mazen nafee / Профиль

- Информация

|

11+ лет

опыт работы

|

0

продуктов

|

0

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

Друзья

982

Заявки

Исходящие

mazen nafee

EUR/GBP Intraday: the upside prevails.

Pivot: 0.79

Our preference: Long positions above 0.79 with targets @ 0.794 & 0.795 in extension.

Alternative scenario: Below 0.79 look for further downside with 0.7885 & 0.787 as targets.

Comment: The pair stands above its support and remains on the upside.

Supports and resistances:

0.7965

0.795

0.794

0.7916 Last

0.79

0.7885

0.787

Pivot: 0.79

Our preference: Long positions above 0.79 with targets @ 0.794 & 0.795 in extension.

Alternative scenario: Below 0.79 look for further downside with 0.7885 & 0.787 as targets.

Comment: The pair stands above its support and remains on the upside.

Supports and resistances:

0.7965

0.795

0.794

0.7916 Last

0.79

0.7885

0.787

mazen nafee

GBP/JPY Intraday: key resistance at 173.35.

Pivot: 173.35

Our preference: Short positions below 173.35 with targets @ 172.55 & 172.35 in extension.

Alternative scenario: Above 173.35 look for further upside with 173.75 & 174.1 as targets.

Comment: The pair remains within a bearish channel.

Supports and resistances:

174.1

173.75

173.35

172.955 Last

172.55

172.35

171.9

Pivot: 173.35

Our preference: Short positions below 173.35 with targets @ 172.55 & 172.35 in extension.

Alternative scenario: Above 173.35 look for further upside with 173.75 & 174.1 as targets.

Comment: The pair remains within a bearish channel.

Supports and resistances:

174.1

173.75

173.35

172.955 Last

172.55

172.35

171.9

mazen nafee

EUR/JPY Intraday: the upside prevails.

Pivot: 136.6

Our preference: Long positions above 136.6 with targets @ 137.1 & 137.35 in extension.

Alternative scenario: Below 136.6 look for further downside with 136.35 & 136 as targets.

Comment: The pair is rebounding above its support.

Supports and resistances:

137.6

137.35

137.1

136.9067 Last

136.6

136.35

136

Pivot: 136.6

Our preference: Long positions above 136.6 with targets @ 137.1 & 137.35 in extension.

Alternative scenario: Below 136.6 look for further downside with 136.35 & 136 as targets.

Comment: The pair is rebounding above its support.

Supports and resistances:

137.6

137.35

137.1

136.9067 Last

136.6

136.35

136

mazen nafee

GBP/USD Intraday: the downside prevails.

Pivot: 1.7

Our preference: Short positions below 1.7 with targets @ 1.692 & 1.6885 in extension.

Alternative scenario: Above 1.7 look for further upside with 1.702 & 1.705 as targets.

Comment: The pair has broken below its support and remains under pressure.

Supports and resistances:

1.705

1.702

1.7

1.6941 Last

1.692

1.6885

1.685

Pivot: 1.7

Our preference: Short positions below 1.7 with targets @ 1.692 & 1.6885 in extension.

Alternative scenario: Above 1.7 look for further upside with 1.702 & 1.705 as targets.

Comment: The pair has broken below its support and remains under pressure.

Supports and resistances:

1.705

1.702

1.7

1.6941 Last

1.692

1.6885

1.685

mazen nafee

поделился продуктом автора Olawale Adenagbe

Общие сведения OCO-ордера (OCO, One-Cancels-the-Other, один ордер отменяет другой) - это пара ордеров, исполнение одного из которых автоматически приводит к отмене другого. Благодаря Verdure OCO EA этот функционал теперь есть и в MT4. Советник представляет собой эффективную реализацию популярного принципа OCO-ордеров с дополнительными преимуществами, функциями и параметрами. Советник упрощает работу по управлению сделками и может быть особенно полезен трейдерам, использующим в своих торговых

mazen nafee

Pivot: 0.856

Our preference: Short positions below 0.856 with targets @ 0.8495 & 0.847 in extension.

Alternative scenario: Above 0.856 look for further upside with 0.8585 & 0.862 as targets.

Comment: As long as 0.856 is resistance, look for choppy price action with a bearish bias. Prices are trading in a bearish channel.

Supports and resistances:

0.862

0.8585

0.856

0.8516 Last

0.8495

0.847

0.843

Our preference: Short positions below 0.856 with targets @ 0.8495 & 0.847 in extension.

Alternative scenario: Above 0.856 look for further upside with 0.8585 & 0.862 as targets.

Comment: As long as 0.856 is resistance, look for choppy price action with a bearish bias. Prices are trading in a bearish channel.

Supports and resistances:

0.862

0.8585

0.856

0.8516 Last

0.8495

0.847

0.843

mazen nafee

Pivot: 1.216

Our preference: Short positions below 1.216 with targets @ 1.213 & 1.2115 in extension.

Alternative scenario: Above 1.216 look for further upside with 1.2175 & 1.219 as targets.

Comment: The upward potential is likely to be limited by the resistance at 1.216.

Supports and resistances:

1.219

1.2175

1.216

1.2152 Last

1.213

1.2115

1.21

Our preference: Short positions below 1.216 with targets @ 1.213 & 1.2115 in extension.

Alternative scenario: Above 1.216 look for further upside with 1.2175 & 1.219 as targets.

Comment: The upward potential is likely to be limited by the resistance at 1.216.

Supports and resistances:

1.219

1.2175

1.216

1.2152 Last

1.213

1.2115

1.21

mazen nafee

mazen nafee

Комментарий к теме Press review

STOXX 600 Telecom MT: the upside prevails 280 is our pivot point. Our preference: As long as 280 is not broken down, we favour an upmove with 360 and then 375 as next targets. Alternative scenario

mazen nafee

mazen nafee

Комментарий к теме Press review

STOXX 600 Construction MT: the upside prevails 310 is our pivot point. Our preference: As long as 310 is not broken down, we favour an upmove with 383 and then 418 as next targets. Alternative

mazen nafee

mazen nafee

Комментарий к теме Press review

STOXX 600 Basic Resource MT: bounce 369 is our pivot point. Our preference: As long as 369 is not broken down, we favour an upmove with 485 and then 543.5 as next targets. Alternative scenario

mazen nafee

mazen nafee

Комментарий к теме Press review

EURO STOXX Telecommunications MT: the upside prevails 270 is our pivot point. Our preference: as long as 270 is support, the upside prevails. Alternative scenario: below 270 expect a drop to 254

mazen nafee

Sergey Golubev

Комментарий к теме Press review

Forum on trading, automated trading systems and testing trading strategies Press review newdigital , 2014.03.31 09:42 For Bitcoin Lessons In The History Of Failed Currencies If someone were to

mazen nafee

mazen nafee

Комментарий к теме Press review

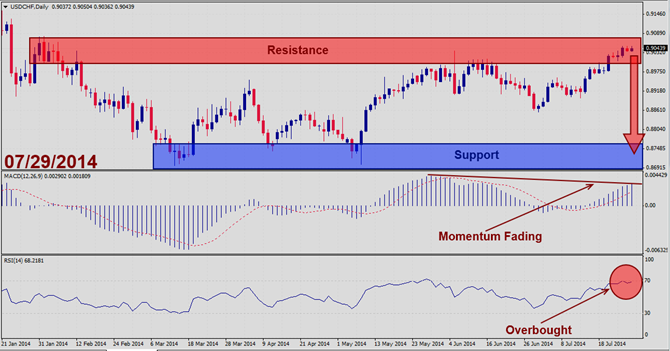

Pax Should price action for the USDCHF remain inside the 0.9020 to 0.9060 zone the following trade set-up is recommended: Timeframe: D1 Recommendation: Short Position Entry Level: Short Position @

mazen nafee

mazen nafee

Комментарий к теме Press review

EURO STOXX Retail MT: the upside prevails Our pivot point stands at 317. Our preference: As long as 317 is not broken down, we favour an upmove with 400 and then 420 as next targets. Alternative

mazen nafee

mazen nafee

Комментарий к теме Press review

STOXX 600 Retail MT: the upside prevails 268 is our pivot point. Our preference: As long as 268 is not broken down, we favour an upmove with 333.73 and then 360 as next targets. Alternative

mazen nafee

mazen nafee

Комментарий к теме Press review

Merlin Entertainments ST: the downside prevails as long as 358.25 is resistance 358.25 is our pivot point. Our preference: the downside prevails as long as 358.25 is resistance. Alternative scenario

mazen nafee

mazen nafee

Комментарий к теме Press review

Partnership Assurance Group ST: the downside prevails as long as 129 is resistance Our pivot point is at 129. Our preference: the downside prevails as long as 129 is resistance. Alternative scenario

mazen nafee

mazen nafee

Комментарий к теме Press review

Greencore Group ST: the upside prevails as long as 264.25 is support Our pivot point stands at 264.25. Our preference: the upside prevails as long as 264.25 is support. Alternative scenario: below

mazen nafee

mazen nafee

Комментарий к теме Press review

Opera Software ST: the RSI is oversold 78.7 is our pivot point. Our preference: the downside prevails as long as 78.7 is resistance. Alternative scenario: the upside breakout of 78.7 would call for

mazen nafee

mazen nafee

Комментарий к теме Press review

Genfit ST: the RSI is overbought Our pivot point is at 28.8. Our preference: the upside prevails as long as 28.8 is support. Alternative scenario: below 28.8, expect 25.5 and 23.6. Comment : the RSI

: