Watch how to download trading robots for free

Find us on Twitter!

Join our fan page

Join our fan page

You liked the script? Try it in the MetaTrader 5 terminal

- Views:

- 163

- Rating:

- Published:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

What is locking?

Locking is a situation where a trader simultaneously holds a long (LONG) and a short (SHORT) position of equal volume on the same asset. As a result:

- Market risk is neutralized: profit or loss on one position is offset by the opposite movement of the other.

- The position value is "frozen": the net financial result ceases to depend on market fluctuations.

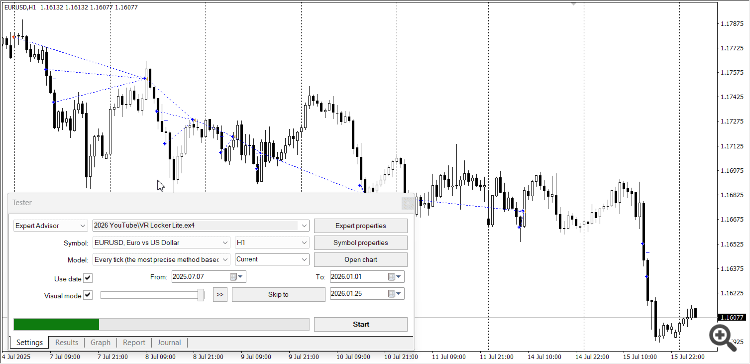

The presented VR Locker Lite trading algorithm demonstrates working with one positive lock:

Operation algorithm:

- The trading robot immediately opens two positions: a buy (BUY) and a sell (SELL).

- Using averaging, the trading robot "widens" the buy (BUY) and sell (SELL) positions.

Options for further work with the lock:

- The simplest one - simply close the lock and start the entire trading cycle anew.

- Unlock the lock - leave one of the positions for a longer period and "let the profit grow".

- Enable a trailing stop for one of the positions or for both simultaneously.

- Move one of the positions to breakeven and "let the profit grow".

- Start the algorithm on another financial instrument or with another MagicNumber to create another positive lock.

Important things not to forget:

- Double commissions and swaps: You pay a commission for opening and (in the future) closing two positions instead of one. In forex, there may be a negative swap (rollover fee) on one of the positions.

- Capital lock-up: The margin (collateral) for the locked position is still frozen. You cannot use these funds for other trades.

- Complication of analysis: You still have to decide which side of the lock to close and when. This is often more difficult than the initial entry.

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/26947

Trading strategy Heads or Tails

Trading strategy Heads or Tails

The classic version of the Heads or Tails trading strategy with the analysis of the signal block code.

RatioZigZag

RatioZigZag

A modification of the ZigZag indicator, where the reversal moment is determined by a specified coefficient.

Three Colors

Three Colors

Example: Moving Average indicator filling by different colors

MACD Sample

MACD Sample

Classical MACD Sample.