1

1 211

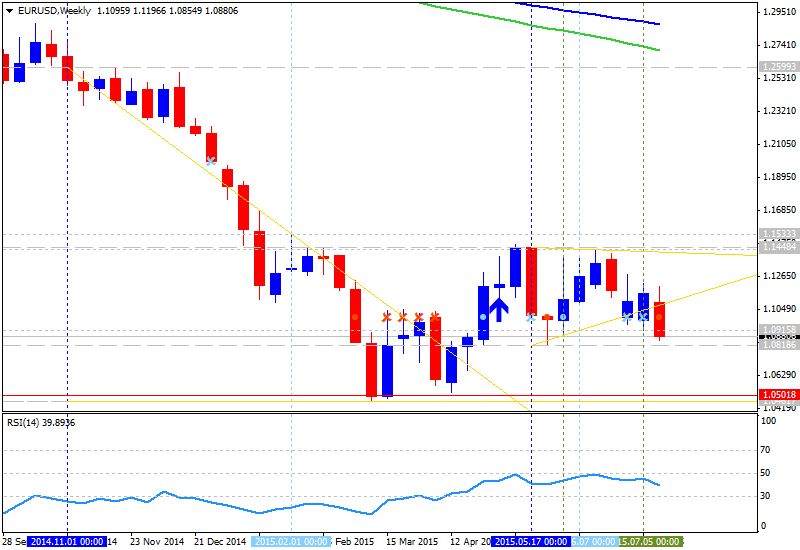

BNP Paribas maintains short position for EURUSD from early this week from 1.1025 with 1.05 as a target, and those are 5 reasons about why this bank is considering the short for this pair:

- Greek outcome. "The EUR’s attempts to rally on positive Greek news proved short-lived this week. As we have long argued, a return of positive risk sentiment re-encourages markets to rebuild long risk positions funded in EUR."

-

EUR less vulnerable. "EUR

short positions now stand at -6 versus a high of -35 this year (on a

-50 to 50 scale) according to BNP Paribas positioning analysis. This

suggests markets have more scope to rebuild EUR shorts and should be

less vulnerable to a positioning squeeze should risk sentiment

deteriorate again."

-

ECB and QE. "There were

few surprises at the ECB policy meeting this week...We think the bottom

line is that the ECB stands ready to counter any economic weakness or

market volatility with even easier policy, which would be negative for

the EUR."

-

US rates. "There is still

substantial scope for an upward adjustment in US front-end yields, which

should be supported by the recent improvement in risk sentiment."

- Bearish for EUR/USD. "We see scope for both US nominal rates and eurozone inflation expectations to push the spread even further against EURUSD, but even at current levels it is sending a clear bearish signal for the pair."