Vincent Vandeyua Orya / 个人资料

- 信息

|

不

经验

|

5

产品

|

14

演示版

|

|

0

工作

|

0

信号

|

0

订阅者

|

各位交易员,你们好!

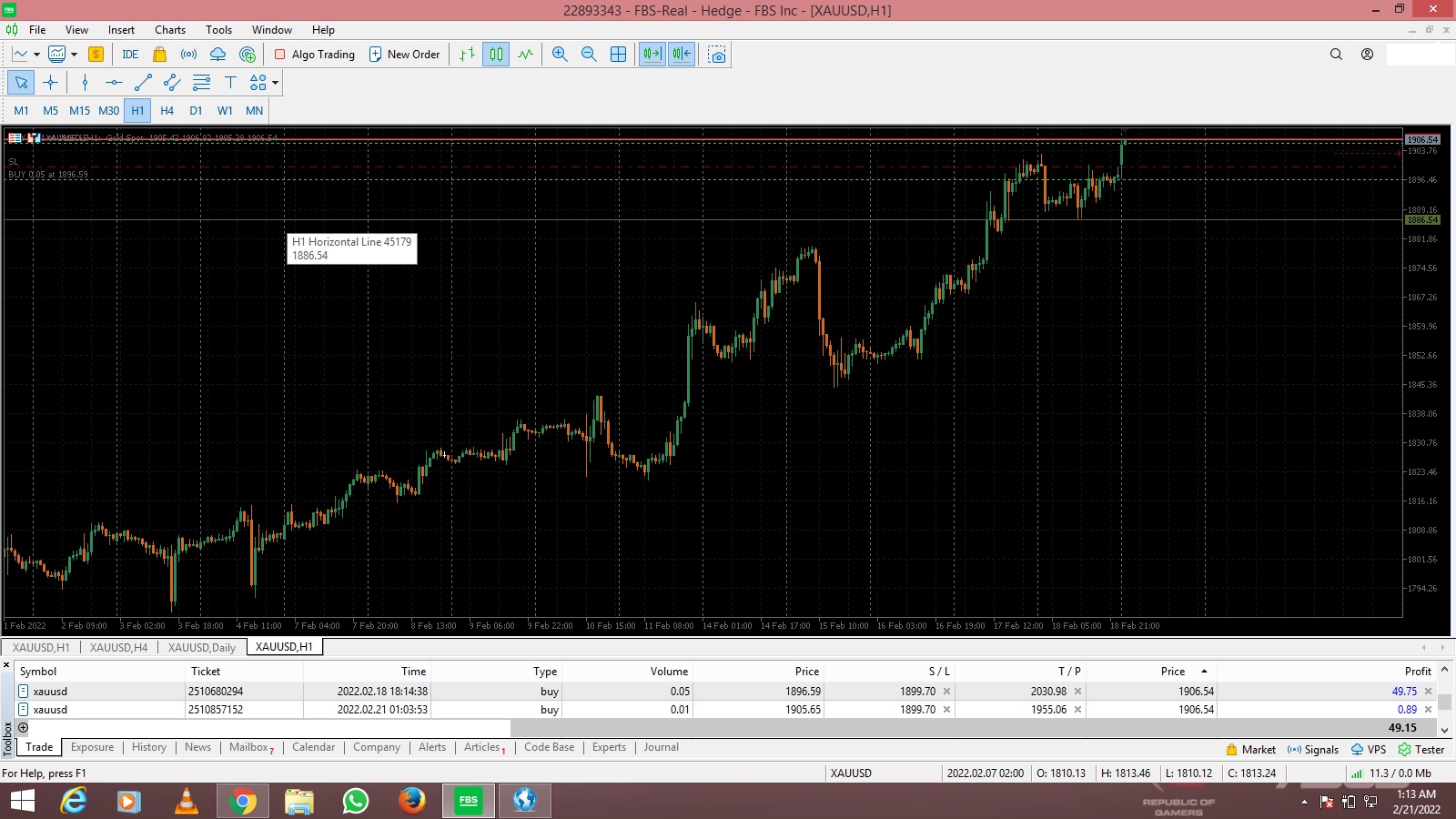

经过多年对外汇市场的深入研究和直接参与,我的旅程是一个持续学习和进化的过程。最初,我选择直接参与真实市场而非模拟账户,这条道路虽然带来了早期的资金挫折,却提供了宝贵的实战经验,让我领悟到成功至关重要的心理纪律:有效管理贪婪、克服“错失恐惧症”(FOMO),以及培养持续盈利所必需的毅力。

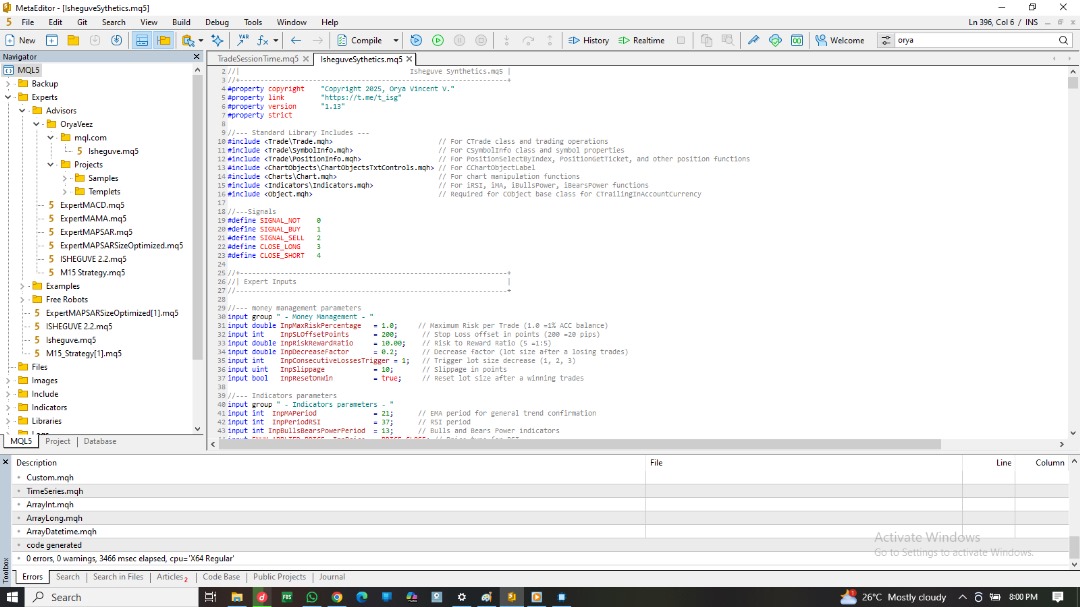

这段基础经验最终促成了一个高效且极其简单的手动交易策略的开发,该策略易于采纳,并持续展现高达87%的胜率。尽管该策略在数年内持续盈利,但我内在的创新动力促使我探索其自动化。我没有将这一关键步骤外包,而是全身心投入到MQL5编程的学习中。利用《MQL5交易者编程》的全面资源,我迅速掌握了技能,在短短几个月内成功开发出功能性的MQL5类、脚本和专家顾问(EA)。

此次开发的巅峰之作便是“ISHEGUVE”,这是一个专有的专家顾问,它根据MQL5标准库的强大功能和从MQL5Book获得的知识,从第一性原理精心打造而成。我为这项创造及其表现感到无比自豪。

https://www.google.com/search?q=%E5%B0%BD%E7%AE%A1%E6%88%91%E7%9A%84MQL5.com账户创建于多年前,但直到最近账户验证通过之前,我的主要精力都集中在其他方面。现在,我已全身心投入到这个充满活力的交易社区中,积极参与市场,并通过自由职业机会提供我的专业知识。

我邀请您探索我的产品和服务,并期待为我们共同的成功做出贡献。

Master Your Market Analysis with Isheguve Trend Scout! Tired of manually drawing trend lines and missing key market shifts? 🚀Isheguve Trend Scout is an MQL5 utility app designed to give you an edge by automatically identifying and plotting trend lines on your chart. Why Choose Isheguve Trend Scout? 🔥 Effortless Trend Detection: ✅Stop guessing and let the app do the work for you. Trend Scout Pro intelligently analyzes historical price data to find significant

用户指南:ISHEGUVE Crash Trader (ISHEGUVE Smart Trader的简化版) 1. ISHEGUVE Crash Trader 简介 ISHEGUVE Crash Trader 是一款专为交易 Crash Index(崩溃指数)而设计的自动化交易系统,Crash Index 是 Deriv.com 等平台上的一种合成指数,它模拟了真实世界的市场波动。该 EA 是 ISHEGUVE Smart Trader 的简化版本,专注于核心功能,以识别并利用这些合成“崩溃”资产中的特定市场状况。 2. 默认设置和配置 以下是 ISHEGUVE Crash Trader EA 的默认输入参数: * 账户模式(Account Mode): 在对冲(Hedging)和净额结算(Netting)之间切换。 * 最大资产风险百分比(Maximum Risk percent of Equity) (1.0 = 1%): 1。 * 风险回报比(Risk to Reward Ratio) (1:5)

Isheguve Scalper Pro 用户指南 Isheguve Scalper Pro 简介 Isheguve Scalper Pro 是一款精密的 MQL5 智能交易系统 (Expert Advisor),旨在自动化您的交易决策。它将先进的技术分析与强大的资金和交易管理相结合,提供全面的自动化交易解决方案。 主要特点包括: * 烛台形态识别:识别各种反转和持续烛台形态。 * 多指标确认:使用指数移动平均线 (EMA)、相对强弱指数 (RSI) 和多空力量指标 (Bulls/Bears Power) 过滤和确认形态。 * 动态风险管理:根据用户定义的风险百分比计算交易手数,并针对连续亏损进行调整。 * 自适应追踪止损:实施基于平均真实波动范围 (ATR) 的动态追踪止损系统,以适应市场波动性。 * 会话管理:在交易时段结束时自动平仓并取消挂单。 * 灵活的交易策略:允许您在同一交易品种上选择类似净值 (单向) 或类似对冲 (多向) 的交易方法。 安装指南

Isheguve Scalper Pro 用户指南 Isheguve Scalper Pro 简介 Isheguve Scalper Pro 是一款精密的 MQL5 智能交易系统 (Expert Advisor),旨在自动化您的交易决策。它将先进的技术分析与强大的资金和交易管理相结合,提供全面的自动化交易解决方案。 主要特点包括: * 烛台形态识别:识别各种反转和持续烛台形态。 * 多指标确认:使用指数移动平均线 (EMA)、相对强弱指数 (RSI) 和多空力量指标 (Bulls/Bears Power) 过滤和确认形态。 * 动态风险管理:根据用户定义的风险百分比计算交易手数,并针对连续亏损进行调整。 * 自适应追踪止损:实施基于平均真实波动范围 (ATR) 的动态追踪止损系统,以适应市场波动性。 * 会话管理:在交易时段结束时自动平仓并取消挂单。 * 灵活的交易策略:允许您在同一交易品种上选择类似净值 (单向) 或类似对冲 (多向) 的交易方法。 安装指南

2. Advanced Candlestick Pattern Recognition

Description: IsheguveScalper identifies a comprehensive suite of powerful candlestick patterns, giving you an edge in market reversals and trend continuations.

Advantages:

2.1. Early Signal Generation: Candlestick patterns are often leading indicators, meaning they can signal potential market shifts before other indicators confirm them. By recognizing a "comprehensive suite" of these patterns, IsheguveScalper can identify high-probability trade setups earlier, allowing for more favorable entry and exit points.

✅Identification of Reversals: Many powerful candlestick patterns (e.g., Engulfing patterns, Hammers, Dojis, Morning/Evening Stars) are specifically designed to signal a potential reversal in the current trend. An EA that can accurately detect these patterns can capitalize on turning points in the market, allowing it to enter trades at the beginning of new trends or exit existing trades before a reversal erodes profits.

✅ Confirmation of Continuations: Beyond reversals, some candlestick patterns (e.g., Three White Soldiers, Three Black Crows) indicate the continuation of an existing trend. The EA's ability to recognize these patterns means it can confidently hold positions or add to them, riding sustained market movements for greater profit.

✅ Insight into Market Sentiment: Each candlestick tells a story about the battle between buyers and sellers over a specific period. By recognizing patterns, the EA effectively "reads" market sentiment – whether buyers are gaining control, sellers are dominating, or there's indecision. This deeper understanding of market psychology, automated by the EA, can lead to more accurate trade decisions.

✅ Reduced False Signals (when combined with other analysis): While individual candlestick patterns can sometimes produce false signals, an "advanced" recognition system, especially when combined with other indicators (as implied by other features of the EA), can filter out less reliable patterns. This increases the overall accuracy of trade signals generated by the EA.

✅ Objective Analysis: Human traders can be prone to misinterpreting candlestick patterns due to emotional biases or lack of experience. An automated system like IsheguveScalper provides objective, rule-based recognition, ensuring consistency and adherence to predefined trading logic.

✅ Speed and Efficiency: Manually scanning charts for candlestick patterns across multiple currency pairs and timeframes is time-consuming and prone to human error. An EA can perform this analysis instantaneously and continuously, identifying opportunities that a human trader might miss.

✅ Enhanced Decision Making: By providing precise, automated identification of significant candlestick patterns, the EA equips itself with a powerful tool for making informed trading decisions, whether it's entering a new position, managing an existing one, or preparing for a market shift.

🚀✅In essence, IsheguveScalper's advanced candlestick pattern recognition feature gives it a highly sophisticated "eye" for reading market price action. This allows it to proactively identify potential turning points and trend strengths, providing a significant advantage in executing timely and profitable trades.

https://www.mql5.com/en/accounting/buy/market/142818

Here's a summary of all its features.

📈 What Makes IsheguveScalper Stand Out?

1. Intelligent Money Management & Risk Control.

2. Advanced Candlestick Pattern Recognition.

3. Robust Indicator Confirmation.

4. Flexible Trade Execution & Management.

1. 🔥Intelligent Money Management & Risk Control.

The IsheguveScalper EA boasts several powerful features centered around intelligent money management and risk control, which are crucial for consistent and disciplined trading. Let's break down the advantages of each:

1.1. 🚀 Dynamic Lot Sizing

Description: The EA automatically calculates the optimal lot size for each trade based on a configurable maximum risk percentage (e.g., 1% of equity per trade).

Advantages:

✅ Protects Capital: This is arguably the most significant advantage. By risking a fixed percentage of your equity per trade, you ensure that no single loss can significantly deplete your account. If your equity decreases, the lot size will automatically decrease, reducing your exposure. Conversely, if your equity grows, the lot size will increase, allowing you to compound your gains efficiently.

✅ Adapts to Account Growth/Drawdown: Dynamic lot sizing naturally scales your trading activity with your account performance. This is far superior to fixed lot sizes, which can lead to over-leveraging during drawdowns or under-utilizing capital during periods of growth.

✅ Removes Emotional Bias: Manually calculating lot sizes can be tedious and prone to emotional decisions (e.g., risking more than planned after a winning streak). Automation ensures consistency and discipline.

✅ Optimizes Profit Potential: As your account grows, dynamic lot sizing allows you to gradually increase your exposure, maximizing the compounding effect of profitable trades without increasing your risk per trade percentage.

1.2. 🚀🚀Adaptive Risk Adjustment

Description: The EA reduces lot size after a specified number of consecutive losses (e.g., 20% decrease after 1 loss) and resets after a win, helping to protect your capital during drawdowns.

Advantages:

✅ Drawdown Protection: This feature is a proactive measure against prolonged losing streaks. By reducing lot size after consecutive losses, the EA automatically lessens the impact of further losses, giving your account a better chance to recover. This is a critical aspect of "survivability" in trading.

✅ Reduces Emotional Stress: Knowing that the EA will automatically adjust risk during difficult periods can significantly reduce the psychological burden on the trader.

✅ Enhances Longevity: By systematically reducing exposure during unfavorable market conditions or strategy performance, the EA helps preserve capital, allowing the system to remain in the market longer and wait for more favorable conditions to return.

✅ Automated Recovery Mechanism: The reset after a win encourages a measured increase in risk as the EA proves its ability to generate profits again, allowing for gradual recovery without being overly aggressive.

1.3. 🚀🚀Flexible Stop Loss & Take Profit

Description: You can set your Stop Loss offset in points (e.g., 20 pips) from detected patterns and define your desired Risk-to-Reward Ratio (e.g., 1:10) for disciplined profit targets.

Advantages:

✅ Risk Management: Stop Loss (SL) is a fundamental risk management tool. By setting it at a specific offset from detected patterns, the EA ensures that every trade has a predefined maximum loss, preventing catastrophic losses from unexpected market movements.

✅ Profit Maximization (with discipline): Take Profit (TP) allows the EA to automatically lock in profits when a predefined target is reached. This removes the temptation to let winning trades run too long and risk a reversal, or conversely, to close them too early out of fear.

✅ Disciplined Exits: Both SL and TP ensure that trades are closed objectively, based on pre-set parameters, rather than emotional decisions. This consistency is vital for long-term profitability.

✅ Defined Risk-to-Reward Ratio: Setting a specific Risk-to-Reward (R:R) ratio, like 1:10, forces a systematic approach to trade selection. It means that for every 1 unit of risk, the EA aims for 10 units of profit. This ratio is a cornerstone of profitable trading, as it allows a system to be profitable even with a relatively low win rate.

✅ Automated Execution: The EA handles the placement and management of these orders, freeing the trader from constant monitoring and allowing them to focus on other aspects or simply let the EA run.

✅ Strategic Alignment: By setting SL based on "detected patterns," it implies that the stop loss is placed logically in relation to the market structure that triggered the trade, increasing the probability of it being a technically sound exit point.

🚀✅In summary, the IsheguveScalper EA's money management and risk control features are designed to create a robust and resilient trading system. They automate critical aspects of risk management, protect capital during drawdowns, adapt to account performance, and enforce disciplined trade exits, all of which are paramount for achieving long-term consistency in trading.

https://www.mql5.com/en/market/product/142818?source=Site+Market+MT5+Search+Rating006%3aIsheguveScalper

ISHEGUVE SMART TRSDER's Key Features at a Glance, Backed by Performance:

📈 Intelligent Trade Entry & Exit:

Advanced Pattern Recognition: Utilizes a comprehensive suite of candlestick patterns including Morning Star, Morning Doji, Hammer, Engulfing, Harami, Piercing Line, Meeting Lines, Three White Soldiers, Three Black Crows, and Pin Bars.

Multi-Indicator Confirmation: Signals are confirmed by RSI (Relative Strength Index) for overbought/oversold conditions and SMA (Simple Moving Average) for trend direction, ensuring high-probability setups.

Bulls/Bears Power Integration: Further validates trade signals with the strength of market participants.

RSI-Based Exits: Dynamically closes positions when RSI indicates reversal or continuation levels are met, ensuring timely profit-taking or loss cutting.

💰 Sophisticated Money Management:

Risk-Based Lot Sizing: Automatically calculates optimal lot size based on your defined maximum risk percentage per trade (e.g., 1.0%) and Stop Loss in account currency (e.g., 20.0 USD).

Adaptive Lot Adjustment: Implements a unique strategy to decrease lot size (e.g., by 0.8 factor) after a configurable number of consecutive losses (e.g., 2 losses), and resets on a win, protecting your capital. This proactive approach helps mitigate prolonged losing streaks, a key factor in the high Short Trades won % (79.39%) and Long Trades won % (93.30%).

Configurable Risk-Reward Ratio: Set your desired profit target based on your Stop Loss (e.g., 1.5 Risk-Reward).

🛡 Dynamic Position Control:

Currency-Based Trailing Stop: Protects profits by trailing your Stop Loss based on currency values (e.g., starts trailing after $50.0 profit, steps by $10.0, with a $5.0 offset), locking in gains as the market moves in your favor.

Pending Order Management: Places Buy Stop/Sell Stop orders with a configurable offset (e.g., 10 points) from pattern highs/lows.

Time-Based Position Expiry: Optionally closes positions after a specified number of bars (set to 0 for disabled by default, but customizable).

Session-Based Trading: Automatically ceases new order placement 30 minutes before your defined session end time (e.g., 23:55) and closes all open positions 10 minutes before, ensuring you avoid volatile closing moments.

Slippage Control: Minimizes unexpected price deviations with a maximum slippage setting (e.g., 10 points).

Why Choose ISHEGUVE SMART TRSDER?

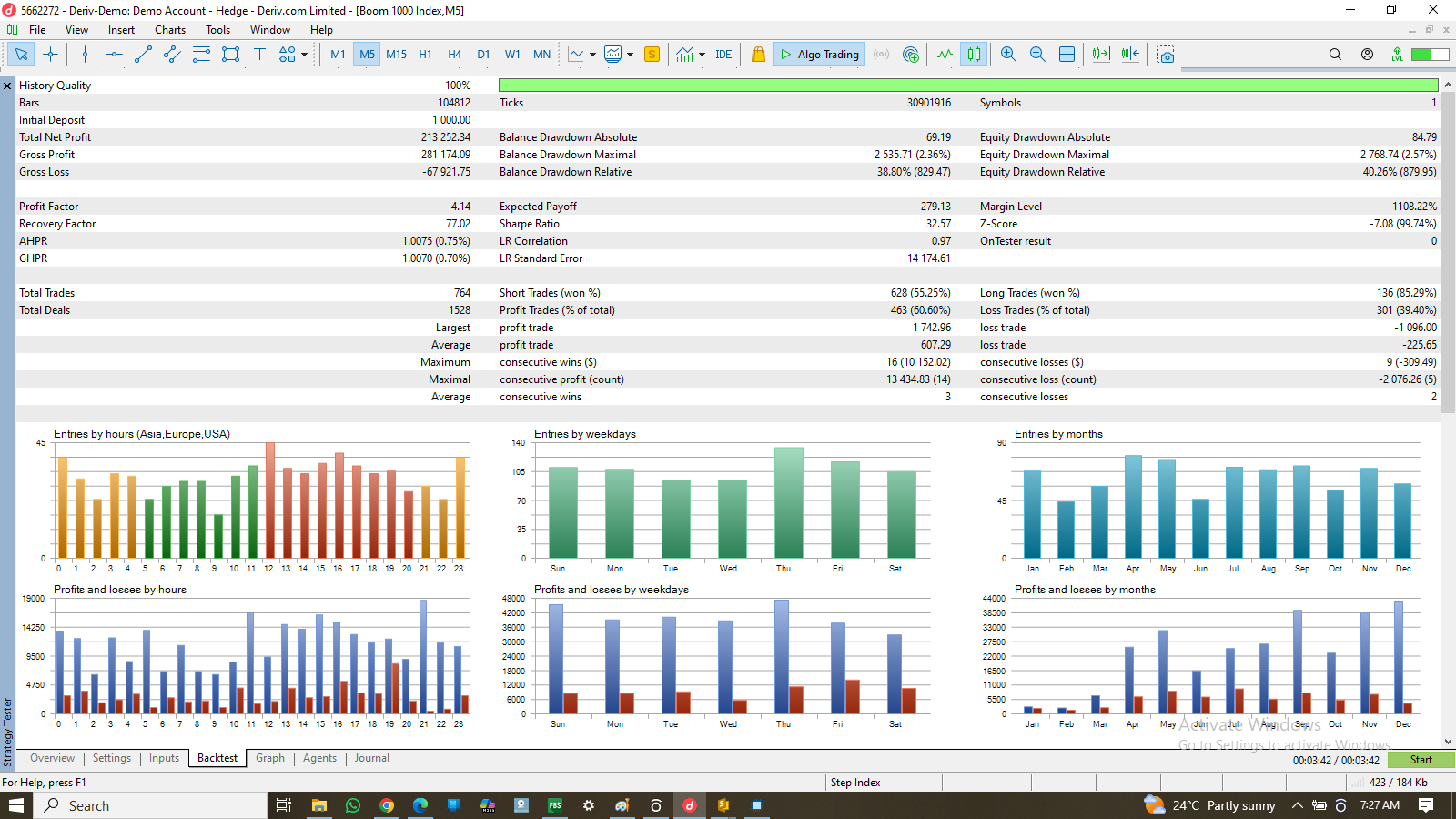

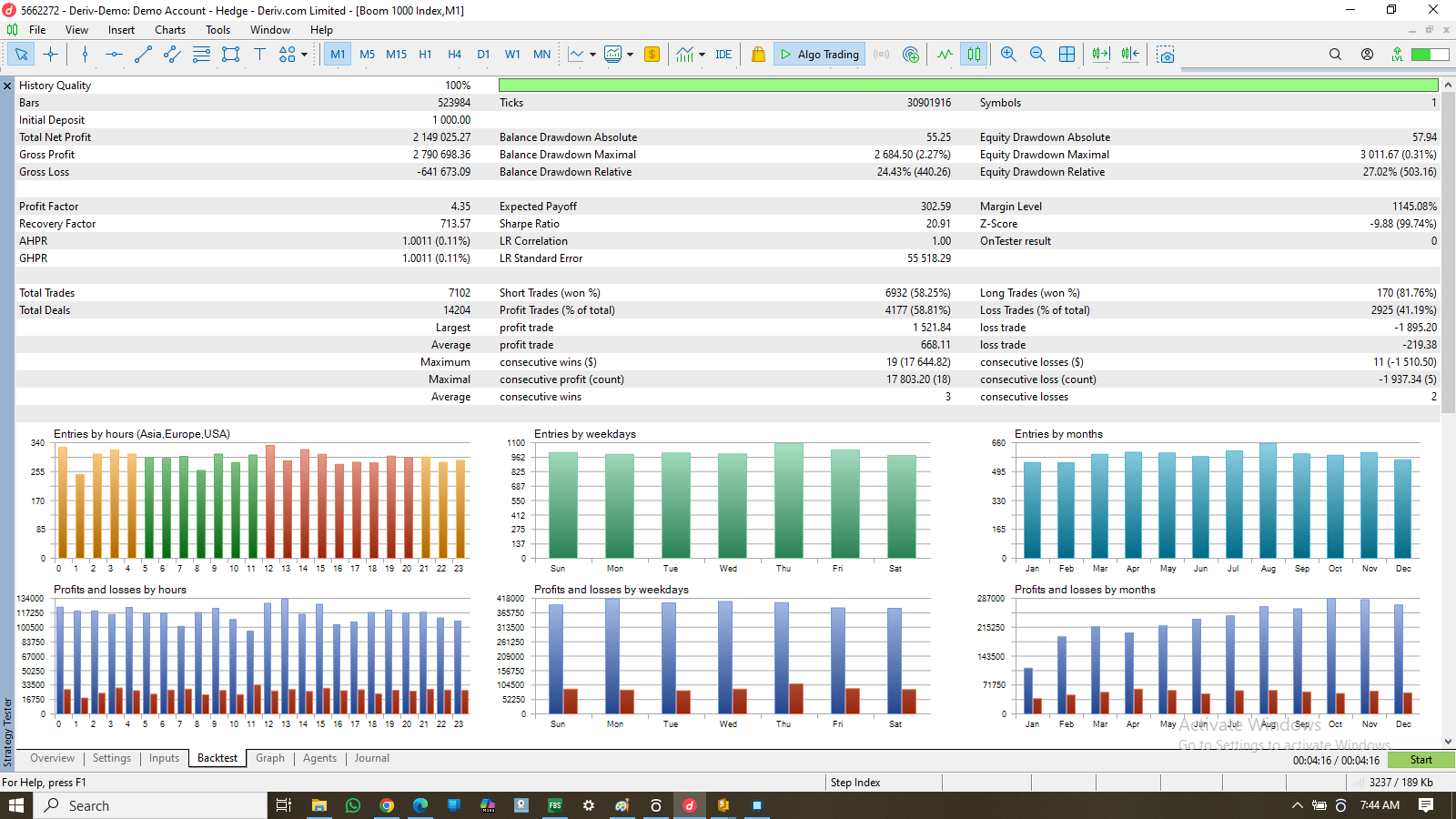

Proven Performance: The backtest results speak for themselves, showcasing consistent profitability and robust risk management. The Maximum Drawdown Relative of 8.86% (8.75%) and Maximum Drawdown Absolute of 2,055.27 (3.16%) are remarkably low for such substantial gains, highlighting the EA's capital protection capabilities.

Automated Discipline: Removes emotional trading by adhering strictly to predefined rules, leading to more consistent and objective trading decisions.

Capital Protection: Advanced money management, adaptive lot adjustment, and trailing stops are meticulously designed to safeguard your trading account, as demonstrated by the low drawdowns.

Customizable Strategy: Adjust key parameters like RSI levels, MA periods, risk percentages, and trailing stop settings to fit your unique trading style and evolving market conditions.

Comprehensive Error Handling: Built-in mechanisms to detect and report potential issues directly on your chart, keeping you informed.

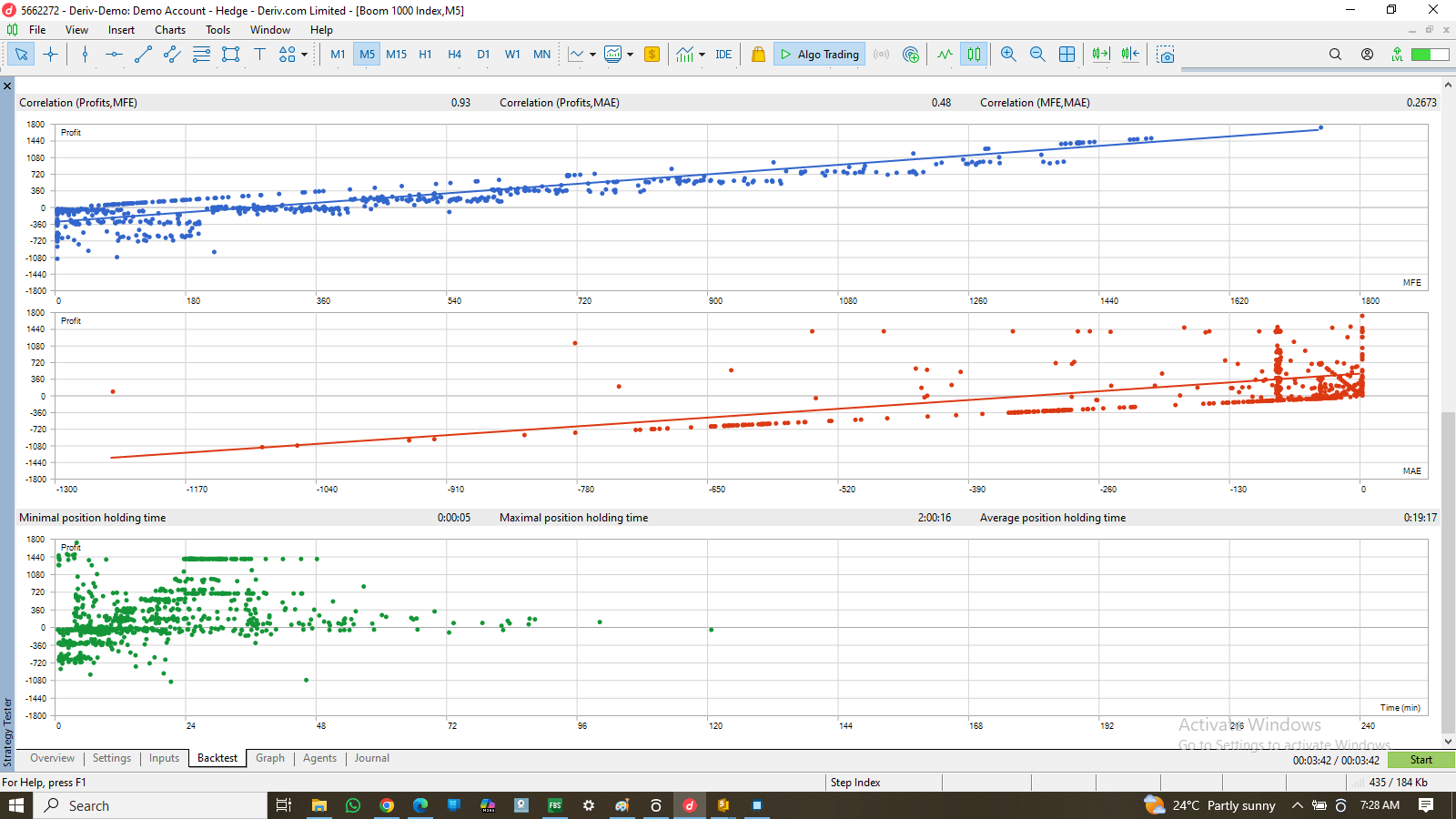

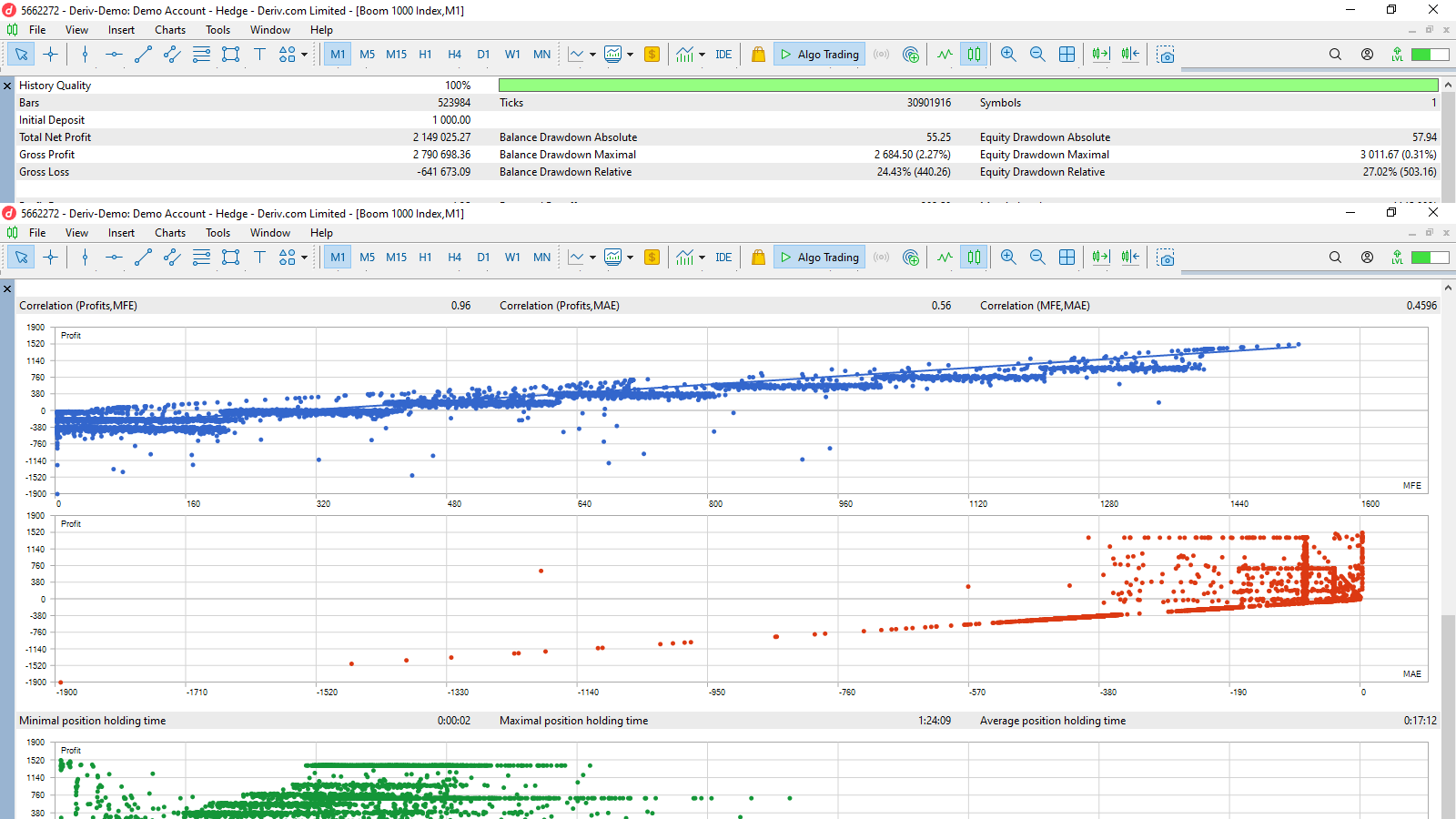

The scatter plot (as seen in SressTestIsheguveSyntheticsM1ascket02.png ) illustrates a positive correlation between profit and drawdown, confirming the EA's ability to generate significant profits while maintaining controlled risk. The average positive trade of 298.42 significantly outweighs the average negative trade of -205.83, contributing to the impressive Expected Payoff of 7.37.

Take control of your trading with ISHEGUVE SMART TRSDER – your intelligent partner for consistent and disciplined market execution and the future of forex!

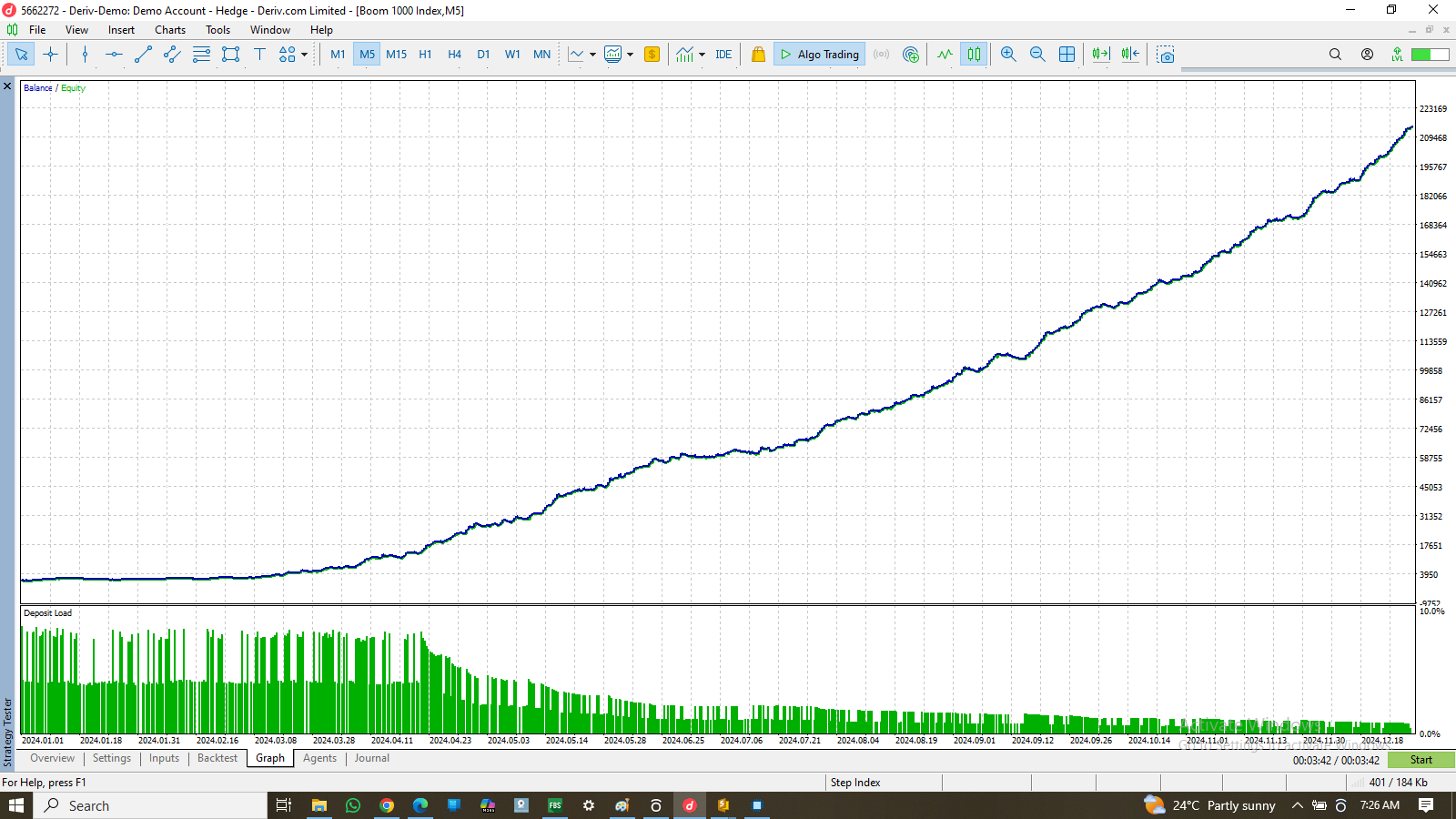

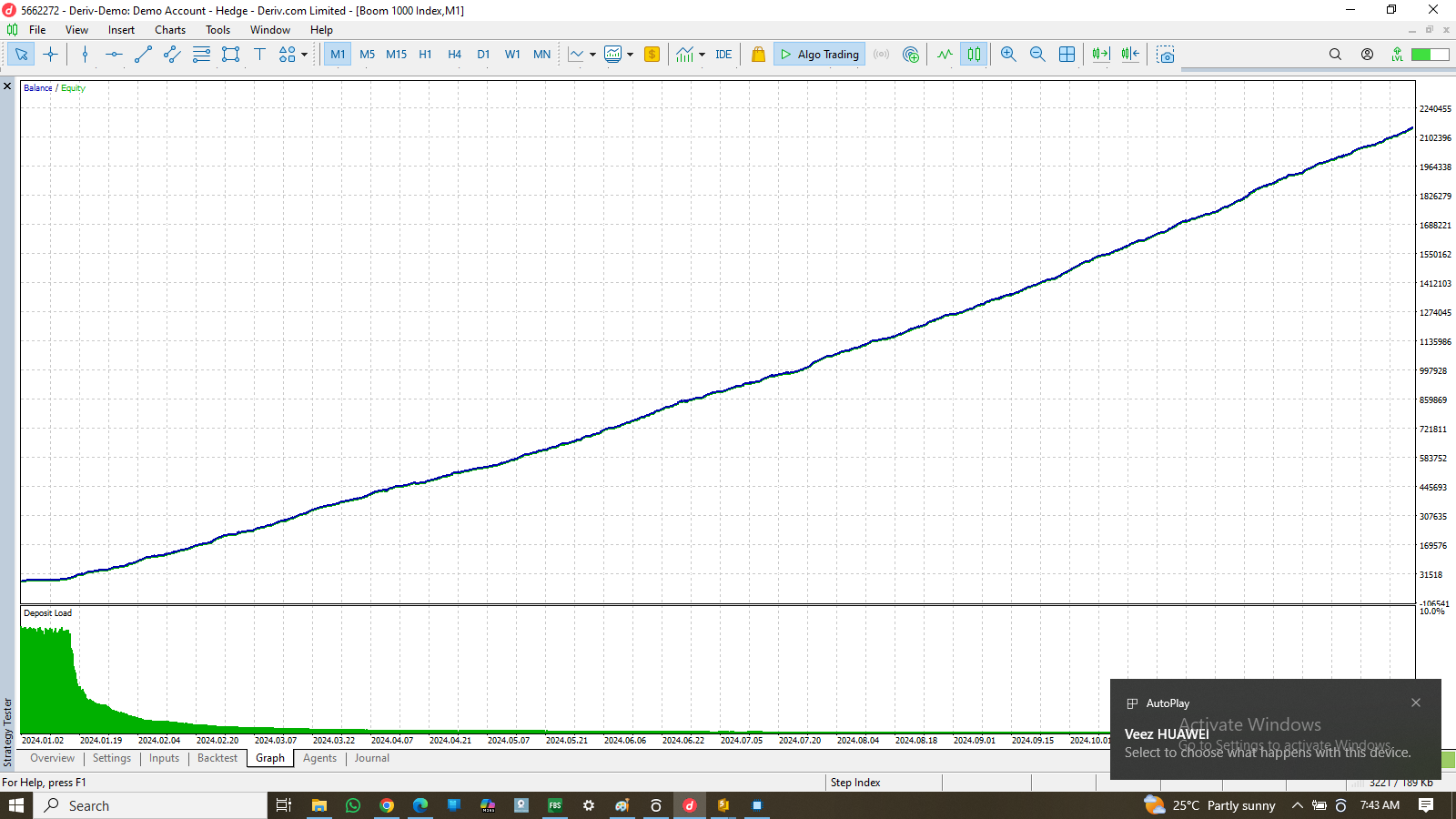

使用 ISHEGUVE 智能交易系统释放您的交易潜力! 您是否正在寻找一个功能强大、智能且可定制的交易解决方案,以提供切实的成果? ISHEGUVE 智能交易系统旨在为您的 MetaTrader 5 交易带来无与伦比的精确性和纪律性,它利用先进的技术分析和强大的资金管理,其令人印象深刻的回测性能就是明证。 使用 ISHEGUVE 智能交易系统体验外汇交易的未来: 所提供的压力测试结果证明了 ISHEGUVE 智能交易系统在一段时间内的卓越一致性和盈利能力。初始入金 100.00,系统在仅仅一年零六个月内产生了 238,808.00 的总净利润,毛利润达到 274,248.96,而毛损失为 -35,240.96。这转化为可观的利润因子 7.57 和出色的恢复因子 113.39,表明其从亏损中恢复并产生可观回报的卓越能力。 权益曲线(如截图所示)展示了平稳且持续的上涨轨迹,这是 EA 强大策略和有效风险管理的证明。通过分析 269,525 个总K线和 15,700,032 个跳动点,SMARSI EA 证明了其在大量市场数据中的弹性。 ISHEGUVE

I have a collection of code structures, very informative and easy to manipulate. They're primarily helpers for different functions such as System Control functions, Candlesticks Patterns Detection & Confirmation, signal generation logics as wellas trading logics and Chart customization.

Please feel free to approach me for any of these.

For Example: //--- Helper for Dark Cloud Cover pattern (moved from Isheguvesignals class)bool IsDarkCloudCover(int shift, int avgBodyPeriod = 20, int trendLookbackPeriod = 5) { if(!UpdateRates()) return false; if(::Bars(_Symbol, _Period) < shift + 1 || ::Bars(_Symbol, _Period) < avgBodyPeriod + 1 || ::Bars(_Symbol, _Period) < trendLookbackPeriod + shift + 1) return false;

double avgBody = AvgBody(avgBodyPeriod); if(avgBody <= 0.0000001) return false;

bool cond1_bullish_body = IsBullish(shift + 1) && (GetBody(shift + 1) > avgBody); bool cond2_bearish = IsBearish(shift); bool cond3_close_lower = GetClose(shift) < GetClose(shift + 1); bool cond4_close_within_body = GetClose(shift) > GetOpen(shift + 1); bool cond5_uptrend = MidOpenClose(shift + 1) > CloseAvg(trendLookbackPeriod, shift + 1); bool cond6_gap_up = GetOpen(shift) > GetHigh(shift + 1);

return cond1_bullish_body && cond2_bearish && cond3_close_lower && cond4_close_within_body && cond5_uptrend && cond6_gap_up; }

//--- Helper for Piercing Line pattern (moved from Isheguvesignals class)bool IsPiercingLine(int shift, int avgBodyPeriod = 20, int trendLookbackPeriod = 5) { if(!UpdateRates()) return false; if(::Bars(_Symbol, _Period) < shift + 1 || ::Bars(_Symbol, _Period) < avgBodyPeriod + 1 || ::Bars(_Symbol, _Period) < trendLookbackPeriod + shift + 1) return false;

double avgBody = AvgBody(avgBodyPeriod); if(avgBody <= 0.0000001) return false;

bool cond1_bullish_body = IsBullish(shift) && (GetBody(shift) > avgBody); bool cond2_bearish_body = IsBearish(shift + 1) && (GetBody(shift + 1) > avgBody); bool cond3_close_higher = GetClose(shift) > GetClose(shift + 1); bool cond4_close_within_body = GetClose(shift) < GetOpen(shift + 1); bool cond5_downtrend = MidOpenClose(shift + 1) < CloseAvg(trendLookbackPeriod, shift + 1); bool cond6_gap_down = GetOpen(shift) < GetLow(shift + 0);

double prev_body_range = GetOpen(shift + 1) - GetClose(shift + 1); bool cond7_piercing_level = GetClose(shift) > (GetClose(shift + 1) + prev_body_range * 0.5);

return cond1_bullish_body && cond2_bearish_body && cond3_close_higher && cond4_close_within_body && cond5_downtrend && cond6_gap_down && cond7_piercing_level; }

🚀 借助 IsheguveScalper EA 释放您的交易潜力 !🚀 您准备好改变您的外汇交易了吗? Isheguve 专家顾问是一款复杂的、全自动的交易解决方案,旨在识别高概率交易设置并精确管理您的头寸。Isheguve 基于强大的技术分析和智能资金管理原则构建,旨在为您的交易之旅带来一致性和纪律性。 IsheguveScalper 的突出特点是什么? * 智能资金管理与风险控制: * 动态手数调整:根据可配置的最大风险百分比(例如,每笔交易账户净值的 1%)自动计算最佳手数。 * 自适应风险调整:在连续亏损达到指定次数后(例如,亏损 1 次后减少 20%)减少手数,并在盈利后重置,有助于在回撤期间保护您的资金。 * 灵活的止损和止盈:根据检测到的模式设置点数止损偏移(例如,20 点),并定义您期望的风险回报比(例如,1:10),以实现有纪律的盈利目标。 * 高级烛台模式识别:IsheguveScalper 能够识别全面的强大烛台模式,让您在市场反转和趋势延续中占据优势。