Vincent Vandeyua Orya / Perfil

- Información

|

no

experiencia

|

5

productos

|

14

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

¡Saludos, colegas traders!

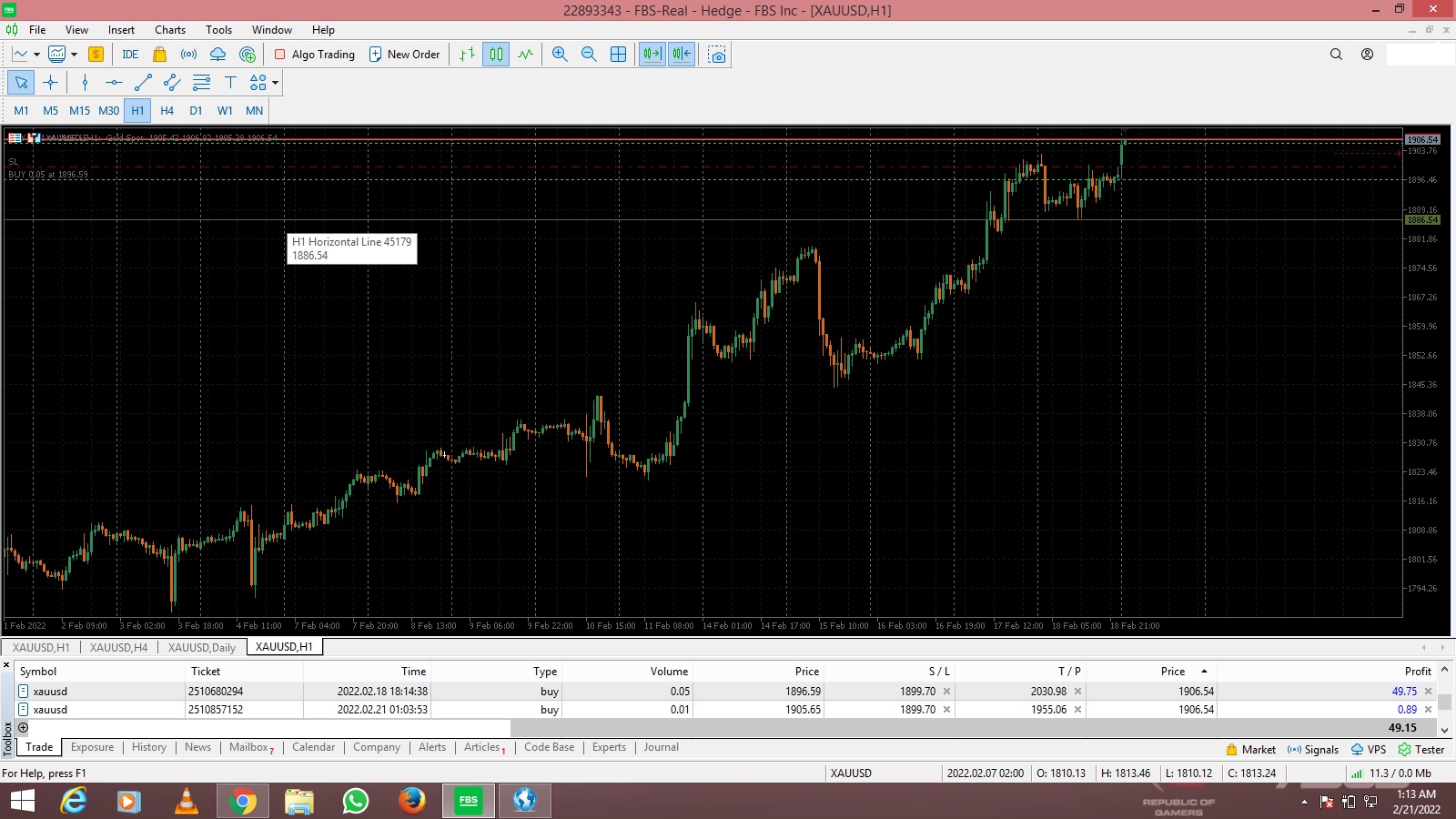

Después de muchos años de estudio intensivo y compromiso directo con el mercado de Forex, mi viaje ha sido de continuo aprendizaje y evolución. Inicialmente, opté por la participación inmediata en el mercado real en lugar de cuentas demo, un camino que, aunque incurrió en contratiempos de capital tempranos, me proporcionó conocimientos invaluables del mundo real sobre las disciplinas psicológicas cruciales para el éxito: gestionar eficazmente la codicia, superar el miedo a perderse algo (FOMO) y cultivar la perseverancia esencial para una rentabilidad sostenida.

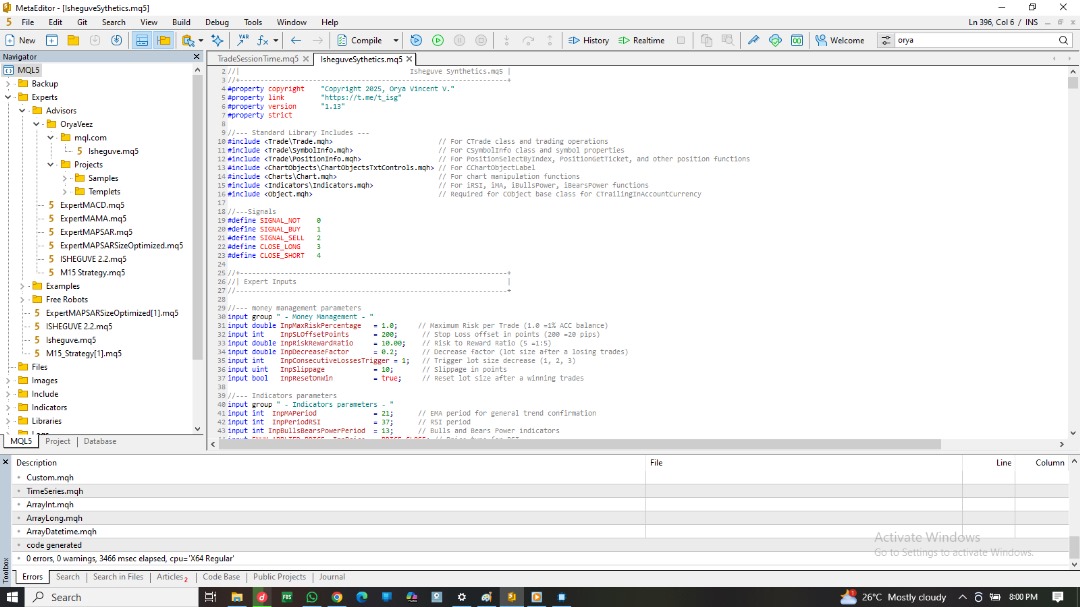

Esta experiencia fundamental culminó en el desarrollo de una estrategia de trading manual altamente efectiva y notablemente sencilla, diseñada para facilitar su adopción y demostrando consistentemente una tasa de éxito de hasta el 87%. Si bien esta estrategia resultó consistentemente rentable durante varios años, mi impulso inherente a la innovación me llevó a explorar su automatización. En lugar de subcontratar este paso crítico, me comprometí a dominar la programación MQL5. Aprovechando los recursos integrales de "Programación MQL5 para Traders", rápidamente adquirí competencia, desarrollando con éxito clases, scripts y Expert Advisors (EAs) funcionales en MQL5 en cuestión de meses.

La cúspide de este desarrollo es "ISHEGUVE", un Expert Advisor propietario meticulosamente elaborado desde cero, basándose en las sólidas capacidades de las bibliotecas estándar de MQL5 y el conocimiento adquirido de MQL5Book. Estoy inmensamente orgulloso de esta creación y su rendimiento.

Aunque mi cuenta de MQL5.com fue establecida hace muchos años, mi enfoque principal estaba en otra parte hasta mi reciente verificación de cuenta. Ahora estoy totalmente comprometido a participar activamente en esta vibrante comunidad de trading, interactuar con el mercado y ofrecer mi experiencia a través de oportunidades de trabajo independiente.

Los invito a explorar mis productos y servicios, y espero contribuir a nuestro éxito compartido.

¡ Domine su análisis de mercado con Isheguve Trend Scout ! ¿Cansado de trazar manualmente líneas de tendencia y perderse los cambios clave del mercado? 🚀Isheguve Trend Scout es una aplicación de utilidad MQL5 diseñada para darle una ventaja mediante la identificación automática y el trazado de líneas de tendencia en su gráfico. Por qué elegir Isheguve Trend Scout ? 🔥 Detección de tendencias sin esfuerzo: ✅ Deje de adivinar y deje que la aplicación haga el trabajo por usted. Trend Scout Pro

Guía de Usuario: ISHEGUVE Crash Trader (Versión Simplificada de ISHEGUVE Smart Trader) 1. Introducción a ISHEGUVE Crash Trader El ISHEGUVE Crash Trader es un sistema de trading automatizado diseñado específicamente para operar en el Crash Index, uno de los Índices Sintéticos. Estos índices simulan movimientos del mercado real y están disponibles en plataformas como Deriv.com . Este Asesor Experto (EA) es una versión simplificada del ISHEGUVE Smart Trader, que se enfoca en funcionalidades

Guía del usuario de Isheguve Scalper pro 1. Introducción a Isheguve Scalper Pro Isheguve Scalper Pro es un sofisticado Asesor Experto MQL5 diseñado para automatizar sus decisiones de trading. Integra el análisis técnico avanzado con una gestión robusta del dinero y de las operaciones para proporcionar una solución completa de trading automatizado. Las características principales incluyen: Reconocimiento de patrones de velas: Identifica varias formaciones de velas de inversión y continuación

Guía del usuario de Isheguve Scalper pro 1. Introducción a Isheguve Scalper Pro Isheguve Scalper Pro es un sofisticado Asesor Experto MQL5 diseñado para automatizar sus decisiones de trading. Integra el análisis técnico avanzado con una gestión robusta del dinero y de las operaciones para proporcionar una solución completa de trading automatizado. Las características principales incluyen: Reconocimiento de patrones de velas: Identifica varias formaciones de velas de inversión y continuación

2. Advanced Candlestick Pattern Recognition

Description: IsheguveScalper identifies a comprehensive suite of powerful candlestick patterns, giving you an edge in market reversals and trend continuations.

Advantages:

2.1. Early Signal Generation: Candlestick patterns are often leading indicators, meaning they can signal potential market shifts before other indicators confirm them. By recognizing a "comprehensive suite" of these patterns, IsheguveScalper can identify high-probability trade setups earlier, allowing for more favorable entry and exit points.

✅Identification of Reversals: Many powerful candlestick patterns (e.g., Engulfing patterns, Hammers, Dojis, Morning/Evening Stars) are specifically designed to signal a potential reversal in the current trend. An EA that can accurately detect these patterns can capitalize on turning points in the market, allowing it to enter trades at the beginning of new trends or exit existing trades before a reversal erodes profits.

✅ Confirmation of Continuations: Beyond reversals, some candlestick patterns (e.g., Three White Soldiers, Three Black Crows) indicate the continuation of an existing trend. The EA's ability to recognize these patterns means it can confidently hold positions or add to them, riding sustained market movements for greater profit.

✅ Insight into Market Sentiment: Each candlestick tells a story about the battle between buyers and sellers over a specific period. By recognizing patterns, the EA effectively "reads" market sentiment – whether buyers are gaining control, sellers are dominating, or there's indecision. This deeper understanding of market psychology, automated by the EA, can lead to more accurate trade decisions.

✅ Reduced False Signals (when combined with other analysis): While individual candlestick patterns can sometimes produce false signals, an "advanced" recognition system, especially when combined with other indicators (as implied by other features of the EA), can filter out less reliable patterns. This increases the overall accuracy of trade signals generated by the EA.

✅ Objective Analysis: Human traders can be prone to misinterpreting candlestick patterns due to emotional biases or lack of experience. An automated system like IsheguveScalper provides objective, rule-based recognition, ensuring consistency and adherence to predefined trading logic.

✅ Speed and Efficiency: Manually scanning charts for candlestick patterns across multiple currency pairs and timeframes is time-consuming and prone to human error. An EA can perform this analysis instantaneously and continuously, identifying opportunities that a human trader might miss.

✅ Enhanced Decision Making: By providing precise, automated identification of significant candlestick patterns, the EA equips itself with a powerful tool for making informed trading decisions, whether it's entering a new position, managing an existing one, or preparing for a market shift.

🚀✅In essence, IsheguveScalper's advanced candlestick pattern recognition feature gives it a highly sophisticated "eye" for reading market price action. This allows it to proactively identify potential turning points and trend strengths, providing a significant advantage in executing timely and profitable trades.

https://www.mql5.com/en/accounting/buy/market/142818

Here's a summary of all its features.

📈 What Makes IsheguveScalper Stand Out?

1. Intelligent Money Management & Risk Control.

2. Advanced Candlestick Pattern Recognition.

3. Robust Indicator Confirmation.

4. Flexible Trade Execution & Management.

1. 🔥Intelligent Money Management & Risk Control.

The IsheguveScalper EA boasts several powerful features centered around intelligent money management and risk control, which are crucial for consistent and disciplined trading. Let's break down the advantages of each:

1.1. 🚀 Dynamic Lot Sizing

Description: The EA automatically calculates the optimal lot size for each trade based on a configurable maximum risk percentage (e.g., 1% of equity per trade).

Advantages:

✅ Protects Capital: This is arguably the most significant advantage. By risking a fixed percentage of your equity per trade, you ensure that no single loss can significantly deplete your account. If your equity decreases, the lot size will automatically decrease, reducing your exposure. Conversely, if your equity grows, the lot size will increase, allowing you to compound your gains efficiently.

✅ Adapts to Account Growth/Drawdown: Dynamic lot sizing naturally scales your trading activity with your account performance. This is far superior to fixed lot sizes, which can lead to over-leveraging during drawdowns or under-utilizing capital during periods of growth.

✅ Removes Emotional Bias: Manually calculating lot sizes can be tedious and prone to emotional decisions (e.g., risking more than planned after a winning streak). Automation ensures consistency and discipline.

✅ Optimizes Profit Potential: As your account grows, dynamic lot sizing allows you to gradually increase your exposure, maximizing the compounding effect of profitable trades without increasing your risk per trade percentage.

1.2. 🚀🚀Adaptive Risk Adjustment

Description: The EA reduces lot size after a specified number of consecutive losses (e.g., 20% decrease after 1 loss) and resets after a win, helping to protect your capital during drawdowns.

Advantages:

✅ Drawdown Protection: This feature is a proactive measure against prolonged losing streaks. By reducing lot size after consecutive losses, the EA automatically lessens the impact of further losses, giving your account a better chance to recover. This is a critical aspect of "survivability" in trading.

✅ Reduces Emotional Stress: Knowing that the EA will automatically adjust risk during difficult periods can significantly reduce the psychological burden on the trader.

✅ Enhances Longevity: By systematically reducing exposure during unfavorable market conditions or strategy performance, the EA helps preserve capital, allowing the system to remain in the market longer and wait for more favorable conditions to return.

✅ Automated Recovery Mechanism: The reset after a win encourages a measured increase in risk as the EA proves its ability to generate profits again, allowing for gradual recovery without being overly aggressive.

1.3. 🚀🚀Flexible Stop Loss & Take Profit

Description: You can set your Stop Loss offset in points (e.g., 20 pips) from detected patterns and define your desired Risk-to-Reward Ratio (e.g., 1:10) for disciplined profit targets.

Advantages:

✅ Risk Management: Stop Loss (SL) is a fundamental risk management tool. By setting it at a specific offset from detected patterns, the EA ensures that every trade has a predefined maximum loss, preventing catastrophic losses from unexpected market movements.

✅ Profit Maximization (with discipline): Take Profit (TP) allows the EA to automatically lock in profits when a predefined target is reached. This removes the temptation to let winning trades run too long and risk a reversal, or conversely, to close them too early out of fear.

✅ Disciplined Exits: Both SL and TP ensure that trades are closed objectively, based on pre-set parameters, rather than emotional decisions. This consistency is vital for long-term profitability.

✅ Defined Risk-to-Reward Ratio: Setting a specific Risk-to-Reward (R:R) ratio, like 1:10, forces a systematic approach to trade selection. It means that for every 1 unit of risk, the EA aims for 10 units of profit. This ratio is a cornerstone of profitable trading, as it allows a system to be profitable even with a relatively low win rate.

✅ Automated Execution: The EA handles the placement and management of these orders, freeing the trader from constant monitoring and allowing them to focus on other aspects or simply let the EA run.

✅ Strategic Alignment: By setting SL based on "detected patterns," it implies that the stop loss is placed logically in relation to the market structure that triggered the trade, increasing the probability of it being a technically sound exit point.

🚀✅In summary, the IsheguveScalper EA's money management and risk control features are designed to create a robust and resilient trading system. They automate critical aspects of risk management, protect capital during drawdowns, adapt to account performance, and enforce disciplined trade exits, all of which are paramount for achieving long-term consistency in trading.

https://www.mql5.com/en/market/product/142818?source=Site+Market+MT5+Search+Rating006%3aIsheguveScalper

ISHEGUVE SMART TRSDER's Key Features at a Glance, Backed by Performance:

📈 Intelligent Trade Entry & Exit:

Advanced Pattern Recognition: Utilizes a comprehensive suite of candlestick patterns including Morning Star, Morning Doji, Hammer, Engulfing, Harami, Piercing Line, Meeting Lines, Three White Soldiers, Three Black Crows, and Pin Bars.

Multi-Indicator Confirmation: Signals are confirmed by RSI (Relative Strength Index) for overbought/oversold conditions and SMA (Simple Moving Average) for trend direction, ensuring high-probability setups.

Bulls/Bears Power Integration: Further validates trade signals with the strength of market participants.

RSI-Based Exits: Dynamically closes positions when RSI indicates reversal or continuation levels are met, ensuring timely profit-taking or loss cutting.

💰 Sophisticated Money Management:

Risk-Based Lot Sizing: Automatically calculates optimal lot size based on your defined maximum risk percentage per trade (e.g., 1.0%) and Stop Loss in account currency (e.g., 20.0 USD).

Adaptive Lot Adjustment: Implements a unique strategy to decrease lot size (e.g., by 0.8 factor) after a configurable number of consecutive losses (e.g., 2 losses), and resets on a win, protecting your capital. This proactive approach helps mitigate prolonged losing streaks, a key factor in the high Short Trades won % (79.39%) and Long Trades won % (93.30%).

Configurable Risk-Reward Ratio: Set your desired profit target based on your Stop Loss (e.g., 1.5 Risk-Reward).

🛡 Dynamic Position Control:

Currency-Based Trailing Stop: Protects profits by trailing your Stop Loss based on currency values (e.g., starts trailing after $50.0 profit, steps by $10.0, with a $5.0 offset), locking in gains as the market moves in your favor.

Pending Order Management: Places Buy Stop/Sell Stop orders with a configurable offset (e.g., 10 points) from pattern highs/lows.

Time-Based Position Expiry: Optionally closes positions after a specified number of bars (set to 0 for disabled by default, but customizable).

Session-Based Trading: Automatically ceases new order placement 30 minutes before your defined session end time (e.g., 23:55) and closes all open positions 10 minutes before, ensuring you avoid volatile closing moments.

Slippage Control: Minimizes unexpected price deviations with a maximum slippage setting (e.g., 10 points).

Why Choose ISHEGUVE SMART TRSDER?

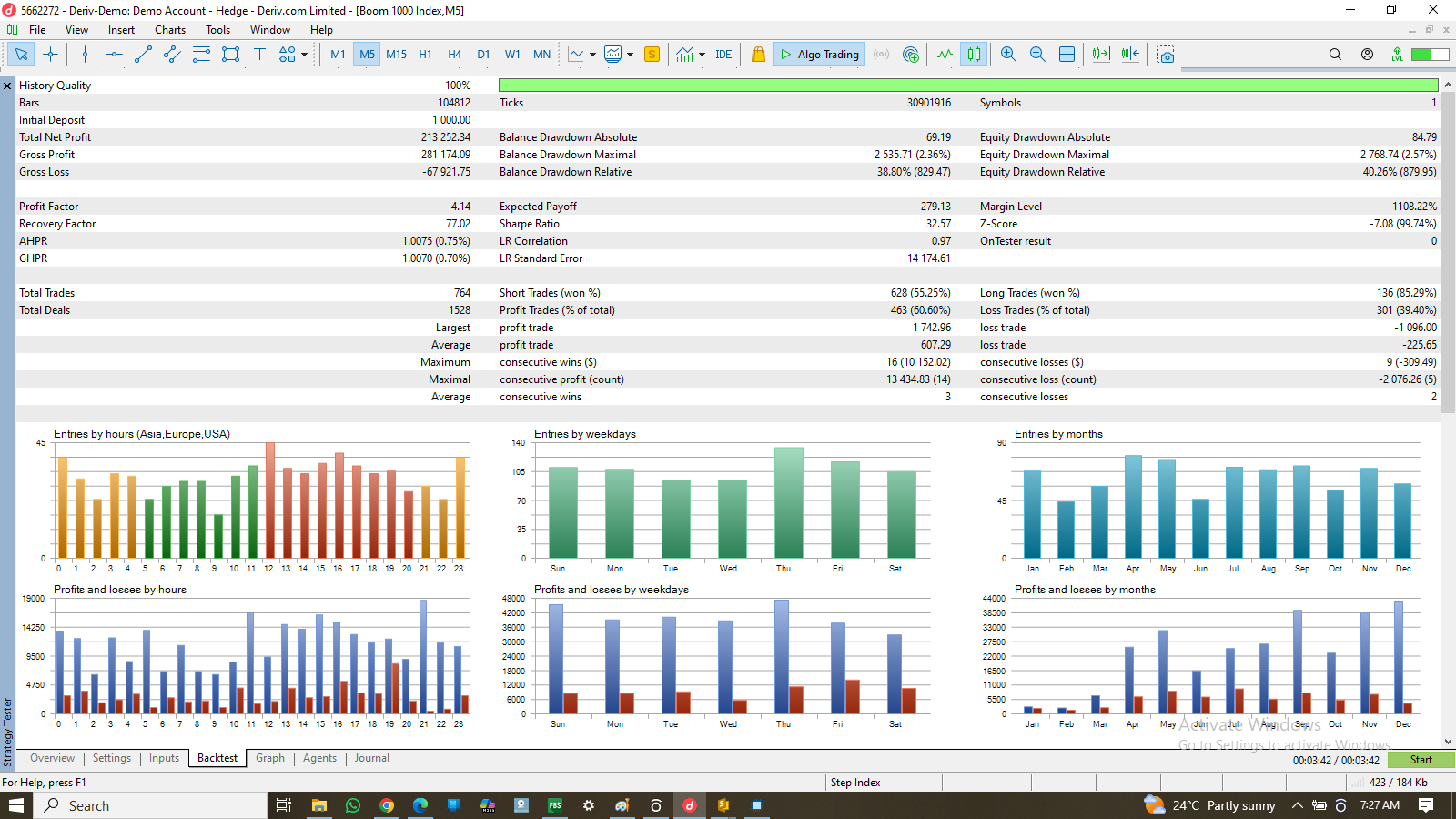

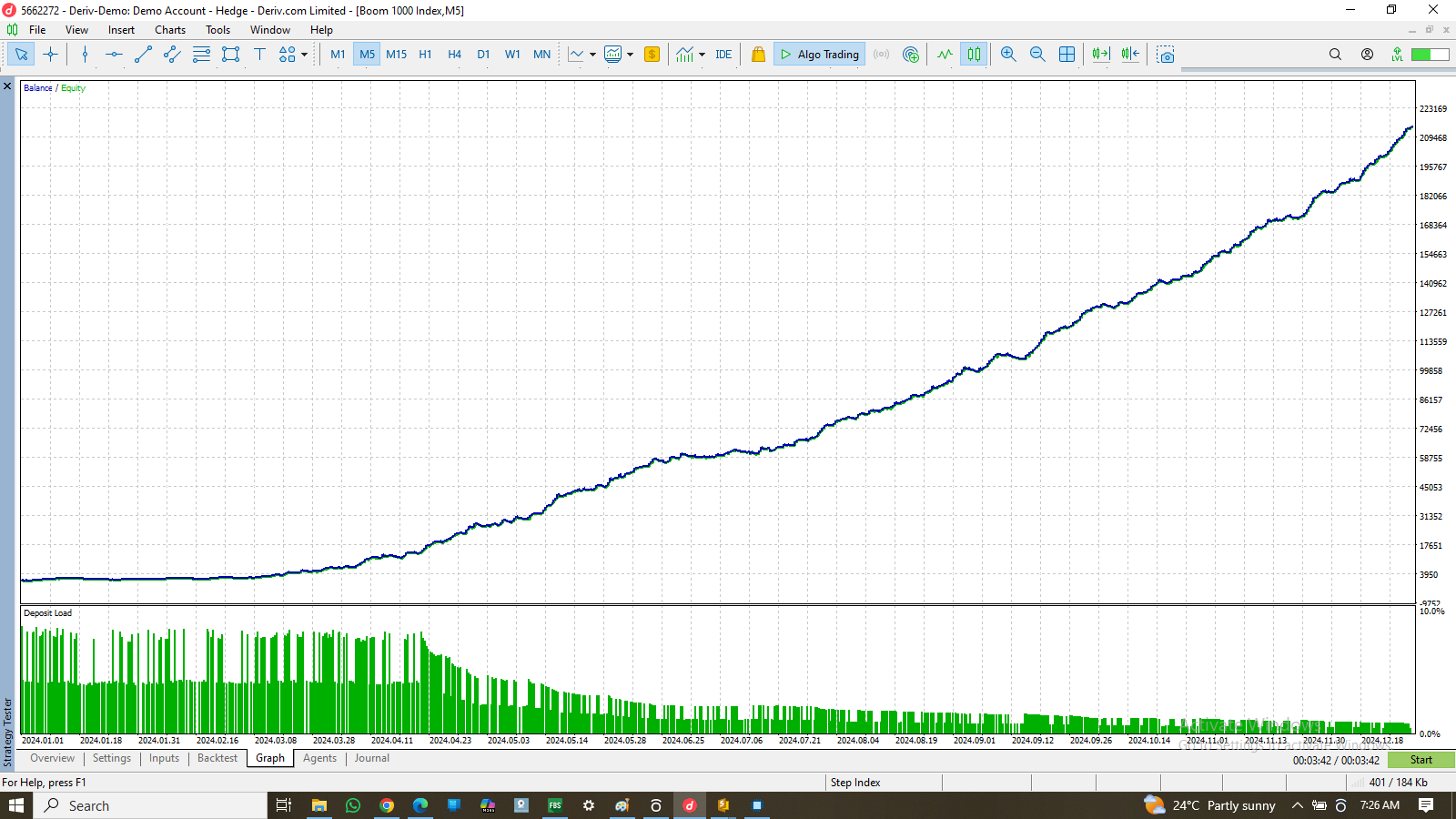

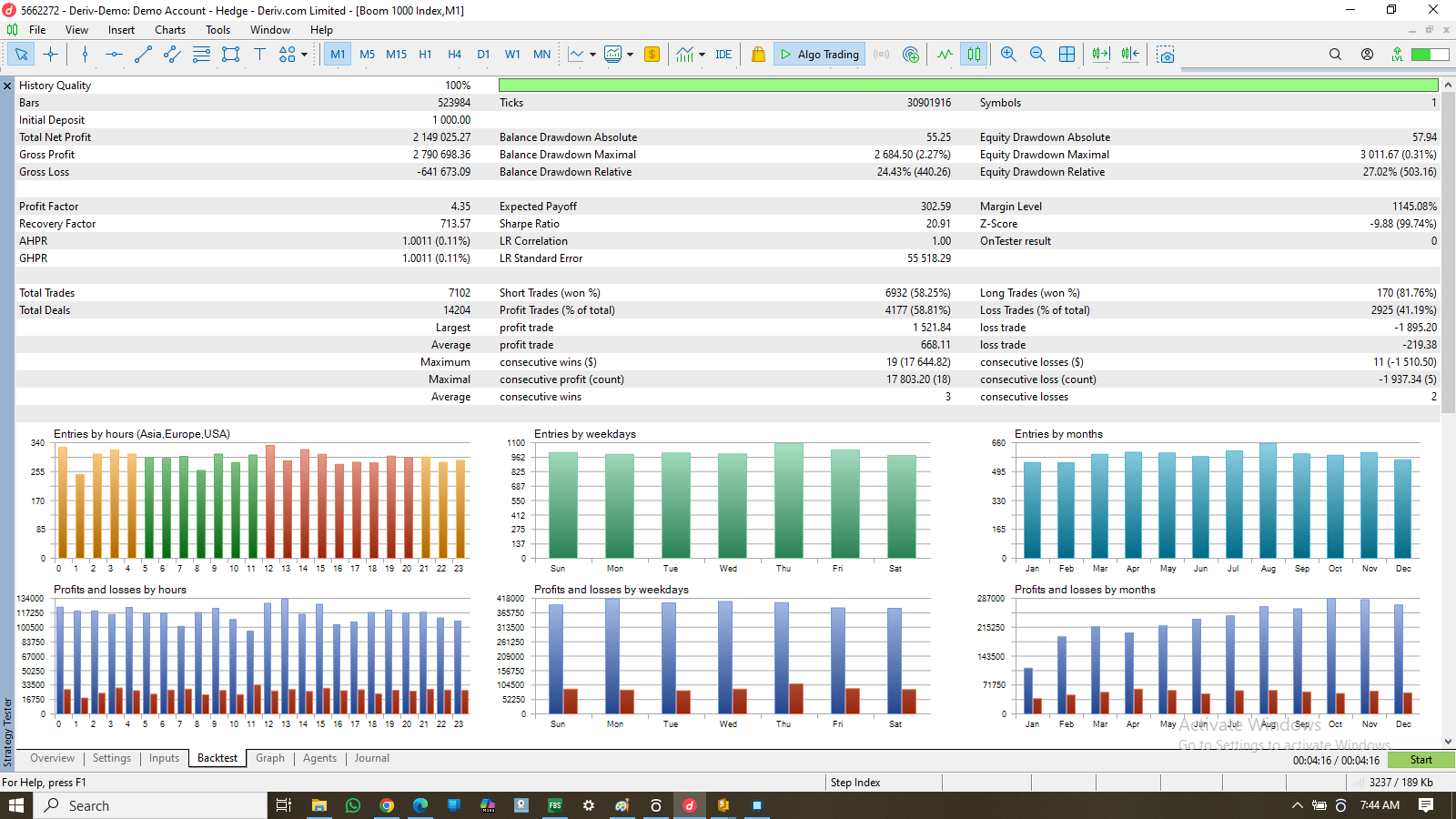

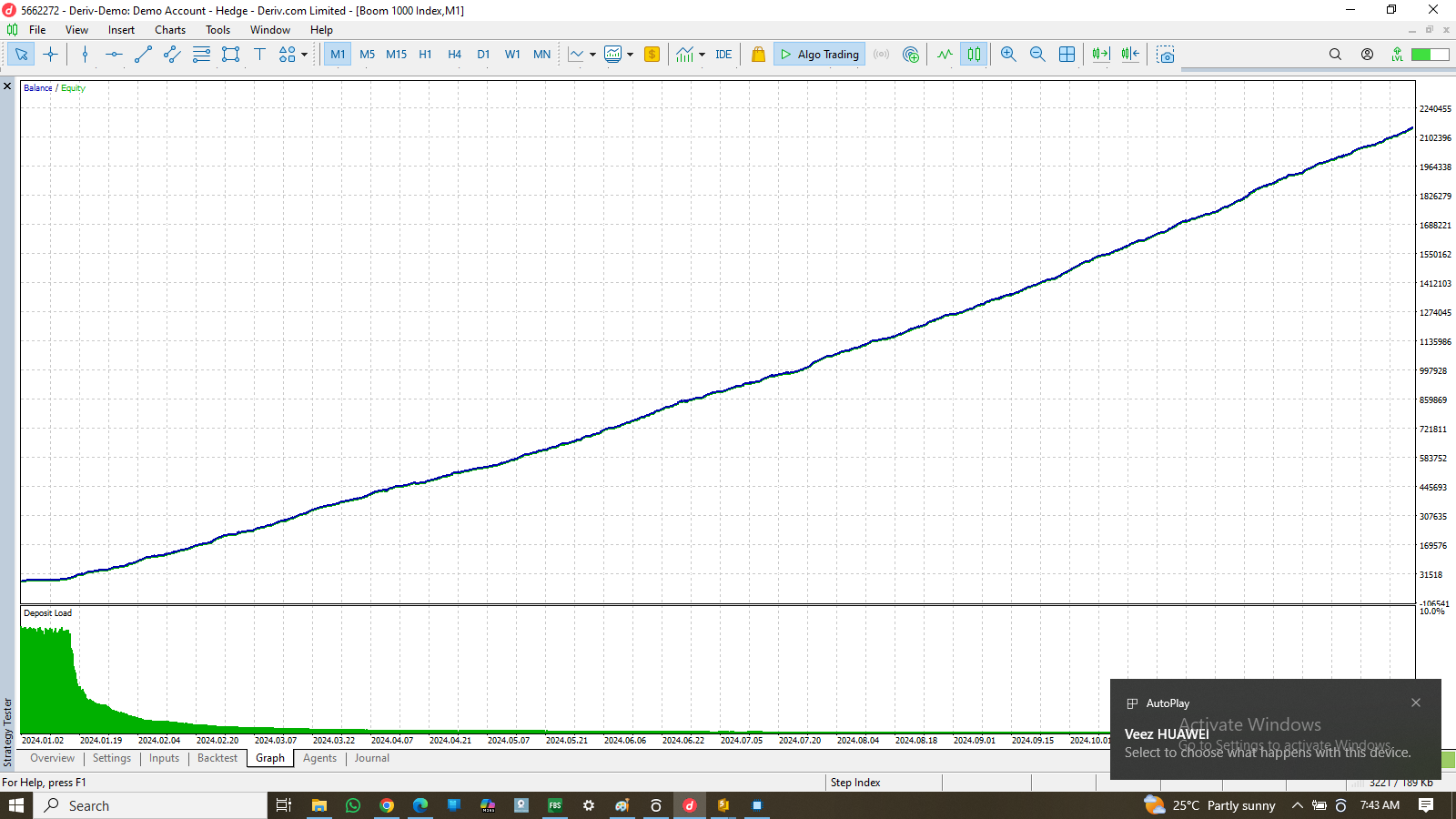

Proven Performance: The backtest results speak for themselves, showcasing consistent profitability and robust risk management. The Maximum Drawdown Relative of 8.86% (8.75%) and Maximum Drawdown Absolute of 2,055.27 (3.16%) are remarkably low for such substantial gains, highlighting the EA's capital protection capabilities.

Automated Discipline: Removes emotional trading by adhering strictly to predefined rules, leading to more consistent and objective trading decisions.

Capital Protection: Advanced money management, adaptive lot adjustment, and trailing stops are meticulously designed to safeguard your trading account, as demonstrated by the low drawdowns.

Customizable Strategy: Adjust key parameters like RSI levels, MA periods, risk percentages, and trailing stop settings to fit your unique trading style and evolving market conditions.

Comprehensive Error Handling: Built-in mechanisms to detect and report potential issues directly on your chart, keeping you informed.

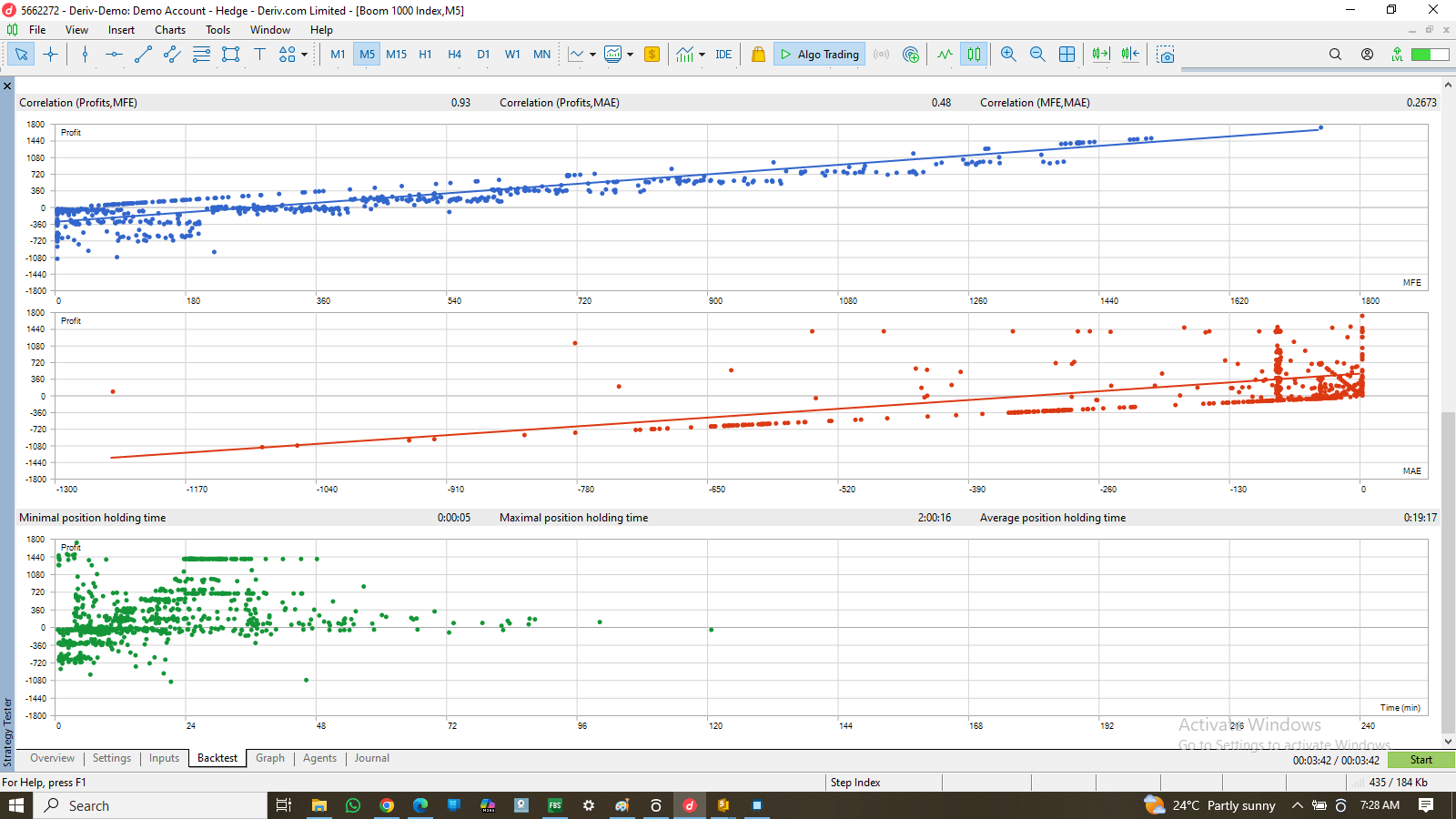

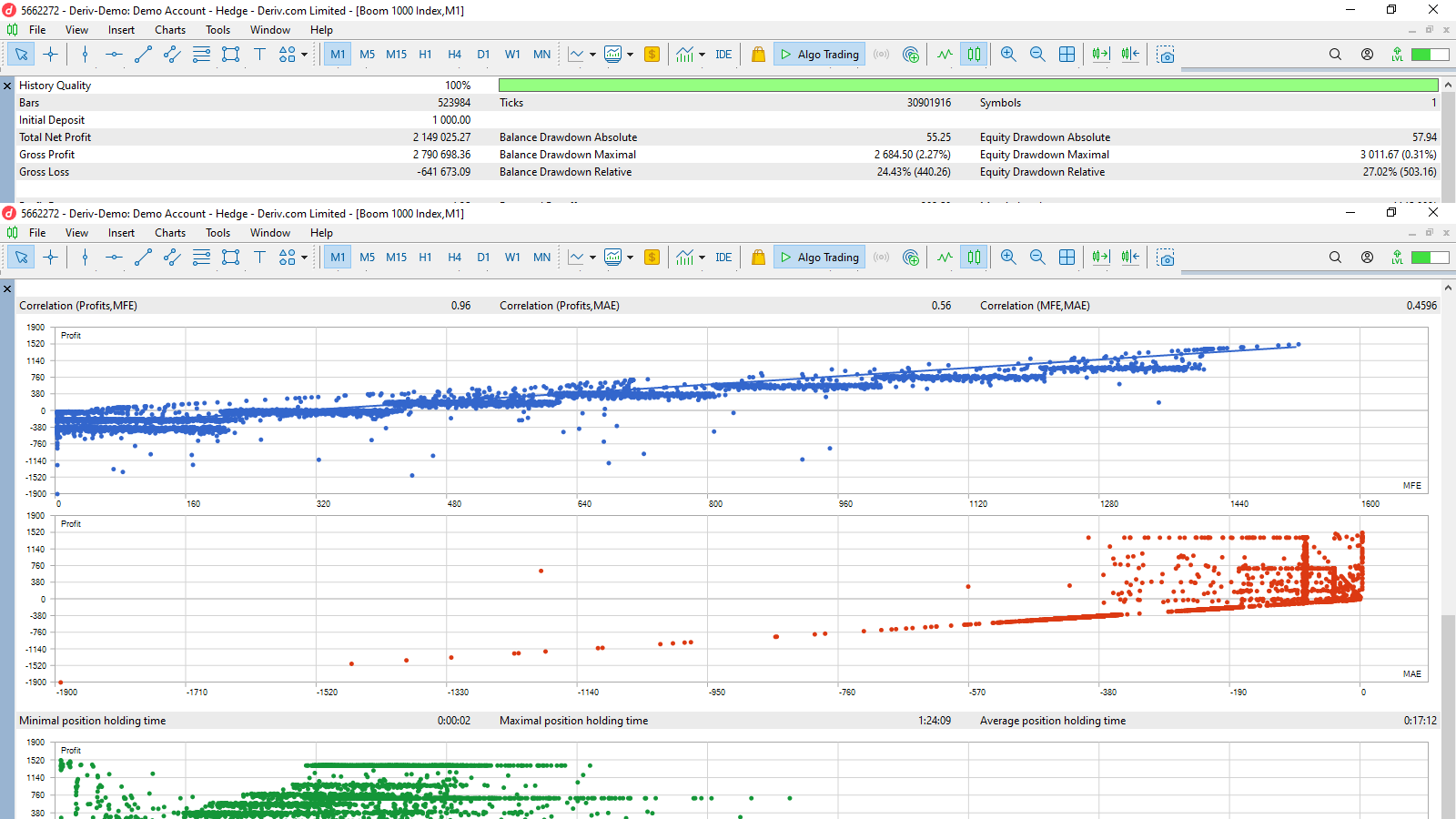

The scatter plot (as seen in SressTestIsheguveSyntheticsM1ascket02.png ) illustrates a positive correlation between profit and drawdown, confirming the EA's ability to generate significant profits while maintaining controlled risk. The average positive trade of 298.42 significantly outweighs the average negative trade of -205.83, contributing to the impressive Expected Payoff of 7.37.

Take control of your trading with ISHEGUVE SMART TRSDER – your intelligent partner for consistent and disciplined market execution and the future of forex!

¡Libere su potencial de trading con el ISHEGUVE SMART TRADER ! ¿Está buscando una solución de trading potente, inteligente y personalizable que ofrezca resultados tangibles? El ISHEGUVE SMART TRADER está diseñado para aportar una precisión y disciplina inigualables a su trading en MetaTrader 5, aprovechando el análisis técnico avanzado y una sólida gestión monetaria, como lo demuestra su impresionante rendimiento en las pruebas de backtesting. Experimente el futuro del trading de Forex con el

I have a collection of code structures, very informative and easy to manipulate. They're primarily helpers for different functions such as System Control functions, Candlesticks Patterns Detection & Confirmation, signal generation logics as wellas trading logics and Chart customization.

Please feel free to approach me for any of these.

For Example: //--- Helper for Dark Cloud Cover pattern (moved from Isheguvesignals class)bool IsDarkCloudCover(int shift, int avgBodyPeriod = 20, int trendLookbackPeriod = 5) { if(!UpdateRates()) return false; if(::Bars(_Symbol, _Period) < shift + 1 || ::Bars(_Symbol, _Period) < avgBodyPeriod + 1 || ::Bars(_Symbol, _Period) < trendLookbackPeriod + shift + 1) return false;

double avgBody = AvgBody(avgBodyPeriod); if(avgBody <= 0.0000001) return false;

bool cond1_bullish_body = IsBullish(shift + 1) && (GetBody(shift + 1) > avgBody); bool cond2_bearish = IsBearish(shift); bool cond3_close_lower = GetClose(shift) < GetClose(shift + 1); bool cond4_close_within_body = GetClose(shift) > GetOpen(shift + 1); bool cond5_uptrend = MidOpenClose(shift + 1) > CloseAvg(trendLookbackPeriod, shift + 1); bool cond6_gap_up = GetOpen(shift) > GetHigh(shift + 1);

return cond1_bullish_body && cond2_bearish && cond3_close_lower && cond4_close_within_body && cond5_uptrend && cond6_gap_up; }

//--- Helper for Piercing Line pattern (moved from Isheguvesignals class)bool IsPiercingLine(int shift, int avgBodyPeriod = 20, int trendLookbackPeriod = 5) { if(!UpdateRates()) return false; if(::Bars(_Symbol, _Period) < shift + 1 || ::Bars(_Symbol, _Period) < avgBodyPeriod + 1 || ::Bars(_Symbol, _Period) < trendLookbackPeriod + shift + 1) return false;

double avgBody = AvgBody(avgBodyPeriod); if(avgBody <= 0.0000001) return false;

bool cond1_bullish_body = IsBullish(shift) && (GetBody(shift) > avgBody); bool cond2_bearish_body = IsBearish(shift + 1) && (GetBody(shift + 1) > avgBody); bool cond3_close_higher = GetClose(shift) > GetClose(shift + 1); bool cond4_close_within_body = GetClose(shift) < GetOpen(shift + 1); bool cond5_downtrend = MidOpenClose(shift + 1) < CloseAvg(trendLookbackPeriod, shift + 1); bool cond6_gap_down = GetOpen(shift) < GetLow(shift + 0);

double prev_body_range = GetOpen(shift + 1) - GetClose(shift + 1); bool cond7_piercing_level = GetClose(shift) > (GetClose(shift + 1) + prev_body_range * 0.5);

return cond1_bullish_body && cond2_bearish_body && cond3_close_higher && cond4_close_within_body && cond5_downtrend && cond6_gap_down && cond7_piercing_level; }

🚀 ¡ Libera tu Potencial de Trading con IsheguveScalper EA! 🚀 ¿ Estás listo para transformar tu trading de Forex? El Asesor Experto Isheguve es una solución de trading sofisticada y totalmente automatizada, diseñada para identificar configuraciones de trading de alta probabilidad y gestionar tus posiciones con precisión. Construido sobre un análisis técnico robusto y principios de gestión inteligente del dinero, Isheguve tiene como objetivo aportar consistencia y disciplina a tu viaje de