Piyush Lalsingh Ratnu / Profilo

- Informazioni

|

1 anno

esperienza

|

0

prodotti

|

0

versioni demo

|

|

0

lavori

|

1

segnali

|

0

iscritti

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm 130+ parameters.

Core focus: XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Ai Verified Track Record since 2021:

https://www.piyushratnu.com/most-accurate-xauusd-spot-gold-price-projection-and-ai-verified-research-generated-by-piyush-ratnu-gold-market-research/

XAUUSD Daily Price Projection:

https://www.piyushratnu.com/xauusd-spot-gold-daily-analysis/

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm 130+ parameters.

Core focus: XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Ai Verified Track Record since 2021:

https://www.piyushratnu.com/most-accurate-xauusd-spot-gold-price-projection-and-ai-verified-research-generated-by-piyush-ratnu-gold-market-research/

XAUUSD Daily Price Projection:

https://www.piyushratnu.com/xauusd-spot-gold-daily-analysis/

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Amici

19

Richieste

In uscita

Piyush Lalsingh Ratnu

Accuracy Review: Piyush Ratnu XAUUSD Spot Gold Analysis

A 20-call verification of Piyush Ratnu’s XAUUSD (Gold) public forecasts, using verifiable public posts and independent historical price data, and present the results in tabular form with dates so accuracy can be judged transparently.

+

XAUUSD P&L Back-Test

Based on 20 Piyush Ratnu public calls

P&L Summary (Trades 1–19)

R-Multiple Performance

Winning trades: 16

Partial wins: 1

Losing trades: 1

Closed trades: 18

Read in depth audit, back test and verification of analysis published by Piyush Ratnu Gold Market Research at:

https://www.piyushratnu.com/accuracy-review-piyush-ratnu-xauusd-spot-gold-analysis/

#XAUUSD #NFP #Gold #Trading #Analysis #LatestUpdates #TrendingNow #ForexMarket

A 20-call verification of Piyush Ratnu’s XAUUSD (Gold) public forecasts, using verifiable public posts and independent historical price data, and present the results in tabular form with dates so accuracy can be judged transparently.

+

XAUUSD P&L Back-Test

Based on 20 Piyush Ratnu public calls

P&L Summary (Trades 1–19)

R-Multiple Performance

Winning trades: 16

Partial wins: 1

Losing trades: 1

Closed trades: 18

Read in depth audit, back test and verification of analysis published by Piyush Ratnu Gold Market Research at:

https://www.piyushratnu.com/accuracy-review-piyush-ratnu-xauusd-spot-gold-analysis/

#XAUUSD #NFP #Gold #Trading #Analysis #LatestUpdates #TrendingNow #ForexMarket

Piyush Lalsingh Ratnu

#XAUUSD #XAUUSD分析 PRICE TARGETS FOR NEXT 24 TRADING HOURS.

Piyush Ratnu Gold Market Research | Dubai | Abu Dhabi | Bangkok

Piyush Ratnu Gold Market Research | Dubai | Abu Dhabi | Bangkok

Piyush Lalsingh Ratnu

#XAUUSD #XAUUSD分析 PRICE TARGETS FOR NEXT 24 TRADING DAYS

IMPORTANT EVENTS:

NFP/CPI/BOE IR/ ECB IR/ BOJ IR/ HOLIDAYS OPTIMISM/ NEW YEAR OPTIMISM

TARGET DATE: 15/26 JANUARY 2026

IMPORTANT EVENTS:

NFP/CPI/BOE IR/ ECB IR/ BOJ IR/ HOLIDAYS OPTIMISM/ NEW YEAR OPTIMISM

TARGET DATE: 15/26 JANUARY 2026

Piyush Lalsingh Ratnu

US President Donald Trump said last Friday that he was leaning toward choosing either former Fed Governor Kevin Warsh or National Economic Council Director Kevin Hassett to lead the US central bank next year. Market participants seem convinced that the new Trump-aligned Fed chair will be an uber-dovish and slash interest rates regardless of the economic fundamentals. This has been another factor behind the recent USD decline and suggests that the path of least resistance for the Gold price remains to the upside. Moreover, the emergence of dip-buying at the start of a new week and acceptance above the $4,303 mark validate the positive outlook.

Piyush Lalsingh Ratnu

Gold (XAU/USD) attracts buyers for the fifth straight day and climbs to the $4,339 region during the Asian session on Monday. The commodity remains well within striking distance of its highest level since October 21, touched on Friday, and seems poised to appreciate further amid a supportive fundamental backdrop.

Traders, however, might opt to wait for this week's important US macro releases, which would shape expectations about the Federal Reserve's (Fed) rate-cut path and drive demand for the non-yielding yellow metal.

📌 The delayed US Nonfarm Payrolls (NFP) report for October and Retail Sales are scheduled for release on Tuesday, along with the provisional manufacturing and services PMIs. This will be followed by the US consumer inflation figures on Thursday.

Apart from this, speeches from influential FOMC members will determine the near-term trajectory for the US Dollar (USD).

Investors this week will further take cues from the Bank of England (BoE) rate decision and the European Central Bank (ECB) meeting on Thursday, and the Bank of Japan (BoJ) policy update on Friday. This should provide a fresh directional impetus to the Gold price.

Traders, however, might opt to wait for this week's important US macro releases, which would shape expectations about the Federal Reserve's (Fed) rate-cut path and drive demand for the non-yielding yellow metal.

📌 The delayed US Nonfarm Payrolls (NFP) report for October and Retail Sales are scheduled for release on Tuesday, along with the provisional manufacturing and services PMIs. This will be followed by the US consumer inflation figures on Thursday.

Apart from this, speeches from influential FOMC members will determine the near-term trajectory for the US Dollar (USD).

Investors this week will further take cues from the Bank of England (BoE) rate decision and the European Central Bank (ECB) meeting on Thursday, and the Bank of Japan (BoJ) policy update on Friday. This should provide a fresh directional impetus to the Gold price.

Piyush Lalsingh Ratnu

Segnale MetaTrader 5 pubblicato

High Frequency Trading based on PR Golden Falcon Algorithm. Max DD: 45% | Lot size: 0.01/0.05 | XAUUSD only

Piyush Lalsingh Ratnu

How to trade XAUUSD Spot Gold accurately during High Volatility News, FOMC – US Interest Rate Decision Day

Gold remains one of the strongest-performing macro assets of Q4, holding elevated levels despite short-term volatility and repeated retests of intraday support.

#XAUUSD #Gold #Forex #trading #forexnews #TrendingNow #LatestNews #FOMC #InterestRates

https://www.piyushratnu.com/how-to-trade-xauusd-spot-gold-accurately-during-high-volatility-news-fomc-us-interest-rate-decision-day/

Gold remains one of the strongest-performing macro assets of Q4, holding elevated levels despite short-term volatility and repeated retests of intraday support.

#XAUUSD #Gold #Forex #trading #forexnews #TrendingNow #LatestNews #FOMC #InterestRates

https://www.piyushratnu.com/how-to-trade-xauusd-spot-gold-accurately-during-high-volatility-news-fomc-us-interest-rate-decision-day/

Piyush Lalsingh Ratnu

Gold is firming up near $4,250 early Monday, its highest level in six weeks. Gold buyers retain control at the start of a new month amid growing calls for another interest rate cut by the US Federal Reserve (Fed) as early as next week.

Markets are now pricing in an 87% chance the Fed will cut by 25 basis points (bps) at its December monetary policy meeting, according to the CME FedWatch tool.

With a December Fed rate cut almost a done deal, the US Dollar (USD) keeps its bearish undertone intact, after having registered its worst week in four months, favoring the Gold price upside.

Concerns over the Fed’s leadership also remain a drag on the USD, as Piyush Ratnu Gold Market Research aim for the $4,444/4545 price target for XAUUSD Spot Gold.

Later this week, a host of US statistics, including the ADP Employment Change, ISM Services PMI, Unemployment Claims and the Core Personal Consumption Expenditures (PCE) Price Index, will fill in the recent data void and offer fresh directives on trading the USD and Gold heading into the Fed showdown next week.

Markets are now pricing in an 87% chance the Fed will cut by 25 basis points (bps) at its December monetary policy meeting, according to the CME FedWatch tool.

With a December Fed rate cut almost a done deal, the US Dollar (USD) keeps its bearish undertone intact, after having registered its worst week in four months, favoring the Gold price upside.

Concerns over the Fed’s leadership also remain a drag on the USD, as Piyush Ratnu Gold Market Research aim for the $4,444/4545 price target for XAUUSD Spot Gold.

Later this week, a host of US statistics, including the ADP Employment Change, ISM Services PMI, Unemployment Claims and the Core Personal Consumption Expenditures (PCE) Price Index, will fill in the recent data void and offer fresh directives on trading the USD and Gold heading into the Fed showdown next week.

Piyush Lalsingh Ratnu

Despite the disruption, spot gold and silver markets remained active, with prices climbing amid continued investor interest.

Gold rose to $4,245 per ounce, while silver made new highs near $57, driven in part by concerns over tight supply and long-term bullish sentiment.

Meanwhile, geopolitical tensions and sanctions have reshaped central bank strategies.

For the first time, Russia’s central bank began selling its gold reserves directly to the domestic market.

Faced with dwindling liquid assets and a shrinking National Welfare Fund, Moscow is offloading substantial amounts of gold to stabilize its currency and meet budgetary needs.

Analysts warn this move, while temporarily supportive, risks depleting Russia’s strategic reserves and increasing its dependency on asset sales for financial stability.

On the global stage, China’s role in the gold market is under increasing scrutiny.

Independent estimates suggest the country’s actual gold purchases may be ten times higher than official figures, positioning China as the second-largest holder of sovereign gold after the U.S.

Analysts believe this quiet accumulation is part of a broader strategy to reduce exposure to U.S. assets amid rising geopolitical uncertainty.

The trend highlights a global shift toward gold as a hedge against sanctions, currency instability, and economic fragmentation.

Together, these developments reflect a broader transformation in the global financial system.

Central banks in emerging markets are doubling down on gold to protect reserves, diversify away from the dollar, and prepare for a more multipolar world.

With prices already surging—gold up over 40% in 2025—analysts forecast further gains, expecting the metal to surpass $5,000 per ounce in a sustained long-term rally.

Gold rose to $4,245 per ounce, while silver made new highs near $57, driven in part by concerns over tight supply and long-term bullish sentiment.

Meanwhile, geopolitical tensions and sanctions have reshaped central bank strategies.

For the first time, Russia’s central bank began selling its gold reserves directly to the domestic market.

Faced with dwindling liquid assets and a shrinking National Welfare Fund, Moscow is offloading substantial amounts of gold to stabilize its currency and meet budgetary needs.

Analysts warn this move, while temporarily supportive, risks depleting Russia’s strategic reserves and increasing its dependency on asset sales for financial stability.

On the global stage, China’s role in the gold market is under increasing scrutiny.

Independent estimates suggest the country’s actual gold purchases may be ten times higher than official figures, positioning China as the second-largest holder of sovereign gold after the U.S.

Analysts believe this quiet accumulation is part of a broader strategy to reduce exposure to U.S. assets amid rising geopolitical uncertainty.

The trend highlights a global shift toward gold as a hedge against sanctions, currency instability, and economic fragmentation.

Together, these developments reflect a broader transformation in the global financial system.

Central banks in emerging markets are doubling down on gold to protect reserves, diversify away from the dollar, and prepare for a more multipolar world.

With prices already surging—gold up over 40% in 2025—analysts forecast further gains, expecting the metal to surpass $5,000 per ounce in a sustained long-term rally.

Piyush Lalsingh Ratnu

A rare technical fault at CME Group temporarily froze global futures trading, including precious metals like gold and silver, triggering safe-haven demand as traders scrambled for clarity.

The outage, caused by cooling failures at a major data center, hit during a low-volume period due to the U.S. Thanksgiving holiday, which muted broader market impact.

The outage, caused by cooling failures at a major data center, hit during a low-volume period due to the U.S. Thanksgiving holiday, which muted broader market impact.

Piyush Lalsingh Ratnu

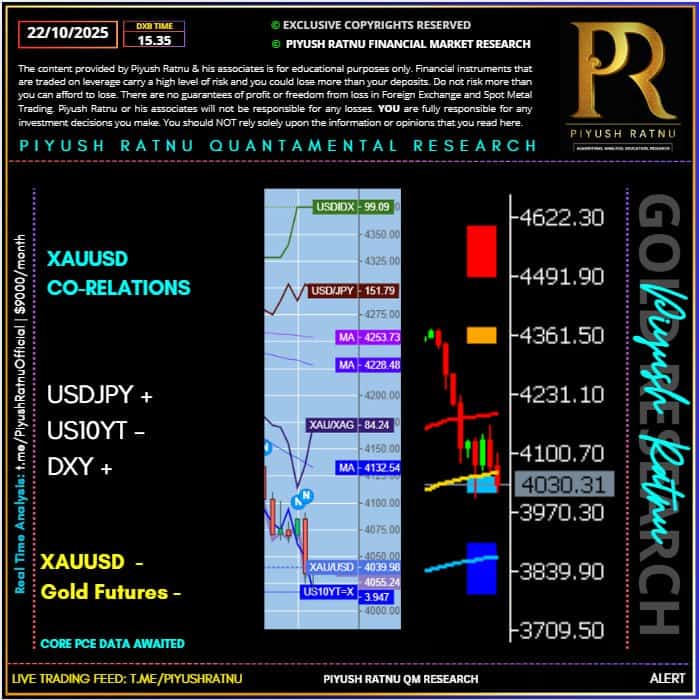

Status of Co-relations post data:

USDJPY V100 achieved

155.665-156.555 achieved

Ideal case: XAUUSD (-) $45/60

$4114/4104/4085 on radar

Suggested trading scenario:

BUY LOWS | Exit NAP

XAUUSD PRSRSDBS D12

S2 S3 crucial

USDJPY V100 achieved

155.665-156.555 achieved

Ideal case: XAUUSD (-) $45/60

$4114/4104/4085 on radar

Suggested trading scenario:

BUY LOWS | Exit NAP

XAUUSD PRSRSDBS D12

S2 S3 crucial

Piyush Lalsingh Ratnu

XAUUSD Crucial Price Zones Ahead:

🔺$4242/4269/4285/4303/4343 | SZ

🔻$4085/4040/3985/3939/3883 | BZ

I suggest BUYING LOWS. Exit NAP.

SZ might be risky, hence avoid to hold the positions, exit in NAP, and before price/liquidity sweep zones.

🔺$4242/4269/4285/4303/4343 | SZ

🔻$4085/4040/3985/3939/3883 | BZ

I suggest BUYING LOWS. Exit NAP.

SZ might be risky, hence avoid to hold the positions, exit in NAP, and before price/liquidity sweep zones.

Piyush Lalsingh Ratnu

Gold is entering the final stretch of November with renewed strength as global markets reposition around a softer dollar and rising expectations of Federal Reserve rate cuts in early 2026. The metal has climbed decisively above the 4141 dollars area, extending the rebound that began after the mid month consolidation and now approaching the upper boundaries of the November range.

The dollar has lost some of the defensive bid that dominated much of the autumn. As Treasury yields retreated and traders began to price in a more accommodative Fed path, the dollar index pulled back from recent highs. For gold, this combination is particularly supportive. The metal tends to benefit when real yields decline and when the currency environment becomes less hostile to non yielding assets.

Behind this shift lies a gradual but meaningful change in economic data. Job growth moderated, leading indicators weakened, and several inflation components decelerated. None of these signals point to recession, but they collectively justify a more cautious policy stance.

Markets are now comfortable assigning a non trivial probability to a mid 2026 rate cut, a scenario that enhances the appeal of gold as a hedge against monetary adjustment.

Geo-political Pressures

The geopolitical environment remains complex. Tensions in several regions persist, energy markets continue to rebalance unevenly, and supply chain fragmentation remains a strategic concern for policymakers. In this context, gold plays a dual role. It offers protection against financial volatility and serves as a hedge against geopolitical surprise.

What's next in December?

The final month of the year often delivers distinct patterns in precious metals as liquidity thins and macro themes dominate. This year, gold enters December with a compelling combination of stabilizing inflation, easing yields, currency softness and persistent geopolitical uncertainty.

These ingredients create a favourable environment for demand to remain steady even if momentum fluctuates.

The dollar has lost some of the defensive bid that dominated much of the autumn. As Treasury yields retreated and traders began to price in a more accommodative Fed path, the dollar index pulled back from recent highs. For gold, this combination is particularly supportive. The metal tends to benefit when real yields decline and when the currency environment becomes less hostile to non yielding assets.

Behind this shift lies a gradual but meaningful change in economic data. Job growth moderated, leading indicators weakened, and several inflation components decelerated. None of these signals point to recession, but they collectively justify a more cautious policy stance.

Markets are now comfortable assigning a non trivial probability to a mid 2026 rate cut, a scenario that enhances the appeal of gold as a hedge against monetary adjustment.

Geo-political Pressures

The geopolitical environment remains complex. Tensions in several regions persist, energy markets continue to rebalance unevenly, and supply chain fragmentation remains a strategic concern for policymakers. In this context, gold plays a dual role. It offers protection against financial volatility and serves as a hedge against geopolitical surprise.

What's next in December?

The final month of the year often delivers distinct patterns in precious metals as liquidity thins and macro themes dominate. This year, gold enters December with a compelling combination of stabilizing inflation, easing yields, currency softness and persistent geopolitical uncertainty.

These ingredients create a favourable environment for demand to remain steady even if momentum fluctuates.

Piyush Lalsingh Ratnu

As Alerted in advance:

XAGUSD crashed $6.5 in last 3 days.

#XAGUSD #PiyushRatnu #forex #trading #analysis

XAGUSD crashed $6.5 in last 3 days.

#XAGUSD #PiyushRatnu #forex #trading #analysis

Piyush Lalsingh Ratnu

1️⃣2️⃣3️⃣WHY XAUUSD Shot up from $3333 zone:

🟢1. Gold rallies to $3,359 after Trump BLS nominee suggests suspending monthly NFP releases.

🟢2. Trump slams Powell, threatens lawsuit, reigniting Fed independence concerns | Uncertainty = XAUUSD +🔺

🟢3. July US CPI misses headline estimates, boosting odds of September Fed rate cut = XAUUSD 🔺

Gold price recovered some ground on Tuesday, climbing 0.20% following the release of July’s inflation print in the United States (US).

Although prices had risen, Bullion’s was supported by US President Donald Trump's remarks threatening the Federal Reserve’s (Fed) independence. The XAU/USD trades at $3,348 at the time of writing.

The US Consumer Price Index (CPI) for July missed estimates in its headline print YoY and increased the odds for a rate cut. However, the core CPI, which excludes volatile items, jumped above the 3% threshold YoY. Impact: XAUUSD 🔺

Initially, XAU/USD fell toward its daily lows but was boosted by Trump's comments on Jerome Powell, calling the Fed Chair too late at cutting rates and threatening to sue him regarding the renovation of the Fed buildings.

It was worth noticing the timing of Mr. Trump's remarks and US CPI data.

On the remarks, Bullion prices rose from around daily lows near $3,331 toward $3,345 before rising toward their daily high of $3,359.

🔔Gold’s last leg up was courtesy of EJ Antoni, the economist nominated by Trump to head the Bureau of Labor Statistics (BLS), who suggested suspending monthly Nonfarm Payrolls (NFP)data. He argued that its underlying methodology, economic modeling, and statistical assumptions are fundamentally flawed. Instead, Antoni proposes quarterly data.

🟢1. Gold rallies to $3,359 after Trump BLS nominee suggests suspending monthly NFP releases.

🟢2. Trump slams Powell, threatens lawsuit, reigniting Fed independence concerns | Uncertainty = XAUUSD +🔺

🟢3. July US CPI misses headline estimates, boosting odds of September Fed rate cut = XAUUSD 🔺

Gold price recovered some ground on Tuesday, climbing 0.20% following the release of July’s inflation print in the United States (US).

Although prices had risen, Bullion’s was supported by US President Donald Trump's remarks threatening the Federal Reserve’s (Fed) independence. The XAU/USD trades at $3,348 at the time of writing.

The US Consumer Price Index (CPI) for July missed estimates in its headline print YoY and increased the odds for a rate cut. However, the core CPI, which excludes volatile items, jumped above the 3% threshold YoY. Impact: XAUUSD 🔺

Initially, XAU/USD fell toward its daily lows but was boosted by Trump's comments on Jerome Powell, calling the Fed Chair too late at cutting rates and threatening to sue him regarding the renovation of the Fed buildings.

It was worth noticing the timing of Mr. Trump's remarks and US CPI data.

On the remarks, Bullion prices rose from around daily lows near $3,331 toward $3,345 before rising toward their daily high of $3,359.

🔔Gold’s last leg up was courtesy of EJ Antoni, the economist nominated by Trump to head the Bureau of Labor Statistics (BLS), who suggested suspending monthly Nonfarm Payrolls (NFP)data. He argued that its underlying methodology, economic modeling, and statistical assumptions are fundamentally flawed. Instead, Antoni proposes quarterly data.

: