Gann Time Reversal Signals

- 指标

- Satya Prakash Mishra

- 版本: 1.0

- 激活: 5

Gann Time Reversal Signals are sophisticated trading concepts developed by Naveen Saroha using W.D. Gann concepts that focus on predicting market turning points through the confluence of time cycles and price movements. Here are the key elements:

Time-Balance: Gann famously stated, "When time is up, the market will reverse regardless of the price. This emphasizes that time cycles often take precedence over price levels in determining market reversals.

Key Reversal Signals

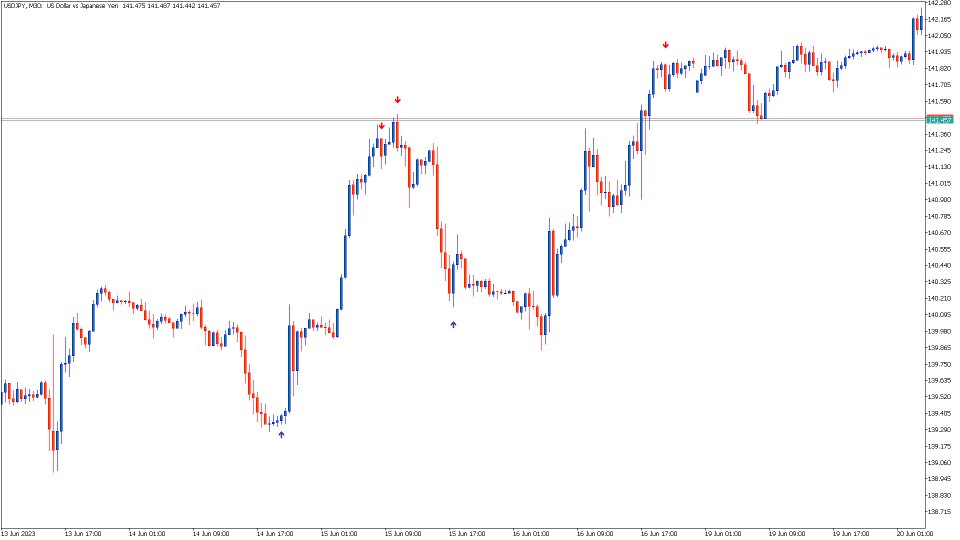

Price-Time Confluence: The most powerful reversal signals occur when both time cycles and price levels align. For example, when a currency pair declines 500 pips over 50 days and time continues but price remains stagnant, it signals momentum loss and possible trend reversal.

Intraday Reversals: Intraday reversal times are specific times that the market is much more likely to reverse price action or start rising/falling impulsively. These can be calculated using Gann's time cycle methods.

Monthly Trend Shifts: Modern applications include indicators that help identify monthly trend changes for swing and positional trading, using Gann's time and price action techniques.

Trading Strategy Elements

The strategy typically involves:

- Identifying critical time cycles using Gann's square of nine, natural cycles, or astronomical calculations

- Looking for confluence points where time cycles and price levels intersect

- Entering trades when price breaks above or below these confluence time candle

The methodology requires significant study and practice, as Gann's techniques combine mathematical calculations, geometric patterns, and time cycle analysis to predict market turning points with remarkable precision when properly applied.

Signals is quite simple to observe (complex math inside)a market reversal on any time frame for swing or intraday trading