Sergey Golubev / Profil

Newdigital

Arkadaşlar

3896

İstekler

Giden

Sergey Golubev

Sergey Golubev

Konuya yorum yap Press review

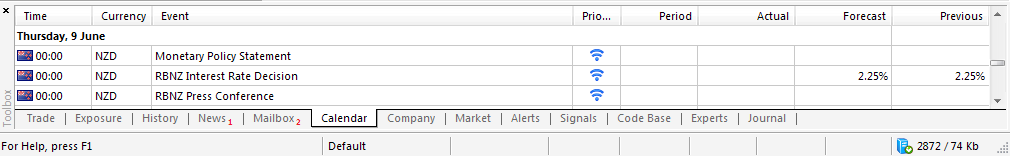

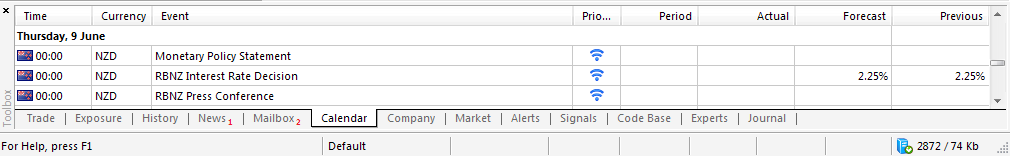

Trading News Events: Reserve Bank of New Zealand Official Cash Rate (adapted from the article ) " According to a Bloomberg News survey, 10 of the 17 economists polled anticipate the Reserve Bank of

Sergey Golubev

Sergey Golubev

Konuya yorum yap Press review

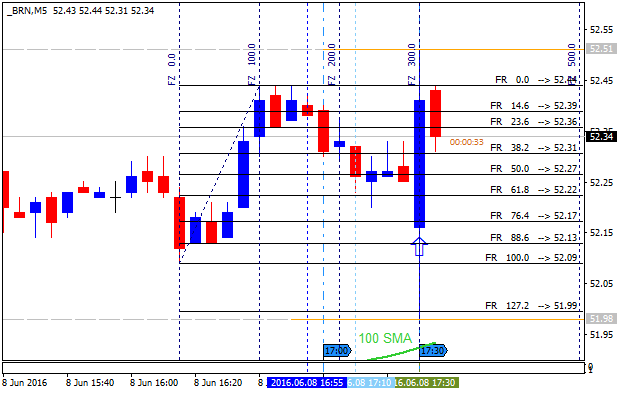

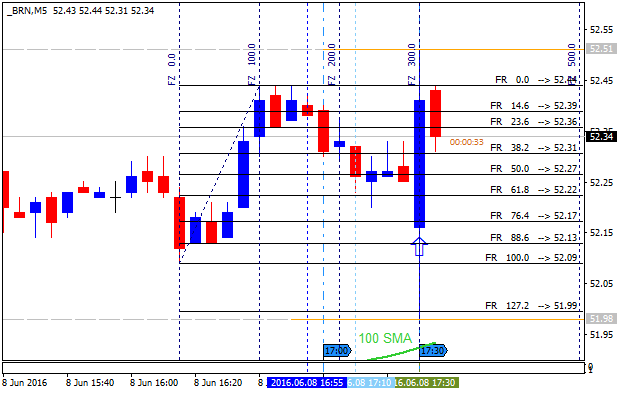

U.S. Commercial Crude Oil Inventories news event: intra-day ranging within narrow levels; daily bullish trend to 6-month high at 53.95 as a target 2016-06-08 14:30 GMT | [USD - Crude Oil Inventories]

Sergey Golubev

Sergey Golubev

Konuya yorum yap Something Interesting

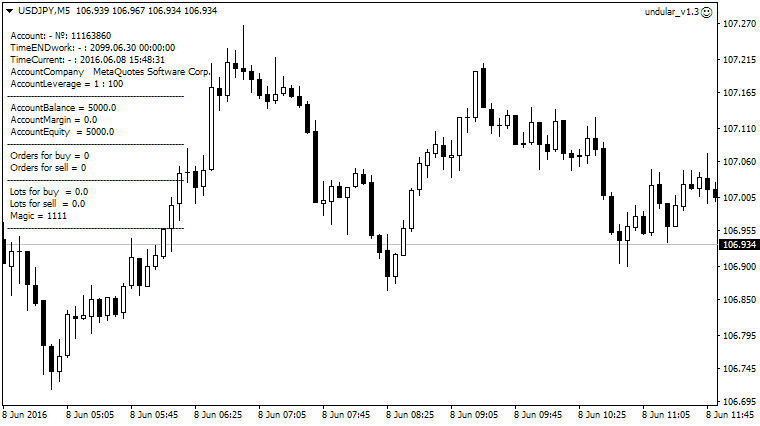

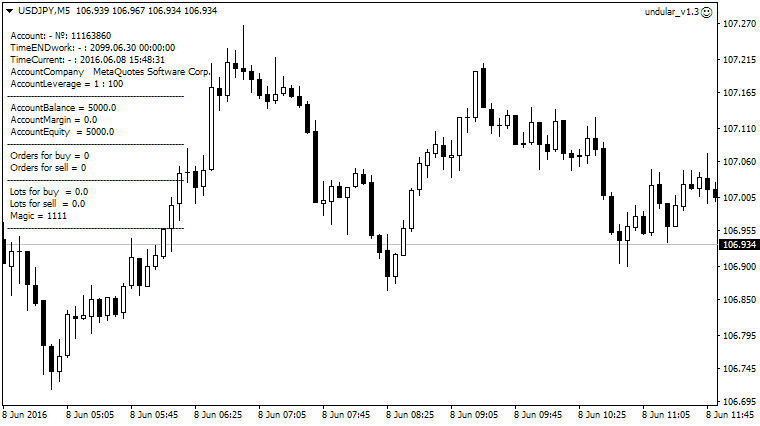

This is interesting EA: undular_v1.3 EA This EA is using standard indicators (Stochastics and MA). The author was making this EA during the 2 years to get some good EA. Best pairs are JPY pairs. Best

Sergey Golubev

Sergey Golubev

Konuya yorum yap Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.06.08 10:48 GBP/USD Intra-Day Fundamentals: U.K. Manufacturing Production and 37 pips

Sergey Golubev

Sergey Golubev

Konuya yorum yap Press review

GBP/USD Intra-Day Fundamentals: U.K. Manufacturing Production and 37 pips price movement 2016-06-08 08:30 GMT | [GBP - Manufacturing Production] past data is 0.1%, forecast data is 0.0%, actual data

Sergey Golubev

Sergey Golubev

Konuya yorum yap Press review

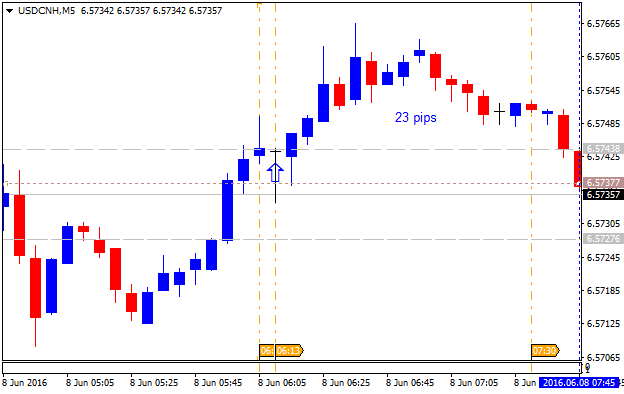

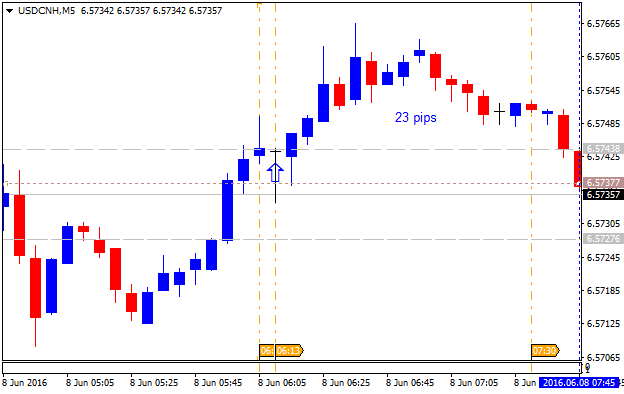

USD/CNH Intra-Day Fundamentals: China Trade Balance and 23 pips price movement 2016-06-08 03:13 GMT | [CNY - Trade Balance ] past data is 298B, forecast data is 358B, actual data is 325B according to

Sergey Golubev

Sergey Golubev

Konuya yorum yap Press review

Intra-day Technical Analysis - DAX Index: bullish ranging within 20-day high resistance and bearish reversal support (based on the article ) H4 price is on primary bullish market condition for the

Sergey Golubev

Sergey Golubev

Konuya yorum yap Press review

AUD/USD Intra-Day Fundamentals: RBA Cash Rate and 64 pips price movement 2016-06-07 04:30 GMT | [AUD - RBA Cash Rate ] past data is 1.75%, forecast data is 1.75%, actual data is 1.75% according to the

Sergey Golubev

Sergey Golubev

Konuya yorum yap Press review

Gold Prices Recovery Friday’s NFP report: daily bullish resumed; intra-day rally to the bullish reversal (based on the article ) " We looked at the precipitous fall in Gold prices on the back of a

Sergey Golubev

Sergey Golubev

Konuya yorum yap Press review

Intra-Day Fundamentals: Signals from Federal Reserve chair Janet Yellen about the US central bank's next rate-hike after payroll data shocks 2016-06-06 16:30 GMT | [USD - Fed Chair Yellen Speaks] past

Sergey Golubev

MetaQuotes

更新metatrader5.com网站:以7种语言修正MetaTrader 5的信息

更新的MetaTrader 5 多资产交易平台网站 www.metatrader5.com 已经发布。改进的网站强化了感官体验并完全更新原有内容。此外,支持的语言数量也提高到7种语言:新网站可以提供英语,中文,西拔牙语,葡萄牙语,法语,日语和俄语界面。 访问 www.metatrader5.com 网站,找出使用交易平台卓越的功能获得最佳交易体验的方法。新网站提供了有关您在平台可以使用何种订单,如何使用自动交易 使您的交易自动化

Sergey Golubev

MetaQuotes

Updated metatrader5.com site: revamped information about MetaTrader 5 in 7 languages!

The updated website of the MetaTrader 5 multi-asset trading platform www.metatrader5.com has been launched. The streamlined site features an enhanced look-and-feel and completely updated content. In addition, the number of supported languages has

Sergey Golubev

Sergey Golubev

Konuya yorum yap Forecast for Q2'16 - levels for Hang Seng Index (HSI)

Hang Seng Index Technical Analysis 2016, 05.06 - 12.06: one-month high at 20,837 to be broken for the daily bullish reversal Daily price is located within 100 SMA/200 SMA reversal area and below

Sergey Golubev

Sergey Golubev

Konuya yorum yap Forecast for Q2'16 - levels for SILVER (XAG/USD)

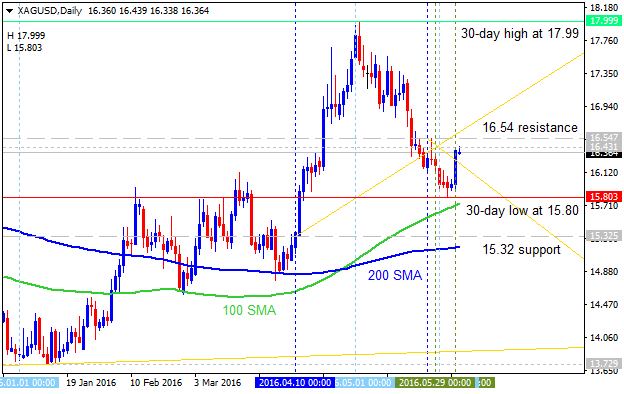

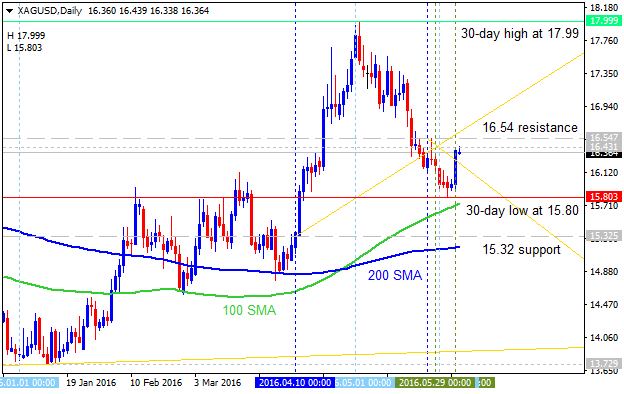

SILVER (XAG/USD) Technical Analysis: Buy Silver - daily bullish ranging within 30-day high/low near bearish reversal area Daily price is located above 200-day SMA and 100-day SMA for the ranging

Sergey Golubev

Sergey Golubev

Konuya yorum yap Forecast for Q2'16 - levels for US Dollar Index

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.06.04 12:06 Fundamental Weekly Forecasts for Dollar Index, EUR/USD, GBP/USD, USD/JPY

Sergey Golubev

Sergey Golubev

Konuya yorum yap Forecast for Q2'16 - levels for GOLD (XAU/USD)

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.06.04 12:06 Fundamental Weekly Forecasts for Dollar Index, EUR/USD, GBP/USD, USD/JPY

Sergey Golubev

Sergey Golubev

Konuya yorum yap Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.06.04 12:06 Fundamental Weekly Forecasts for Dollar Index, EUR/USD, GBP/USD, USD/JPY

Sergey Golubev

Sergey Golubev

Konuya yorum yap Forecast for Q2'16 - levels for NZD/USD

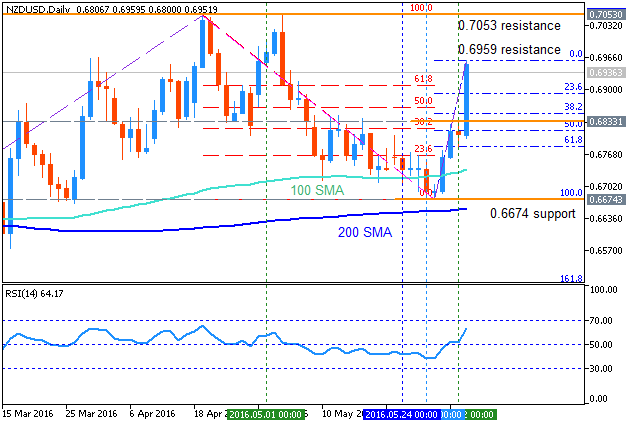

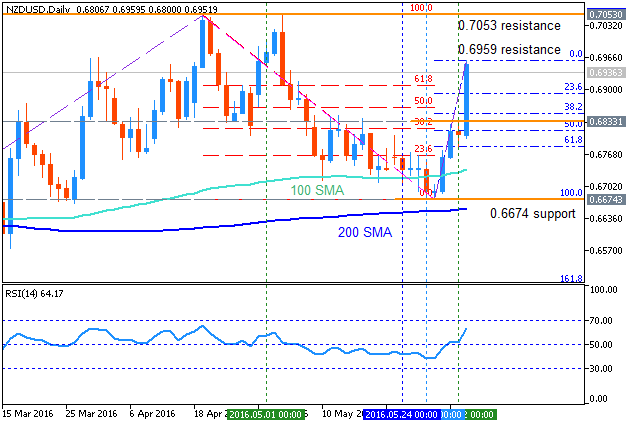

NZD/USD Technical Analysis 2016, 05.06 - 12.06: Fibo level at 0.6959 to be broken for the bullish breakout to be continuing Daily price is located above 100 SMA/200 SMA reversal area for the primary

: