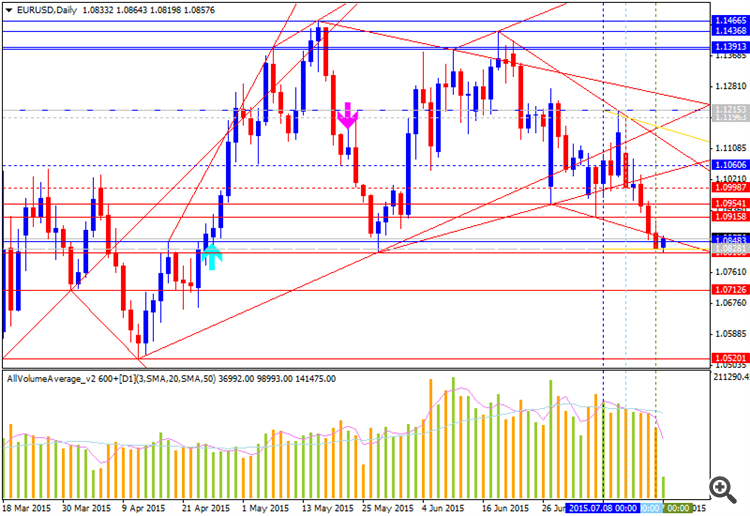

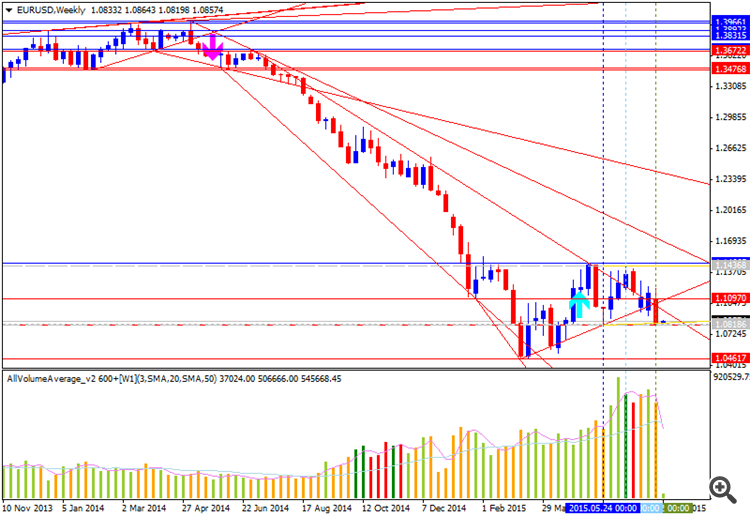

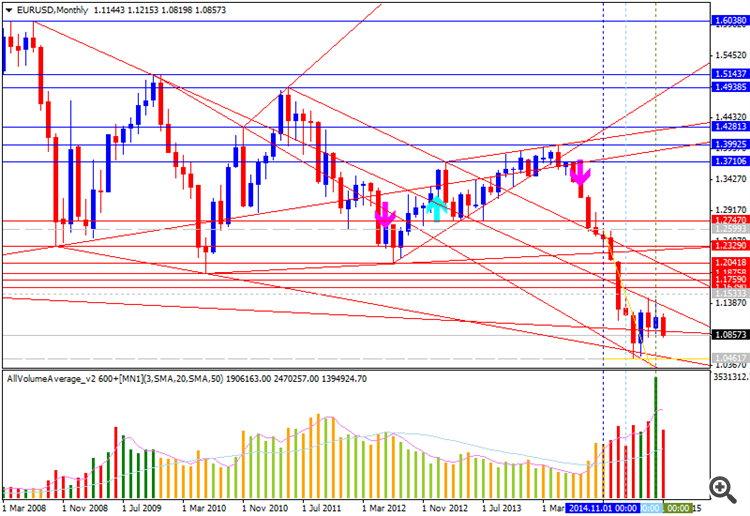

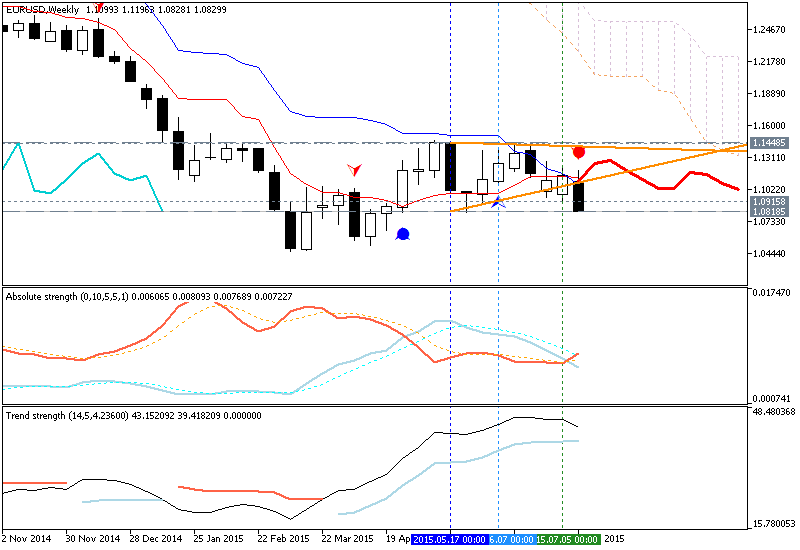

EUR: Bearish

- Weekly price is on primary bearish market condition located below Ichimoku cloud for trying to break key support level for the bearish to be continuing.

- Price is located below 100 SMA and below 200 SMA for the primary bearish.

- The data of AbsoluteStrength indicator and Trend Strength indicator are in contradiction with each other for ranging market condition

- "With uncertainty regarding Greece diminished, we believe that investors will feel more comfortable reinitiating EUR shorts, as evidenced by the latest break in EURUSD below the 100 DMA. Draghi has reiterated that the ECB stands ready to act if needed, which could be enough to weigh on EUR, particularly if it supports equities, given the inverse relationship between European stocks and EUR."

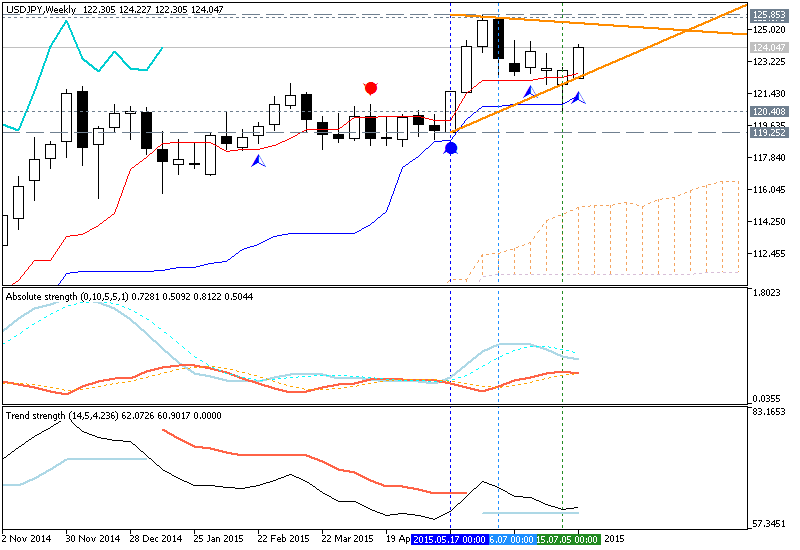

JPY: Bullish

- Weekly price is located far above Ichimoku cloud for the primary bullish market condition to be continuing.

- Price is located above 100 SMA and above 200 SMA for the bullish trend.

- The values of Absolute Strength indicator are estimating the secondary ranging which is going between 119.25 support and 125.85 resistance levels.

- "We expect JPY weakness to reverse, and maintain our bullish view, despite the recent pick-up in equity markets. Recent data from Japanese pension funds point to the reallocation process being largely complete, suggesting that foreign outflows from Japan could slow."