Sergey Golubev / Profilo

For those debating whether or not the Federal Reserve will start tapering at its September taper, Wednesday’s Beige Book likely did little to convince the skeptics or spark doubt from the believers.

read more here: http://www.forbes.com/sites/steveschaefer/2013/09/04/feds-beige-book-housing-autos-pace-growth-but-lending-weakens/

THX 1138 (source - wikipedia):

As of 2013, the film is rated "fresh" on the review aggregator Rotten Tomatoes with a score of 90% and an average rating of 7/10. The consensus reads, "George Lucas' feature debut presents a spare, bleak, dystopian future, and features evocatively minimal set design and creepy sound effects.

be first to know and read more on this thread : https://www.mql5.com/en/forum/13601/page2

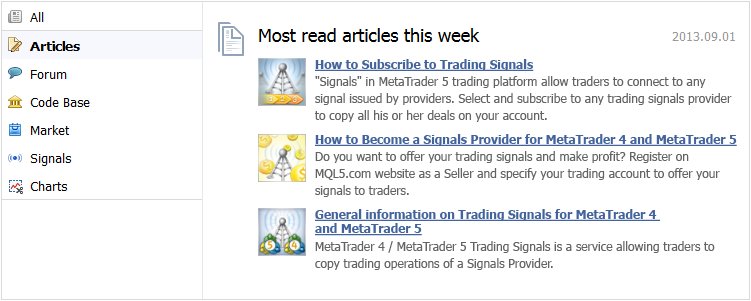

Analizza gli esempi di tecniche su come l'analisi del trading può essere eseguita sulla piattaforma MetaTrader 5 e MetaTrader 4. L'articolo ti mostrerà come creare un semplice fornitore di segnali nel tuo MetaTrader 5 e connetterti ad esso con più client, anche eseguendo MetaTrader 4. Inoltre scoprirai come puoi seguire i partecipanti all’Automated Trading Championship nel tuo vero conto MetaTrader 4.

Come scrivere correttamente le specifiche dei requisiti? Cosa ci si dovrebbe e non ci si dovrebbe aspettare da un programmatore quando ordina un Expert Advisor o un indicatore? Come mantenere un dialogo, a quali momenti prestare particolare attenzione? Questo articolo fornisce le risposte a queste e a molte altre domande, le quali spesso non sembrano ovvie a molte persone.

You Don't Need A Crystal Ball To See Why These 3 Stocks Will Go Higher

read more here : http://www.forbes.com/sites/wallaceforbes/2013/09/03/you-dont-need-a-crystal-ball-to-see-why-these-3-stocks-will-go-higher/

1. Trading the breakout channel

Forex Traders simply set Buy and Sell pending orders on both sides of a price channel, so when the data comes out one of the orders will probably be hit. Although this method is very simple, it also carries real risks of potentially hitting two orders: Buy and Sell as the market is shaken by the economic report. In such a double-hit situation traders will face losses on one or sometimes even both trades.

2. By analyzing the news report

Forex Traders can predict most probable outcome of the news by looking at the economic calendar fields labeled as Forecast and Previous. These figures are then compared with the economic data released to give an idea about the current economic situation.

Forex Traders watch the news report and pay attention to the actual numbers released. If the numbers come as a surprise meaning the reports are not close to what was expected or forecasted, then fundamental analysts opening trading position according to the economic reports. If the report is better than expected then fundamental traders open Long positions. If the reports are not favorable traders open Short positions.

The most important thing you have to know about fundamental analysis is the market expectation of an indicator. Economic analysts provide a prediction of a probable number of the indicator to be announced. This has an impact to the market and traders are positioned accordingly. When the indicator is announced it affects the market only when the report is different from what the market expected. That happens because every available to the public information is already taken into account.

New York-traded crude oil futures fell more than 1% on Friday, giving back some of the week’s strong gains amid fading expectations for imminent U.S. military action against Syria.

On the New York Mercantile Exchange, light sweet crude futures for delivery in October fell 1.05% Friday to settle the week at USD107.66 a barrel by close of trade. The October contract settled 1.2% lower at USD108.80 a barrel on Thursday.

Oil futures were likely to find support at USD105.58 a barrel, the low from August 26 and resistance at USD110.03 a barrel, the high from August 29.

Despite Thursday’s and Friday’s sharp losses, Nymex oil futures still ended the week with a 1.2% gain.

"Will You Still Love Me?" is a song written by David Foster, Tom Keane and Richard Baskin for the group Chicago and recorded for their album Chicago 18 (1986). The second single released from that album, it reached #3 on the U.S. Billboard Hot 100 chart.

The song was Chicago's first Top Ten hit after the departure of Peter Cetera, and it featured new singer and bassist, Jason Scheff on lead vocals. One of the song's co-writers, Tom Keane had previously fronted the early 1980s band Keane, for whom Jason Scheff played bass.

=====

Q: what is the most profitable pair to trade the news?

A: GBPUSD

=====

Q: what is the most risky pair to trade the news?

A: GBPUSD

=====

Q: what is the most stable pair to trade the news (consistantly profitable pair for trading news events)?

A: USDCAD

=====

Q: what is less risky pair to trade the news?

A: USDCAD

=====

Thanx for your attention

That's all news

Bull market (Bull Market).

Bear market (Bear Market).

Correction (Correction) in a bull market.

Correction in a bear market (Bear Market Rally).

Choppy market (Choppy Market).

Flat market (Sideways Market).