Hello Everyone,

I want to create an Expert advisor with a simple logic of taking trades at a specific price position over a period of time with a capability of increasing the lot size if the bid closed at a loss from the initial position.

So what happens is that at beginning of installation, the market identifies the high price and low price position after the installation. It then uses a gap position (in real price) to lock the market up as a BUY and SELL position.

After identifying the 2 positions (BUY and SELL), then the bid will activate at the position and then starts taking the bid at the position and then if the bid closes at a loss, it will retake the bid again but with an higher lot size either at same side or at the opposite position.

So For Example if price is installed when the price is at position A, then market reaches the HIGHEST position and then falls downwards to get to the Gap and then locks the 2 positions labelled 1. And then it takes a SELL at the lower position or a BUY at the higher position. However if market is volatile and goes again to the opposite side after activating, it will close the old bid iat a minimal SL and retake the bid when market goes outside the 2 lines in Position 1, but will increase the lot size of the new bid. The condition of increasing the lot size will be a variable as a multiplier or an addition.

For example if bid is at the lower side at position B and price moves upwards to reach the gap between the lowest and the next line upwards, the EA locks up the 2 prices at line 2 and then begins to trade as a BUY at the higher price or a SELL at the lower price, also using the multiplier and a SL that can be adjusted to close below the entry point at the minimal loss for a BUY, or above the entry point for a minimal loss for a SELL.

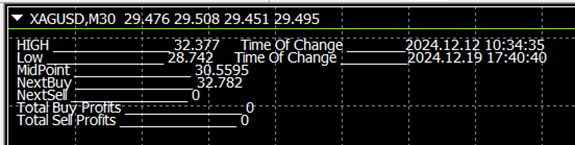

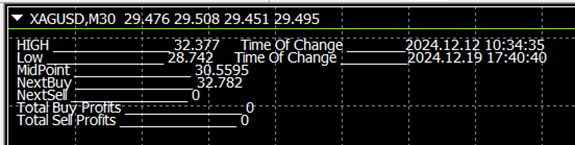

The EA will show on the screen the highest and lowest price position after installation and the date and time of position like below sample

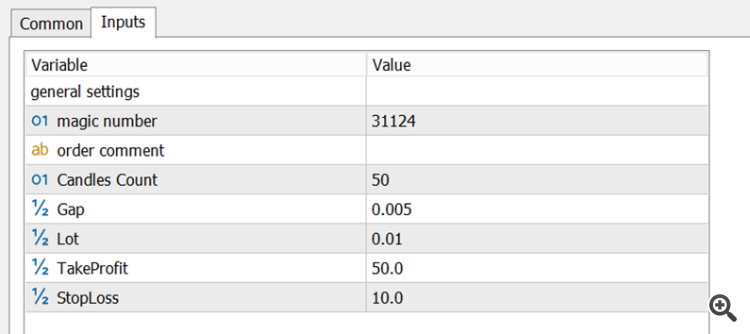

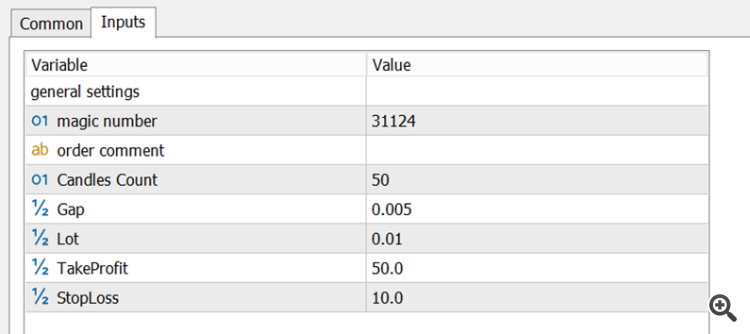

The Variables will include

Gap (in Prices), start lot size (from 0.01), Multiplier/Addition variable, Risk multiplier (this will reduce the SL value as the number of bid position increases), Stop Loss (SL) and Take profit (TP).

Once the 2 Price positions are achieved, it will show on the screen as the BUY and SELL position in prices and also the time range of the position.

If bid reaches the TP position, it will restart itself again afresh, but if it closed at SL, it will continue to retake the bids at the same price position established with the previous bid.

I can give more clarity and show more visual scripts to clarify any area of the description.

The EA will have to be tested for up to 10 days to close the job and then additional support will need to be provided for up to 2 Months after completion in case of any area that needs revision.

EA should be able to be applied to indices, currecies or products like Gold, Silver etc

Source code will be provided at end of project.

Only immediately available and experienced programmers should bid for the job.

Pedidos semelhantes

I am looking to purchase a proven scalping Expert Advisor with verified live account performance. Requirements: • Minimum 6 months live trading history • Proven profitability with controlled drawdown • Scalping strategy with Buy and Sell trades • Works on XAUUSD (Gold), MT5 preferred • Includes Stop Loss and Take Profit • Suitable for small accounts ($100) • Reasonable one time price Please share live performance

Trade Copier from MT4/ MT5 to MT4/ MT5 (local) , i am looking for some local copier where i can copy trade from meta trader 4 to meta trader 5 or meta trader 5 to meta trader 4 , looking for fast execution

I. YÊU CẦU DỰ ÁN Tôi đang tìm cách phát triển một hệ thống giao dịch tự động (Expert Advisor) được xây dựng trên nền tảng Smart Money Concepts (SMC), tích hợp Trí tuệ Nhân tạo (AI) và có cơ chế quản lý vốn tiên tiến. EA (Expert Advisor) phải được tối ưu hóa cho cả thị trường biến động mạnh như Vàng (XAUUSD) cũng như các thị trường ổn định, có xu hướng như EURUSD. Nó phải thân thiện với người mới bắt đầu nhưng cũng đủ

The indicator a bit inverted. But it doesn’t matter to me as long as the winrate make sense for investment. For brief details regarding the indicator. What should have been a sell, i inverted it into buy with sl and tp swapped(only change the name of sl and tp for visualisation , but the code still on right tp and sl) . And in script ive inverted the signal command code. But the trouble is the tp and sl cant be

Tuyển dụng chuyên gia MQL4 để tối ưu hóa và hoàn thiện hệ thống giao dịch tự động (EA) I. Tổng quan Tôi đang tìm kiếm một nhà phát triển MQL4 giàu kinh nghiệm để tinh chỉnh, tối ưu hóa và hoàn thiện một Expert Advisor (EA) được thiết kế riêng cho nền tảng MetaTrader 4 (MT4). Logic cốt lõi đã được phát triển; mục tiêu chính là nâng cao hiệu suất và đảm bảo tính ổn định sẵn sàng cho môi trường sản xuất. II. Yêu cầu kỹ

The EA should only set TP and SL( Both Optional, We can set one at the time or no one at the same time or both active at the same time) 1. We active trade ourself , But in The EA this should ask if what the the TP and SL in form of USD we need. We'll put the Exact Required profit and or loss. This EA should calculate and set the tps and Sls itself to all the trades, and when we change the USD profit from info meter

Hi, I want to build a trading robot specifically for passing a prop firm challenge. The EA should focus on strict risk management, low drawdown, and consistency suitable for prop firm rules. My current budget for this project is $30. Please let me know what is achievable within this budget and the strategy you recommend

Indicator Simple Moving Averages and Exponential Moving Average BUY SIGNALS SMA 7 High Crosses Above 20 EMA= LIME color Buy Signal at the low of next candle. SMA 7 High Crosses above 40 EMA= BLUE color Buy Signal at low of next candle. SMA 7 High Crossed above 200 EMA= YELLOW Color buy signal at the low of next candle. SELL SIGNALS SMA 7 Low Crosses below 20 Ema= LIME color Sell Signal at the high of next candle. SMA

I trade manually on M1 chart (XAUUSD) with fractals and alligator. When there is a price break on fractal (or some fractals that form a price level) or a price level created by multiple candles spikes, I enter 2 trades (0.02 lots), and 2 trades (0.04 lots). If I go in profit (5/10€), I close in profit. But if I go in loss with DD, at this point starts the management: every price level (important level) created by

99.99% signal accuracy 10-15 trades distribution all currency trade and meta AI assistance on loss[advice] stop and start robot cyber security firewall protection activation code: 20060605TLP20 Please create a trading bot with any logo with the name elevation