Volumes and Sentiments 4

- Göstergeler

- Svetoslav Boyadzhiev

- Sürüm: 4.0

- Etkinleştirmeler: 20

"Volumes and Sentiments 4" was created to help traders navigate market situations. This indicator is the result of many years of research and understanding of the nature of market movements. It is a modified version of the "On-Balance Volume" indicator, which corrects some imperfections of the original indicator. "Volumes and Sentiments 4" includes additional ideas (the author's) that visually show the sentiments of market participants.

The important advantages of the indicator are the following:

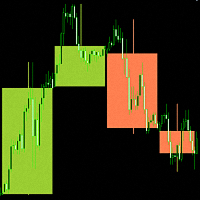

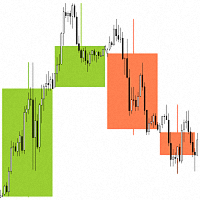

- The indicator shows bullish and bearish volumes separated by a line with a "0" value. These volumes are selected according to the rules of the original "On-Balance Volume" indicator from 1960, with minor adjustments. Unlike the original indicator, the volumes that are reset and the volumes when "gaps" occur are calculated according to the new author's methodology.

- We call the volumes above the zero line "Volumes of Buyers" and the volumes below this line "Volumes of Sellers".

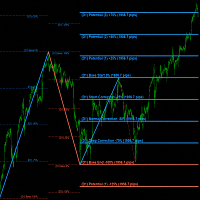

- The indicator draws a line of accumulated volumes, similar to the original On-Balance Volume indicator, but this line is calculated over a certain number of bars, which prevents data from accumulating over a long period of time. The "Volumes and Sentiments 4" indicator gives the best results over approximately 150–250 bars. After that, the information starts to get distorted by the accumulation of data. Since this line is derived from accumulated volumes with a "+" sign and a "-" sign, in the indicator, we call this line "Imbalance".

- The "Imbalance" line is very similar to the "Line Chart" of a financial instrument. Based on this, in the "Volumes and Sentiments 4" indicator, two moving averages—"Fast" and "Slow"—have been added to this line, which use the data from it. The idea is to reduce the "noise" from the signals given by the movement of the "Imbalance" line.

- A histogram is built between the "Moving average" lines. When the "Fast" moving average is above the "Slow" one, we say we have a "Bullish" histogram. When the "Fast" moving average is below the "Slow" one, we say we have a "Bearish" histogram. The "Bullish" and "Bearish" histograms visually show the "Bullish" and "Bearish" sentiments, which are derived from the volumes of financial instruments.

- When the "Imbalance" line, the moving averages, and the histograms between them are above the zero line, then we say that we have "Imbalance" in the "Buyers' Zone", and that we observe "Bull" and "Bear" sentiments in the "Buyers' Zone".

- When the "Imbalance" line, the moving averages, and the histograms between them are below the zero line, then we say that we have "Imbalance" in the "Sellers' Zone", and that we observe "Bull" and "Bear" sentiments in the "Sellers' Zone".

- In the first versions, the indicator showed a percentage ratio between the volumes of buyers and sellers, but the difference in percentages was less than 10% due to the tendency of the market to be in balance. This information has been removed because it is misleading to inexperienced traders. Only the number of bars of the "Bullish" volumes are left, as well as the number of bars of the "Bearish" volumes.

- The "Volumes and Sentiments 4" indicator has an option to lock to the "Open" (unfinished) range area of the "MR Range Breakouts 4" indicator. In the area of the bars in the range, an "Imbalance" line is calculated, as well as histograms of the sentiment in the range. When an "Expansion" area appears in the "Open range" between market participants (buyers and sellers), a second "Imbalance" line is calculated. When the "Imbalance" line of the range coincides with the "Imbalance" line of the "Expansion", then we say that we have confirmation of the intentions of market participants in the "Range". When the "Imbalance" line of the range does not coincide with the "Imbalance" line of the "Expansion", then we say that we have disagreements in the intentions of market participants in the "Range". Remember that the "Imbalance" lines are calculated from the volumes.

- The indicator offers 4 options for selecting areas of bars to calculate: 1. By the number of specified bars, 2. From the vertical line to the right, 3. Between two vertical lines, and 4. Lock to the "Open Range" from the indicator "MR Range Breakouts".

- Very good compatibility is observed with the other indicators from the "Masters of Risk" series, as well as with the "Pullbacks on Trend 4" and "Impulses and Corrections 4" indicators.

If you liked the indicator, please support our work by giving it 5 stars!

For MetaTrader 5 https://www.mql5.com/en/market/product/166031

Indicator settings:

Drawing mode: - The indicator offers 4 options for selecting areas of bars to calculate:

1. By "N" Bars History - Option to calculate by the specified number of bars.Bars to calculate: - Number of bars (candles) for the first selected option.

2. From the "Vertical" line to the right - Option to calculate by bars (candles) after the vertical line.

3. Between the "Vertical" lines - Option to calculate by bars (candles) between two vertical lines.

4. Lock to indicator "MR Range Breakouts" - Option to calculate by bars (candles) locked to the "Open Range" from the indicator "MR Range Breakouts 4".

Section Volumes Settings

Bullish volume color: - You choose a color for the "Bullish" volumes.

Bearish volume color: - You choose a color for the "Bearish" volumes.

"Imbalance" line color: - You choose a color for the "Imbalance" line.

Section "Volumes data" Settings

Show "Volumes data" information: - Shows or hides "Volumes data" information.

Buyer volumes Text color: - You choose the text color for all "Bullish" volumes.

Seller volumes Text color: - You choose the text color for all "Bearish" volumes.

Points in 1 Pip: - Offers you a choice of the number of Points in 1 Pip.

Text position in pips: - Offers you the choice of the position of the text relative to the zero line in pips.

Text font size: - You can choose the text size.

Section "Vertical" lines Settings

"Vertical" line width: - You can choose the "Vertical" line width.

"Vertical" line style: - You can choose the "Vertical" line style.

"Vertical" line color: - You can choose the "Vertical" line color.

Section MAs to the "Imbalance" line Settings

Fast moving average color: - You can choose the "Fast" moving average color.

Slow moving average color: - You can choose the "Slow" moving average color.

Bullish Histogram color: - You can choose the "Bullish" histogram color.

Bearish Histogram color: - You can choose the "Bearish" histogram color.

Section Lock to "MR Range Breakouts"

"MR Range Breakouts" period: - Here, you must specify the same timeframe as the one set in the "MR Range Breakouts 4" indicator. Otherwise, the indicator will not detect the data from the "MR Range Breakouts 4" indicator.