ATREND: How It Works and How to Use It

How It Works

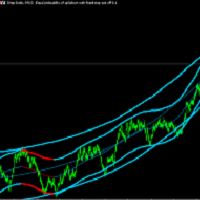

The "ATREND" indicator for the MT5 platform is designed to provide traders with robust buy and sell signals by utilizing a combination of technical analysis methodologies. This indicator primarily leverages the Average True Range (ATR) for volatility measurement, alongside trend detection algorithms to identify potential market movements.

Leave a massage after purchase and receive a special bonus gift.

⦁ Dynamic Trend Detection: The indicator assesses market trends and adjusts its signals accordingly, helping traders align their strategies with prevailing market conditions.

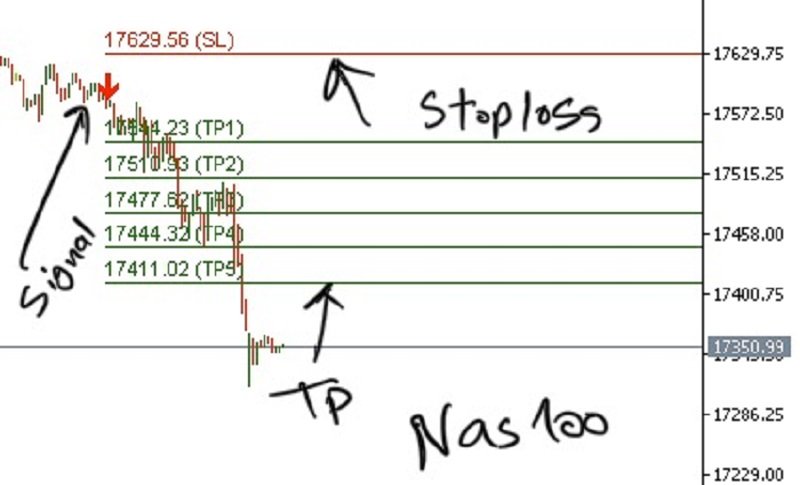

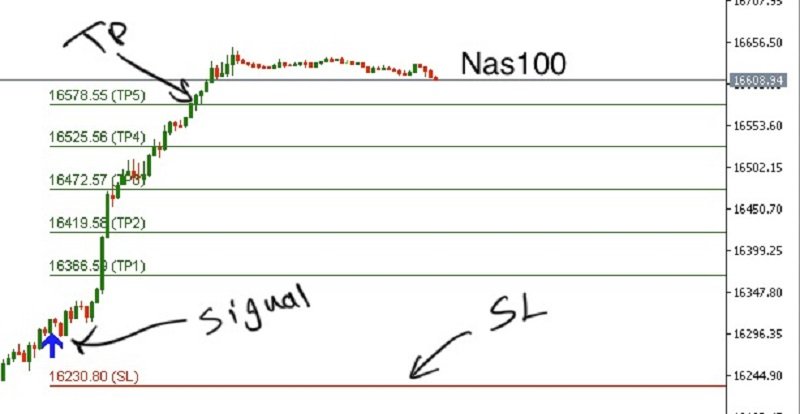

⦁ Volatility Measurement: By employing ATR, the indicator gauges market volatility, which is crucial for determining optimal Stop Loss (SL) and Take Profit (TP) levels.

⦁ Signal Visualization: The indicator visually represents buy and sell signals on the chart, enhancing decision-making for traders.

Operational Steps

Inputs and Settings

⦁ TimeFrame: This input allows you to set the primary timeframe for the indicator's calculations. The default value is set to 15 minutes.

⦁ TimeFrame2: This input can be used to define a secondary timeframe for additional analysis, with a default value of 1 minute.

⦁ Shift: This parameter allows you to shift the indicator's calculations back in time, with a default value of 0.

⦁ SLATR: This input defines the multiplier used to calculate the Stop Loss level based on ATR, with a default value of 2.56.

⦁ TPATR: This input defines the multiplier used for calculating the Take Profit level based on ATR, also set to 2.56 by default.

⦁ AlertsOn: Enables or disables alerts for trading signals. The default is set to true.

⦁ AlertsMessage: When enabled, this option sends alert messages. The default is set to true.

⦁ AlertsEmail: This option allows for email notifications when alerts are triggered. The default is set to false.

⦁ AlertsSound: This option enables sound notifications for alerts. The default is set to false.

⦁ ATR Measurement: The ATR is calculated to assess market volatility, which influences SL and TP levels. This measurement is critical for managing risk effectively.

Signal Generation Logic

The OnCalculate function processes the following:

1 Data Validation: The function first checks if the necessary data is available for calculation. If not, it resets the indicator.

2 Trend Analysis: The function computes the highest highs and lowest lows over a specified period to determine the current trend.

3 Signal Conditions:

⦁ If the closing price exceeds the calculated high, a buy signal is generated.

⦁ Conversely, if the closing price is below the calculated low, a sell signal is generated.

1 Visual Representation: The indicator draws lines for SL and TP on the chart, providing clear visual cues for traders.

Adding the Indicator to the Chart

1 Download the ATREND indicator from a trusted source.

2 In MT5, navigate to "File" > "Open Data Folder."

3 Go to the "MQL5" folder, then "Indicators."

4 Place the downloaded .ex5 file into this folder.

5 Restart MT5 to ensure the indicator appears in the "Navigator" window.

6 Drag the indicator from the "Navigator" onto your chart.

⦁ TimeFrame: Set the primary timeframe for calculations (default is 15).

⦁ TimeFrame2: Define a secondary timeframe for additional insights (default is 1).

⦁ Shift: Adjust the calculation shift (default is 0).

⦁ SLATR: Set the Stop Loss multiplier based on ATR (default is 2.56).

⦁ TPATR: Set the Take Profit multiplier based on ATR (default is 2.56).

⦁ AlertsOn: Toggle to enable or disable alerts.

⦁ AlertsMessage: Enable or disable alert messages.

⦁ AlertsEmail: Toggle to enable email notifications.

⦁ AlertsSound: Toggle to enable sound alerts.

Interpreting Signals

⦁ Buy Signals: Indicated by a specific visual cue (e.g., green arrows).

⦁ Sell Signals: Marked by a different visual cue (e.g., red arrows).

⦁ Stop Loss and Take Profit Lines: Use these to manage your trades effectively.

Using Alerts

⦁ Set up alerts in MT5 to be notified of buy and sell signals based on the indicator's conditions.

Important Notes

⦁ Risk Management: Always utilize Stop Loss points to manage trading risks effectively.

⦁ Testing and Optimization: Test the indicator on a demo account before applying it to live trading scenarios to ensure its effectiveness.

Combine with Other Analyses: Enhance your trading decisions by integrating this indicator with other technical and fundamental analysis methods.

The indicator demonstrates high accuracy, I get some profit consistently with the help of it.