Sergey Golubev / Profilo

=========

Why this Jobless Claims is high impacted news event for some economic calendar, and some calendar is having it as low impacted? Because initially - this news event is low impacted by definition (if we are talking about how this news event should move the price by itself ony). But as this news event (value of it) is connected with the other news so the people/traders/market understands this event as high impacted from time to time.

As to the calendars so there are 2 kinds of economic calendar:

calendar which is used for analytical purposes only (discussion, technical analysis, "do not trade during the news" etc)

calendar which is used to trade news events (impacting of news events are fully related to "forecasting" the movement of the price, means: "we are expecting the price to be moved a lot during this event today so what is why this news event is high impacted in our economic calendar"

Metatrader 5 calendar is analytical calendar as I understand it.

=========

Forecasting data ... why is it so different from one calendar to an other one, but some of forecasting data are the same ones? because some forecasting data are announced in almost official way so that is why those data may be same value for any calendar for any website. But most of forecasting data values are not announced - they are just discussed before news events on different way. So, analytists are placing his own forecasting data based on something. By the way, forecasting data is not very different one from one calendar to the other one.

Cos'è il social trading? È una cooperazione reciprocamente vantaggiosa di trader e investitori in cui i trader di successo consentono il monitoraggio del loro trading e i potenziali investitori sfruttano l'opportunità di monitorare le loro prestazioni e copiare le negoziazioni di coloro che sembrano più promettenti.

Tenkan Sen / Kijun Sen Cross - very weak signal but it is coming as the first one ... but it may be a lot of false signals

price crossing Kijun Sen - more strong signal

price crossing Sinkou Span A line (Kumo Breakout)

price crossing Sinkou Span B line (Kumo Breakout)

Senkou Span A crossing the Senkou Span B (trend reversal)

Chikou Span crossing historical price - it is most strong signal for Ichimoku but it is lagging on timeframes started with H1, and not lagging for lower timeframes.

The combination of all those 6 signals = Ichimoku indicator.

- Kijun Sen - moving average of the highest high and lowest low over the last 26 trading days. (Highest high + Lowest low) / 2 over the last 26 trading days.

- Senkou Span A - the average of the Tenkan Sen and Kijun Sen, plotted 26 days ahead. (Tenkan Sen + Kijun Sen) / 2 plotted 26 days ahead

- Senkou Span B - the average of the highest high and lowest low over the last 52 days, plotted 26 days ahead. (Highest high + Lowest low) / 2 over the last 52 trading days plotted 26 days ahead.

- Chikou Span - the closing price plotted 26 days behind.

Qualsiasi trader darebbe molto per l'opportunità di rilevare con precisione una tendenza in un dato momento. Forse, questo è il Santo Graal che tutti stanno cercando. In questo articolo, considereremo diversi modi per rilevare una tendenza. Per essere più precisi - come programmare diversi modi classici per rilevare una tendenza mediante MQL5.

È passato più di un anno da quando MQL5 ha iniziato a fornire supporto nativo per OpenCL. Tuttavia, non molti utenti hanno capito il vero valore nell'utilizzo del calcolo parallelo nei loro Expert Advisor, indicatori o script. Questo articolo ti aiuta a installare e configurare OpenCL sul tuo computer in modo che tu possa provare a utilizzare questa tecnologia nel terminale di trading MetaTrader 5.

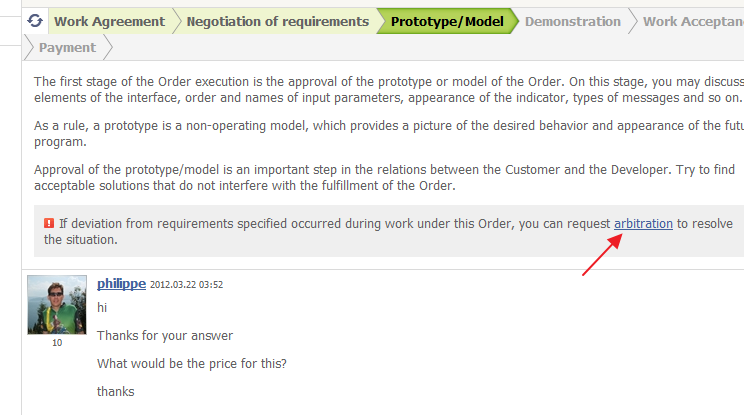

- he can do it by himself (if he understands mql5 programming language)

- he can ask someone using Job service for example,

- or some coder can do it for free for him ... but coders are coding for free if it is interesting for them personally and if it is interesting for majority of mql5 members.