EA. Thank you for taking the time to run another backtest and post the results. You achieved an average annual ROI of 212% when the TP=10 versus 216% when the TP=5, which is not much of an ROI sacrifice for improving the profit margin on individual trades.

You can obviously run the EA at whatever TP setting you prefer. I was simply trying to draw out that there may be some better settings available in your EA. In my opinion you have demonstrated that very fact.

When you start live trading I recommend that you start with a small account and dumbdown the size of trades (say 2% of account balance) for 30 to 60 days to ensure you are obtaining adequate profit margins before increasing the size of the trades.

Good trading my friend ---- enjoy :)

PS One of my EA's runs very nicely with a setting of TP=16 & SL=200 with 97% win percentage, but more importantly it also runs very well when the TP=36 & SL=14 with a 48% win percentage. I prefer the SL=14 setting much better as I consider that stochastic model to be more stable in the long run. Have you tried a wide range of TP & SL settings in the backtester?

Thank you again..

Do you have msn?

Do you have msn?

Not sure I understand your msn question.

Not sure I understand your msn question.

Msn== Messenger from Microsoft. Like ICQ, Skype, etc.

Msn== Messenger from Microsoft. Like ICQ, Skype, etc.

I sent you a PM.

You just have to look at that equity curve to see something is wrong. Run it live you'll see the difference in the first day.

I have never been able to make back testing work with any form of acuracy.

You just have to look at that equity curve to see something is wrong. Run it live you'll see the difference in the first day.

I have never been able to make back testing work with any form of acuracy.

Hi P.Monkey,

Not only have I heard it from you, but from others in this forum and from other forums, that back testing does not work with any degree of acuracy. If this statement is held so true with so many, it must have some truth to it. And if this is so, why bother with backtesting for profits, drawdown, etc., if there is no acuracy?

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Do you believe in it?

It's my system, bu, I was consulting some professionals, an they said that it's only in historic.

Using 10% of the capital (10k)