The iMBalance

500 USD

ダウンロードされたデモ:

136

パブリッシュ済み:

28 8月 2024

現在のバージョン:

2.1

Didn't find a suitable robot?

Order your own one

on Freelance

フリーランスにアクセス

Order your own one

on Freelance

取引の機会を逃しています。

- 無料取引アプリ

- 8千を超えるシグナルをコピー

- 金融ニュースで金融マーケットを探索

Link to our default set files: Set files

Note: Our default settings are for brokers in the time zone GMT+2/GMT+3 DST. Please adjust the GMT+2 Offset via 'System Settings' if your broker is not in the same time zone and you intend to use our settings, otherwise we encourage you to test out different trading instruments and adjust the times to match your brokers time zone. The iMBalance trading session can be configured to trade very frequently or less frequent depending on your preference and risk tolerance.

Regards,

MegaTrade Systems.

Hi,

can you please provide a detailled description what every setting of the EA is doing exactly and which values can be set/need to be set?

Thanks a lot.

Hi,

can you please provide a detailled description what every setting of the EA is doing exactly and which values can be set/need to be set?

Thanks a lot.

Hi there, sure I will send you a link to the manual shortly. Regards, MegaTrade Systems.

Hi, purchased the EA. Can you provide the manual and guides? Thank you!

Hi, sure I will send you the links shortly. In mean time please use our 'default' NASDAQ set files which trades quite aggressively and frequently. Please note that the EA is highly configurable, like for example if you only want the EA to trade the 'Kill zone' a.k.a 'The Silver Bullet' (opening hour of a session) you can do so by simply configuring the trade detection times and limiting the detection period. However, our 'unique' approach to trading the imbalances by combining price action patterns and multi timeframe trend alignment etc. is what 'tHE iMBalance' is all about. Regards, MegaTrade Systems.

Hi, sure I will send you the links shortly. In mean time please use our 'default' NASDAQ set files which trades quite aggressively and frequently. Please note that the EA is highly configurable, like for example if you only want the EA to trade the 'Kill zone' a.k.a 'The Silver Bullet' (opening hour of a session) you can do so by simply configuring the trade detection times and limiting the detection period. However, our 'unique' approach to trading the imbalances by combining price action patterns and multi timeframe trend alignment etc. is what 'tHE iMBalance' is all about. Regards, MegaTrade Systems.

Do you have a Telegram chat group? Can PM me?

No we are looking into that, although MQL encourages us to communicate here. You are welcome to send me a PM if you need personal assistance!

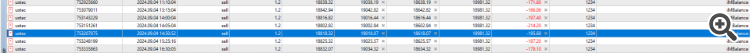

The EA sold today near the lows on nasdaq, i would have expected a pullback to the upside and would have bought (H4 massive bullish candle from 13.08. 50% retest done now) from here, but i would never hit the sell button here:

can you explain why we got the sell today at the absolute lows - and why it opened position after position (7 trades - really a lot for such a dangerous trade)?

i would personally only open so many positions when the probability of the trades is VERY high.

All of them hit SL.

Which strategy was used for those trades?

Thanks

The EA sold today near the lows on nasdaq, i would have expected a pullback to the upside and would have bought (H4 massive bullish candle from 13.08. 50% retest done now) from here, but i would never hit the sell button here:

can you explain why we got the sell today at the absolute lows - and why it opened position after position (7 trades - really a lot for such a dangerous trade)?

i would personally only open so many positions when the probability of the trades is VERY high.

All of them hit SL.

Which strategy was used for those trades?

Thanks

The EA sold today near the lows on nasdaq, i would have expected a pullback to the upside and would have bought (H4 massive bullish candle from 13.08. 50% retest done now) from here, but i would never hit the sell button here:

can you explain why we got the sell today at the absolute lows - and why it opened position after position (7 trades - really a lot for such a dangerous trade)?

i would personally only open so many positions when the probability of the trades is VERY high.

All of them hit SL.

Which strategy was used for those trades?

Thanks

Hi, the new and revamped EA has build in risk management to handle bulk operations of trades but in yesterdays case nothing triggered and it is normal to loose a batch in a row, that is why we trade with small lot sizes and risk a small % per trade. You can avoid those trades by filtering out trade entry criteria, like for example adjust the 'RSI Offset' in order for the EA not to keep selling when the RSI is over sold, and also set 'Liquidity sweep override all filters = false'.

Please note that the 'default' set files trades with the design of the new algorithm, and can be very aggressive so also perhaps filter out some hours but at the core we want to catch the momentum of iMBalances aligned with the prevailing trend direction and price action.

I hope that clears out confusion! :)

Regards, Paul.

no offense, i only want to find out why the EA took those trades and if there room for improvement here and there...

Sure no problem, we are still in 'launch' phase although the provided set files has been tested since beginning of July 2024 and made a decent amount of profit in July as well as August trading 'live'. I will post some results of July and August 'out of sample' on the EA page.

Hi all, please note that if you run both Tokyo and London/New York set files then you need to adjust risk proportionally.

If you need any assistance feel free to send me a direct message!

Regards, MegaTrade Systems

Hello Paul

Could you please provide a manual for the ea as I purchased it .

Hello Paul

Could you please provide a manual for the ea as I purchased it .

Hi there, thank you for your support and trust you will find great benefit in using tHE iMBalance.

I will send everybody a link to the user manual shortly, in mean time play a bit with the settings like changing the trade detection time period, the trade filters and the risk management. The EA should work on any trading instrument with high trading volume, so go ahead and experiment with like S&P 500, Gold, EURUSD, BTCUSD and consider creating two set files for each instrument, one aggressive and the other only trading the 'kill zone' hour.

I will invite you guys to a telegram group soon, this way we can share set files and use the power of numbers to possibly create the most awesome set files! :)

Hi everybody, just a quick update on the past week. Although there were a few losses earlier in the week, the algorithm sticks to its rules by buying or selling iMBalances only in the direction of the multi time frame trend, which over time should have a very high success rate. The EA handled the volatility extremely well profiting through Tokyo session as well as London and New York sessions. Yesterday a gain of almost 2% was achieved and one trade's SL was just tapped and price immediately reversed. Notice how the EA handles positions later in the day when price is weak and hovering around a liquidity pool. The EA attempts to adapt and will not keep losing positions open for too long, and rather closing them if an opposite signal is identified or simply if the position becomes invalidated due to not aligning with the internal confluences.

I hope everybody has a great weekend! :)

Regards, Paul (MegaTrade Systems)

crazy profitability last week with latest update + nasdaq setfile!

crazy profitability last week with latest update + nasdaq setfile!

Excellent! Yes that is what you guys can expect from this EA, so never be too concerned about a few losses in a row! Thank you

Awesome work, still working on my customized sets for JPY and Silver but this is going great. Snippet from today: