Piyush Lalsingh Ratnu / Profilo

- Informazioni

|

1 anno

esperienza

|

0

prodotti

|

0

versioni demo

|

|

0

lavori

|

2

segnali

|

0

iscritti

|

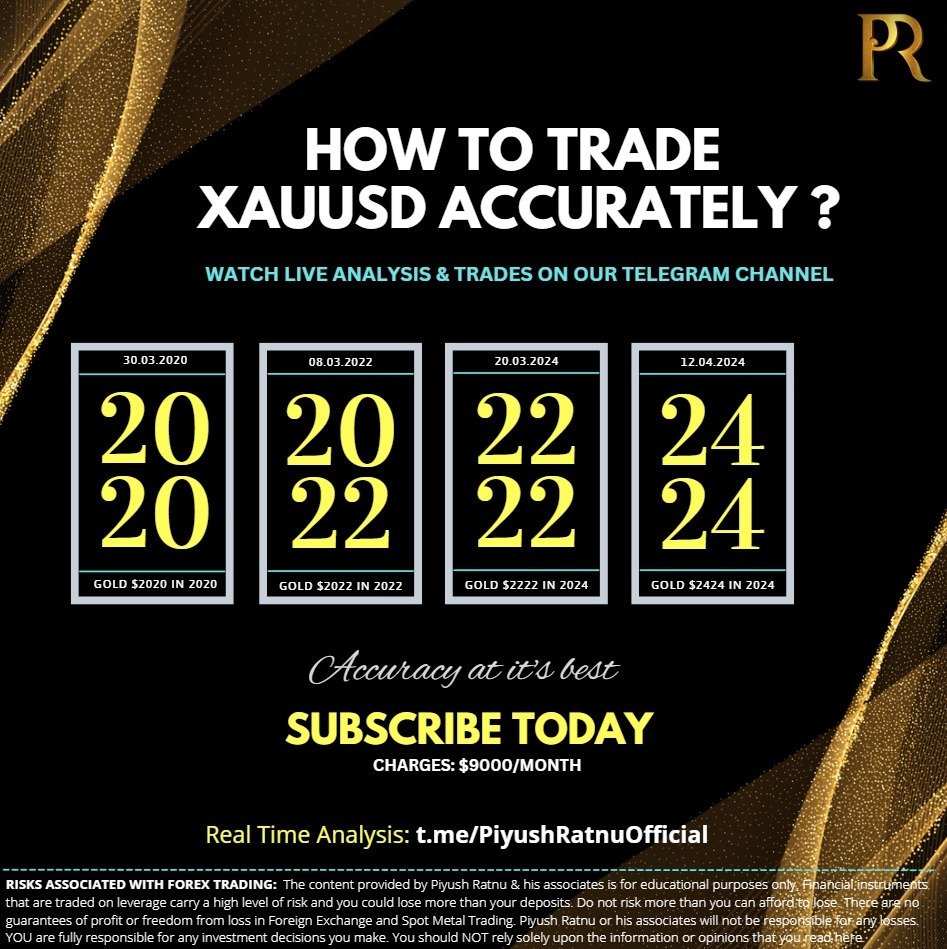

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm 130+ parameters.

Core focus: XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Ai Verified Track Record since 2021:

https://www.piyushratnu.com/most-accurate-xauusd-spot-gold-price-projection-and-ai-verified-research-generated-by-piyush-ratnu-gold-market-research/

XAUUSD Daily Price Projection:

https://www.piyushratnu.com/xauusd-spot-gold-daily-analysis/

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm 130+ parameters.

Core focus: XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Ai Verified Track Record since 2021:

https://www.piyushratnu.com/most-accurate-xauusd-spot-gold-price-projection-and-ai-verified-research-generated-by-piyush-ratnu-gold-market-research/

XAUUSD Daily Price Projection:

https://www.piyushratnu.com/xauusd-spot-gold-daily-analysis/

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Amici

19

Richieste

In uscita

Piyush Lalsingh Ratnu

#XAUUSD #FOMC #Forex #Powell

Power of disinflation has been unwinding pandemic shocks - POWELL

FAQ: What is disinflation?

Disinflation is a temporary slowing of the pace of price inflation. The term is used to describe occasions when the inflation rate has reduced marginally over the short term. Unlike inflation and deflation, which refer to the direction of prices, disinflation refers to the rate of change in the rate of inflation.

Power of disinflation has been unwinding pandemic shocks - POWELL

FAQ: What is disinflation?

Disinflation is a temporary slowing of the pace of price inflation. The term is used to describe occasions when the inflation rate has reduced marginally over the short term. Unlike inflation and deflation, which refer to the direction of prices, disinflation refers to the rate of change in the rate of inflation.

Piyush Lalsingh Ratnu

Federal Reserve issues FOMC statement

12 June 2024

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. In recent months, there has been modest further progress toward the Committee's 2 percent inflation objective.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals have moved toward better balance over the past year. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Michael S. Barr; Raphael W. Bostic; Michelle W. Bowman; Lisa D. Cook; Mary C. Daly; Philip N. Jefferson; Adriana D. Kugler; Loretta J. Mester; and Christopher J. Waller.

12 June 2024

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. In recent months, there has been modest further progress toward the Committee's 2 percent inflation objective.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals have moved toward better balance over the past year. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Michael S. Barr; Raphael W. Bostic; Michelle W. Bowman; Lisa D. Cook; Mary C. Daly; Philip N. Jefferson; Adriana D. Kugler; Loretta J. Mester; and Christopher J. Waller.

Piyush Lalsingh Ratnu

🆘 USDPY approaching H1A100

🟢 XAUUSD H1V100 @ 2385

🔺Crucial + stops: $2369/2385/2407/2424

🔻Crucial - stops: $2313/2288/2266/2244

Key Economic Data Ahead:

22:00 USD Federal Budget Balance (May) -279.6B 210.0B

22:00 USD Interest Rate Projection - 1st Yr (Q2) 3.9%

22:00 USD Interest Rate Projection - 2nd Yr (Q2) 3.1%

22:00 USD Interest Rate Projection - 3rd Yr 2.9%

22:00 USD Interest Rate Projection - Current (Q2) 4.6%

22:00 USD Interest Rate Projection - Longer (Q2) 2.6%

22:00 USD FOMC Economic Projections

22:00 USD FOMC Statement

22:00 USD Fed Interest Rate Decision 5.50% 5.50%

22:30 USD FOMC Press Conference

🟢 XAUUSD H1V100 @ 2385

🔺Crucial + stops: $2369/2385/2407/2424

🔻Crucial - stops: $2313/2288/2266/2244

Key Economic Data Ahead:

22:00 USD Federal Budget Balance (May) -279.6B 210.0B

22:00 USD Interest Rate Projection - 1st Yr (Q2) 3.9%

22:00 USD Interest Rate Projection - 2nd Yr (Q2) 3.1%

22:00 USD Interest Rate Projection - 3rd Yr 2.9%

22:00 USD Interest Rate Projection - Current (Q2) 4.6%

22:00 USD Interest Rate Projection - Longer (Q2) 2.6%

22:00 USD FOMC Economic Projections

22:00 USD FOMC Statement

22:00 USD Fed Interest Rate Decision 5.50% 5.50%

22:30 USD FOMC Press Conference

Piyush Lalsingh Ratnu

#XAUUSD under PPZ R2/S2 crucial entry zones.

#PiyushRatnu #PRDXb #Forex #Gold #Fx

#PiyushRatnu #PRDXb #Forex #Gold #Fx

Piyush Lalsingh Ratnu

H1V236 achieved $2309 CMP

+ Target $2323

- Target $2288

#XAUUSD #PiyushRatnu #PRDXB #Forex

+ Target $2323

- Target $2288

#XAUUSD #PiyushRatnu #PRDXB #Forex

Piyush Lalsingh Ratnu

Critical Week Ahead

This week promises another critical data event with the release of the Consumer Price Index (CPI) on Wednesday. This data, followed immediately by the Federal Reserve's interest rate decision, will significantly impact market volatility.

The contrasting data releases, with weak ADP data followed by strong Nonfarm Payrolls, have been mixed. While expectations of robust US employment solidified, the rising unemployment rate presents another data point leaving investors uncertain.

This week's CPI release could provide some clarity. A higher-than-expected CPI could prompt a cautious statement from the Fed, potentially bolstering the dollar's appeal as a safe haven asset. Conversely, lower-than-expected CPI would ease pressure on the Fed, potentially paving the way for a future rate cut.

The Fed initially anticipated three rate cuts in 2024, but current forecasts suggest only one. The exact timing of this cut remains speculative and will significantly impact markets.

The week began with subdued risk appetite due to the lingering effects of the employment data. The dollar maintained its positive momentum against other major currencies, pushing towards the 105 level on the DXY.

This week's economic data, particularly the CPI and Fed decision, will be crucial in determining the dollar's near-term trajectory and providing further clues about the Fed's future monetary policy actions.

A strong US NFP headline print and the wage inflation data drove the US Treasury bond yields sharply higher across the curve, with the 2-year Treasury yields, which is sensitive to Fed policy expectations, shooting up by the most in two months. The US Dollar followed the upsurge in the US Treasury bond yields on a significant decline in the bets for a US Federal Reserve (Fed) interest rate cut in September, weighing heavily on the non-interest-bearing Gold price.

Markets dialed down bets of a 25 basis points (bps) rate cut in September to about 43% from about 55% before the report, according to the CME Group’s FedWatch Tool, and now see roughly an even chance of two rate cuts by the end of 2024, versus about a 68% chance seen before the NFP release, per Reuters.

The US Dollar upside gains renewed traction early Monday, as markets ramp up their bets on delayed Fed rate cuts heading into the US Consumer Price Index (CPI) data and the Fed policy announcements due on Wednesday.

Further, traders also digest mounting political tension in the Euro area, especially after French President Emmanuel Macron announced snap elections on Sunday, dissolving parliament after exit polls showed his alliance suffered a heavy defeat in European elections to Marine Le Pen’s far-right National Rally (RN) party.

The French political uncertainty could continue to exert downside pressure on the EUR/USD pair, adding extra legs to the US Dollar at the expense of the Gold price.

Meanwhile, in the absence of top-tier US economic data on Monday, all eyes will remain on risk sentiment and the US Dollar dynamics for fresh trading impetus on Gold price.

This week promises another critical data event with the release of the Consumer Price Index (CPI) on Wednesday. This data, followed immediately by the Federal Reserve's interest rate decision, will significantly impact market volatility.

The contrasting data releases, with weak ADP data followed by strong Nonfarm Payrolls, have been mixed. While expectations of robust US employment solidified, the rising unemployment rate presents another data point leaving investors uncertain.

This week's CPI release could provide some clarity. A higher-than-expected CPI could prompt a cautious statement from the Fed, potentially bolstering the dollar's appeal as a safe haven asset. Conversely, lower-than-expected CPI would ease pressure on the Fed, potentially paving the way for a future rate cut.

The Fed initially anticipated three rate cuts in 2024, but current forecasts suggest only one. The exact timing of this cut remains speculative and will significantly impact markets.

The week began with subdued risk appetite due to the lingering effects of the employment data. The dollar maintained its positive momentum against other major currencies, pushing towards the 105 level on the DXY.

This week's economic data, particularly the CPI and Fed decision, will be crucial in determining the dollar's near-term trajectory and providing further clues about the Fed's future monetary policy actions.

A strong US NFP headline print and the wage inflation data drove the US Treasury bond yields sharply higher across the curve, with the 2-year Treasury yields, which is sensitive to Fed policy expectations, shooting up by the most in two months. The US Dollar followed the upsurge in the US Treasury bond yields on a significant decline in the bets for a US Federal Reserve (Fed) interest rate cut in September, weighing heavily on the non-interest-bearing Gold price.

Markets dialed down bets of a 25 basis points (bps) rate cut in September to about 43% from about 55% before the report, according to the CME Group’s FedWatch Tool, and now see roughly an even chance of two rate cuts by the end of 2024, versus about a 68% chance seen before the NFP release, per Reuters.

The US Dollar upside gains renewed traction early Monday, as markets ramp up their bets on delayed Fed rate cuts heading into the US Consumer Price Index (CPI) data and the Fed policy announcements due on Wednesday.

Further, traders also digest mounting political tension in the Euro area, especially after French President Emmanuel Macron announced snap elections on Sunday, dissolving parliament after exit polls showed his alliance suffered a heavy defeat in European elections to Marine Le Pen’s far-right National Rally (RN) party.

The French political uncertainty could continue to exert downside pressure on the EUR/USD pair, adding extra legs to the US Dollar at the expense of the Gold price.

Meanwhile, in the absence of top-tier US economic data on Monday, all eyes will remain on risk sentiment and the US Dollar dynamics for fresh trading impetus on Gold price.

Piyush Lalsingh Ratnu

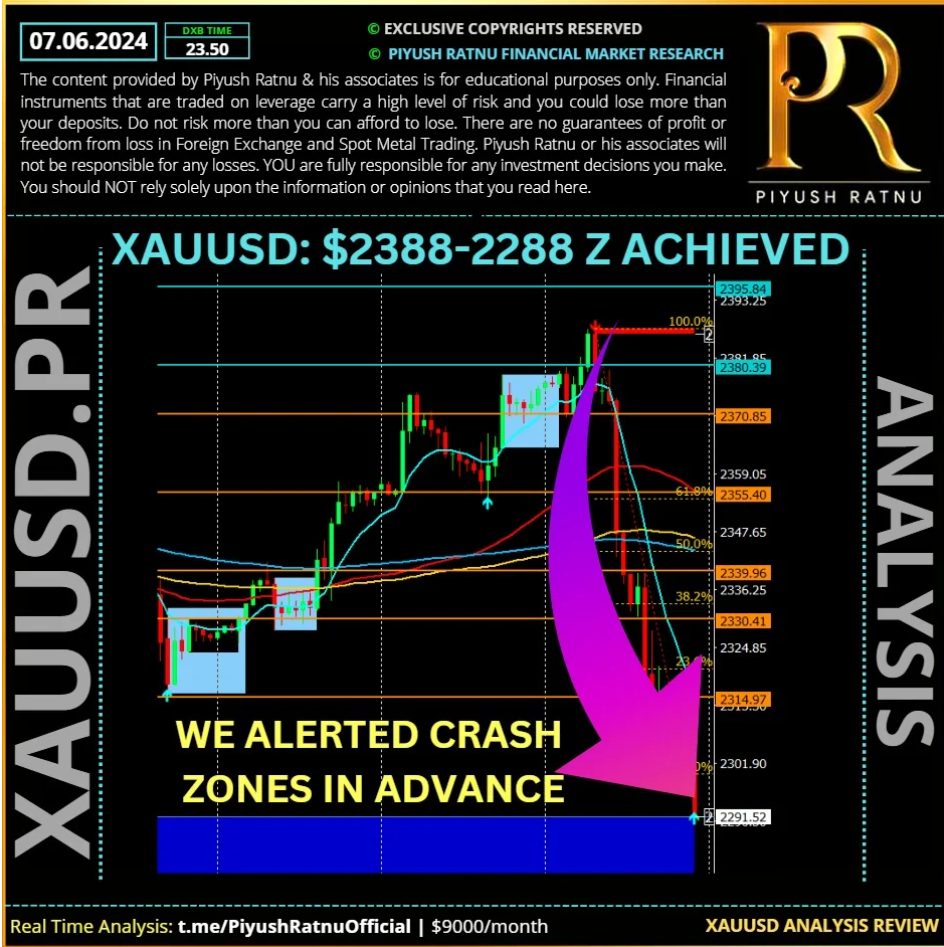

After NFP: $2388-2288 achieved, After FOMC: $2244/2222 or $2400/2424 next? Analysis by Piyush Ratnu

A strong US NFP headline print and the wage inflation data drove the US Treasury bond yields sharply higher across the curve, with the 2-year Treasury yields, which is sensitive to Fed policy expectations, shooting up by the most in two months. The US Dollar followed the upsurge in the US Treasury bond yields on a significant decline in the bets for a US Federal Reserve (Fed) interest rate cut in September, weighing heavily on the non-interest-bearing 🔻 Gold price.

Markets dialed down bets of a 25 basis points (bps) rate cut in September to about 43% from about 55% before the report, according to the CME Group’s FedWatch Tool, and now see roughly an even chance of two rate cuts by the end of 2024, versus about a 68% chance seen before the NFP release, per Reuters.

Furthermore, reports that the People's Bank of China (PBoC) paused gold purchases to its reserves in May, ending a massive buying spree that ran for 18 months, further seem to undermine the Gold price. That said, a cautious market mood lends some support to the safe-haven XAU/USD and helps limit deeper losses. Traders also seem reluctant to place aggressive directional bets ahead of this week's key US data and central bank event risk – the release of the latest US consumer inflation figures and the outcome of the two-day FOMC policy meeting on Wednesday. This, in turn, warrants caution before positioning for further losses.

The US Dollar 🔺 upside gains renewed traction early Monday, as markets ramp up their bets on delayed Fed rate cuts heading into the US Consumer Price Index (CPI) data and the Fed policy announcements due on Wednesday.⚠️

XAUUSD/Spot GOLD: Crucial Price zones today:

XAUUSD under PPZ

🔻 S2 $2244 zone

🔺 R2 $2342 zone

AVOID Big Lots.

Wednesday 12.06.2024 will mark another $100 movement in the following days.

I had alerted $100 price action is expected last week, verify here: https://t.me/c/1654158888/9313: where in $2387-$2287 price crash was observed in a single day before and after NFP data was published.

As usual, justifying a price crash after the crash or rise is too convenient for media houses, however what needs to be noticed here is that we alert and project price movements in advance, where in traders get enough time to encash it / save their account from higher drawdowns.

🟢 Hence trade wisely, at price zones projected by us and avoid taking high risks in between the price zones mentioned by me, to keep low drawdowns and higher ROI like this:

https://bit.ly/PRtrackRecord

A strong US NFP headline print and the wage inflation data drove the US Treasury bond yields sharply higher across the curve, with the 2-year Treasury yields, which is sensitive to Fed policy expectations, shooting up by the most in two months. The US Dollar followed the upsurge in the US Treasury bond yields on a significant decline in the bets for a US Federal Reserve (Fed) interest rate cut in September, weighing heavily on the non-interest-bearing 🔻 Gold price.

Markets dialed down bets of a 25 basis points (bps) rate cut in September to about 43% from about 55% before the report, according to the CME Group’s FedWatch Tool, and now see roughly an even chance of two rate cuts by the end of 2024, versus about a 68% chance seen before the NFP release, per Reuters.

Furthermore, reports that the People's Bank of China (PBoC) paused gold purchases to its reserves in May, ending a massive buying spree that ran for 18 months, further seem to undermine the Gold price. That said, a cautious market mood lends some support to the safe-haven XAU/USD and helps limit deeper losses. Traders also seem reluctant to place aggressive directional bets ahead of this week's key US data and central bank event risk – the release of the latest US consumer inflation figures and the outcome of the two-day FOMC policy meeting on Wednesday. This, in turn, warrants caution before positioning for further losses.

The US Dollar 🔺 upside gains renewed traction early Monday, as markets ramp up their bets on delayed Fed rate cuts heading into the US Consumer Price Index (CPI) data and the Fed policy announcements due on Wednesday.⚠️

XAUUSD/Spot GOLD: Crucial Price zones today:

XAUUSD under PPZ

🔻 S2 $2244 zone

🔺 R2 $2342 zone

AVOID Big Lots.

Wednesday 12.06.2024 will mark another $100 movement in the following days.

I had alerted $100 price action is expected last week, verify here: https://t.me/c/1654158888/9313: where in $2387-$2287 price crash was observed in a single day before and after NFP data was published.

As usual, justifying a price crash after the crash or rise is too convenient for media houses, however what needs to be noticed here is that we alert and project price movements in advance, where in traders get enough time to encash it / save their account from higher drawdowns.

🟢 Hence trade wisely, at price zones projected by us and avoid taking high risks in between the price zones mentioned by me, to keep low drawdowns and higher ROI like this:

https://bit.ly/PRtrackRecord

Piyush Lalsingh Ratnu

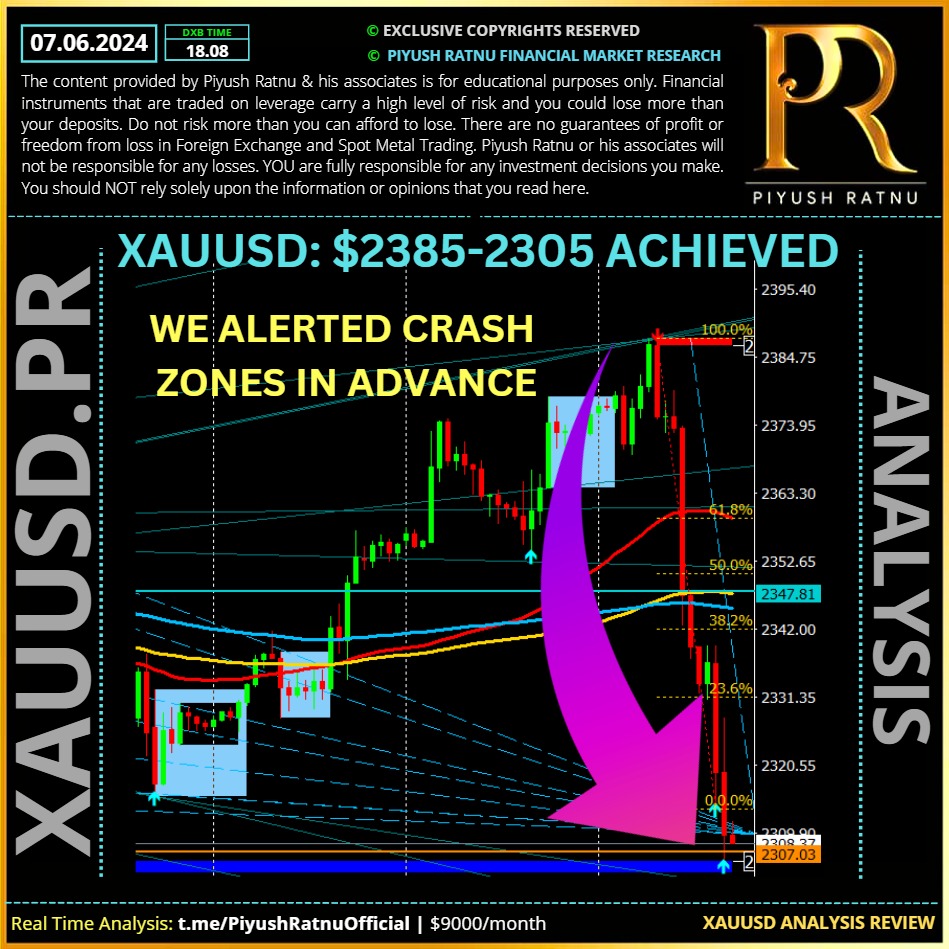

XAUUSD crashed from $2385-2305: we alerted the crash zone in advance!

Verify at:

https://t.me/c/1654158888/9436

Accuracy proved once again!

#XAUUSD #PiyushRatnu

Verify at:

https://t.me/c/1654158888/9436

Accuracy proved once again!

#XAUUSD #PiyushRatnu

Piyush Lalsingh Ratnu

Gold return slows in May

Gold posted a third consecutive monthly gain in May, rising by 2% m/m to US$2,348/oz. Despite the more moderate gain compared to March and April, gold hit a new all-time high of US$2,427/oz mid-month before pulling back – likely reflecting some profit taking. But market activity remained supportive during the month, with net long managed money positions on COMEX hitting a four-year high and gold ETFs seeing net inflows (US$529mn) for the first time since May 2023.Looking at our Gold Return Attribution Model (GRAM), there was no single variable that stood out as a key driver in May. Momentum and a weaker US dollar were positive drivers but their impact was marginal. And while the unexplained component of the model shrank considerably in May, it was still the largest factor by far. As we have noted previously, we believe some of this can be attributed to strong over-the-counter buying, including central bank purchases which have been a notable contributor to recent gold returns.

In summary

It appears the US dollar is in a protracted range-trading environment but having performed well recently it could be due for a further pullback following its first down month of 2024 in May. And as highlighted in our analysis, any prolonged weakness in the dollar should, at a minimum, ease headwinds and provide potential upside for gold over the ensuing months.

SOURCE:https://www.gold.org/goldhub/research/gold-market-commentary-may-2024#XAUUSD

CMP $2323 #Gold #NFP

Gold posted a third consecutive monthly gain in May, rising by 2% m/m to US$2,348/oz. Despite the more moderate gain compared to March and April, gold hit a new all-time high of US$2,427/oz mid-month before pulling back – likely reflecting some profit taking. But market activity remained supportive during the month, with net long managed money positions on COMEX hitting a four-year high and gold ETFs seeing net inflows (US$529mn) for the first time since May 2023.Looking at our Gold Return Attribution Model (GRAM), there was no single variable that stood out as a key driver in May. Momentum and a weaker US dollar were positive drivers but their impact was marginal. And while the unexplained component of the model shrank considerably in May, it was still the largest factor by far. As we have noted previously, we believe some of this can be attributed to strong over-the-counter buying, including central bank purchases which have been a notable contributor to recent gold returns.

In summary

It appears the US dollar is in a protracted range-trading environment but having performed well recently it could be due for a further pullback following its first down month of 2024 in May. And as highlighted in our analysis, any prolonged weakness in the dollar should, at a minimum, ease headwinds and provide potential upside for gold over the ensuing months.

SOURCE:https://www.gold.org/goldhub/research/gold-market-commentary-may-2024#XAUUSD

CMP $2323 #Gold #NFP

Piyush Lalsingh Ratnu

🆘 NFP Day: XAUUSD Price Projection:

🔻 $2313/2300/2288 on radar

🔺$23692385/2407 on radar

avoid entries till 45 minutes after NFP

18.18 and 18.30/19.19 crucial RT/PA.

Avoid BIG Lots: Monday is a Chinese and Australia holiday, hence early morning one directional price movement might be observed. Heavy DD might result in substantial losses.

I expect a price movement of $25/40 from CMP $2335, RT/continuation might be observed 18.18 onwards.

🔻scenario

Suggested PG $ 10/10/5/5/5

SMGR pattern 11 22 33 55

🔺scenario

Suggested PG $25/15/10/5/5

SMGR Pattern 111 222 333 555 888

🟢Exit in both scenarios: NAP

ALL THE BEST!

🔻 $2313/2300/2288 on radar

🔺$23692385/2407 on radar

avoid entries till 45 minutes after NFP

18.18 and 18.30/19.19 crucial RT/PA.

Avoid BIG Lots: Monday is a Chinese and Australia holiday, hence early morning one directional price movement might be observed. Heavy DD might result in substantial losses.

I expect a price movement of $25/40 from CMP $2335, RT/continuation might be observed 18.18 onwards.

🔻scenario

Suggested PG $ 10/10/5/5/5

SMGR pattern 11 22 33 55

🔺scenario

Suggested PG $25/15/10/5/5

SMGR Pattern 111 222 333 555 888

🟢Exit in both scenarios: NAP

ALL THE BEST!

Piyush Lalsingh Ratnu

Key Economic Data Today:

16:30 USD Average Hourly Earnings (YoY) (YoY) (May) 3.9% 3.9%

16:30 USD Average Hourly Earnings (MoM) (May) 0.3% 0.2%

16:30 USD Nonfarm Payrolls (May) 182K 175K

16:30 USD Participation Rate (May) 62.7%

16:30 USD Private Nonfarm Payrolls (May) 170K 167K

16:30 USD U6 Unemployment Rate (May) 7.4%

16:30 USD Unemployment Rate (May) 3.9% 3.9%

18:15 EUR ECB President Lagarde Speaks

#XAUUSD

16:30 USD Average Hourly Earnings (YoY) (YoY) (May) 3.9% 3.9%

16:30 USD Average Hourly Earnings (MoM) (May) 0.3% 0.2%

16:30 USD Nonfarm Payrolls (May) 182K 175K

16:30 USD Participation Rate (May) 62.7%

16:30 USD Private Nonfarm Payrolls (May) 170K 167K

16:30 USD U6 Unemployment Rate (May) 7.4%

16:30 USD Unemployment Rate (May) 3.9% 3.9%

18:15 EUR ECB President Lagarde Speaks

#XAUUSD

Piyush Lalsingh Ratnu

XAUUSD CMP @ H1AS1 S2

H1A100 $2313

Crucial stops BZ $2332 $2323 $2313 $2303 $2288

Target UP zones: $2342/2369/2385/2407

#XAUUSD #Gold #PiyushRatnu #PRDXB

H1A100 $2313

Crucial stops BZ $2332 $2323 $2313 $2303 $2288

Target UP zones: $2342/2369/2385/2407

#XAUUSD #Gold #PiyushRatnu #PRDXB

Piyush Lalsingh Ratnu

How to trade XAUUSD accurately on NFP Day?

#XAUUSD #NFP #NonfarmPayrolls #Forex #PRDXB #PiyushRatnu #Gold

#XAUUSD #NFP #NonfarmPayrolls #Forex #PRDXB #PiyushRatnu #Gold

Piyush Lalsingh Ratnu

Gold price (XAU/USD)🔺 attracts some follow-through buying for the second straight day and climbs to a two-week top, around the $2,373 area during the Asian session on Thursday. Moreover, the near-term bias remains tilted in favor of bulls in the wake of bets that major central banks will lower borrowing costs to bolster economic activity. In fact, the Bank of Canada (BoC) on Wednesday lowered its benchmark rate for the first time in four years, from a more than two-decade high and signaled concern about slowing economic growth. Furthermore, the European Central Bank (ECB) is also expected to 🔺cut interest rates for the first time since March 2016 at the end of its June policy meeting later today.

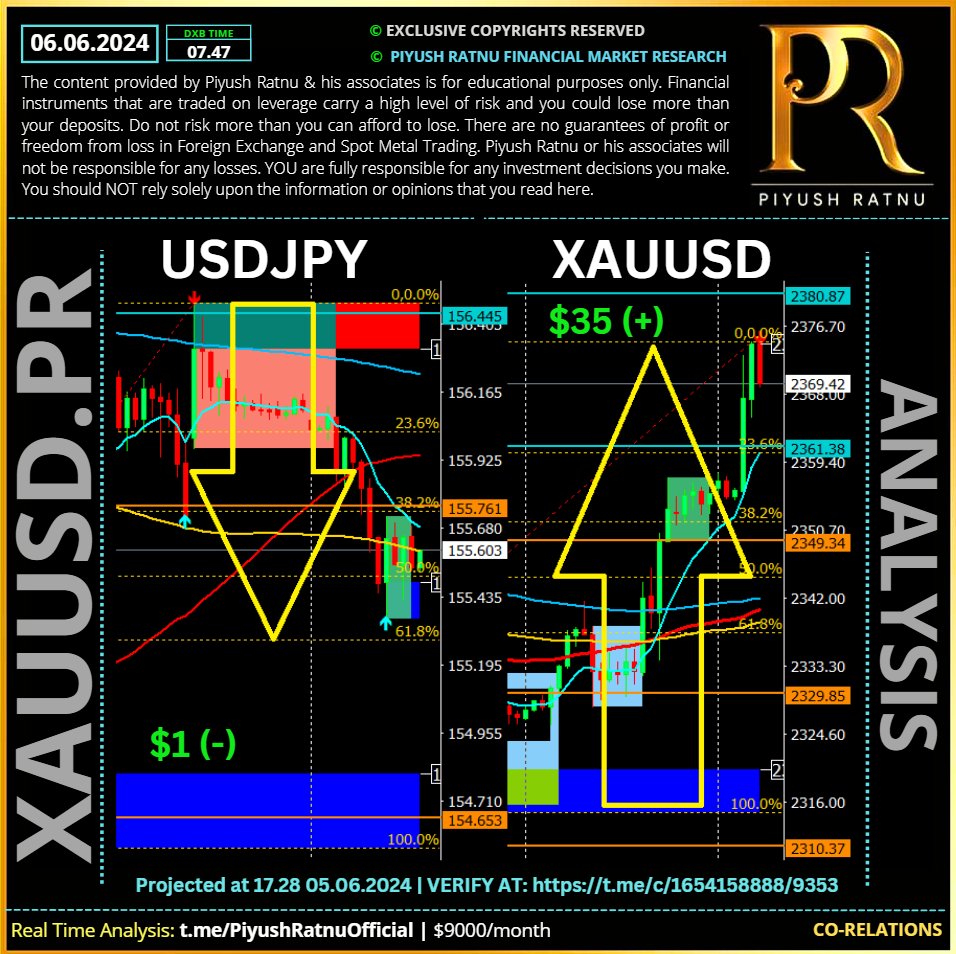

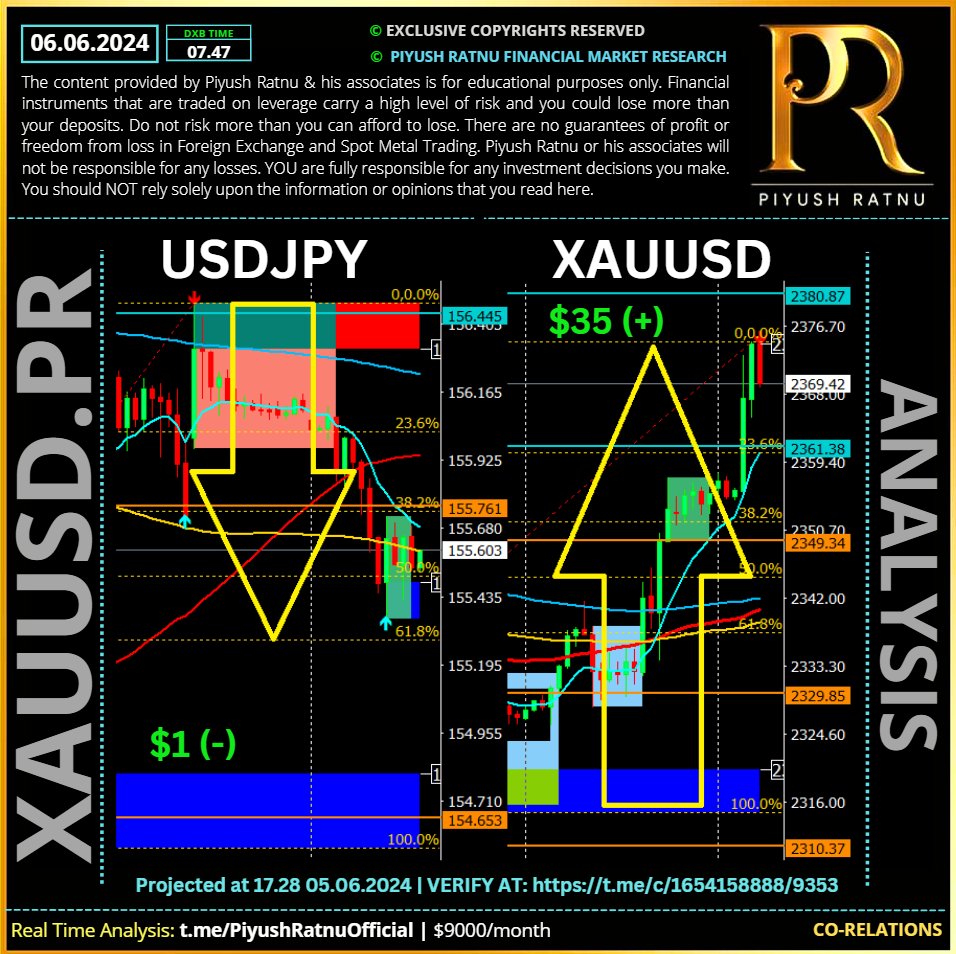

Meanwhile, the markets are now pricing in a greater chance for an imminent rate cut by the Federal Reserve (Fed) amid signs of a slowdown in the US economy. The expectations keep the 🔻US Treasury bond yields depressed near the lowest level in over two months and fail to assist the US Dollar (USD) to build on its modest recovery gains registered over the past two days. This, along with persistent geopolitical tensions stemming from ongoing conflicts in the Middle East, continues to act as a tailwind for the safe-haven Gold price. Despite a combination of supporting factors, the upside for the XAU/USD seems limited as traders keenly await the release of the 🟢US Nonfarm Payrolls (NFP) report on Friday.

✔️ $2369 target achieved as projected on 03.06.2024

Meanwhile, the markets are now pricing in a greater chance for an imminent rate cut by the Federal Reserve (Fed) amid signs of a slowdown in the US economy. The expectations keep the 🔻US Treasury bond yields depressed near the lowest level in over two months and fail to assist the US Dollar (USD) to build on its modest recovery gains registered over the past two days. This, along with persistent geopolitical tensions stemming from ongoing conflicts in the Middle East, continues to act as a tailwind for the safe-haven Gold price. Despite a combination of supporting factors, the upside for the XAU/USD seems limited as traders keenly await the release of the 🟢US Nonfarm Payrolls (NFP) report on Friday.

✔️ $2369 target achieved as projected on 03.06.2024

Piyush Lalsingh Ratnu

Subscribe to our Telegram Channel to receive Real Time XAUUSD Analysis & LIVE Trading Feed.

#PiyushRatnu | Connect at t.me/PiyushRatnuofficial

#XAUUSD #Gold #Forex #TradingEducation #Fx

#PiyushRatnu | Connect at t.me/PiyushRatnuofficial

#XAUUSD #Gold #Forex #TradingEducation #Fx

Piyush Lalsingh Ratnu

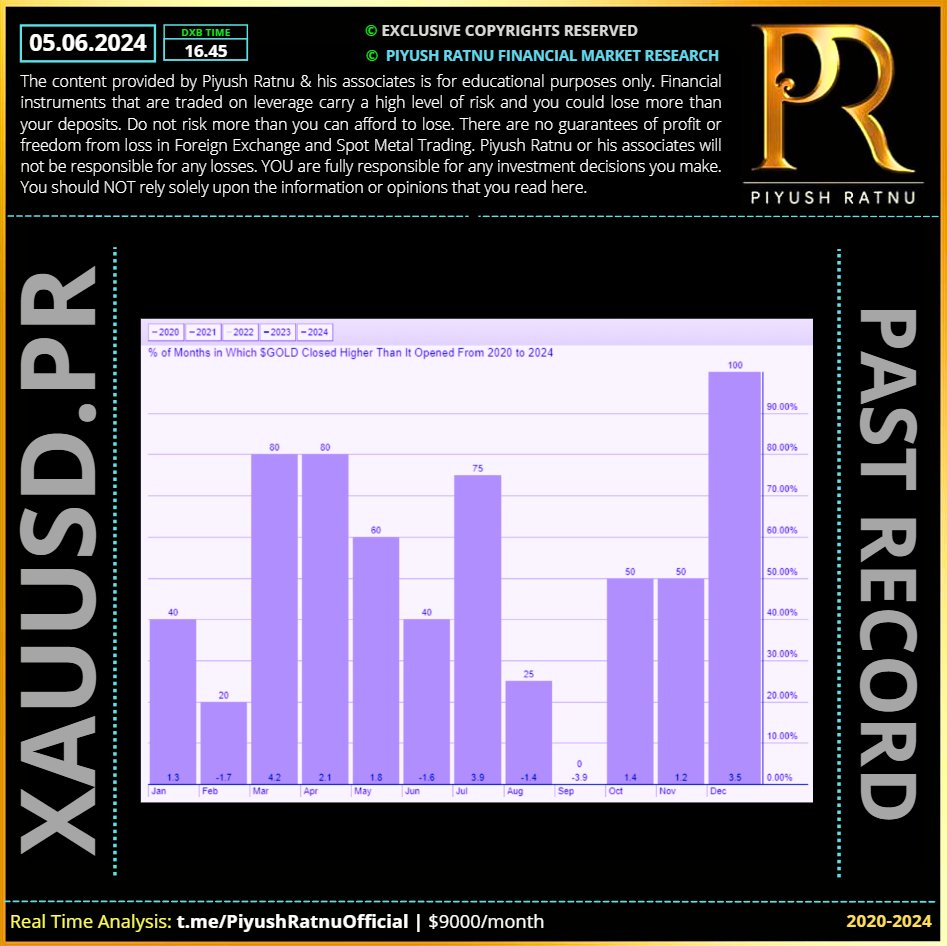

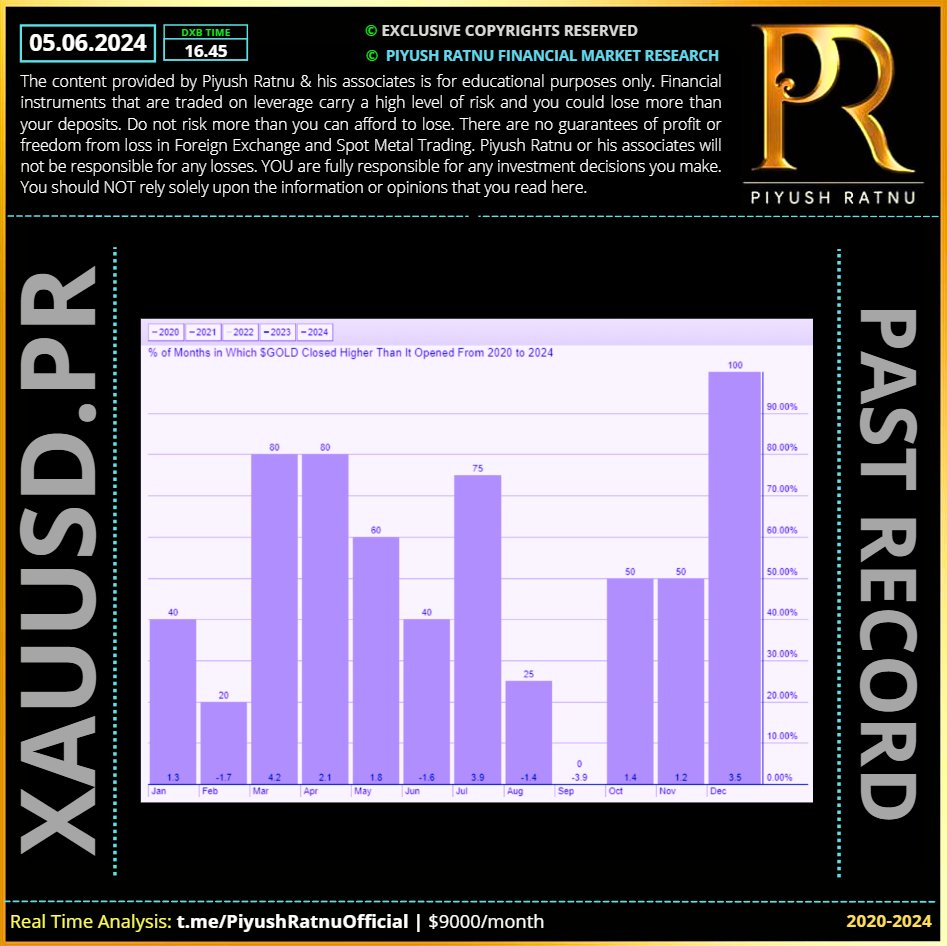

The seasonal chart of gold supports this view, showing that June has only a 40% chance of positive monthly closing, while July has a 75% chance of positive monthly closing over the past five years.

#PiyushRatnu #Gold #XAUUSD #Forex

#PiyushRatnu #Gold #XAUUSD #Forex

Piyush Lalsingh Ratnu

On Monday, Gold price defended the critical daily support line and witnessed a solid turnaround in the latter part of the day after the US Dollar was smashed alongside the US Treasury bond yields, following the release of downbeat Institute for Supply Management (ISM) Manufacturing PMI and the Price Paid component.

Data released by the ISM showed on Monday, the main PMI index dropped from 49.2 in April to 48.7 in May, missing the expected 49.6 print. The ISM Manufacturing Prices Paid eased to 57.0 in May vs. 60.9 previous and 60.0 expected.

Weak data revived bets for a September interest rate cut by the US Federal Reserve (Fed). Markets are currently pricing in about a 52% chance of a 25 basis points (bps) Fed rate cut in September, against a 47% probability of such a reduction last Friday, CME Group’s FedWatch tool shows.

In Tuesday's trading so far, Gold price is struggling to hold its recovery momentum, as the US Dollar attempts a tepid bounce along with the US Treasury bond yields, as the market mood turns cautious ahead of the key US employment data. The US JOLTS Job Opening is likely to show a slight decrease to 8.34 million on the last day of April, as against the previous reading of 8.488 million.

Additionally, the broader market sentiment will also play a pivotal role in the Gold price action, as markets seek Fed policy cues from the upcoming employment data due for release this week. The ADP employment report will be published on Wednesday and Nonfarm Payrolls data will feature on Friday. The data will help gauge the US economic performance, which will have a significant impact on the Fed’s policy action, the value of the US Dollar and the non-interest-bearing Gold price.

🟢Crucial Price Zones this week: as projected on 03.06.2024

BZ: $2288/2266/2244/2222

SZ: $2369/2385/2407/2424

XAUUSD CMP $2330, low $2328, high $2353

Selling zone projected yesterday: $2355

Buying zone projected on Friday: $2313

Both directions based price targets achieved.

#XAUUSD #PiyushRatnu #Gold #Forex

Data released by the ISM showed on Monday, the main PMI index dropped from 49.2 in April to 48.7 in May, missing the expected 49.6 print. The ISM Manufacturing Prices Paid eased to 57.0 in May vs. 60.9 previous and 60.0 expected.

Weak data revived bets for a September interest rate cut by the US Federal Reserve (Fed). Markets are currently pricing in about a 52% chance of a 25 basis points (bps) Fed rate cut in September, against a 47% probability of such a reduction last Friday, CME Group’s FedWatch tool shows.

In Tuesday's trading so far, Gold price is struggling to hold its recovery momentum, as the US Dollar attempts a tepid bounce along with the US Treasury bond yields, as the market mood turns cautious ahead of the key US employment data. The US JOLTS Job Opening is likely to show a slight decrease to 8.34 million on the last day of April, as against the previous reading of 8.488 million.

Additionally, the broader market sentiment will also play a pivotal role in the Gold price action, as markets seek Fed policy cues from the upcoming employment data due for release this week. The ADP employment report will be published on Wednesday and Nonfarm Payrolls data will feature on Friday. The data will help gauge the US economic performance, which will have a significant impact on the Fed’s policy action, the value of the US Dollar and the non-interest-bearing Gold price.

🟢Crucial Price Zones this week: as projected on 03.06.2024

BZ: $2288/2266/2244/2222

SZ: $2369/2385/2407/2424

XAUUSD CMP $2330, low $2328, high $2353

Selling zone projected yesterday: $2355

Buying zone projected on Friday: $2313

Both directions based price targets achieved.

#XAUUSD #PiyushRatnu #Gold #Forex

: