Mochamad Briend Mega Bayu Angkasa / Profil

- Bilgiler

|

2 yıl

deneyim

|

0

ürünler

|

0

demo sürümleri

|

|

0

işler

|

1

sinyaller

|

0

aboneler

|

Mochamad Briend Mega Bayu Angkasa

The complex correction is finally behind us, and the structure is shifting back to an impulsive phase. This is exactly why we don’t force trades during the chop, we simply wait for the clear path to reveal itself.

Now that the roadmap is defined, the real opportunity begins.

Patience pays.

Now that the roadmap is defined, the real opportunity begins.

Patience pays.

Mochamad Briend Mega Bayu Angkasa

The GBPCHF 14H chart is showing a strong corrective structure where price has respected the major support zone and is now pushing upward with increasing bullish momentum. After completing a clear five-wave decline into support, the pair formed an A-B corrective base, signaling the start of a potential wave C recovery. Buyers stepped in aggressively at support, and the current upward move suggests that the market is aiming toward the next resistance zone where the larger wave (iv) is expected to complete. If bullish strength continues, price may climb toward the highlighted resistance area, completing the projected C wave before any major reversal or continuation decision is made. This structure reflects a classic Elliott Wave correction with well-defined support, resistance, and impulse-correction sequencing.

Mochamad Briend Mega Bayu Angkasa

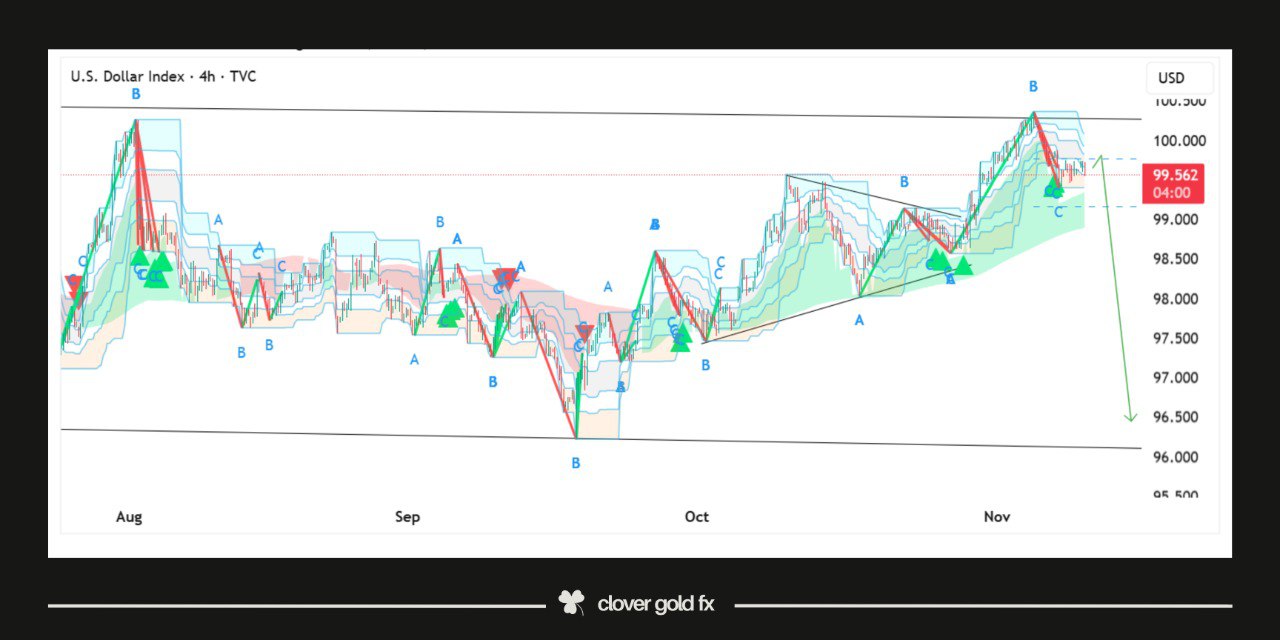

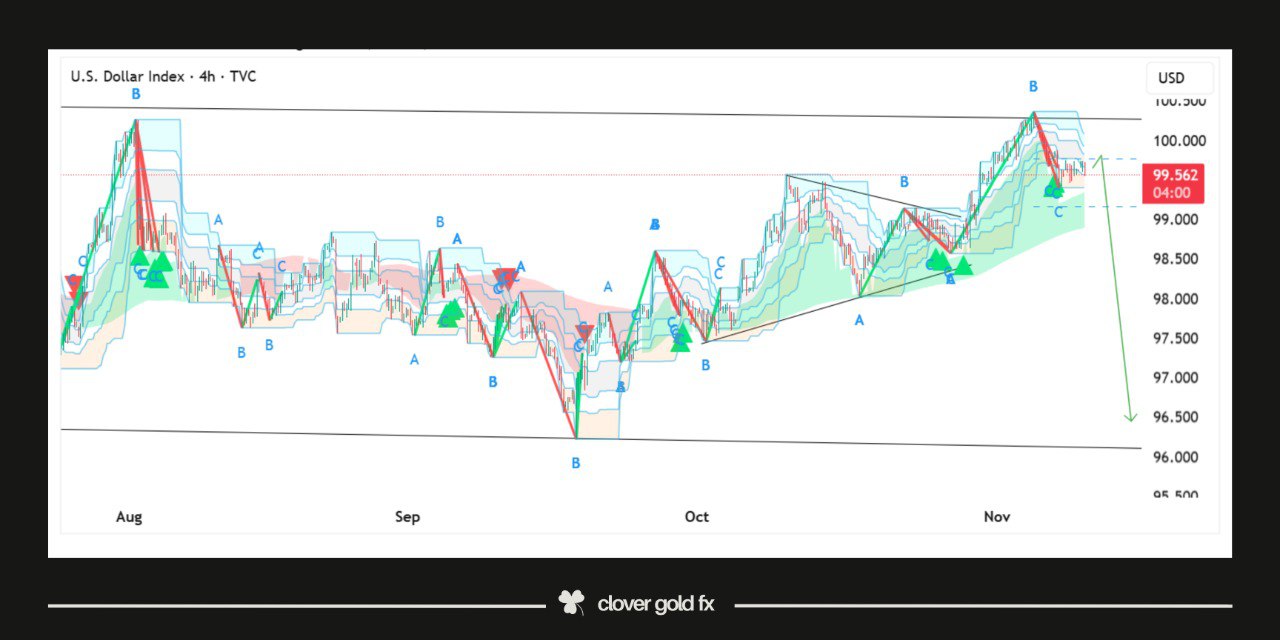

DXY 4H chart has completed a clear five wave impulsive structure topping at wave 5 before breaking below thi major blue trend line drawn from wave 2 to wave 4, signaling a shift from bullish momentum into a corrective phase. After forming wave a price is now attempting a weak wave b pullback that is struggling near the previous support-turned-resistance and the dotted bearish trend line, keeping the market vulnerable for a further drop toward the anticipated wave c zone around 98.00. This technical bearish setup aligns strongly with current fundamentals as slowing U.S. inflation, softer labor market data, and weakening consumer spending are increasing expectations of upcoming Federal Reserve rate cuts reducing the dollar’s yield advantage. At the same time improving global risk sentiment and strengthening performance in other major economies are creating pressure on the dollar, decreasing its safe-haven demand supporting the probability of a deeper corrective move on the chart.

Mochamad Briend Mega Bayu Angkasa

CADJPY is showing a clean bullish structure where price has completed a corrective ABC pattern within the broader wave 4 and has now broken above the descending trendline resistance that capped previous upside attempts. This breakout from the consolidation zone, supported by strong rejection from the lower boundary of the correction, signals that buyers are gaining momentum and preparing for the next impulsive phase. The grey zone highlights the key retest area where bulls are stepping back in, and as long as price holds above this region, the market is positioned to advance toward the anticipated wave 5 continuation. Overall, the structure reflects strength, trend alignment, and a potential bullish extension as market sentiment shifts firmly in favor of buyers.

Mochamad Briend Mega Bayu Angkasa

CAD Break the Structure

✅ Price Below The Ascending Channel

❤️ Bearish Bias

📉 Any Retest of channel will push the Price

👉 PRICE Below very Important channel and last Fundamental and Upcoming fundemntal Also Supporting our idea. Last Idea was very clear and this Time again I am expecting the Same move As last times price Follow my Arrow.

👍 Don't Rush out Watch and wait is the Best policy of All major Currency Pairs until price gives any retest and on Retest I will be Looking for Reverseal Candle like shooting stars and Bearish Engulfing

✅ Price Below The Ascending Channel

❤️ Bearish Bias

📉 Any Retest of channel will push the Price

👉 PRICE Below very Important channel and last Fundamental and Upcoming fundemntal Also Supporting our idea. Last Idea was very clear and this Time again I am expecting the Same move As last times price Follow my Arrow.

👍 Don't Rush out Watch and wait is the Best policy of All major Currency Pairs until price gives any retest and on Retest I will be Looking for Reverseal Candle like shooting stars and Bearish Engulfing

Mochamad Briend Mega Bayu Angkasa

EURAUD on the 4H timeframe is showing a clear bearish structure as the market breaks below the major support zone that has now turned into strong resistance. After completing a corrective ABC cycle followed by a five-wave rising wedge pattern, price failed to sustain higher highs and reversed sharply from the upper trendline. The break and retest of the highlighted zone confirm seller dominance, and the consistent lower lows signal continuation of downside momentum. With the structure shifting fully bearish, the current breakout suggests that EURAUD may extend toward deeper downside targets as long as price remains below the resistance area, giving sellers control and increasing the probability of further decline.

Mochamad Briend Mega Bayu Angkasa

XAUUSD on the 4H is compressing inside a clean symmetrical triangle after completing a corrective structure where price respected both trendlines perfectly showing strong buildup of pressure as buyers continue to defend higher lows while sellers cap the highs and this type of consolidation often leads to an explosive breakout with momentum favoring an upside continuation if price holds above support and confirms a bullish break and retest toward the upper trendline opening the path for a measured expansion move toward the next major resistance area while risk remains defined below the triangle base.

Mochamad Briend Mega Bayu Angkasa

GBPUSD on the daily shows a clean pullback where selling pressure is getting weaker and price is holding the lower area with small candles which often means buyers are stepping in this kind of calm movement after a drop usually leads to a bounce higher if price breaks above the trendline with strength it can start the next upward move so the focus stays on waiting for a clear breakout and strong close before entering instead of jumping in too early.

Mochamad Briend Mega Bayu Angkasa

AUDJPY 14H price is still moving inside a clean ascending channel showing that buyers remain in control but the recent reaction from the upper boundary signals short term exhaustion after the final push into resistance as momentum starts to fade and the structure hints at a corrective phase where price may rotate back toward the mid channel and possibly test the lower channel support since this area has repeatedly acted as a high probability reaction zone in the past while any failure to hold above the 50 percent channel could open the door for a deeper pullback toward channel support whereas bullish continuation will only be confirmed if price stabilizes after the pullback and then breaks and holds above the channel top showing renewed strength and trend continuation.

Mochamad Briend Mega Bayu Angkasa

USDJPY on the daily is approaching a critical technical decision area after completing a clean impulsive drive into long-term descending trendline resistance while riding the upper boundary of the rising channel from the B-wave low. Price has delivered a near textbook five-wave advance into this supply zone and is now showing signs of exhaustion with rejection wicks and loss of bullish momentum near the highs. This structure favors a corrective rotation back toward the channel base as profit taking and mean reversion pressure build. Unless price can hold above the trendline with strong continuation candles the higher probability remains a pullback phase targeting deeper liquidity below before any sustainable upside can resume.

Mochamad Briend Mega Bayu Angkasa

#GBPUSD 🇬🇧🇺🇸

👨🏼💻 Update your trading plan and your mindset every single day!

📍 Here are 4 things that will always pay off in the long run:

👉🏻 Trust your plan, not your emotions.

👉🏻 Focus on today’s setup, not yesterday’s mistakes.

👉🏻 Follow the process, not the outcome.

👉🏻 Improve your discipline, not just your strategy.

👨🏼💻 Update your trading plan and your mindset every single day!

📍 Here are 4 things that will always pay off in the long run:

👉🏻 Trust your plan, not your emotions.

👉🏻 Focus on today’s setup, not yesterday’s mistakes.

👉🏻 Follow the process, not the outcome.

👉🏻 Improve your discipline, not just your strategy.

Mochamad Briend Mega Bayu Angkasa

#DXY 🇺🇸

📍 The Dollar Index is the key chart to watch closely in the coming weeks.

Every major move across FX, metals, and indices will be shaped by what happens here.

As we always say, trading plan is everything!

📍 The Dollar Index is the key chart to watch closely in the coming weeks.

Every major move across FX, metals, and indices will be shaped by what happens here.

As we always say, trading plan is everything!

Mochamad Briend Mega Bayu Angkasa

This XAUUSD 4 hour chart shows that gold has completed a corrective wave pattern labeled as a b and c after a strong fall from the previous high. The market reached the horizontal resistance zone which aligns with the 61% Fibonacci retracement level. This area is acting as a key rejection point where buyers are losing strength and sellers may take control again. The pattern indicates a potential reversal as the price action forms rejection candles around this level. The overall structure suggests that gold could start a new downward move from this resistance area as the market respects both technical resistance and Fibonacci retracement signals showing a shift from bullish correction to bearish continuation.

Mochamad Briend Mega Bayu Angkasa

US oil on the 4 hour chart is showing a descending channel pattern where price is moving between two parallel trendlines forming lower highs and lower lows after completing a five wave impulsive structure the current movement appears to be a corrective phase targeting the 61.8% retracement level the overall momentum remains bearish as price continues to respect the upper resistance trendline if price breaks below the channel support it could confirm continuation toward the next key Fibonacci extension level indicating further downside pressure while any rejection from the lower boundary might lead to a short term pullback before the next major move.

Mochamad Briend Mega Bayu Angkasa

AUDUSD on the 4hour chart is showing a clear ascending flat support structure that has been respected multiple times indicating strong buyer interest at lower levels the recent corrective pattern has completed its abc formation suggesting the potential beginning of a bullish impulse the market is now reacting from the support zone aiming toward the highlighted resistance area where sellers may attempt to regain control as long as price remains above the ascending trend line the overall sentiment stays bullish and a continuation toward the upper resistance zone is likely

Mochamad Briend Mega Bayu Angkasa

#chfjpy #chf #jpy

CHFJPY on the 1D shows a long impulsive structure that has now completed a five wave formation with the fifth wave forming a rising wedge pattern which usually indicates weakness in the bullish trend the chart highlights a possible reversal zone where the price has started dropping leaving a visible gap toward the lower support area this setup suggests that the market may attempt to fill the big gap as part of a corrective phase traders should watch the support region closely since a clear break below it could confirm the start of a deeper retracement while a strong rejection could lead to short term recovery before further downside continuation.

CHFJPY on the 1D shows a long impulsive structure that has now completed a five wave formation with the fifth wave forming a rising wedge pattern which usually indicates weakness in the bullish trend the chart highlights a possible reversal zone where the price has started dropping leaving a visible gap toward the lower support area this setup suggests that the market may attempt to fill the big gap as part of a corrective phase traders should watch the support region closely since a clear break below it could confirm the start of a deeper retracement while a strong rejection could lead to short term recovery before further downside continuation.

Mochamad Briend Mega Bayu Angkasa

#cadchf #cad #chf

The CADCHF 14H chart shows that the pair has been trading in a clear downtrend forming a falling wedge pattern after an extended bearish move. The recent solid breakout from the wedge signals a potential shift in momentum as buyers start gaining strength. The breakout candle indicates increased bullish activity suggesting that the market may attempt a corrective rally toward the next resistance area shown by the red arrow. This upward move represents a possible reversal phase where price could retest previous structure levels before deciding its next major direction. Overall the chart reflects early signs of recovery with the breakout acting as a key confirmation for short term bullish continuation.

The CADCHF 14H chart shows that the pair has been trading in a clear downtrend forming a falling wedge pattern after an extended bearish move. The recent solid breakout from the wedge signals a potential shift in momentum as buyers start gaining strength. The breakout candle indicates increased bullish activity suggesting that the market may attempt a corrective rally toward the next resistance area shown by the red arrow. This upward move represents a possible reversal phase where price could retest previous structure levels before deciding its next major direction. Overall the chart reflects early signs of recovery with the breakout acting as a key confirmation for short term bullish continuation.

Mochamad Briend Mega Bayu Angkasa

#GBPUSD 🇬🇧🇺🇸

As forecasted in the previous post, price continued exactly within the expected structure. The upside potential remains strong, but patience is key.

Before we rush in, let’s quickly remember our —> trading plan!

📌 Why we avoid Wave 1

• Confirm the correction is complete.

• Early entries offer poor risk-to-reward.

• Wave 1 may still be part of the correction; avoid traps.

📌 What we wait for

Enter at the start of Wave 3, where:

✅ Structure is confirmed

✅ Momentum is stronger

✅ RRR is significantly higher

Waiting for minor Wave 1 & 2 protects from losses and provides high-probability setups.

Similar structures are forming across multiple pairs.

As forecasted in the previous post, price continued exactly within the expected structure. The upside potential remains strong, but patience is key.

Before we rush in, let’s quickly remember our —> trading plan!

📌 Why we avoid Wave 1

• Confirm the correction is complete.

• Early entries offer poor risk-to-reward.

• Wave 1 may still be part of the correction; avoid traps.

📌 What we wait for

Enter at the start of Wave 3, where:

✅ Structure is confirmed

✅ Momentum is stronger

✅ RRR is significantly higher

Waiting for minor Wave 1 & 2 protects from losses and provides high-probability setups.

Similar structures are forming across multiple pairs.

Mochamad Briend Mega Bayu Angkasa

After completing a strong nine-week bullish sequence on the weekly chart, XAUUSD appears to be entering a corrective phase that mirrors previous market behavior seen after extended impulsive rallies. Historically, such prolonged bullish runs often trigger profit-taking and short-term reversals as momentum fades and institutional traders rebalance positions. The current structure shows signs of exhaustion at the top, with a shift from large impulsive candles to smaller corrective ones, suggesting reduced buying pressure. If history repeats, gold may retrace toward the 50% Fibonacci zone, a level that often acts as a natural equilibrium between buyers and sellers before the broader trend resumes. This area also aligns with prior consolidation zones, making it a potential demand region where new accumulation could begin if the long-term uptrend remains intact.

: