Vincent Vandeyua Orya / Profil

- Informations

|

Aucun

expérience

|

5

produits

|

14

versions de démo

|

|

0

offres d’emploi

|

0

signaux

|

0

les abonnés

|

Chers collègues traders,

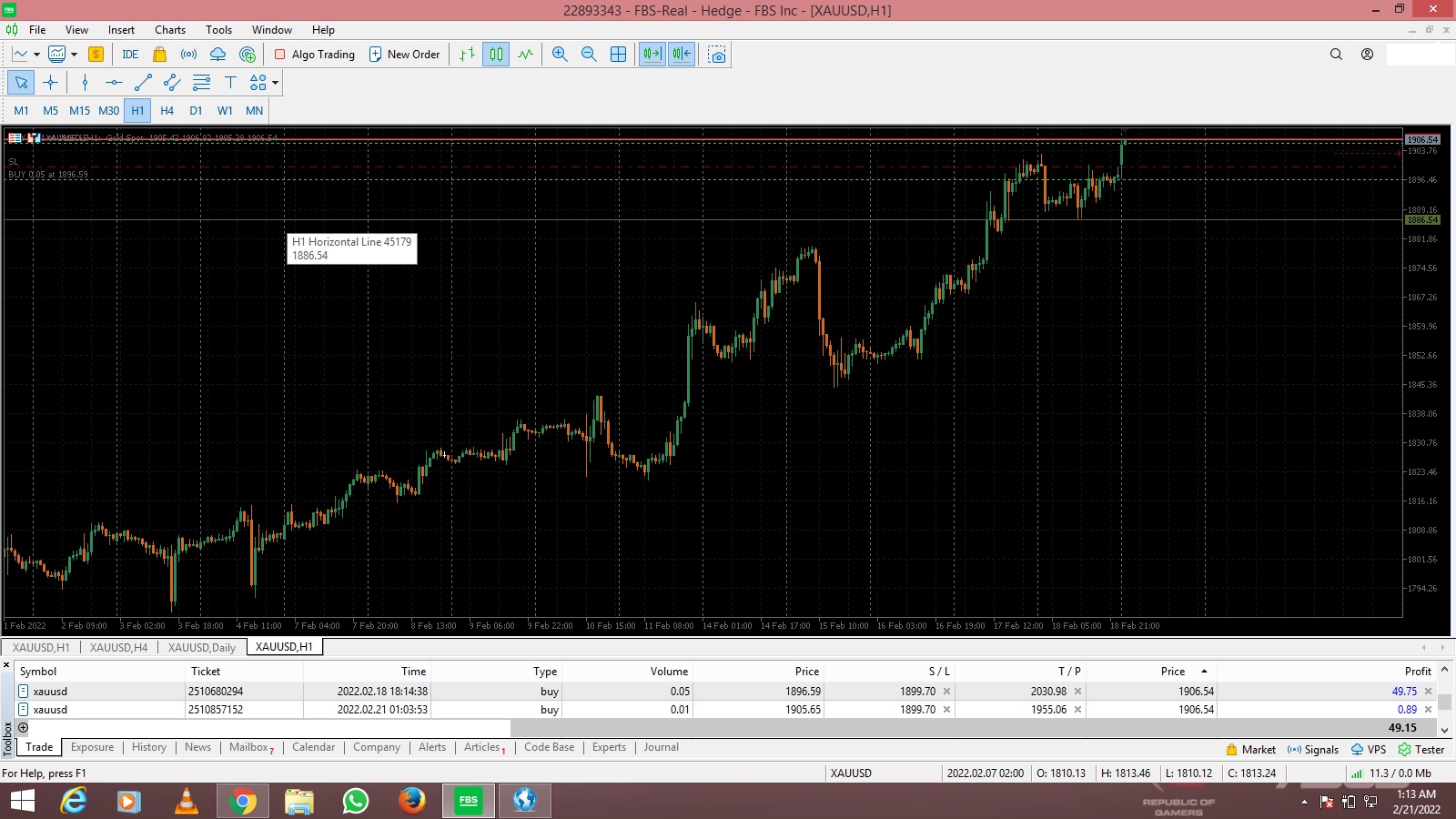

Après de nombreuses années d'étude intensive et d'engagement direct avec le marché du Forex, mon parcours a été celui de l'apprentissage et de l'évolution continus. Au départ, j'ai opté pour une participation immédiate au marché réel plutôt que pour des comptes de démonstration, un chemin qui, bien qu'ayant entraîné des revers de capital précoces, a fourni des informations inestimables sur le monde réel concernant les disciplines psychologiques cruciales pour le succès : gérer efficacement la cupidité, surmonter la peur de manquer (FOMO) et cultiver la persévérance essentielle pour une rentabilité soutenue.

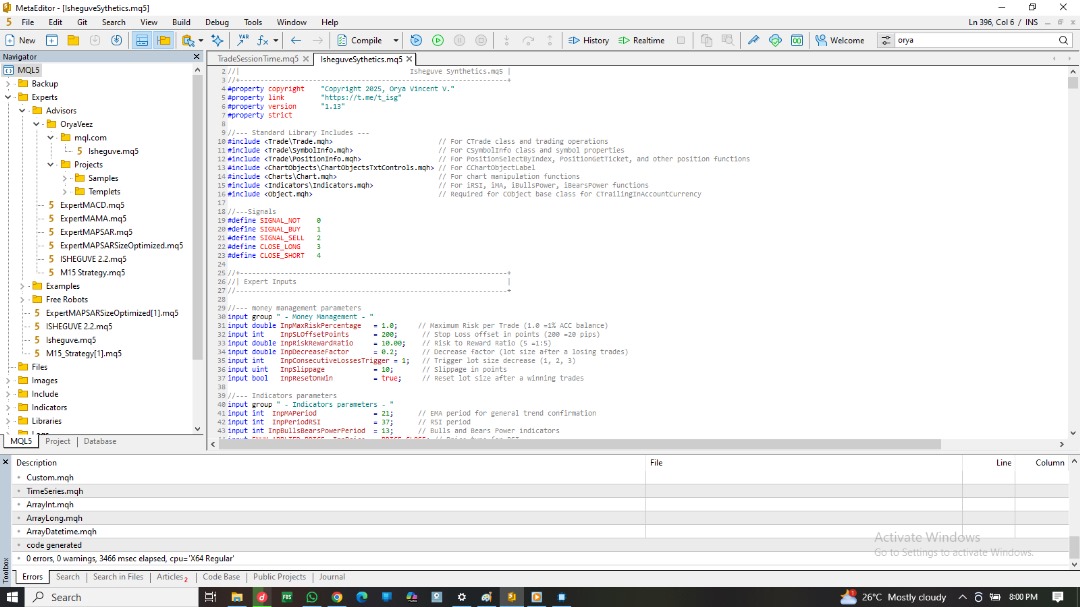

Cette expérience fondamentale a abouti au développement d'une stratégie de trading manuel très efficace et remarquablement simple, conçue pour une adoption facile et démontrant constamment un taux de réussite allant jusqu'à 87 %. Bien que cette stratégie se soit avérée constamment rentable pendant plusieurs années, ma volonté inhérente d'innover m'a incité à explorer son automatisation. Plutôt que d'externaliser cette étape critique, je me suis engagé à maîtriser la programmation MQL5. En tirant parti des ressources complètes de "MQL5 Programming for Traders", j'ai rapidement acquis des compétences, développant avec succès des classes, des scripts et des Expert Advisors (EA) MQL5 fonctionnels en quelques mois.

Le summum de ce développement est "ISHEGUVE", un Expert Advisor propriétaire méticuleusement conçu à partir des principes fondamentaux, en s'appuyant sur les capacités robustes des bibliothèques standard MQL5 et les connaissances acquises grâce à MQL5Book. Je suis immensément fier de cette création et de ses performances.

Bien que mon compte MQL5.com ait été établi il y a de nombreuses années, mon objectif principal était ailleurs jusqu'à ma récente vérification de compte. Je suis maintenant pleinement engagé à participer activement à cette communauté de trading dynamique, à m'engager sur le marché et à offrir mon expertise par le biais d'opportunités de freelance.

Je vous invite à explorer mes produits et services, et j'ai hâte de contribuer à notre succès partagé.

Master Your Market Analysis with Isheguve Trend Scout! Tired of manually drawing trend lines and missing key market shifts? 🚀Isheguve Trend Scout is an MQL5 utility app designed to give you an edge by automatically identifying and plotting trend lines on your chart. Why Choose Isheguve Trend Scout? 🔥 Effortless Trend Detection: ✅Stop guessing and let the app do the work for you. Trend Scout Pro intelligently analyzes historical price data to find significant

Guide de l'utilisateur : ISHEGUVE Crash Trader (Version simplifiée d'ISHEGUVE Smart Trader) 1. Introduction à l'ISHEGUVE Crash Trader L'ISHEGUVE Crash Trader est un système de trading automatisé spécialement conçu pour trader sur le Crash Index, l'un des indices synthétiques. Ces indices simulent les mouvements de marché réels et sont disponibles sur des plateformes comme Deriv.com . Cet EA est une version simplifiée de l'ISHEGUVE Smart Trader, axée sur les fonctionnalités de base pour

Isheguve Scalper pro user guide 1. Introduction to Isheguve Scalper Pro Isheguve Scalper Pro is a sophisticated MQL5 Expert Advisor designed to automate your trading decisions. It integrates advanced technical analysis with robust money and trade management to provide a comprehensive automated trading solution. Key features include: Candlestick Pattern Recognition: Identifies various reversal and continuation candlestick formations. Multi-Indicator Confirmation: Filters and confirms

Isheguve Scalper pro user guide 1. Introduction to Isheguve Scalper Pro Isheguve Scalper Pro is a sophisticated MQL5 Expert Advisor designed to automate your trading decisions. It integrates advanced technical analysis with robust money and trade management to provide a comprehensive automated trading solution. Key features include: Candlestick Pattern Recognition: Identifies various reversal and continuation candlestick formations. Multi-Indicator Confirmation: Filters and confirms

2. Advanced Candlestick Pattern Recognition

Description: IsheguveScalper identifies a comprehensive suite of powerful candlestick patterns, giving you an edge in market reversals and trend continuations.

Advantages:

2.1. Early Signal Generation: Candlestick patterns are often leading indicators, meaning they can signal potential market shifts before other indicators confirm them. By recognizing a "comprehensive suite" of these patterns, IsheguveScalper can identify high-probability trade setups earlier, allowing for more favorable entry and exit points.

✅Identification of Reversals: Many powerful candlestick patterns (e.g., Engulfing patterns, Hammers, Dojis, Morning/Evening Stars) are specifically designed to signal a potential reversal in the current trend. An EA that can accurately detect these patterns can capitalize on turning points in the market, allowing it to enter trades at the beginning of new trends or exit existing trades before a reversal erodes profits.

✅ Confirmation of Continuations: Beyond reversals, some candlestick patterns (e.g., Three White Soldiers, Three Black Crows) indicate the continuation of an existing trend. The EA's ability to recognize these patterns means it can confidently hold positions or add to them, riding sustained market movements for greater profit.

✅ Insight into Market Sentiment: Each candlestick tells a story about the battle between buyers and sellers over a specific period. By recognizing patterns, the EA effectively "reads" market sentiment – whether buyers are gaining control, sellers are dominating, or there's indecision. This deeper understanding of market psychology, automated by the EA, can lead to more accurate trade decisions.

✅ Reduced False Signals (when combined with other analysis): While individual candlestick patterns can sometimes produce false signals, an "advanced" recognition system, especially when combined with other indicators (as implied by other features of the EA), can filter out less reliable patterns. This increases the overall accuracy of trade signals generated by the EA.

✅ Objective Analysis: Human traders can be prone to misinterpreting candlestick patterns due to emotional biases or lack of experience. An automated system like IsheguveScalper provides objective, rule-based recognition, ensuring consistency and adherence to predefined trading logic.

✅ Speed and Efficiency: Manually scanning charts for candlestick patterns across multiple currency pairs and timeframes is time-consuming and prone to human error. An EA can perform this analysis instantaneously and continuously, identifying opportunities that a human trader might miss.

✅ Enhanced Decision Making: By providing precise, automated identification of significant candlestick patterns, the EA equips itself with a powerful tool for making informed trading decisions, whether it's entering a new position, managing an existing one, or preparing for a market shift.

🚀✅In essence, IsheguveScalper's advanced candlestick pattern recognition feature gives it a highly sophisticated "eye" for reading market price action. This allows it to proactively identify potential turning points and trend strengths, providing a significant advantage in executing timely and profitable trades.

https://www.mql5.com/en/accounting/buy/market/142818

Here's a summary of all its features.

📈 What Makes IsheguveScalper Stand Out?

1. Intelligent Money Management & Risk Control.

2. Advanced Candlestick Pattern Recognition.

3. Robust Indicator Confirmation.

4. Flexible Trade Execution & Management.

1. 🔥Intelligent Money Management & Risk Control.

The IsheguveScalper EA boasts several powerful features centered around intelligent money management and risk control, which are crucial for consistent and disciplined trading. Let's break down the advantages of each:

1.1. 🚀 Dynamic Lot Sizing

Description: The EA automatically calculates the optimal lot size for each trade based on a configurable maximum risk percentage (e.g., 1% of equity per trade).

Advantages:

✅ Protects Capital: This is arguably the most significant advantage. By risking a fixed percentage of your equity per trade, you ensure that no single loss can significantly deplete your account. If your equity decreases, the lot size will automatically decrease, reducing your exposure. Conversely, if your equity grows, the lot size will increase, allowing you to compound your gains efficiently.

✅ Adapts to Account Growth/Drawdown: Dynamic lot sizing naturally scales your trading activity with your account performance. This is far superior to fixed lot sizes, which can lead to over-leveraging during drawdowns or under-utilizing capital during periods of growth.

✅ Removes Emotional Bias: Manually calculating lot sizes can be tedious and prone to emotional decisions (e.g., risking more than planned after a winning streak). Automation ensures consistency and discipline.

✅ Optimizes Profit Potential: As your account grows, dynamic lot sizing allows you to gradually increase your exposure, maximizing the compounding effect of profitable trades without increasing your risk per trade percentage.

1.2. 🚀🚀Adaptive Risk Adjustment

Description: The EA reduces lot size after a specified number of consecutive losses (e.g., 20% decrease after 1 loss) and resets after a win, helping to protect your capital during drawdowns.

Advantages:

✅ Drawdown Protection: This feature is a proactive measure against prolonged losing streaks. By reducing lot size after consecutive losses, the EA automatically lessens the impact of further losses, giving your account a better chance to recover. This is a critical aspect of "survivability" in trading.

✅ Reduces Emotional Stress: Knowing that the EA will automatically adjust risk during difficult periods can significantly reduce the psychological burden on the trader.

✅ Enhances Longevity: By systematically reducing exposure during unfavorable market conditions or strategy performance, the EA helps preserve capital, allowing the system to remain in the market longer and wait for more favorable conditions to return.

✅ Automated Recovery Mechanism: The reset after a win encourages a measured increase in risk as the EA proves its ability to generate profits again, allowing for gradual recovery without being overly aggressive.

1.3. 🚀🚀Flexible Stop Loss & Take Profit

Description: You can set your Stop Loss offset in points (e.g., 20 pips) from detected patterns and define your desired Risk-to-Reward Ratio (e.g., 1:10) for disciplined profit targets.

Advantages:

✅ Risk Management: Stop Loss (SL) is a fundamental risk management tool. By setting it at a specific offset from detected patterns, the EA ensures that every trade has a predefined maximum loss, preventing catastrophic losses from unexpected market movements.

✅ Profit Maximization (with discipline): Take Profit (TP) allows the EA to automatically lock in profits when a predefined target is reached. This removes the temptation to let winning trades run too long and risk a reversal, or conversely, to close them too early out of fear.

✅ Disciplined Exits: Both SL and TP ensure that trades are closed objectively, based on pre-set parameters, rather than emotional decisions. This consistency is vital for long-term profitability.

✅ Defined Risk-to-Reward Ratio: Setting a specific Risk-to-Reward (R:R) ratio, like 1:10, forces a systematic approach to trade selection. It means that for every 1 unit of risk, the EA aims for 10 units of profit. This ratio is a cornerstone of profitable trading, as it allows a system to be profitable even with a relatively low win rate.

✅ Automated Execution: The EA handles the placement and management of these orders, freeing the trader from constant monitoring and allowing them to focus on other aspects or simply let the EA run.

✅ Strategic Alignment: By setting SL based on "detected patterns," it implies that the stop loss is placed logically in relation to the market structure that triggered the trade, increasing the probability of it being a technically sound exit point.

🚀✅In summary, the IsheguveScalper EA's money management and risk control features are designed to create a robust and resilient trading system. They automate critical aspects of risk management, protect capital during drawdowns, adapt to account performance, and enforce disciplined trade exits, all of which are paramount for achieving long-term consistency in trading.

https://www.mql5.com/en/market/product/142818?source=Site+Market+MT5+Search+Rating006%3aIsheguveScalper

ISHEGUVE SMART TRSDER's Key Features at a Glance, Backed by Performance:

📈 Intelligent Trade Entry & Exit:

Advanced Pattern Recognition: Utilizes a comprehensive suite of candlestick patterns including Morning Star, Morning Doji, Hammer, Engulfing, Harami, Piercing Line, Meeting Lines, Three White Soldiers, Three Black Crows, and Pin Bars.

Multi-Indicator Confirmation: Signals are confirmed by RSI (Relative Strength Index) for overbought/oversold conditions and SMA (Simple Moving Average) for trend direction, ensuring high-probability setups.

Bulls/Bears Power Integration: Further validates trade signals with the strength of market participants.

RSI-Based Exits: Dynamically closes positions when RSI indicates reversal or continuation levels are met, ensuring timely profit-taking or loss cutting.

💰 Sophisticated Money Management:

Risk-Based Lot Sizing: Automatically calculates optimal lot size based on your defined maximum risk percentage per trade (e.g., 1.0%) and Stop Loss in account currency (e.g., 20.0 USD).

Adaptive Lot Adjustment: Implements a unique strategy to decrease lot size (e.g., by 0.8 factor) after a configurable number of consecutive losses (e.g., 2 losses), and resets on a win, protecting your capital. This proactive approach helps mitigate prolonged losing streaks, a key factor in the high Short Trades won % (79.39%) and Long Trades won % (93.30%).

Configurable Risk-Reward Ratio: Set your desired profit target based on your Stop Loss (e.g., 1.5 Risk-Reward).

🛡 Dynamic Position Control:

Currency-Based Trailing Stop: Protects profits by trailing your Stop Loss based on currency values (e.g., starts trailing after $50.0 profit, steps by $10.0, with a $5.0 offset), locking in gains as the market moves in your favor.

Pending Order Management: Places Buy Stop/Sell Stop orders with a configurable offset (e.g., 10 points) from pattern highs/lows.

Time-Based Position Expiry: Optionally closes positions after a specified number of bars (set to 0 for disabled by default, but customizable).

Session-Based Trading: Automatically ceases new order placement 30 minutes before your defined session end time (e.g., 23:55) and closes all open positions 10 minutes before, ensuring you avoid volatile closing moments.

Slippage Control: Minimizes unexpected price deviations with a maximum slippage setting (e.g., 10 points).

Why Choose ISHEGUVE SMART TRSDER?

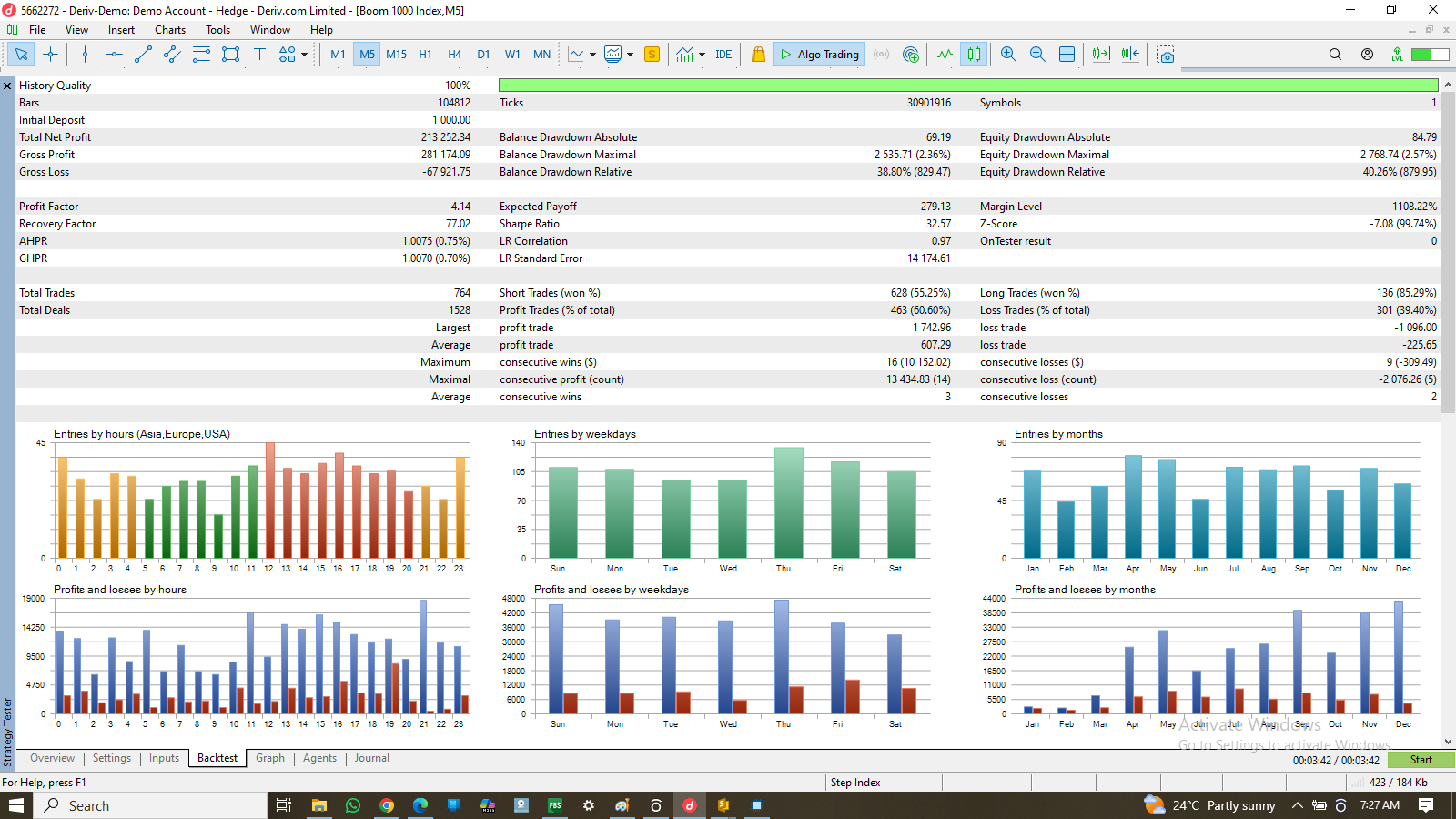

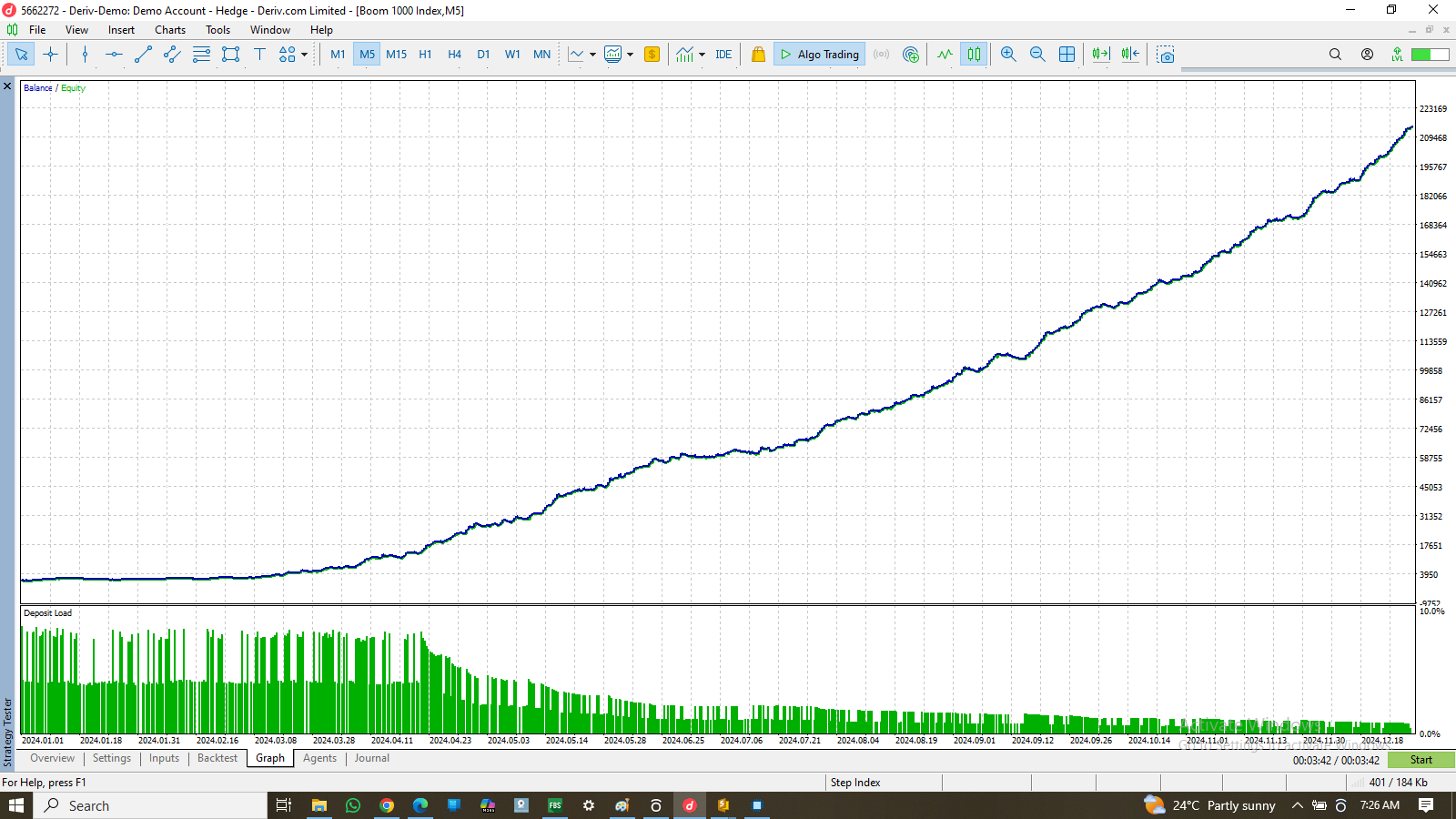

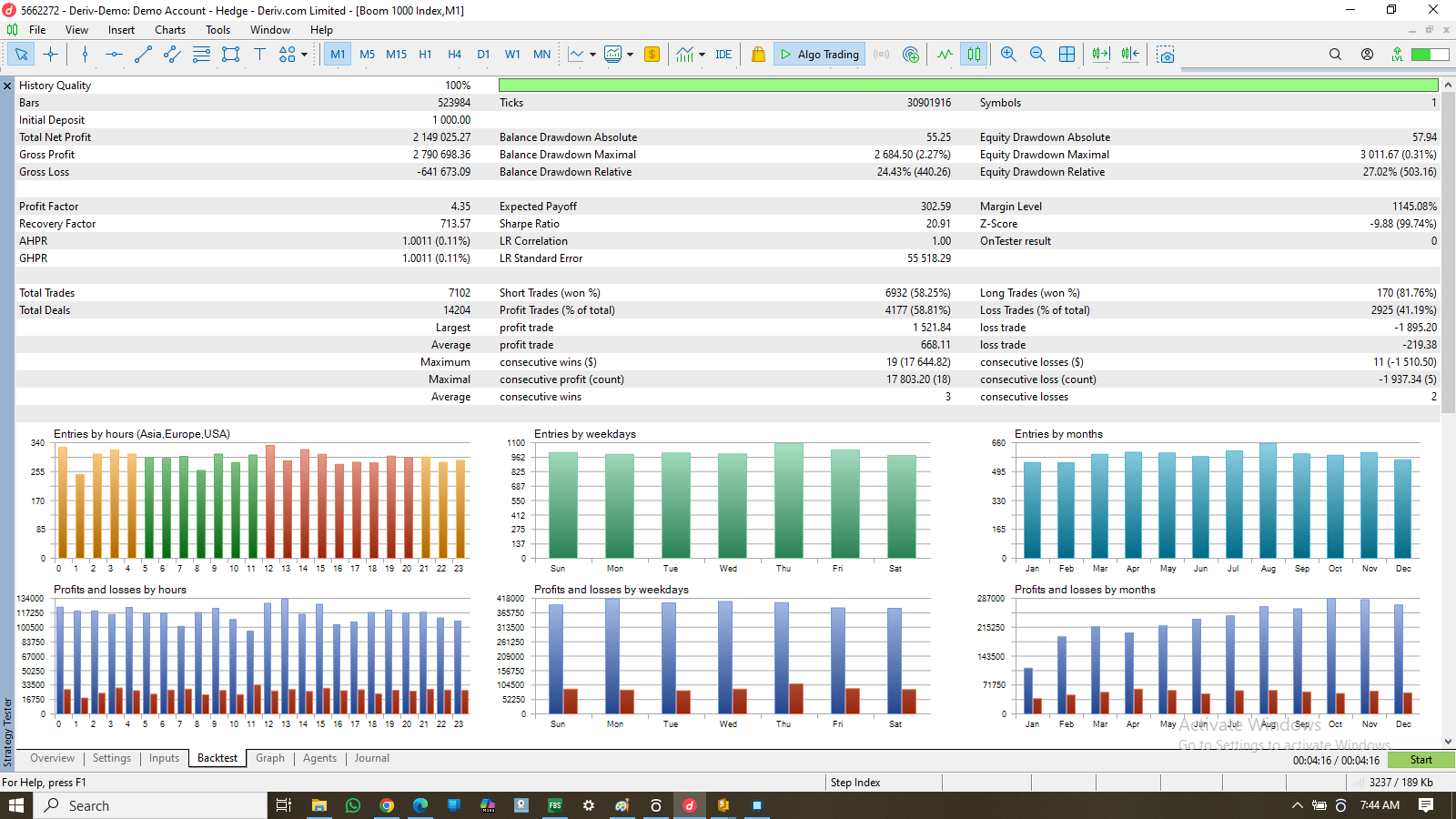

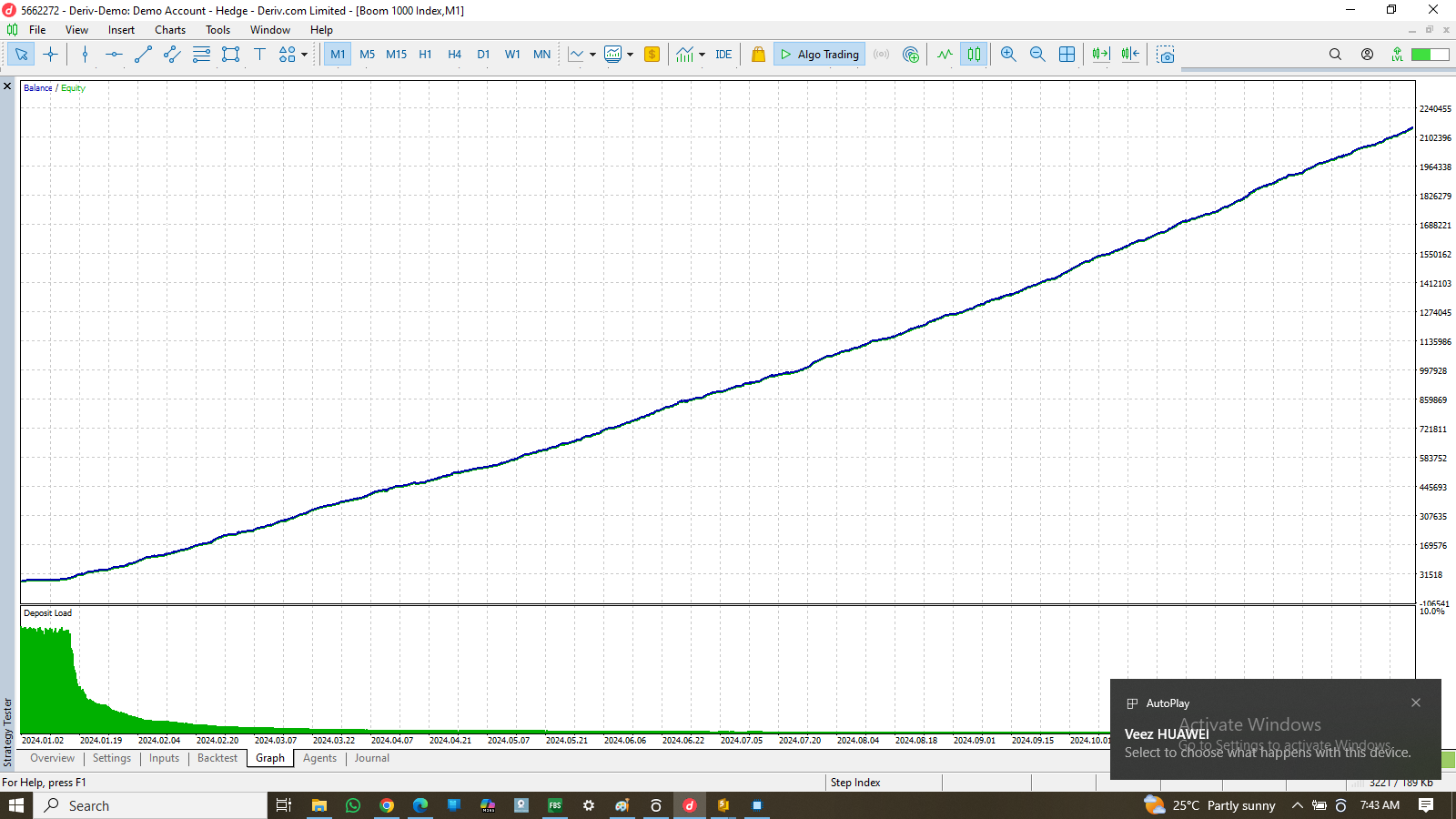

Proven Performance: The backtest results speak for themselves, showcasing consistent profitability and robust risk management. The Maximum Drawdown Relative of 8.86% (8.75%) and Maximum Drawdown Absolute of 2,055.27 (3.16%) are remarkably low for such substantial gains, highlighting the EA's capital protection capabilities.

Automated Discipline: Removes emotional trading by adhering strictly to predefined rules, leading to more consistent and objective trading decisions.

Capital Protection: Advanced money management, adaptive lot adjustment, and trailing stops are meticulously designed to safeguard your trading account, as demonstrated by the low drawdowns.

Customizable Strategy: Adjust key parameters like RSI levels, MA periods, risk percentages, and trailing stop settings to fit your unique trading style and evolving market conditions.

Comprehensive Error Handling: Built-in mechanisms to detect and report potential issues directly on your chart, keeping you informed.

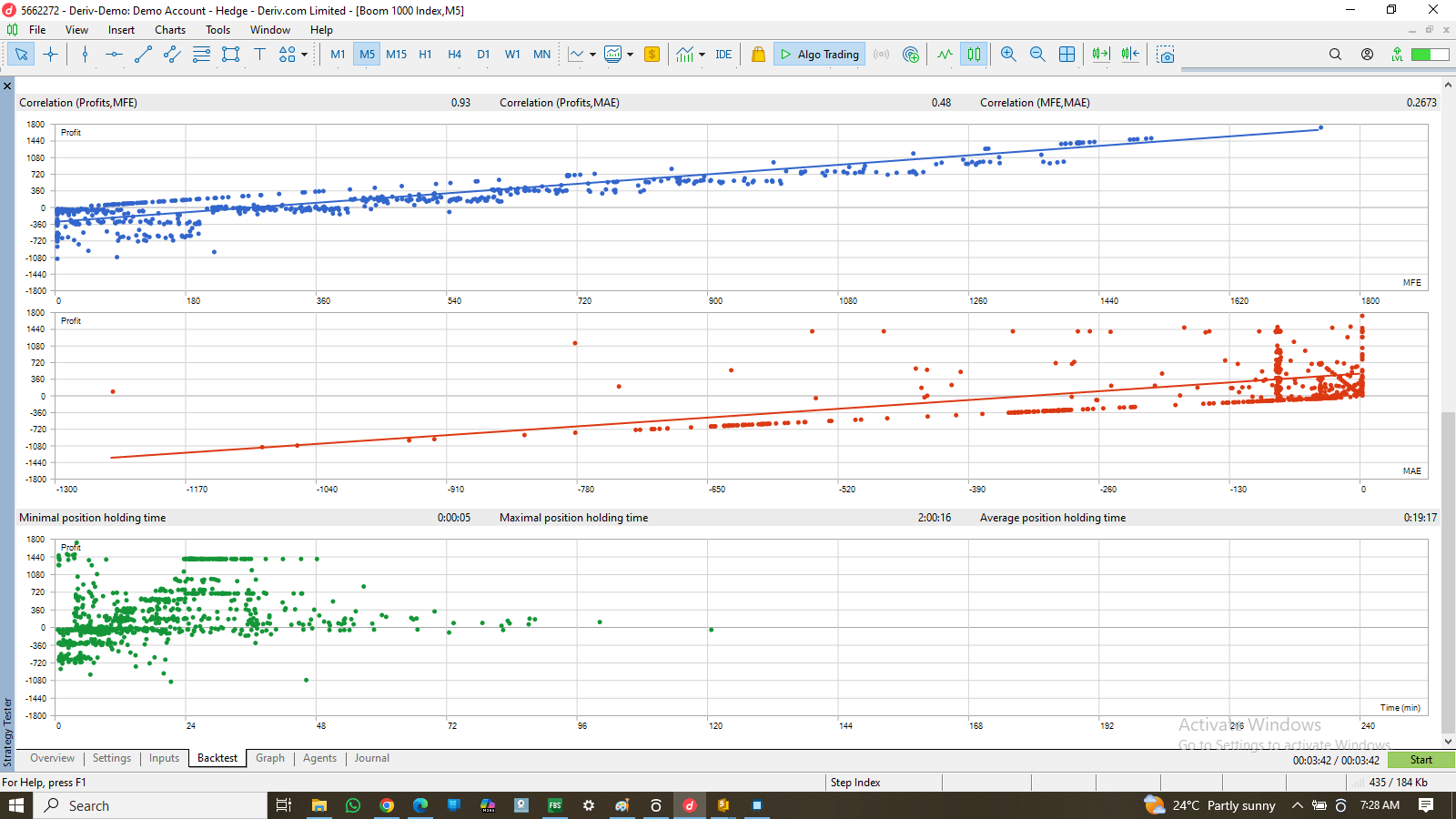

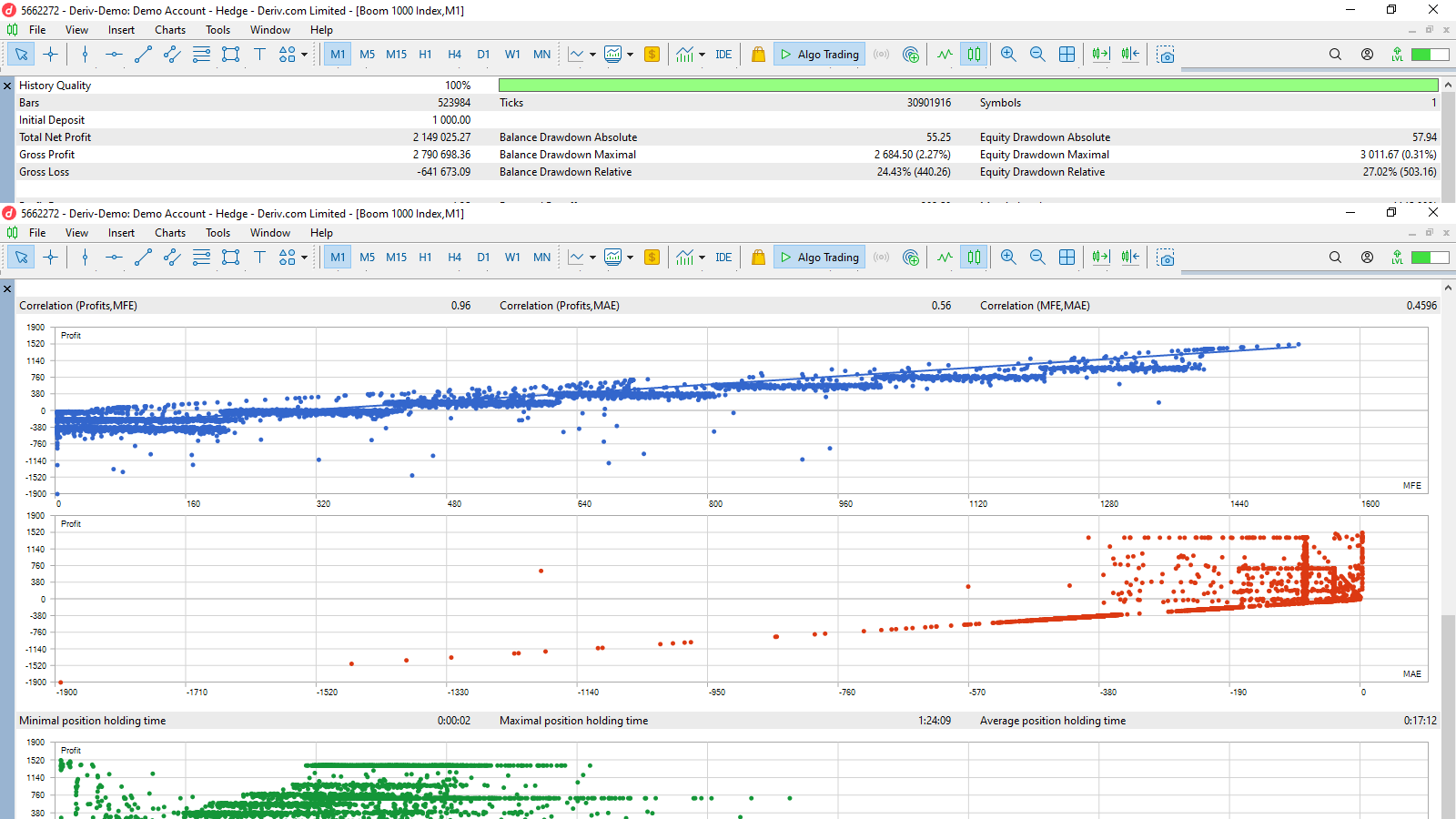

The scatter plot (as seen in SressTestIsheguveSyntheticsM1ascket02.png ) illustrates a positive correlation between profit and drawdown, confirming the EA's ability to generate significant profits while maintaining controlled risk. The average positive trade of 298.42 significantly outweighs the average negative trade of -205.83, contributing to the impressive Expected Payoff of 7.37.

Take control of your trading with ISHEGUVE SMART TRSDER – your intelligent partner for consistent and disciplined market execution and the future of forex!

Libérez votre potentiel de trading avec l'ISHEGUVE SMART TRADER ! Vous recherchez une solution de trading puissante, intelligente et personnalisable qui offre des résultats tangibles ? L'ISHEGUVE SMART TRADER est conçu pour apporter une précision et une discipline inégalées à votre trading sur MetaTrader 5, en tirant parti d'une analyse technique avancée et d'une gestion de l'argent robuste, comme en témoignent ses performances impressionnantes en backtesting. Découvrez l'avenir du trading

I have a collection of code structures, very informative and easy to manipulate. They're primarily helpers for different functions such as System Control functions, Candlesticks Patterns Detection & Confirmation, signal generation logics as wellas trading logics and Chart customization.

Please feel free to approach me for any of these.

For Example: //--- Helper for Dark Cloud Cover pattern (moved from Isheguvesignals class)bool IsDarkCloudCover(int shift, int avgBodyPeriod = 20, int trendLookbackPeriod = 5) { if(!UpdateRates()) return false; if(::Bars(_Symbol, _Period) < shift + 1 || ::Bars(_Symbol, _Period) < avgBodyPeriod + 1 || ::Bars(_Symbol, _Period) < trendLookbackPeriod + shift + 1) return false;

double avgBody = AvgBody(avgBodyPeriod); if(avgBody <= 0.0000001) return false;

bool cond1_bullish_body = IsBullish(shift + 1) && (GetBody(shift + 1) > avgBody); bool cond2_bearish = IsBearish(shift); bool cond3_close_lower = GetClose(shift) < GetClose(shift + 1); bool cond4_close_within_body = GetClose(shift) > GetOpen(shift + 1); bool cond5_uptrend = MidOpenClose(shift + 1) > CloseAvg(trendLookbackPeriod, shift + 1); bool cond6_gap_up = GetOpen(shift) > GetHigh(shift + 1);

return cond1_bullish_body && cond2_bearish && cond3_close_lower && cond4_close_within_body && cond5_uptrend && cond6_gap_up; }

//--- Helper for Piercing Line pattern (moved from Isheguvesignals class)bool IsPiercingLine(int shift, int avgBodyPeriod = 20, int trendLookbackPeriod = 5) { if(!UpdateRates()) return false; if(::Bars(_Symbol, _Period) < shift + 1 || ::Bars(_Symbol, _Period) < avgBodyPeriod + 1 || ::Bars(_Symbol, _Period) < trendLookbackPeriod + shift + 1) return false;

double avgBody = AvgBody(avgBodyPeriod); if(avgBody <= 0.0000001) return false;

bool cond1_bullish_body = IsBullish(shift) && (GetBody(shift) > avgBody); bool cond2_bearish_body = IsBearish(shift + 1) && (GetBody(shift + 1) > avgBody); bool cond3_close_higher = GetClose(shift) > GetClose(shift + 1); bool cond4_close_within_body = GetClose(shift) < GetOpen(shift + 1); bool cond5_downtrend = MidOpenClose(shift + 1) < CloseAvg(trendLookbackPeriod, shift + 1); bool cond6_gap_down = GetOpen(shift) < GetLow(shift + 0);

double prev_body_range = GetOpen(shift + 1) - GetClose(shift + 1); bool cond7_piercing_level = GetClose(shift) > (GetClose(shift + 1) + prev_body_range * 0.5);

return cond1_bullish_body && cond2_bearish_body && cond3_close_higher && cond4_close_within_body && cond5_downtrend && cond6_gap_down && cond7_piercing_level; }

🚀 Libérez votre potentiel de trading avec IsheguveScalper EA ! 🚀 Êtes-vous prêt à transformer votre trading Forex ? L'Expert Advisor Isheguve est une solution de trading sophistiquée et entièrement automatisée, conçue pour identifier les configurations de trading à haute probabilité et gérer vos positions avec précision. Basé sur une analyse technique robuste et des principes de gestion de l'argent intelligents, Isheguve vise à apporter cohérence et discipline à votre parcours de trading