Piyush Lalsingh Ratnu / Perfil

Piyush Lalsingh Ratnu

- Trader & Analyst en Piyush Ratnu Financial Market Research

- Emiratos Árabes Unidos

- 234

- Información

|

3 años

experiencia

|

0

productos

|

0

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

Amigos

14

Solicitudes

Enviadas

Piyush Lalsingh Ratnu

Traders should pay close attention to the OPEC+ meeting on Sunday, Dec. 4. Even though markets are closed that day, OPEC+ plans to meet virtually. Last week, it seemed the group might be discussing a supply increase but this week the rumors are that OPEC+ is discussing a supply cut.

Goldman Sachs thinks that OPEC+ producers are concerned about the recent price declines and will act to cut production in order to shore up prices. However, five OPEC+ delegates said that OPEC+ will likely decide not to change production quotas at all. According to two other OPEC+ sources, the group will discuss cutting production quotas, but it is more likely that the group will keep quotas unchanged.

Since OPEC+’s meeting will take place the day before the implementation of Russian oil sanctions and the price cap, OPEC+ is likely to avoid making any changes to production quotas until it has had time to observe how the market reacts. OPEC+ can call an “extraordinary” meeting to change production quotas if they believe that is needed.

THIS might impact Inflation related data, USD and GOLD too.

Goldman Sachs thinks that OPEC+ producers are concerned about the recent price declines and will act to cut production in order to shore up prices. However, five OPEC+ delegates said that OPEC+ will likely decide not to change production quotas at all. According to two other OPEC+ sources, the group will discuss cutting production quotas, but it is more likely that the group will keep quotas unchanged.

Since OPEC+’s meeting will take place the day before the implementation of Russian oil sanctions and the price cap, OPEC+ is likely to avoid making any changes to production quotas until it has had time to observe how the market reacts. OPEC+ can call an “extraordinary” meeting to change production quotas if they believe that is needed.

THIS might impact Inflation related data, USD and GOLD too.

Piyush Lalsingh Ratnu

CHINESE Stocks + +

USD - -

Reason: Strikes | Authorities' commitment to re-opening

YEN 64

AUD 78 (strongly co-related to CHINA)

NZD 83 (strong impact of CHINA)

In addition to US weakness

USDJPY -

US10YT -

DXY -

Impact: XAUUSD +

USD - -

Reason: Strikes | Authorities' commitment to re-opening

YEN 64

AUD 78 (strongly co-related to CHINA)

NZD 83 (strong impact of CHINA)

In addition to US weakness

USDJPY -

US10YT -

DXY -

Impact: XAUUSD +

Piyush Lalsingh Ratnu

USD S @ 4%

JPY 37

AUD 93

EUR 67

DXY 106.100

US10YT 3.707

USDJPY 138.400

XAUXAG 82.18

AAAU 17.26

POF

China COVID Cases (+ for $)

Amidst market unrest and panic, the US Dollar’s demand as a safe-haven shot through the roof, weighing on the US Dollar dominated Gold price.

FOMC Statements: Impact

The US Federal Reserve minutes showed in the previous that a “substantial majority” of Federal Reserve policymakers agreed it would “likely soon be appropriate” to slow the pace of rate hikes.

BOE speech+ CB Consumer Confidence | 19.00 hours

Week ahead:

Wednesday’s United States ADP Employment Change and the second estimate of the US Gross Domestic Product (GDP) will be closely scrutinized ahead of Federal Reserve Chair Jerome Powell’s speech. Fed Chair Powell is due to speak about the economic outlook, inflation, and the labor market at the Brooking Institution, in Washington, DC. Powell’s words will hold significant relevance before Friday’s all-important US Nonfarm Payrolls release.

JPY 37

AUD 93

EUR 67

DXY 106.100

US10YT 3.707

USDJPY 138.400

XAUXAG 82.18

AAAU 17.26

POF

China COVID Cases (+ for $)

Amidst market unrest and panic, the US Dollar’s demand as a safe-haven shot through the roof, weighing on the US Dollar dominated Gold price.

FOMC Statements: Impact

The US Federal Reserve minutes showed in the previous that a “substantial majority” of Federal Reserve policymakers agreed it would “likely soon be appropriate” to slow the pace of rate hikes.

BOE speech+ CB Consumer Confidence | 19.00 hours

Week ahead:

Wednesday’s United States ADP Employment Change and the second estimate of the US Gross Domestic Product (GDP) will be closely scrutinized ahead of Federal Reserve Chair Jerome Powell’s speech. Fed Chair Powell is due to speak about the economic outlook, inflation, and the labor market at the Brooking Institution, in Washington, DC. Powell’s words will hold significant relevance before Friday’s all-important US Nonfarm Payrolls release.

Piyush Lalsingh Ratnu

As projected and indicated after completion of A pattern at 1746: XAUUSD moved from 1746 to 1756-1764 today.

XAUUSD under PPZ currently.

S2/R2 +/-3/6/9 crucial and ideal entries.

POF:

ECB + FOMC statements today eve

Post holiday sessions: HVPR expected

Next two weeks are extremely volatile weeks

This is NFP week, 14.12.2022: FOMC

15.12.2022: CRS

$1735/1717 and 1777/1818 crucial stops

XAUUSD under PPZ currently.

S2/R2 +/-3/6/9 crucial and ideal entries.

POF:

ECB + FOMC statements today eve

Post holiday sessions: HVPR expected

Next two weeks are extremely volatile weeks

This is NFP week, 14.12.2022: FOMC

15.12.2022: CRS

$1735/1717 and 1777/1818 crucial stops

Piyush Lalsingh Ratnu

CHINA: Bank RRR cut by 0.25

Meaning:

The reserve ratio/requirements set by the central bank are the amount of funds that a bank holds in reserve to ensure that it is able to meet liabilities in case of sudden withdrawals.

Reserve requirement ratio is a tool used by the central bank to increase or decrease the money supply in the economy and influence interest rates.

This means: more monetary stimulus = Higher Inflation

China’s economic outlook is darkening as Covid cases climb to a record and cities tighten restrictions to combat the spread of infections. Even with a RRR cut and more monetary stimulus, the economy is still likely to be pressured by Covid Zero.

China’s benchmark CSI 300 Index of stocks fell 0.5% as of 1:16 p.m. local time as the country reported a record high number of Covid cases. The yield on 10-year government bonds rose 4 basis points after a decline of 7 basis points in the previous session. The onshore yuan traded 0.28% stronger at 7.1378 per dollar.

Releasing more low-cost cash via a RRR reduction could encourage banks to lend to ailing developers as China takes more concerted steps to put a floor under the property crisis. Regulators this week asked banks to stabilize lending to the firms, a call that’s been heeded by major state-owned banks, who are offering at least 220 billion yuan ($31 billion) in new credit to developers.

Meaning:

The reserve ratio/requirements set by the central bank are the amount of funds that a bank holds in reserve to ensure that it is able to meet liabilities in case of sudden withdrawals.

Reserve requirement ratio is a tool used by the central bank to increase or decrease the money supply in the economy and influence interest rates.

This means: more monetary stimulus = Higher Inflation

China’s economic outlook is darkening as Covid cases climb to a record and cities tighten restrictions to combat the spread of infections. Even with a RRR cut and more monetary stimulus, the economy is still likely to be pressured by Covid Zero.

China’s benchmark CSI 300 Index of stocks fell 0.5% as of 1:16 p.m. local time as the country reported a record high number of Covid cases. The yield on 10-year government bonds rose 4 basis points after a decline of 7 basis points in the previous session. The onshore yuan traded 0.28% stronger at 7.1378 per dollar.

Releasing more low-cost cash via a RRR reduction could encourage banks to lend to ailing developers as China takes more concerted steps to put a floor under the property crisis. Regulators this week asked banks to stabilize lending to the firms, a call that’s been heeded by major state-owned banks, who are offering at least 220 billion yuan ($31 billion) in new credit to developers.

Piyush Lalsingh Ratnu

Gold price eyes more upside amid light trading on Thanksgiving Day. STAY ALERT.

Gold price is rejoicing fresh bids above the $1,750 psychological level in what seems to be another down day for the United States Dollar (USD). Investors are likely to hold the recent upside in Gold price amid holiday-thinned light trading conditions on account of Thanksgiving Day in the United States this Thursday.

United States data, Federal Reserve minutes smash US Dollar

The US Dollar and US Treasury bond yields are reeling from the pain inflicted by the dovish US Federal Reserve (Fed) November meeting minutes and discouraging top-tier United States economic releases. The FOMC minutes read: "A substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate" adding that “a slower pace in these circumstances would better allow the Committee to assess progress toward its goals of maximum employment and price stability.”

China covid woes affect physical Gold demand

Amidst a dovish Federal Reserve pivot, Gold price has ignored China’s covid resurgence and fresh restrictions even though these factors have impacted the physical gold demand in Asia this week. Gold premiums in top hub China have eased further while higher domestic prices have curbed the demand for the yellow metal in India. Note that India and China are the world’s top two Gold consumers. China's daily coronavirus cases hit a record high since the beginning of the pandemic, the official data showed Thursday. The country recorded 31,454 domestic cases, with major cities back under lockdown restrictions.

The market sentiment remains cautiously optimistic, as the Federal Reserve’s dovishness overshadows China’s covid concerns, as traders from the United States move on the sidelines to celebrate Thanksgiving Day.

Gold price is rejoicing fresh bids above the $1,750 psychological level in what seems to be another down day for the United States Dollar (USD). Investors are likely to hold the recent upside in Gold price amid holiday-thinned light trading conditions on account of Thanksgiving Day in the United States this Thursday.

United States data, Federal Reserve minutes smash US Dollar

The US Dollar and US Treasury bond yields are reeling from the pain inflicted by the dovish US Federal Reserve (Fed) November meeting minutes and discouraging top-tier United States economic releases. The FOMC minutes read: "A substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate" adding that “a slower pace in these circumstances would better allow the Committee to assess progress toward its goals of maximum employment and price stability.”

China covid woes affect physical Gold demand

Amidst a dovish Federal Reserve pivot, Gold price has ignored China’s covid resurgence and fresh restrictions even though these factors have impacted the physical gold demand in Asia this week. Gold premiums in top hub China have eased further while higher domestic prices have curbed the demand for the yellow metal in India. Note that India and China are the world’s top two Gold consumers. China's daily coronavirus cases hit a record high since the beginning of the pandemic, the official data showed Thursday. The country recorded 31,454 domestic cases, with major cities back under lockdown restrictions.

The market sentiment remains cautiously optimistic, as the Federal Reserve’s dovishness overshadows China’s covid concerns, as traders from the United States move on the sidelines to celebrate Thanksgiving Day.

Piyush Lalsingh Ratnu

DXY 106.250

AAAU 17.32

US10YT 3.743

US F - in RT + zone

US S 19

AUD 69

JPY 69

EUR 50

XAUXAG 81.51

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram:

https://www.instagram.com/prgoldanalysis

You Tube Channel:

https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Track Daily: Spot Gold: XAUUSD Price Forecast

https://bit.ly/DailyGoldPriceForecastbyPR

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis

10 days complimentary.

Annual Package: contact for charges

(Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

AAAU 17.32

US10YT 3.743

US F - in RT + zone

US S 19

AUD 69

JPY 69

EUR 50

XAUXAG 81.51

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram:

https://www.instagram.com/prgoldanalysis

You Tube Channel:

https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Track Daily: Spot Gold: XAUUSD Price Forecast

https://bit.ly/DailyGoldPriceForecastbyPR

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis

10 days complimentary.

Annual Package: contact for charges

(Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

Piyush Lalsingh Ratnu

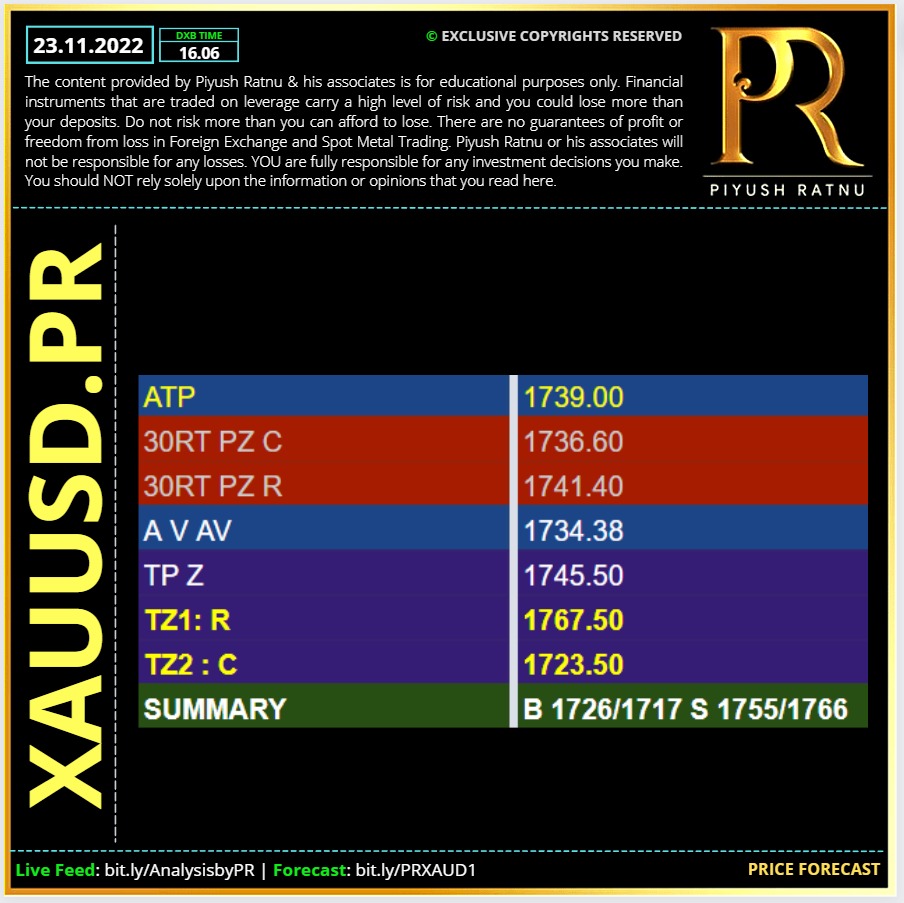

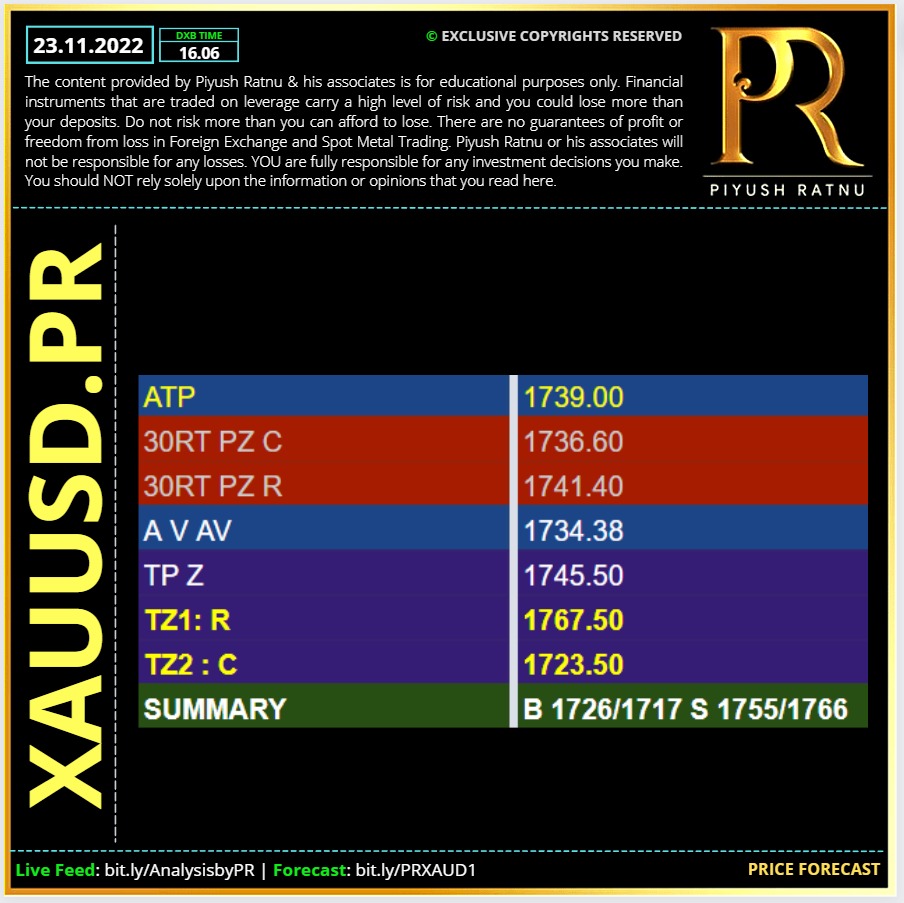

23.11.2022 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram:

https://www.instagram.com/prgoldanalysis

You Tube Channel:

https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Track Daily: Spot Gold: XAUUSD Price Forecast

https://bit.ly/DailyGoldPriceForecastbyPR

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis

10 days complimentary.

Annual Package: contact for charges

(Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram:

https://www.instagram.com/prgoldanalysis

You Tube Channel:

https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Track Daily: Spot Gold: XAUUSD Price Forecast

https://bit.ly/DailyGoldPriceForecastbyPR

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis

10 days complimentary.

Annual Package: contact for charges

(Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

Piyush Lalsingh Ratnu

What Happens When A Crypto Exchange Goes Bankrupt?

Cryptocurrency users have limited recourse if the cryptocurrency company that they use goes bankrupt.

After the bankruptcies of crypto firms Celsius and Voyager, investors have a reason for concern.

Cryptocurrency holdings are not protected by government-backed insurance.

Key Examples:

Celsius Network, a large cryptocurrency lending platform, filed for bankruptcy protection on July 13, 2022. The filing came about a month after Celsius paused all withdrawals, swaps, and transfers among customer accounts. In a filing with the U.S. Bankruptcy Court in New York, Celsius shared that it owes roughly $1.2 billion more than it has on hand.

How to Recover Funds from a Bankrupt Cryptocurrency Company

If you followed know your customer (KYC) requirements and created your account with legitimate information, the crypto company should have your contact information and an accounting of what you’re owed on file. If the company goes bankrupt, you should ideally hear from them right away with information on recovering funds.

Most companies will employ their own process to distribute funds to customers. That may require you to follow up by completing forms, confirming your address or payment information, and keeping up with any other necessary paperwork to get your crypto or cash returned.

While there’s a risk that cryptocurrency investors could get no money or crypto back after bankruptcy, there’s also a chance that they will get something back—even if it’s just a portion of their original investment.

Are cryptocurrencies backed by other assets?

Each cryptocurrency is unique and follows its own set of rules and features. Some cryptocurrencies, like stablecoins, have assets backing them, while others don’t.

Cryptocurrency users have limited recourse if the cryptocurrency company that they use goes bankrupt.

After the bankruptcies of crypto firms Celsius and Voyager, investors have a reason for concern.

Cryptocurrency holdings are not protected by government-backed insurance.

Key Examples:

Celsius Network, a large cryptocurrency lending platform, filed for bankruptcy protection on July 13, 2022. The filing came about a month after Celsius paused all withdrawals, swaps, and transfers among customer accounts. In a filing with the U.S. Bankruptcy Court in New York, Celsius shared that it owes roughly $1.2 billion more than it has on hand.

How to Recover Funds from a Bankrupt Cryptocurrency Company

If you followed know your customer (KYC) requirements and created your account with legitimate information, the crypto company should have your contact information and an accounting of what you’re owed on file. If the company goes bankrupt, you should ideally hear from them right away with information on recovering funds.

Most companies will employ their own process to distribute funds to customers. That may require you to follow up by completing forms, confirming your address or payment information, and keeping up with any other necessary paperwork to get your crypto or cash returned.

While there’s a risk that cryptocurrency investors could get no money or crypto back after bankruptcy, there’s also a chance that they will get something back—even if it’s just a portion of their original investment.

Are cryptocurrencies backed by other assets?

Each cryptocurrency is unique and follows its own set of rules and features. Some cryptocurrencies, like stablecoins, have assets backing them, while others don’t.

Piyush Lalsingh Ratnu

CMP 1755

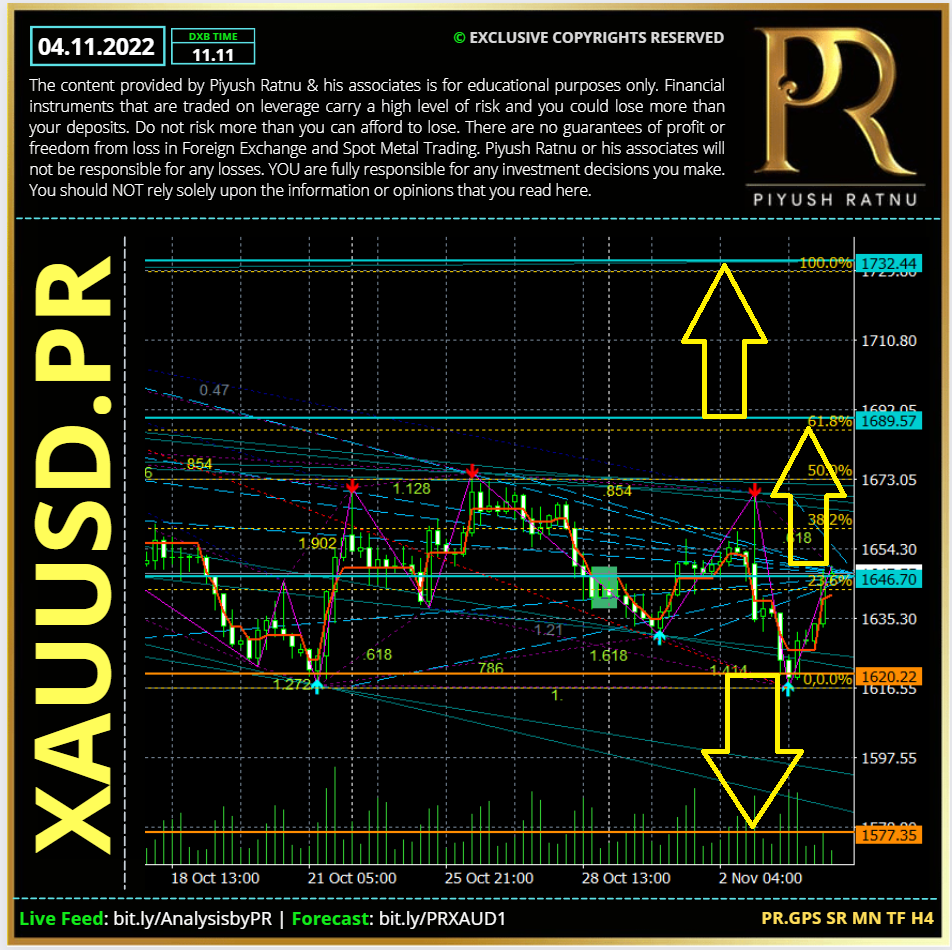

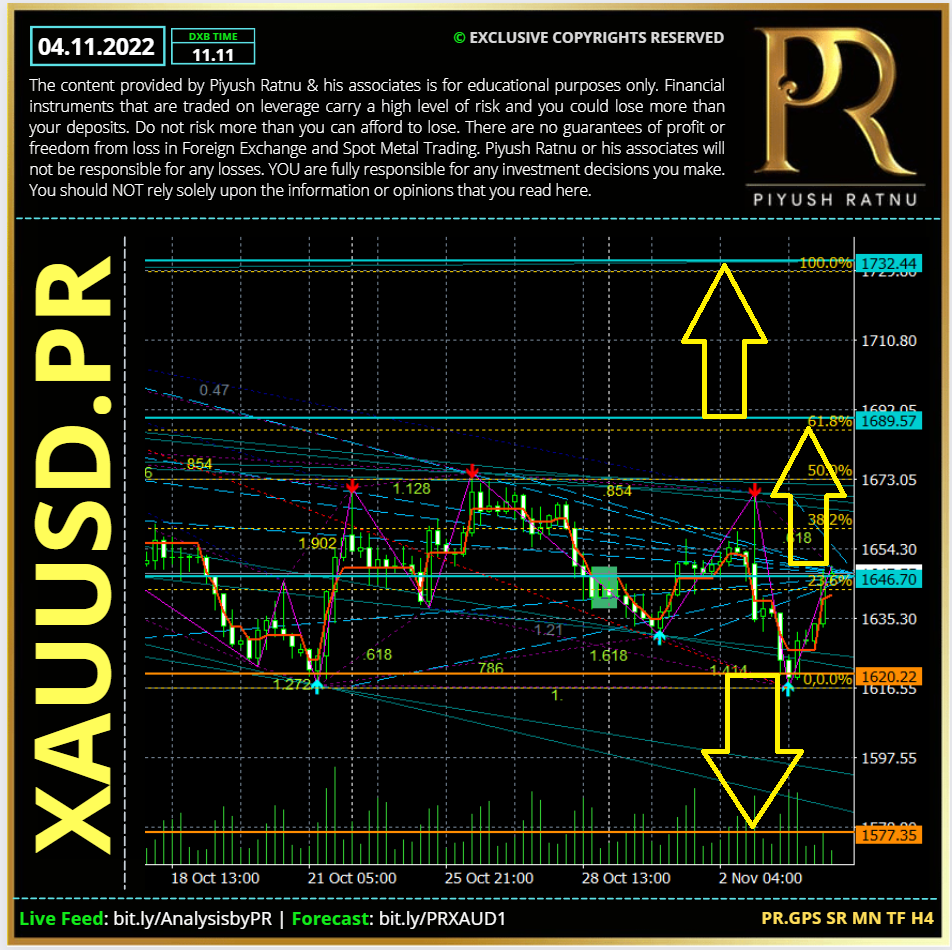

As projected on 04.11.2022

Breach of 1692 = 1717/1735/1755

Read analysis at https://bit.ly/04112022NFPAnalysisPR

As projected on 04.11.2022

Breach of 1692 = 1717/1735/1755

Read analysis at https://bit.ly/04112022NFPAnalysisPR

Piyush Lalsingh Ratnu

As projected in NFP Analysis: https://bit.ly/04112022NFPAnalysisPR

IF Gold breaches 1692: 1717.1735,1755 NEXT | Friday high: 1772

See analysis on Instagram: @prgoldanalysis | Copy and paste this url in browser: bit.ly/PRXAUD1

IF Gold breaches 1692: 1717.1735,1755 NEXT | Friday high: 1772

See analysis on Instagram: @prgoldanalysis | Copy and paste this url in browser: bit.ly/PRXAUD1

Piyush Lalsingh Ratnu

Current status

DXY -

USDJPY -

US10YT 4.073-

US F RT mode +

US S 44

EUR 9

JPY 76

AUD 55

XAUXAG 80.59 -

AAU BAR + 16.66+ C

14.11.2022 ahead: STAY ALERT

Mr. TRUMP to surprise all on 15.11.2022

(As broadcasted)

DXY -

USDJPY -

US10YT 4.073-

US F RT mode +

US S 44

EUR 9

JPY 76

AUD 55

XAUXAG 80.59 -

AAU BAR + 16.66+ C

14.11.2022 ahead: STAY ALERT

Mr. TRUMP to surprise all on 15.11.2022

(As broadcasted)

Piyush Lalsingh Ratnu

Yesterday’s high: 1717

Today’s low: 1706.92

1717-1707 achieved.

Selling price as mentioned in my analysis published at 19.28 hours yesterday evening.

Net pips: 10*100= 1000 pips.

See analysis on Instagram: @prgoldanalysis | Copy and paste this url in browser: bit.ly/PRXAUD1

Today’s low: 1706.92

1717-1707 achieved.

Selling price as mentioned in my analysis published at 19.28 hours yesterday evening.

Net pips: 10*100= 1000 pips.

See analysis on Instagram: @prgoldanalysis | Copy and paste this url in browser: bit.ly/PRXAUD1

Piyush Lalsingh Ratnu

BTCUSD: touched $18,000 mark ahead

14.11.2022: remarkable day, the turning point.

As observed since last 4 years.

Time to HOLD BTCUSD | CMP 18100

Target: 20,000 | 11% ROI on the cards.

14.11.2022: remarkable day, the turning point.

As observed since last 4 years.

Time to HOLD BTCUSD | CMP 18100

Target: 20,000 | 11% ROI on the cards.

Piyush Lalsingh Ratnu

High volumes based price movement observed in XAUUSD and major currencies. 200-300 pips price movement traced in M1 - USDJPY indicating a major role of bank.

CAC completed 100% RT

US F next? If yes, then Impact: XAUUSD crash.

HVPR expected.

NFP Analysis: https://bit.ly/04112022NFPAnalysisPR

CAC completed 100% RT

US F next? If yes, then Impact: XAUUSD crash.

HVPR expected.

NFP Analysis: https://bit.ly/04112022NFPAnalysisPR

Piyush Lalsingh Ratnu

SUMMARY of FED MONETARY POLICY STATEMENT:

"Effective November 3, 2022, the Federal Open Market Committee directs the Desk to:

o Undertake open market operations as necessary to maintain the federal funds rate in a target range of 3-3/4 to 4 percent.

o Conduct overnight repurchase agreement operations with a minimum bid rate of 4 percent and with an aggregate operation limit of $500 billion; the aggregate operation limit can be temporarily increased at the discretion of the Chair.

o Conduct overnight reverse repurchase agreement operations at an offering rate of 3.8 percent and with a per-counterparty limit of $160 billion per day; the percounterparty limit can be temporarily increased at the discretion of the Chair.

o Roll over at auction the amount of principal payments from the Federal Reserve's holdings of Treasury securities maturing in each calendar month that exceeds a cap of $60 billion per month. Redeem Treasury coupon securities up to this monthly cap and Treasury bills to the extent that coupon principal payments are less than the monthly cap.

o Reinvest into agency mortgage-backed securities (MBS) the amount of principal payments from the Federal Reserve's holdings of agency debt and agency MBS received in each calendar month that exceeds a cap of $35 billion per month.

o Allow modest deviations from stated amounts for reinvestments, if needed for operational reasons.

o Engage in dollar roll and coupon swap transactions as necessary to facilitate settlement of the Federal Reserve's agency MBS transactions."

Important point from the policy:

The Committee is strongly committed to returning inflation to its 2 percent objective.

In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that were issued in May.

Russia’s war against Ukraine is causing tremendous human and economic hardship. The war and related events are creating additional upward pressure on inflation and are weighing on global economic activity. The Committee is highly attentive to inflation risks.

IMPACT: more higher interest rates = pressure on GOLD

POLICY: https://www.federalreserve.gov/monetarypolicy/files/monetary20221102a1.pdf

"Effective November 3, 2022, the Federal Open Market Committee directs the Desk to:

o Undertake open market operations as necessary to maintain the federal funds rate in a target range of 3-3/4 to 4 percent.

o Conduct overnight repurchase agreement operations with a minimum bid rate of 4 percent and with an aggregate operation limit of $500 billion; the aggregate operation limit can be temporarily increased at the discretion of the Chair.

o Conduct overnight reverse repurchase agreement operations at an offering rate of 3.8 percent and with a per-counterparty limit of $160 billion per day; the percounterparty limit can be temporarily increased at the discretion of the Chair.

o Roll over at auction the amount of principal payments from the Federal Reserve's holdings of Treasury securities maturing in each calendar month that exceeds a cap of $60 billion per month. Redeem Treasury coupon securities up to this monthly cap and Treasury bills to the extent that coupon principal payments are less than the monthly cap.

o Reinvest into agency mortgage-backed securities (MBS) the amount of principal payments from the Federal Reserve's holdings of agency debt and agency MBS received in each calendar month that exceeds a cap of $35 billion per month.

o Allow modest deviations from stated amounts for reinvestments, if needed for operational reasons.

o Engage in dollar roll and coupon swap transactions as necessary to facilitate settlement of the Federal Reserve's agency MBS transactions."

Important point from the policy:

The Committee is strongly committed to returning inflation to its 2 percent objective.

In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that were issued in May.

Russia’s war against Ukraine is causing tremendous human and economic hardship. The war and related events are creating additional upward pressure on inflation and are weighing on global economic activity. The Committee is highly attentive to inflation risks.

IMPACT: more higher interest rates = pressure on GOLD

POLICY: https://www.federalreserve.gov/monetarypolicy/files/monetary20221102a1.pdf

Piyush Lalsingh Ratnu

North Korea Warns US With ‘Powerful Measures’ After Drills

North Korea threatened to unleash a powerful action if the US does not halt joint military drills with partners including South Korea, in what might be an effort by Kim Jong Un to lay the groundwork for his first nuclear test in five years.

“If the US continuously persists in the grave military provocations, the DPRK will take into account more powerful follow-up measures,” the state’s foreign ministry said in a statement released on official media Tuesday. Such ministry statements are often used by the country, officially known as the Democratic People’s Republic of Korea, to make clear the warning is coming from Kim’s regime.

The US and South Korea this week started joint air drills known as Vigilant Storm that will run through Friday and involve about 240 aircraft in about 1,600 sorties to “hone their wartime capabilities,” the US 7th Air Force said in a statement. The drills have added to a series of joint exercises on land, sea and air in recent weeks, some of which have also included Japan, that have led to complaints and provocations from Pyongyang.

“If the U.S. does not want any serious developments not suited to its security interests, it should stop the useless and ineffective war exercises at once,” said the statement from the Foreign Ministry, which was released by the official Korean Central News Agency. “If not, it will have to totally take the blame for all the consequences.”

North Korea has finished preparations for a nuclear test, South Korea’s president told parliament, stoking concerns that Pyongyang’s first blast of an atomic device in five years could be imminent.

“We assess that it has already completed preparations for a seventh nuclear test,” Yoon Suk Yeol said Tuesday, adding Kim Jong Un’s regime has defended the preemptive use of nuclear weapons.

Impact: XAUUSD +$100-120 in 48 hours

North Korea threatened to unleash a powerful action if the US does not halt joint military drills with partners including South Korea, in what might be an effort by Kim Jong Un to lay the groundwork for his first nuclear test in five years.

“If the US continuously persists in the grave military provocations, the DPRK will take into account more powerful follow-up measures,” the state’s foreign ministry said in a statement released on official media Tuesday. Such ministry statements are often used by the country, officially known as the Democratic People’s Republic of Korea, to make clear the warning is coming from Kim’s regime.

The US and South Korea this week started joint air drills known as Vigilant Storm that will run through Friday and involve about 240 aircraft in about 1,600 sorties to “hone their wartime capabilities,” the US 7th Air Force said in a statement. The drills have added to a series of joint exercises on land, sea and air in recent weeks, some of which have also included Japan, that have led to complaints and provocations from Pyongyang.

“If the U.S. does not want any serious developments not suited to its security interests, it should stop the useless and ineffective war exercises at once,” said the statement from the Foreign Ministry, which was released by the official Korean Central News Agency. “If not, it will have to totally take the blame for all the consequences.”

North Korea has finished preparations for a nuclear test, South Korea’s president told parliament, stoking concerns that Pyongyang’s first blast of an atomic device in five years could be imminent.

“We assess that it has already completed preparations for a seventh nuclear test,” Yoon Suk Yeol said Tuesday, adding Kim Jong Un’s regime has defended the preemptive use of nuclear weapons.

Impact: XAUUSD +$100-120 in 48 hours

Piyush Lalsingh Ratnu

Saudi Arabia, US Share Intel on Possible Iran Attack

Saudi Arabia and the US have shared information indicating Iran may attack the kingdom or other nations in the region sometime soon, leading Washington and Riyadh to adjust their military posture, according to people familiar with the matter.

The two countries as well as regional allies have raised their military alert level, said the people, who asked not to be identified discussing internal deliberations. They described the possible attacks as an effort to distract from nationwide protests that have roiled Iran in recent weeks.

Tensions remain high, with Iran arrayed against Saudi Arabia and other nations in the region after a series of attacks in recent years that included Iran’s Islamic Revolutionary Guard Corps firing more than 70 missiles in September into Iraq’s Kurdish region, where the US still has troops stationed. In addition, a United Nations-brokered truce between Yemen’s government backed by the Saudis and the Iran-backed Shiite Houthi rebel militia has expired.

IMPACT: XAUUSD + $75-120 price movement in 24/48 hours.

Saudi Arabia and the US have shared information indicating Iran may attack the kingdom or other nations in the region sometime soon, leading Washington and Riyadh to adjust their military posture, according to people familiar with the matter.

The two countries as well as regional allies have raised their military alert level, said the people, who asked not to be identified discussing internal deliberations. They described the possible attacks as an effort to distract from nationwide protests that have roiled Iran in recent weeks.

Tensions remain high, with Iran arrayed against Saudi Arabia and other nations in the region after a series of attacks in recent years that included Iran’s Islamic Revolutionary Guard Corps firing more than 70 missiles in September into Iraq’s Kurdish region, where the US still has troops stationed. In addition, a United Nations-brokered truce between Yemen’s government backed by the Saudis and the Iran-backed Shiite Houthi rebel militia has expired.

IMPACT: XAUUSD + $75-120 price movement in 24/48 hours.

: