Guillermo Monguia / プロファイル

- 情報

|

3 年

経験

|

3

製品

|

18

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

This is one of the biggest trading myths which have fooled most traders…

“If you have a winning trading strategy, you can use it to make millions of dollars from the markets.”

That’s B.S.

I’ll explain…

Yes, you can have a winning strategy but, it doesn’t mean you can make millions of dollars.

Why?

Because the size of your account matters!

Let me give you an example…

Let’s say you have a trading strategy that makes 20% a year.

On a $1,000 account, that’s $200/year.

On a $10,000 account, that’s $2,000/year.

On a $1m account, that’s $200,000/year.

As you can see, your trading strategy is one part of the equation, the other equally important aspect is the size of your account.

And this is the same reason why hedge funds raise millions, if not billions of dollars—they need money to make money in trading.

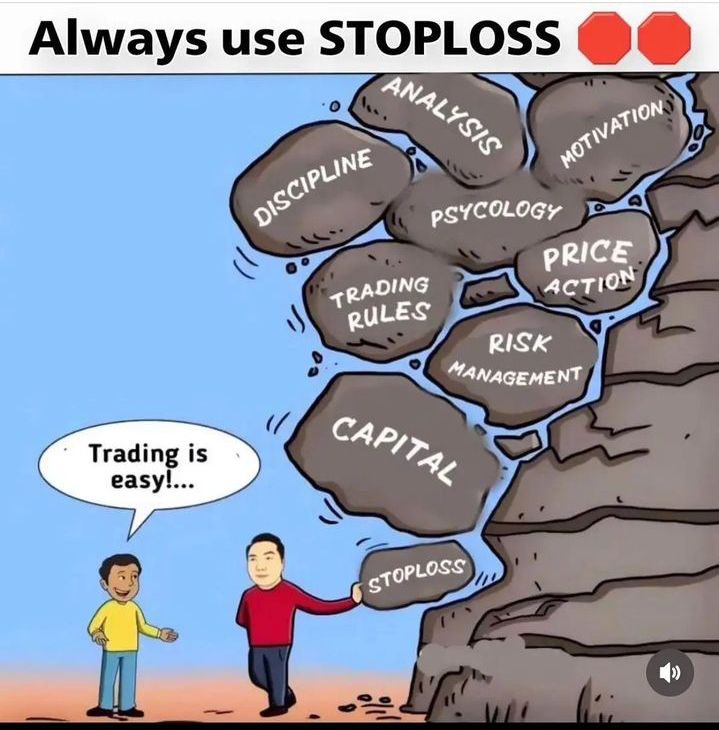

No range sustains all the time.

No strategy works all the time.

That's why you MANAGE RISK all the time!

1) Take care of your body. Remember health is another form of wealth

2) Normalize walking some path alone because goals are personal.

3) Don't waste your energy on fear. Use your energy to believe, learn, create, and grow.

4) If you want to be happy, always have zero expectations of others.

5) You won't be young forever, do what makes you happy every day.

6) Don't try to change any. Change how you deal with them.

7) Be mature enough to control your emotions. Learn to react less.

8) Free yourself from society's advise, most of them have no idea what they're doing.

Manage risk

Stay humble

Trade with an edge

Continuously improve

Know they can be wrong

Focus on what they do best

Never let ego get in the way

Know when to stay out of the markets

Let me ask you…

Have you ever put on a trade only to watch the market hit your stop loss, and then continue moving in your expected direction?

It sucks, right?

And that’s because your stop loss is “too tight”.

So, what’s the solution?

Give your trade room to breathe.

This means your stop loss should be wide enough to accommodate the daily swings of the market.

Now you’re probably wondering:

“But how much is wide enough?”

“How to use ATR to improve my stop loss objectively, will it actually help?”

Well, here’s how you can use the ATR indicator to help you with it…

1. Find out what’s the current ATR value

2. Select a multiple of the ATR value

3. Add that amount to nearest Support & Resistance level

So…

If you are long from Support and have a multiple of 1, then set your stop loss 1ATR below the lows of Support.

Or if you’re short from Resistance, and have a multiple of 2 then set your stop loss 2ATR above the highs of Resistance.

TrendFollowing is an multi-currency scanner that just indicates where to buy/sell: Abilities: Opens up the chart automatically with and arrow indicating where to take action. Send the signal to a telegram channel, see @fx_signal_com channel to get the idea. Configuration: Configure "Market Watch" with all the symbol you like to trade. Open a chart and attach the scanner to it. Trading Rules: Use only buystop/sellstop orders above/below arrow on the chart Delete the pending order if price

TrendFollowing is an multi-currency scanner that just indicates where to buy/sell: Abilities: Opens up the chart automatically with and arrow indicating where to take action. Send the signal to a telegram channel, see @fx_signal_com channel to get the idea. Configuration: No need to configure "Market Watch". Open a chart and attach the scanner to it. Trading Rules: Use only buystop/sellstop orders above/below arrow on the chart. Delete the pending order if price retraces below/above the moving

I remembered my first trading system.

It was a Bollinger Band mean reversion strategy.

You buy when the price is at the lower band and sell when it’s at the upper band.

The first few trades I did were winners, then the losses came and I figured this trading strategy doesn’t work.

So, I moved on.

Next, I chanced upon harmonic patterns.

I spent half a year learning how to draw these patterns (guess I’m a slower learner).

At the start, I had some wins but slowly, the losses kicked in and eroded all my profits.

Again, I told myself…

“This trading strategy doesn’t work. Let’s try something else.”

This brought me to the world of price action trading, support and resistance, candlestick patterns, etc.

Again, the same pattern repeated itself.

I had some winners, some losers, and I gave up the strategy.

One day, I asked myself…

“Why does this always happen?”

“Why am I not getting any consistency in my trading?”

“It’s always a few winners and then the losses pile up and take everything away.”

Do you know what I realized?

The problem was me.

I was hopping from one trading strategy to the next.

My actions were inconsistent. And because my actions were inconsistent, I got inconsistent results (duh).

So, don’t make my mistakes.

✅If you want consistent results from trading, you must have consistent actions.

✅Stick to one trading strategy, master it—and then move on.

Take a look 👀: https://www.mql5.com/en/market/product/92807

☝️A stop loss order is a type of order that gets you out of a trade automatically.

😎It means that you don’t need to stare at your charts the whole day and try to scare your pants off as the price approaches your stop loss order.

Now…

I’m not going to lie to you…

It hurts taking a loss…

Even if it’s just a losing trade.

But how would you feel when your stop loss order got hit, and the price went against you even more?

Except…

You’re not there to take the hit.

You feel relieved, right?

Not only do you free up space on your portfolio early to look for better trading opportunities.

But you also prevented a huge potential loss.

Can you see why this is important?

✅That’s why you can think of a stop loss order as a “risk police” that prevents you from losing more money or having unexpected losses.

Take a look 👀: https://www.mql5.com/en/market/product/92807

You bought 1 lot of EUR/USD at 1.3000.

⚠️Shortly, the price dropped 50 pips and you’re down $500.

Now you’re thinking to yourself…

“I knew it, the market is out to get me again.”

❌“But wait… if I buy another 1 lot of EUR/USD, then I can quickly get out at breakeven if the price moves up 25 pips.”

“I’m a genius!”

So…

You buy another lot of EUR/USD at 1.2950.

⚠️Next thing you know, EUR/USD tanked 100 pips—which puts you at a loss of $3,500.

In other words…

If you had cut your loss from the start, it would have only been a loss of $500.

But because you gave in to your emotions and averaged into your losses, it grew into a $3,500 loss.

⚜️So the lesson is this:

✅If the market proves you wrong, get out of the trade.

✅Don’t average into your losers because it could snowball into something near impossible to recover from.

Solution 👀: https://www.mql5.com/en/market/product/92807

You may like this 👀: https://www.mql5.com/en/market/product/92807

by doing the correct things over and over again. Don't forget that!

You may like this 👀: https://www.mql5.com/en/market/product/92807

OVERVIEW The "Scalplux " EA follows a “ scalping breakout ” strategy that exploits a vulnerability in EUR/USD pair. It is highly suggested to trade with a low spread and commission broker. Does not need forced optimization, which is the main factor of its reliability and guarantee of stable profit in the future. Suitable for both beginners and experienced traders. Please download the free demo to do your own testing. REQUIREMENTS Trading pair EUR/USD (***) Minimum deposit 100$ Leverage

OVERVIEW The "Scalplux " EA follows a “ scalping breakout ” strategy that exploits a vulnerability in EUR/USD pair. It is highly suggested to trade with a low spread and commission broker. Does not need forced optimization, which is the main factor of its reliability and guarantee of stable profit in the future. Suitable for both beginners and experienced traders. Please download the free demo to do your own testing. REQUIREMENTS Trading pair EUR/USD (***) Minimum deposit 100$ Leverage