True Volatility

FREE

パブリッシュ済み:

10 6月 2019

現在のバージョン:

1.21

Didn't find a suitable robot?

Order your own one

on Freelance

フリーランスにアクセス

Order your own one

on Freelance

取引の機会を逃しています。

- 無料取引アプリ

- 8千を超えるシグナルをコピー

- 金融ニュースで金融マーケットを探索

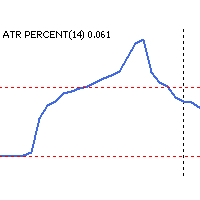

Hello, please it needs be adjusted to run well in WING21 indice Brazilian, I think it make a division for a big number to result in percent. Can you fix-it? Example, market volatility is 30 but price is 100k, so it calculate 30/100000 and do no show result in the graphic. See image below

Hi thanks for valueble feedback!

I've fixed the incorrect digit-switching between pairs, and added the abliity to manually specify digits(in extreme cases).

Let me know what you think.

Hi thanks for valueble feedback!

I've fixed the incorrect digit-switching between pairs, and added the abliity to manually specify digits(in extreme cases).

Let me know what you think.

Great indicator, thanks for your support. Now it work very well.

Hello, I really love the indicator.I just want to confirm that I understand its purpose correctly. Basically, this ATR PERCENT was developed to compare volatility against other multi-paired instruments? Say in your example, XAUUSD vs EURJPY. Since the percentage is higher in EURJPY, then we can assume that at the moment, the most active instrument will be EURJPY. Did I get it right? basically, this can serve as a volatility filter to know which pairs to trade based on volatility. This is a useful tool for trend traders if that is the case, I assume. Please correct me if I am wrong. Did you add the / close[i-1] in the formula? I just want to understand the math behind it or there is more to it?

Hello, I really love the indicator.I just want to confirm that I understand its purpose correctly. Basically, this ATR PERCENT was developed to compare volatility against other multi-paired instruments? Say in your example, XAUUSD vs EURJPY. Since the percentage is higher in EURJPY, then we can assume that at the moment, the most active instrument will be EURJPY. Did I get it right? basically, this can serve as a volatility filter to know which pairs to trade based on volatility. This is a useful tool for trend traders if that is the case, I assume. Please correct me if I am wrong. Did you add the / close[i-1] in the formula? I just want to understand the math behind it or there is more to it?

Yes that is correct. But just keep in mind that some pairs like BitcoinUsd or GoldUsd moves more naturally even when the volume is in the low of the day. So it's not necessary that the biggest mover is the most active one at the current time. But it will show you how much a pair is currently moving. If you want to know how much a wave is paying, you would have to compare the atr converted to dollar. If Atr is 50ticks, and tick value is 1. 50 ticks would produce 0.50$ with the lot size 0.01.