mazen nafee / Профиль

- Информация

|

11+ лет

опыт работы

|

0

продуктов

|

0

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

Друзья

982

Заявки

Исходящие

mazen nafee

mazen nafee

Комментарий к теме Press review

AstraZeneca ST: short term consolidation in place Our pivot point stands at 3960. Our preference: As long as 3960 is not broken down, we favour an upmove with 4900 and then 5080 as next targets

mazen nafee

mazen nafee

Комментарий к теме Press review

BMW ST: the upside prevails 85.8 is our pivot point. Our preference: As long as 85.8 is not broken down, we favour an upmove with 96.1 and then 100 as next targets. Alternative scenario: below 85.8

mazen nafee

mazen nafee

Комментарий к теме Press review

Daimler ST: under pressure Our pivot point stands at 68. Our preference: As long as 68 is support, we are bullish. In this case, the upside breakout of 68 will trigger a bullish acceleration towards

mazen nafee

mazen nafee

Комментарий к теме Press review

Anglo American ST: the upside prevails 1415 is our pivot point. Our preference: As long as 1415 is not broken down, we favour an upmove with 1675 and then 1745 as next targets. Alternative scenario

mazen nafee

mazen nafee

Комментарий к теме Press review

Telecom Italia ST: the upside prevails 0.78 is our pivot point. Our preference: As long as 0.78 is not broken down, we favour an upmove with 1.01 and then 1.1 as next targets. Alternative scenario

mazen nafee

mazen nafee

Комментарий к теме Press review

Saipem ST: caution 18 is our pivot point. Our preference: As long as 18 is not broken down, we favour an upmove with 20.95 and then 23 as next targets. Alternative scenario: below 18 expect a drop

mazen nafee

mazen nafee

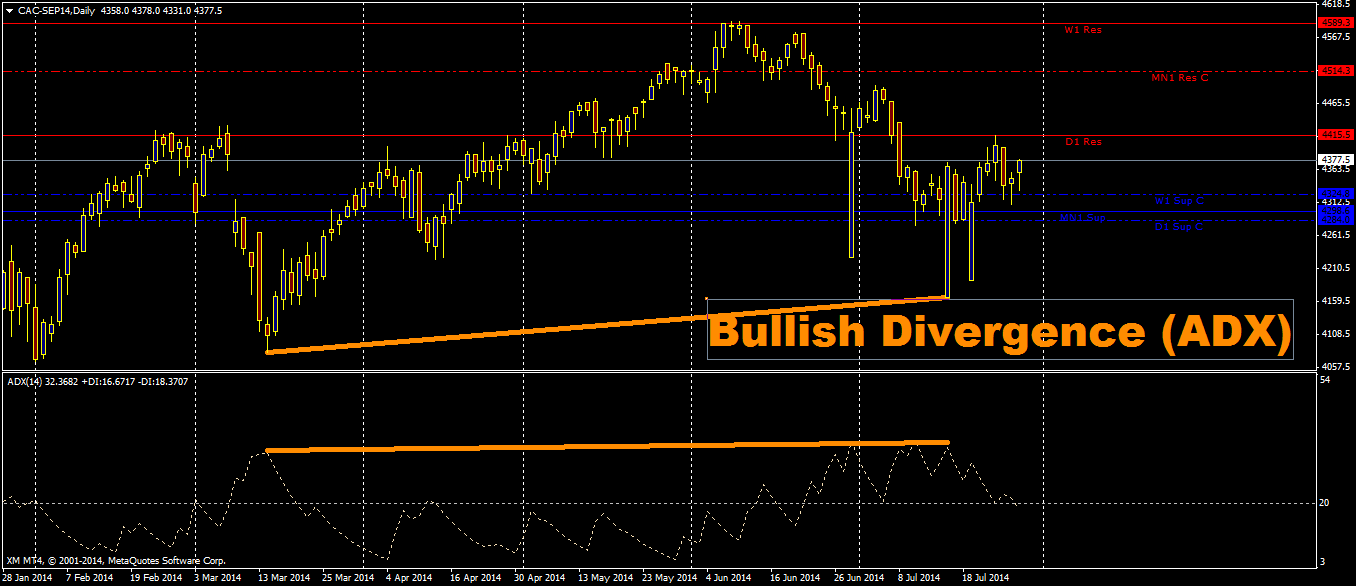

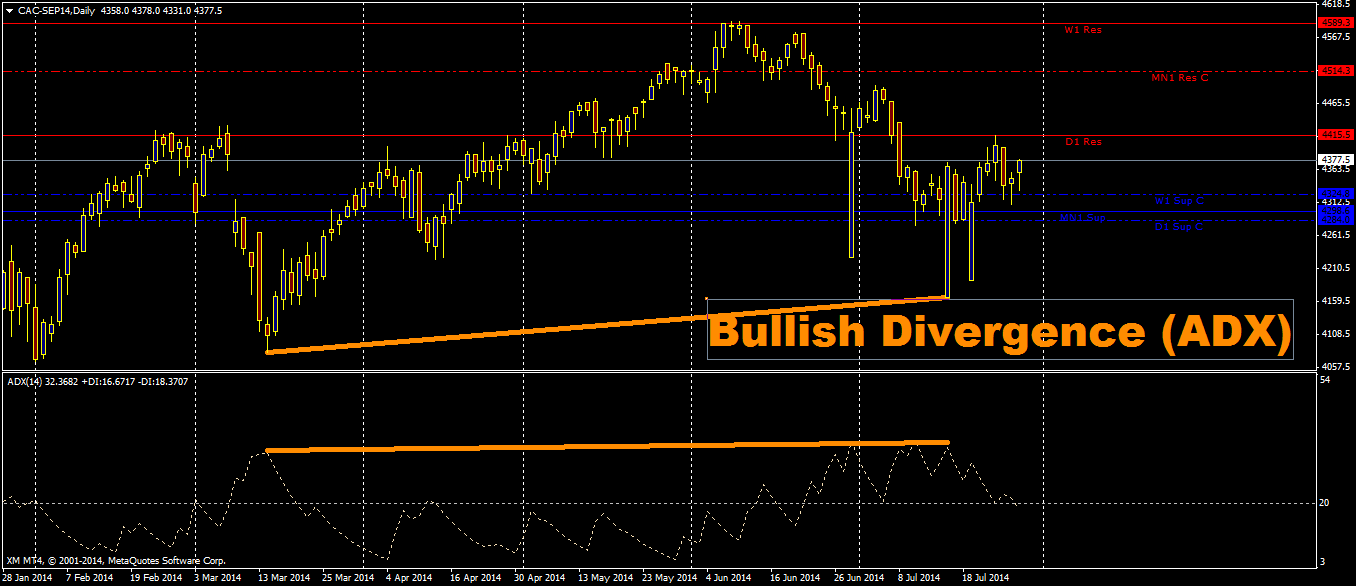

Комментарий к теме Indices Technical Analysis

Cac 40 (NYSE Liffe) (Q4) Daily chart Bullish Divergence (ADX)

mazen nafee

mazen nafee

Комментарий к теме Press review

Hongkong Land Holdings ST: under pressure. Pivot: 6.92 Our preference: Short positions below 6.92 with targets @ 6.44 & 6.23 in extension. Alternative scenario: Above 6.92 look for further upside

mazen nafee

mazen nafee

Комментарий к теме Press review

Philips Electronics ST: the downside prevails 24.25 is our pivot point. Our preference: As long as 24.25 is not broken up, we favour a down move with 22.1 and then 20.25 as next targets. Alternative

mazen nafee

mazen nafee

Комментарий к теме Press review

Reckitt Benckiser ST: supported by a rising trend line Our preference: As long as 4790 is not broken down, we favour an upmove with 5500 and then 5650 as next targets. Alternative scenario: below

mazen nafee

mazen nafee

Комментарий к теме Indices Technical Analysis

Forum on trading, automated trading systems and testing trading strategies Press review mazennafee , 2014.07.29 13:53 SSE Composite ST: continuation of the rebound. Pivot: 2085 Our preference: Long

mazen nafee

mazen nafee

Комментарий к теме Indices Technical Analysis

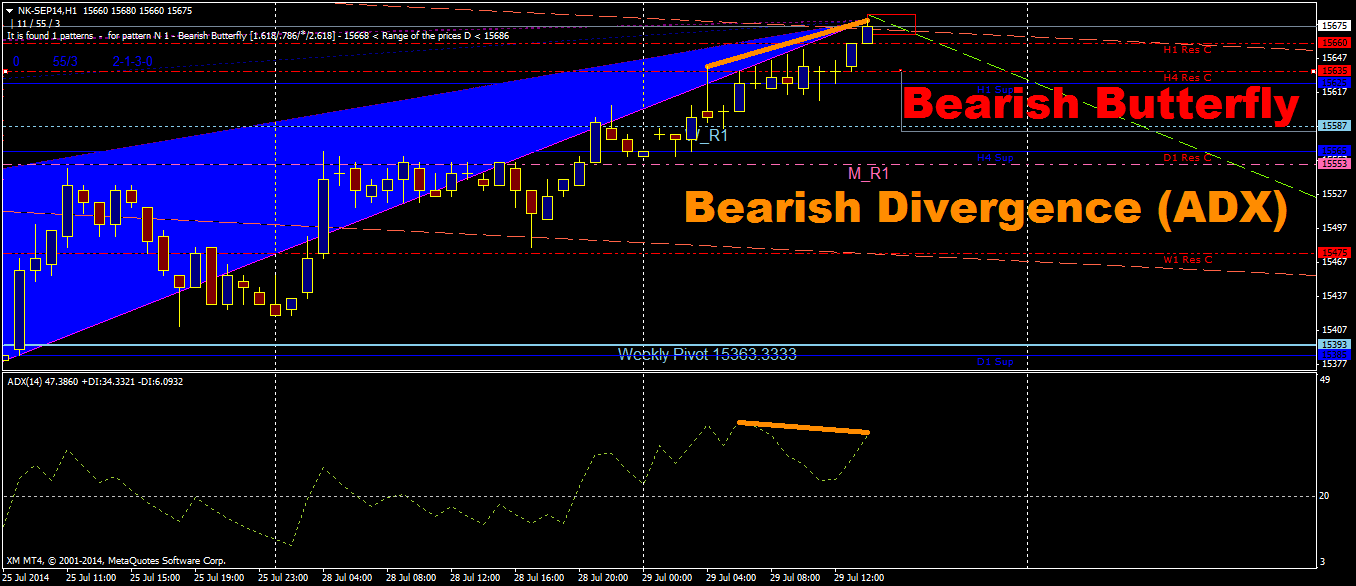

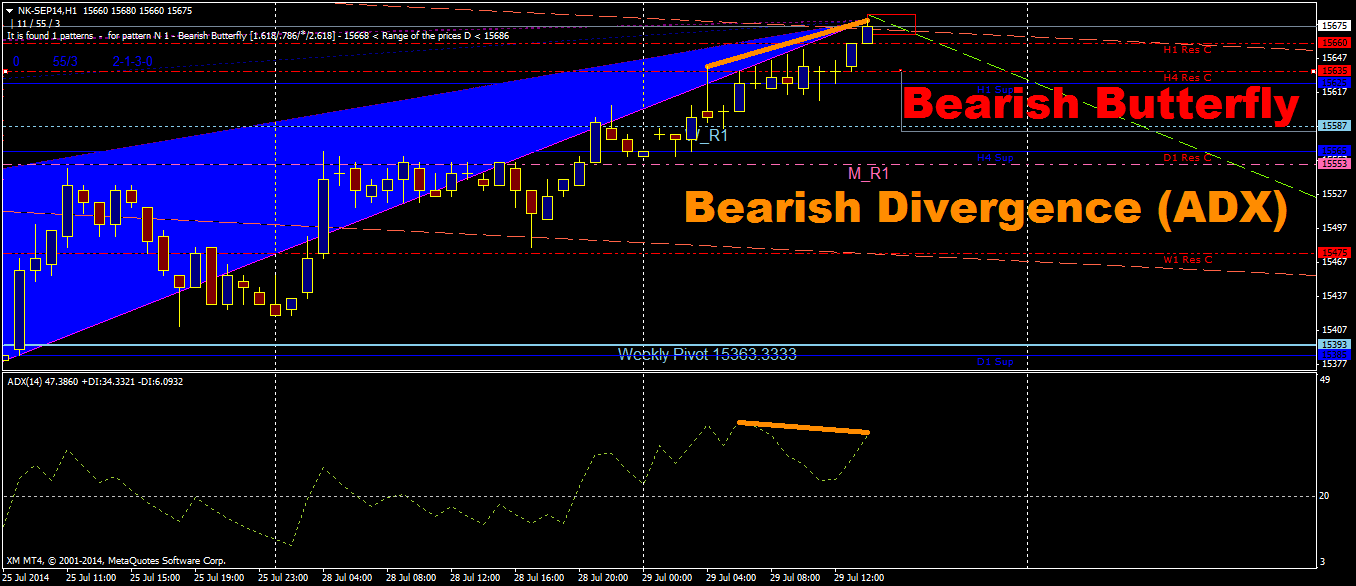

Nikkei 225 ST: caution. H1 Time Frame Bearish Butterfly [1.618/.786/*/2.618] Pattern Bearish Divergence (ADX)

mazen nafee

mazen nafee

Комментарий к теме Indices Technical Analysis

Nikkei 225 ST: caution. Pivot: 15000 Our preference: Long positions above 15000 with targets @ 15660 & 16000 in extension. Alternative scenario: Below 15000 look for further downside with 14520 &

mazen nafee

mazen nafee

Комментарий к теме Indices Technical Analysis

Hang Seng ST: the bias remains bullish. Pivot: 23150 Our preference: Long positions above 23150 with targets @ 25000 & 26000 in extension. Alternative scenario: Below 23150 look for further

mazen nafee

mazen nafee

Комментарий к теме Indices Technical Analysis

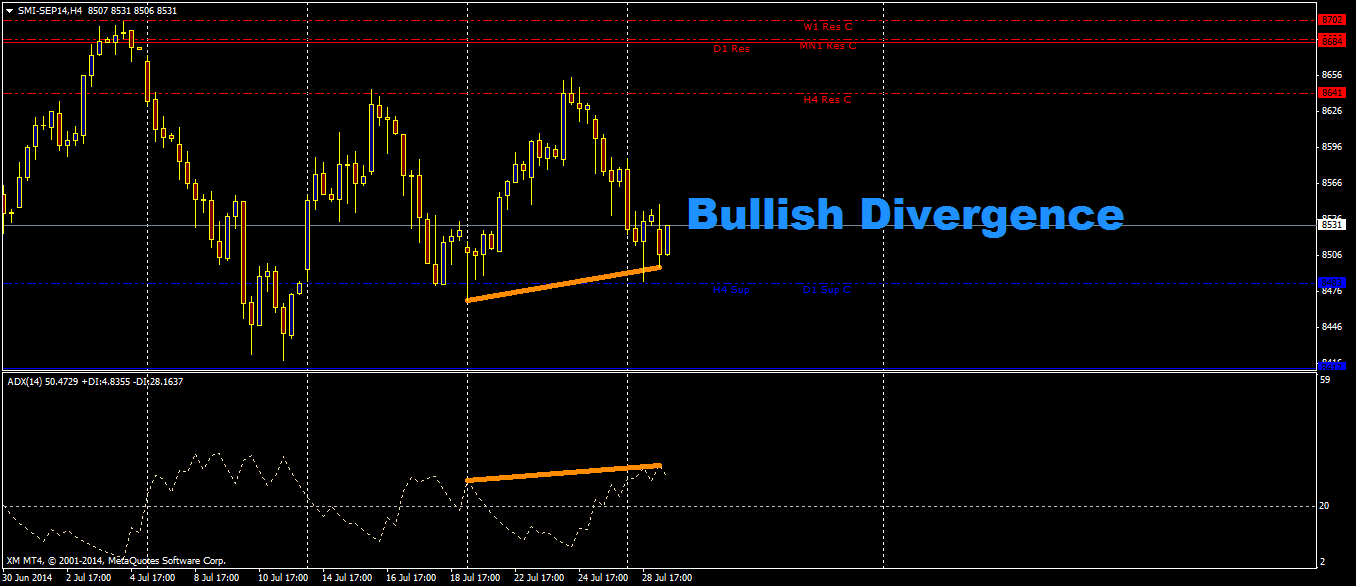

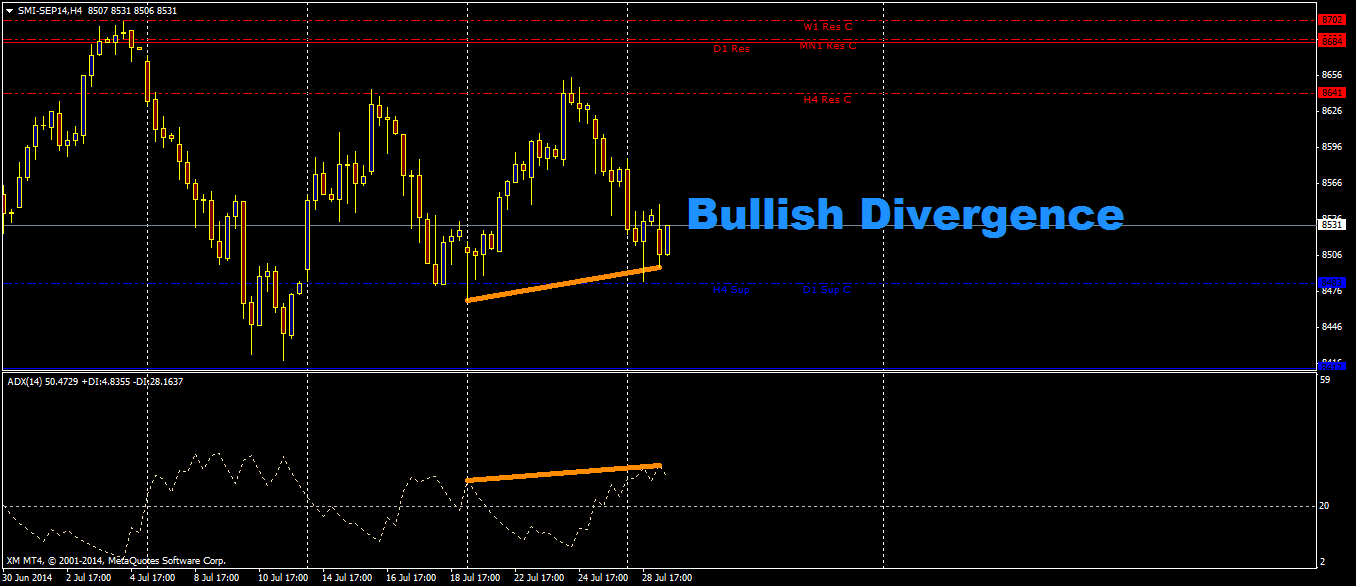

SMI (Eurex) (U4) Intraday: intraday support around 8469. H4 Time frame Bullish Divergence (ADX)

mazen nafee

mazen nafee

Комментарий к теме Indices Technical Analysis

SMI (Eurex) (U4) Intraday: intraday support around 8469. Pivot: 8469 Our preference: Long positions above 8469 with targets @ 8590 & 8655 in extension. Alternative scenario: Below 8469 look for

mazen nafee

mazen nafee

Комментарий к теме Indices Technical Analysis

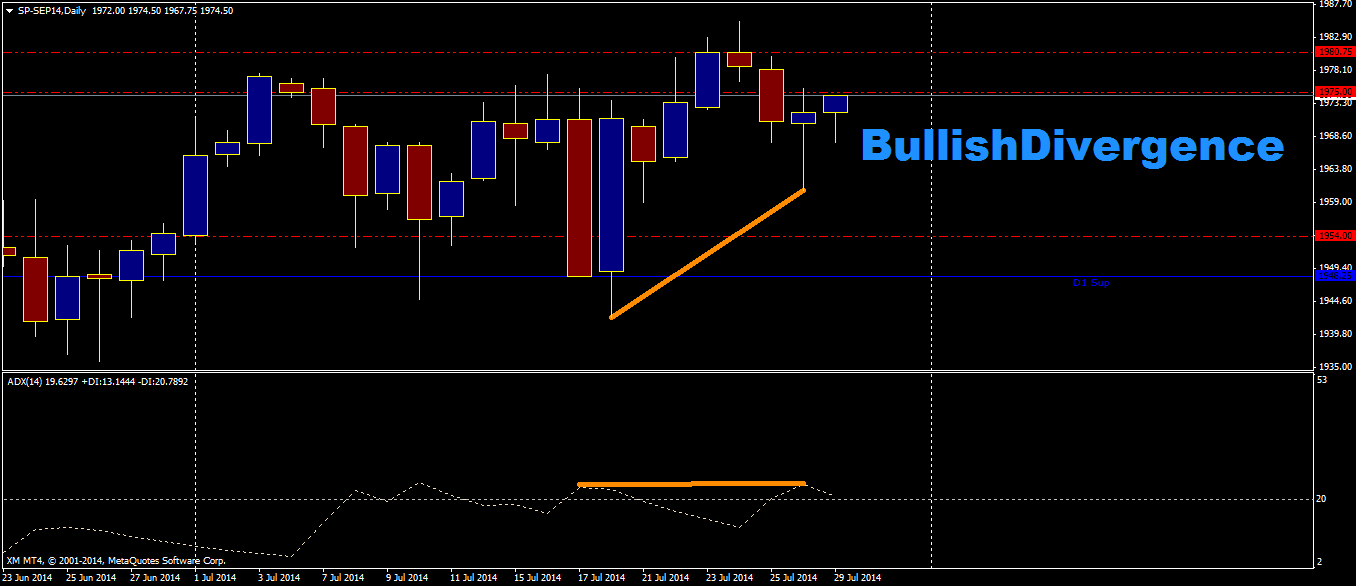

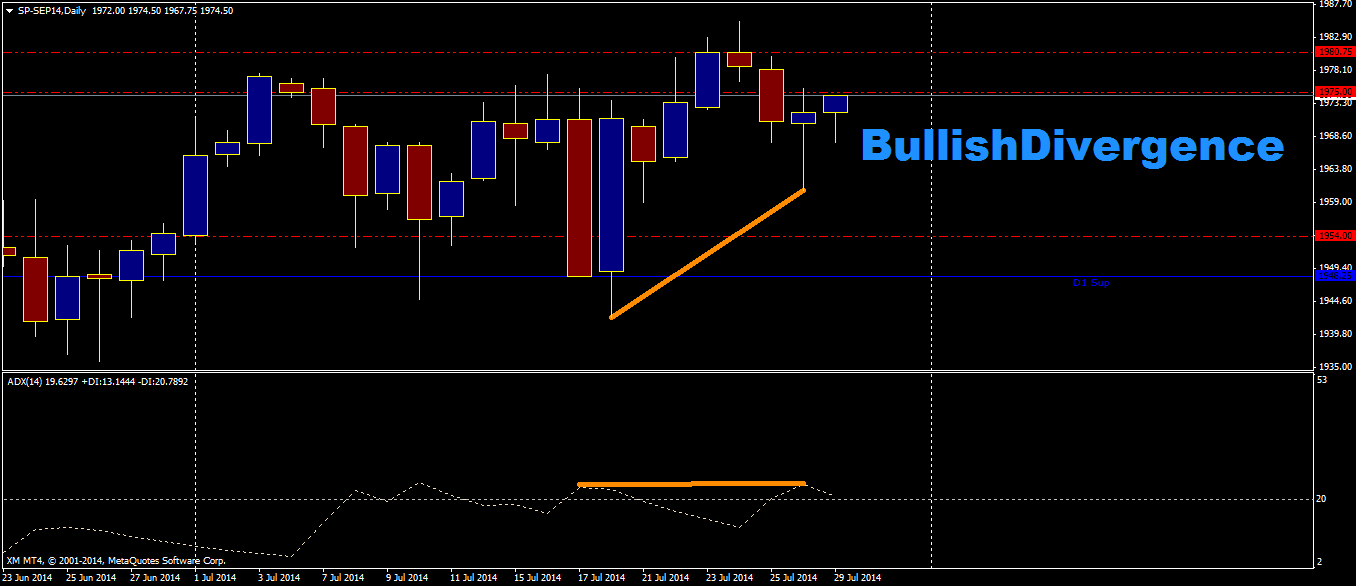

S&P500 (CME) (U4) Daily Time Frame Bullish Divergence (ADX) Daily Chart

mazen nafee

mazen nafee

Комментарий к теме Indices Technical Analysis

Straits Times ST: bullish bias above 3265. Pivot: 3265 Our preference: Long positions above 3265 with targets @ 3370 & 3410 in extension. Alternative scenario: Below 3265 look for further downside

mazen nafee

mazen nafee

Комментарий к теме Indices Technical Analysis

S&P500 (CME) (U4) Intraday: the downside prevails. Pivot: 1976 Our preference: Short positions below 1976 with targets @ 1959 & 1952 in extension. Alternative scenario: Above 1976 look for

mazen nafee

mazen nafee

Комментарий к теме Indices Technical Analysis

Nasdaq 100 (CME) (U4) Intraday: the downside prevails. Pivot: 3991 Our preference: Short positions below 3991 with targets @ 3909 & 3883 in extension. Alternative scenario: Above 3991 look for

: