Mochamad Briend Mega Bayu Angkasa / 프로필

- 정보

|

2 년도

경험

|

0

제품

|

0

데몬 버전

|

|

0

작업

|

1

거래 신호

|

0

구독자

|

Mochamad Briend Mega Bayu Angkasa

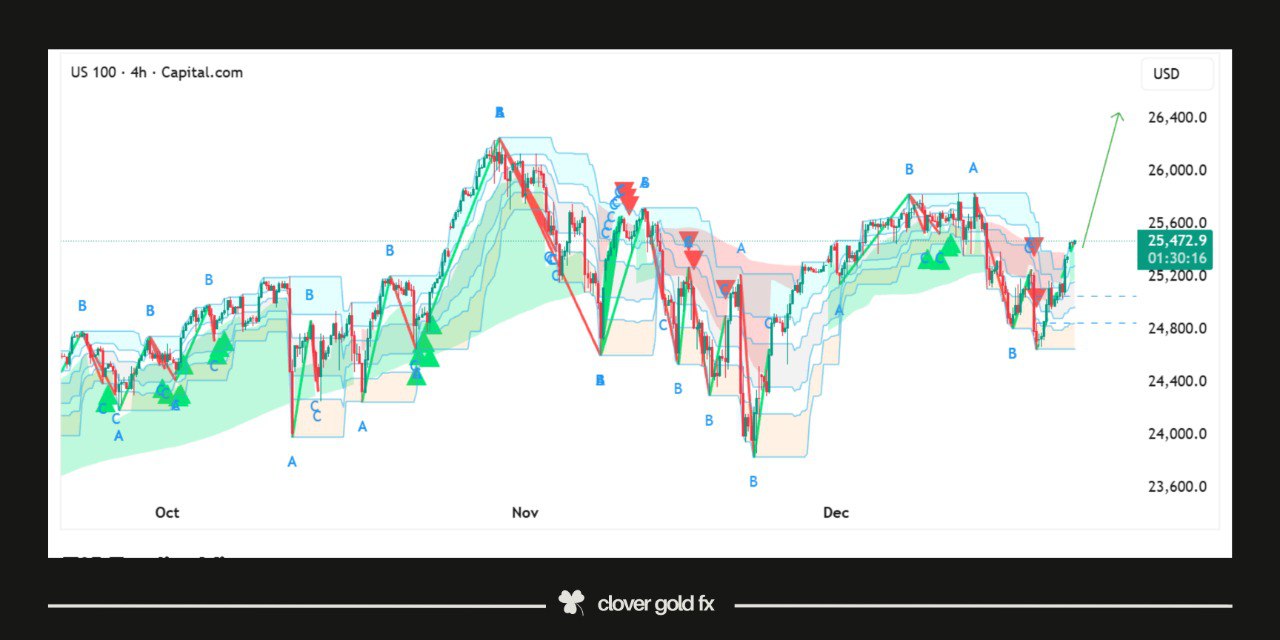

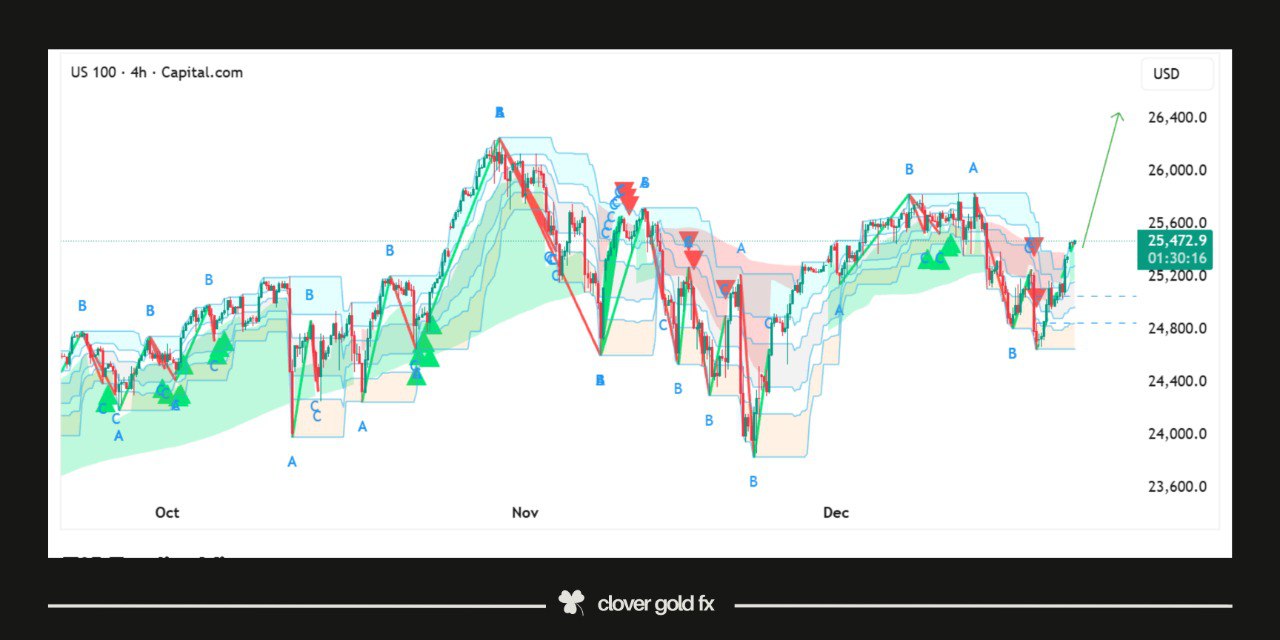

Don’t let market drops scare you; they are often just the preparation for the next major leap. Wave (i) is complete, and price is now gathering strength within the Wave (ii) correction for the next powerful Impulsive move.

The Bow Must Be Drawn Before the Arrow Flies! The blue box on the chart (the 0.5 - 0.618 Fibonacci zone) represents the point where the bow is most taut, ready to release the arrow. For the patient trader, corrections aren’t a sign of a reversal; they are your ticket into the main trend.

The Bow Must Be Drawn Before the Arrow Flies! The blue box on the chart (the 0.5 - 0.618 Fibonacci zone) represents the point where the bow is most taut, ready to release the arrow. For the patient trader, corrections aren’t a sign of a reversal; they are your ticket into the main trend.

Mochamad Briend Mega Bayu Angkasa

XAUUSD shows a clear bullish structure supported by repeated demand reactions and a well respected ascending trend support that confirms strong buyer control. The market created higher lows and higher highs which signals healthy continuation momentum while the recent impulsive move left an imbalance gap that often attracts price for mitigation before continuation. Demand zones below act as a solid base where institutions previously accumulated positions which increases the probability of bullish defense on pullbacks. From a fundamental perspective gold remains supported by global economic uncertainty expectations of easing monetary policy and ongoing demand for safe haven assets which aligns with the technical bullish outlook. As long as trend support and demand remain intact the bias favors continuation toward the next demand area above with pullbacks viewed as potential buying opportunities rather than trend reversal signals.

Mochamad Briend Mega Bayu Angkasa

BTCUSD shows a completed corrective structure followed by a strong impulsive decline that appears to have finished its fifth wave near a rising support trendline after which price entered a consolidation phase forming higher lows which signals selling pressure exhaustion and potential accumulation the market is now reacting to a key resistance zone where previous supply existed and a successful breakout and hold above this area would confirm a trend shift from bearish to bullish while a rejection could lead to a temporary pullback toward the trendline before continuation overall the structure favors upside continuation as long as price respects ascending support and maintains higher low formation indicating improving market strength and momentum shift in favor of buyers.

Mochamad Briend Mega Bayu Angkasa

NZDUSD on the 4H chart shows a strong impulsive move followed by a controlled bullish flag correction. The a b c structure inside the flag reflects healthy consolidation rather than weakness and suggests trend continuation. A breakout above the flag resistance would likely resume upside momentum toward the previous high zone while holding above the lower channel keeps the bullish bias intact.

Mochamad Briend Mega Bayu Angkasa

MetaTrader 5 시그널 발표됨

With more than 5 years of experience in the forex market, I know very well how the forex market works, I have a precise strategy on how the market moves properly, I do not promise you what % return I will make each month, but what is clear is that I ensure low risk and can get profit every month, and my strategy is suitable for workers who want to get passive income every month without doing anything. 📈we use low risk mode, and definitely use stop loss. 📊we use in-depth analysis, and we have

Mochamad Briend Mega Bayu Angkasa

#EURJPY 🇪🇺🇯🇵

Corrections in a strong trend are gifts. #EURJPY gave us a shallow pullback into support, recharged its momentum, and is now ready for the next impulse.

The JPY weakness continues to drive the pair higher. Don’t fight the trend, ride the wave.

Corrections in a strong trend are gifts. #EURJPY gave us a shallow pullback into support, recharged its momentum, and is now ready for the next impulse.

The JPY weakness continues to drive the pair higher. Don’t fight the trend, ride the wave.

Mochamad Briend Mega Bayu Angkasa

USDCHF is showing a completed corrective structure followed by a rising wedge which often signals trend exhaustion and potential reversal The market formed a clear five wave decline that respected a strong demand zone and from that base price moved higher in a corrective manner labeled as a b and c Inside this move price is compressing within a wedge structure which indicates weakening bullish momentum . The sharp rejection from the upper boundary of the wedge suggests sellers are stepping in With price failing to hold higher levels the probability favors a bearish continuation toward the previous demand zone. This setup aligns with technical structure momentum behavior and market psychology making downside movement the higher probability scenario if confirmation continues.

Mochamad Briend Mega Bayu Angkasa

NZDCHF on the 4H timeframe shows a completed impulsive structure where price advanced strongly into wave five followed by a clear corrective phase The correction unfolded as an ABC pattern and price respected the key Fibonacci retracement zone between fifty percent and sixty one point eight percent This area acted as strong demand and buyers stepped back in showing rejection and stabilization Momentum is now shifting bullish again with higher lows forming and structure support holding If price continues to hold above the retracement zone a continuation move toward the previous high and the zero percent Fibonacci level is likely confirming trend continuation and renewed bullish strength in the market.

Mochamad Briend Mega Bayu Angkasa

CADJPY shows a mature bullish structure that is now transitioning into a corrective phase as price has completed a clear five wave advance and started to lose momentum near the recent highs. The market respected the ascending trendline throughout the impulse move which confirms strong buyer control earlier but the latest candles show rejection and a break of short term structure indicating distribution. Price is reacting to previous support turned resistance zones and the downside projection suggests a pullback toward the trendline and demand area near the lower marked level. As long as price remains below the recent high sellers may continue to pressure the market for a deeper correction before any fresh bullish continuation is considered.

Mochamad Briend Mega Bayu Angkasa

On the NZDJPY 4H chart the market moved up strongly for a long time but now that strength looks weak. Price made higher highs around the marked area but momentum did not support the move which shows buyers are getting tired. The upward trendline that held price before is now being tested and price is reacting negatively from it. This behavior usually means big traders are closing buys and starting sells. If price stays below this trendline a deeper drop is likely toward earlier support areas. Any small pullback upward that fails can be a good chance to sell as long as price does not break back above the recent highs.

Mochamad Briend Mega Bayu Angkasa

NZDCHF is showing a corrective structure after completing a strong impulsive advance where the market topped and entered a pullback phase that unfolded in a clear three wave correction this correction respected key retracement support and shows signs of exhaustion as selling pressure weakens near the lower boundary the rejection from this zone suggests buyers are starting to regain control and momentum is gradually shifting back to the upside the structure supports a potential continuation of the broader bullish trend as long as price holds above the recent corrective low a sustained recovery could lead to a move back toward the previous high area confirming trend strength and renewed bullish intent on the higher

Mochamad Briend Mega Bayu Angkasa

In trading, money isn’t made by trading every single candle. It’s made by sitting on your hands until the structure confirms.

While amateurs chase the intraday noise, we wait for clarity on the higher timeframes. There is a big difference. One is gambling, the other is business.

While amateurs chase the intraday noise, we wait for clarity on the higher timeframes. There is a big difference. One is gambling, the other is business.

Mochamad Briend Mega Bayu Angkasa

#GER40 🇩🇪

True Trading Plan is the difference between “hoping” for a move and “anticipating” a move.

We don’t force the market. We let the market come to our zone, and then we trade!

True Trading Plan is the difference between “hoping” for a move and “anticipating” a move.

We don’t force the market. We let the market come to our zone, and then we trade!

Mochamad Briend Mega Bayu Angkasa

#eurusd

EURUSD shows a mature bullish structure that has transitioned into a contracting corrective phase. The prior impulse completed cleanly and price is now respecting a rising support trendline while repeatedly rejecting a major supply zone above. This behavior signals distribution rather than continuation as momentum weakens with each push higher. The sequence of lower highs against steady higher lows forms a classic wedge pattern which often precedes a decisive breakdown. The latest rejection from resistance followed by strong bearish pressure suggests sellers are gaining control. A move toward the lower boundary of the structure remains the higher probability scenario before any meaningful trend continuation can be considered.

EURUSD shows a mature bullish structure that has transitioned into a contracting corrective phase. The prior impulse completed cleanly and price is now respecting a rising support trendline while repeatedly rejecting a major supply zone above. This behavior signals distribution rather than continuation as momentum weakens with each push higher. The sequence of lower highs against steady higher lows forms a classic wedge pattern which often precedes a decisive breakdown. The latest rejection from resistance followed by strong bearish pressure suggests sellers are gaining control. A move toward the lower boundary of the structure remains the higher probability scenario before any meaningful trend continuation can be considered.

Mochamad Briend Mega Bayu Angkasa

The GBPCAD 4H chart shows a corrective phase completing after a broader bearish structure followed by a developing bullish reaction from strong horizontal support around the 1.8330–1.8350 zone. Price previously respected a descending channel and completed an impulsive move down, labeled into a five-wave decline, indicating bearish exhaustion near wave 5. From this base, the market formed an ABC corrective structure where price repeatedly defended the same horizontal support, highlighting strong buyer interest and liquidity absorption. The recent decline into point C aligns with a higher-probability reversal area, suggesting sellers are weakening while buyers are gradually gaining control. As long as price holds above this support, the structure favors a bullish recovery with upside potential toward the previous corrective high near 1.8650, which also aligns with the dotted resistance projection. A clean hold and bullish confirmation from this zone could trigger a sustained move higher, while a decisive break below support would invalidate the bullish outlook and reopen downside risk.

Mochamad Briend Mega Bayu Angkasa

The complex correction is finally behind us, and the structure is shifting back to an impulsive phase. This is exactly why we don’t force trades during the chop, we simply wait for the clear path to reveal itself.

Now that the roadmap is defined, the real opportunity begins.

Patience pays.

Now that the roadmap is defined, the real opportunity begins.

Patience pays.

: