Piyush Lalsingh Ratnu / Perfil

Piyush Lalsingh Ratnu

- Trader & Analyst en Piyush Ratnu Gold Market Research

- Emiratos Árabes Unidos

- 296

- Información

|

1 año

experiencia

|

0

productos

|

0

versiones demo

|

|

0

trabajos

|

2

señales

|

0

suscriptores

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Amigos

19

Solicitudes

Enviadas

Piyush Lalsingh Ratnu

XAUUSD Crucial Price Zones Ahead:

🔺$4242/4269/4285/4303/4343 | SZ

🔻$4085/4040/3985/3939/3883 | BZ

I suggest BUYING LOWS. Exit NAP.

SZ might be risky, hence avoid to hold the positions, exit in NAP, and before price/liquidity sweep zones.

🔺$4242/4269/4285/4303/4343 | SZ

🔻$4085/4040/3985/3939/3883 | BZ

I suggest BUYING LOWS. Exit NAP.

SZ might be risky, hence avoid to hold the positions, exit in NAP, and before price/liquidity sweep zones.

Piyush Lalsingh Ratnu

Gold is entering the final stretch of November with renewed strength as global markets reposition around a softer dollar and rising expectations of Federal Reserve rate cuts in early 2026. The metal has climbed decisively above the 4141 dollars area, extending the rebound that began after the mid month consolidation and now approaching the upper boundaries of the November range.

The dollar has lost some of the defensive bid that dominated much of the autumn. As Treasury yields retreated and traders began to price in a more accommodative Fed path, the dollar index pulled back from recent highs. For gold, this combination is particularly supportive. The metal tends to benefit when real yields decline and when the currency environment becomes less hostile to non yielding assets.

Behind this shift lies a gradual but meaningful change in economic data. Job growth moderated, leading indicators weakened, and several inflation components decelerated. None of these signals point to recession, but they collectively justify a more cautious policy stance.

Markets are now comfortable assigning a non trivial probability to a mid 2026 rate cut, a scenario that enhances the appeal of gold as a hedge against monetary adjustment.

Geo-political Pressures

The geopolitical environment remains complex. Tensions in several regions persist, energy markets continue to rebalance unevenly, and supply chain fragmentation remains a strategic concern for policymakers. In this context, gold plays a dual role. It offers protection against financial volatility and serves as a hedge against geopolitical surprise.

What's next in December?

The final month of the year often delivers distinct patterns in precious metals as liquidity thins and macro themes dominate. This year, gold enters December with a compelling combination of stabilizing inflation, easing yields, currency softness and persistent geopolitical uncertainty.

These ingredients create a favourable environment for demand to remain steady even if momentum fluctuates.

The dollar has lost some of the defensive bid that dominated much of the autumn. As Treasury yields retreated and traders began to price in a more accommodative Fed path, the dollar index pulled back from recent highs. For gold, this combination is particularly supportive. The metal tends to benefit when real yields decline and when the currency environment becomes less hostile to non yielding assets.

Behind this shift lies a gradual but meaningful change in economic data. Job growth moderated, leading indicators weakened, and several inflation components decelerated. None of these signals point to recession, but they collectively justify a more cautious policy stance.

Markets are now comfortable assigning a non trivial probability to a mid 2026 rate cut, a scenario that enhances the appeal of gold as a hedge against monetary adjustment.

Geo-political Pressures

The geopolitical environment remains complex. Tensions in several regions persist, energy markets continue to rebalance unevenly, and supply chain fragmentation remains a strategic concern for policymakers. In this context, gold plays a dual role. It offers protection against financial volatility and serves as a hedge against geopolitical surprise.

What's next in December?

The final month of the year often delivers distinct patterns in precious metals as liquidity thins and macro themes dominate. This year, gold enters December with a compelling combination of stabilizing inflation, easing yields, currency softness and persistent geopolitical uncertainty.

These ingredients create a favourable environment for demand to remain steady even if momentum fluctuates.

Piyush Lalsingh Ratnu

As Alerted in advance:

XAGUSD crashed $6.5 in last 3 days.

#XAGUSD #PiyushRatnu #forex #trading #analysis

XAGUSD crashed $6.5 in last 3 days.

#XAGUSD #PiyushRatnu #forex #trading #analysis

Piyush Lalsingh Ratnu

1️⃣2️⃣3️⃣WHY XAUUSD Shot up from $3333 zone:

🟢1. Gold rallies to $3,359 after Trump BLS nominee suggests suspending monthly NFP releases.

🟢2. Trump slams Powell, threatens lawsuit, reigniting Fed independence concerns | Uncertainty = XAUUSD +🔺

🟢3. July US CPI misses headline estimates, boosting odds of September Fed rate cut = XAUUSD 🔺

Gold price recovered some ground on Tuesday, climbing 0.20% following the release of July’s inflation print in the United States (US).

Although prices had risen, Bullion’s was supported by US President Donald Trump's remarks threatening the Federal Reserve’s (Fed) independence. The XAU/USD trades at $3,348 at the time of writing.

The US Consumer Price Index (CPI) for July missed estimates in its headline print YoY and increased the odds for a rate cut. However, the core CPI, which excludes volatile items, jumped above the 3% threshold YoY. Impact: XAUUSD 🔺

Initially, XAU/USD fell toward its daily lows but was boosted by Trump's comments on Jerome Powell, calling the Fed Chair too late at cutting rates and threatening to sue him regarding the renovation of the Fed buildings.

It was worth noticing the timing of Mr. Trump's remarks and US CPI data.

On the remarks, Bullion prices rose from around daily lows near $3,331 toward $3,345 before rising toward their daily high of $3,359.

🔔Gold’s last leg up was courtesy of EJ Antoni, the economist nominated by Trump to head the Bureau of Labor Statistics (BLS), who suggested suspending monthly Nonfarm Payrolls (NFP)data. He argued that its underlying methodology, economic modeling, and statistical assumptions are fundamentally flawed. Instead, Antoni proposes quarterly data.

🟢1. Gold rallies to $3,359 after Trump BLS nominee suggests suspending monthly NFP releases.

🟢2. Trump slams Powell, threatens lawsuit, reigniting Fed independence concerns | Uncertainty = XAUUSD +🔺

🟢3. July US CPI misses headline estimates, boosting odds of September Fed rate cut = XAUUSD 🔺

Gold price recovered some ground on Tuesday, climbing 0.20% following the release of July’s inflation print in the United States (US).

Although prices had risen, Bullion’s was supported by US President Donald Trump's remarks threatening the Federal Reserve’s (Fed) independence. The XAU/USD trades at $3,348 at the time of writing.

The US Consumer Price Index (CPI) for July missed estimates in its headline print YoY and increased the odds for a rate cut. However, the core CPI, which excludes volatile items, jumped above the 3% threshold YoY. Impact: XAUUSD 🔺

Initially, XAU/USD fell toward its daily lows but was boosted by Trump's comments on Jerome Powell, calling the Fed Chair too late at cutting rates and threatening to sue him regarding the renovation of the Fed buildings.

It was worth noticing the timing of Mr. Trump's remarks and US CPI data.

On the remarks, Bullion prices rose from around daily lows near $3,331 toward $3,345 before rising toward their daily high of $3,359.

🔔Gold’s last leg up was courtesy of EJ Antoni, the economist nominated by Trump to head the Bureau of Labor Statistics (BLS), who suggested suspending monthly Nonfarm Payrolls (NFP)data. He argued that its underlying methodology, economic modeling, and statistical assumptions are fundamentally flawed. Instead, Antoni proposes quarterly data.

Piyush Lalsingh Ratnu

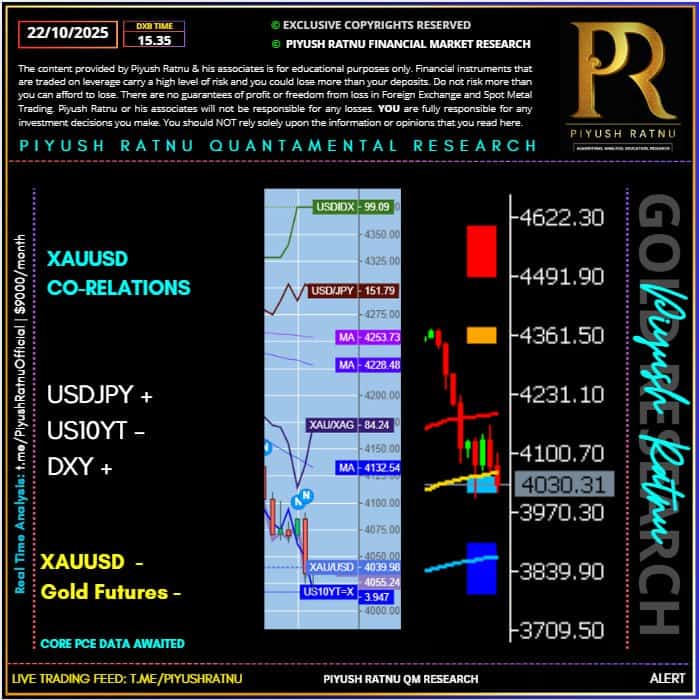

USDJPY - XAUUSD Co-relations:

USDJPY: S1-R2 achieved

XAUUSD: R1-S2 (ahead)

USDJPY $146.775-147.935 +

Expected impact on XAUUSD:

$35/50 | $3373-50 = $3323

BZ $3333/3309/3285 on radar

Reversal scenario:

USDJPY RT (-) = XAUUSD +

1000P/$30

USDJPY: S1-R2 achieved

XAUUSD: R1-S2 (ahead)

USDJPY $146.775-147.935 +

Expected impact on XAUUSD:

$35/50 | $3373-50 = $3323

BZ $3333/3309/3285 on radar

Reversal scenario:

USDJPY RT (-) = XAUUSD +

1000P/$30

Piyush Lalsingh Ratnu

WHY XAUUSD is crashing?

The risk-on market environment continues to diminish the safe-haven appeal of the US Dollar (USD) and Gold price.

The ECB is widely expected to hold key interest rates following its July policy meeting later this Thursday.

Markets will also closely follow the developments surrounding the ongoing feud between US President Donald Trump and Fed Chairman Jerome Powell as the former is set to visit the Fed today.

The risk-on market environment continues to diminish the safe-haven appeal of the US Dollar (USD) and Gold price.

The ECB is widely expected to hold key interest rates following its July policy meeting later this Thursday.

Markets will also closely follow the developments surrounding the ongoing feud between US President Donald Trump and Fed Chairman Jerome Powell as the former is set to visit the Fed today.

Piyush Lalsingh Ratnu

USDJPY 1000 P crash observed after 85% RT of price gap witnessed early morning.

What it indicates?

This price action indicates strengthening YEN, resulting in lower USD = XAUUSD +.

USDJPY: (-) 1000P = XAUUSD $30/45+

$3355+30= $3385/3404 zone on radar.

What it indicates?

This price action indicates strengthening YEN, resulting in lower USD = XAUUSD +.

USDJPY: (-) 1000P = XAUUSD $30/45+

$3355+30= $3385/3404 zone on radar.

Piyush Lalsingh Ratnu

🔴 XAUUSD

H1VS5 achieved

$3312-3308 achieved

Exit ALL SELL Positions

💬I will NOT SHORT XAUUSD

🟢I will ONLY BUY LOWS at my BUYING ZONES.

H1VS5 achieved

$3312-3308 achieved

Exit ALL SELL Positions

💬I will NOT SHORT XAUUSD

🟢I will ONLY BUY LOWS at my BUYING ZONES.

Piyush Lalsingh Ratnu

WHY XAUUSD price crashed today?

🔴Gold drops over 1% as US Dollar and Treasury yields strengthen.

🔴Trump delays tariff deadline to August 1, calming trade nerves.

🔴Traders scale back 2025 Fed cut expectations to just 48 basis points

+NFP Data published on Thursday, gave additional strength to Dollar and co-related assets boosting risk sentiment impacting XAUUSD price negatively.

I had projected $3285 (check here: https://t.me/c/1654158888/17434) as a possible price target, today 70% positions were observed on LONG, and a crash in GOLD price generated a good retail revenue for the GOLD LPs.

CMP $3303 XAUUSD Spot Gold

🔴Gold drops over 1% as US Dollar and Treasury yields strengthen.

🔴Trump delays tariff deadline to August 1, calming trade nerves.

🔴Traders scale back 2025 Fed cut expectations to just 48 basis points

+NFP Data published on Thursday, gave additional strength to Dollar and co-related assets boosting risk sentiment impacting XAUUSD price negatively.

I had projected $3285 (check here: https://t.me/c/1654158888/17434) as a possible price target, today 70% positions were observed on LONG, and a crash in GOLD price generated a good retail revenue for the GOLD LPs.

CMP $3303 XAUUSD Spot Gold

Piyush Lalsingh Ratnu

Through the first half of 2025, gold-backed funds globally reported the highest semi-annual inflows of metal since H1 2020 in the early months of the pandemic.

After modest outflows of gold in May, flows flipped positive in June with ETFs globally adding 74.6 tonnes of gold to their holdings.

Every region reported positive flows last month.

Through the first half of 2025, gold-backed funds globally increased their holdings by 397.1 tonnes.

Gold inflows totaled $38 billion through the first half of the year. That drove total assets under management (AUM) higher by 41 percent to $383 billion. That broke a month-end record and hit the highest level in 34 months.

North American funds led the way, increasing their gold holdings by 206.8 tonnes. Total H1 inflows totaled $21 billion. It was the strongest H1 for North American gold ETFs in five years.

European funds increased their gold holdings by 78.9 tonnes, totaling $6 billion through the first half of 2025. According to the World Gold Council, “The eighth cut from the European Central Bank, uncertainties surrounding growth, and rising geopolitical risks generally, contributed to gold ETF demand in several major markets.”

Asian ETFs increased their gold reserves by a record 104.3 tonnes in H1, totaling $ 11 billion. Asian investors bought a record amount of gold ETFs during H1, making up 28 percent of net global flows with only 9 percent of the total AUM.

China’s inflows of 85 tonnes totaling $8.8 were unprecedented, driven by spiking trade risks with the U.S., growth concerns, and the surging gold price.

Funds listed in other regions, including Australia and Africa, added 7.2 tonnes of gold to their holdings. ETFs based in Australia and South Africa were the main contributors.

ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

Why ETF Volumes are increasing?

ETFs are relatively liquid.

You can buy or sell an ETF with a couple of mouse clicks. You don’t have to worry about transporting or storing metal. In a nutshell, it allows investors to play the gold market without buying full ounces of metal at the spot price.

Since you are just buying a number in a computer, you can easily trade your ETF shares for another stock or cash whenever you want, even multiple times on the same day. Many speculative investors take advantage of this liquidity.

But while a gold ETF is a convenient way to play the price of gold on the market, you don’t actually possess any gold. You have paper. And you don’t know for sure that the fund has all the gold either, especially when the fund sees inflows. In such a scenario, there have been difficulties or delays in obtaining physical metal.

🟢Gold trading volumes

Gold market trading volumes averaged $329 billion per day through the first half of the year. That was the highest semi-annual average on record.

Over-the-counter trading increased to an average of $165 billion per day in H1, well above the 2024 average of $128 billion/day.

Exchange-traded volumes also saw a significant increase through H1, averaging $159 billion per day. Increased activity on COMEX and the Shanghai Futures Exchange helped drive this momentum.

Money managers reduced their long gold positions by 28 percent over the first six months.

However, there was a notable shift in June, with longs increasing by 11 percent. According to the World Gold Council, “This was likely supported by consolidation in the gold price, providing investors with a window of opportunity to begin rebuilding positions.”

After modest outflows of gold in May, flows flipped positive in June with ETFs globally adding 74.6 tonnes of gold to their holdings.

Every region reported positive flows last month.

Through the first half of 2025, gold-backed funds globally increased their holdings by 397.1 tonnes.

Gold inflows totaled $38 billion through the first half of the year. That drove total assets under management (AUM) higher by 41 percent to $383 billion. That broke a month-end record and hit the highest level in 34 months.

North American funds led the way, increasing their gold holdings by 206.8 tonnes. Total H1 inflows totaled $21 billion. It was the strongest H1 for North American gold ETFs in five years.

European funds increased their gold holdings by 78.9 tonnes, totaling $6 billion through the first half of 2025. According to the World Gold Council, “The eighth cut from the European Central Bank, uncertainties surrounding growth, and rising geopolitical risks generally, contributed to gold ETF demand in several major markets.”

Asian ETFs increased their gold reserves by a record 104.3 tonnes in H1, totaling $ 11 billion. Asian investors bought a record amount of gold ETFs during H1, making up 28 percent of net global flows with only 9 percent of the total AUM.

China’s inflows of 85 tonnes totaling $8.8 were unprecedented, driven by spiking trade risks with the U.S., growth concerns, and the surging gold price.

Funds listed in other regions, including Australia and Africa, added 7.2 tonnes of gold to their holdings. ETFs based in Australia and South Africa were the main contributors.

ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

Why ETF Volumes are increasing?

ETFs are relatively liquid.

You can buy or sell an ETF with a couple of mouse clicks. You don’t have to worry about transporting or storing metal. In a nutshell, it allows investors to play the gold market without buying full ounces of metal at the spot price.

Since you are just buying a number in a computer, you can easily trade your ETF shares for another stock or cash whenever you want, even multiple times on the same day. Many speculative investors take advantage of this liquidity.

But while a gold ETF is a convenient way to play the price of gold on the market, you don’t actually possess any gold. You have paper. And you don’t know for sure that the fund has all the gold either, especially when the fund sees inflows. In such a scenario, there have been difficulties or delays in obtaining physical metal.

🟢Gold trading volumes

Gold market trading volumes averaged $329 billion per day through the first half of the year. That was the highest semi-annual average on record.

Over-the-counter trading increased to an average of $165 billion per day in H1, well above the 2024 average of $128 billion/day.

Exchange-traded volumes also saw a significant increase through H1, averaging $159 billion per day. Increased activity on COMEX and the Shanghai Futures Exchange helped drive this momentum.

Money managers reduced their long gold positions by 28 percent over the first six months.

However, there was a notable shift in June, with longs increasing by 11 percent. According to the World Gold Council, “This was likely supported by consolidation in the gold price, providing investors with a window of opportunity to begin rebuilding positions.”

Piyush Lalsingh Ratnu

Gold price (XAU/USD) maintains its heavily offered tone through the first half of the European session and currently trades just above a nearly two-week low touched earlier this Tuesday.

🔻News of the Iran-Israel ceasefire boosts investors' confidence and triggers a fresh wave of global risk-on trade, which, in turn, is seen as a key factor driving flows away from the safe-haven precious metal.

Meanwhile, the intraday downfall in XAUUSD Price seems rather unaffected by some follow-through US Dollar (USD) selling, which tends to benefit the Gold price.

The mixed US PMI data and dovish remarks from Fed officials fueled speculations about the possibility of a rate cut in July.

Federal Reserve Governor Michelle Bowman said that the time to cut rates may be fast approaching as she has grown more worried about risks to the job market and less concerned that tariffs will cause an inflation problem.

Fed Governor Christopher Waller's stated the US central bank should consider cutting interest rates at its next policy meeting on July 29-30, which keeps the USD depressed and further supports the non-yielding yellow metal.

The focus remains on Fed Chair Jerome Powell's testimony before the House Financial Services Committee, which could offer cues about the future rate-cut path and determine the near-term trajectory for the XAU/USD pair.

🟢XAUUSD 🔺 🔺

Crucial Price Zones: XAUUSD:

🔺SZ $3434/3469/3485

🔻BZ $3285/3269/3232

Traders now look to the US economic docket – featuring the release of the Conference Board's Consumer Confidence Index and the Richmond Manufacturing Index. This, along with speeches by influential FOMC members, will drive the USD.

🔻News of the Iran-Israel ceasefire boosts investors' confidence and triggers a fresh wave of global risk-on trade, which, in turn, is seen as a key factor driving flows away from the safe-haven precious metal.

Meanwhile, the intraday downfall in XAUUSD Price seems rather unaffected by some follow-through US Dollar (USD) selling, which tends to benefit the Gold price.

The mixed US PMI data and dovish remarks from Fed officials fueled speculations about the possibility of a rate cut in July.

Federal Reserve Governor Michelle Bowman said that the time to cut rates may be fast approaching as she has grown more worried about risks to the job market and less concerned that tariffs will cause an inflation problem.

Fed Governor Christopher Waller's stated the US central bank should consider cutting interest rates at its next policy meeting on July 29-30, which keeps the USD depressed and further supports the non-yielding yellow metal.

The focus remains on Fed Chair Jerome Powell's testimony before the House Financial Services Committee, which could offer cues about the future rate-cut path and determine the near-term trajectory for the XAU/USD pair.

🟢XAUUSD 🔺 🔺

Crucial Price Zones: XAUUSD:

🔺SZ $3434/3469/3485

🔻BZ $3285/3269/3232

Traders now look to the US economic docket – featuring the release of the Conference Board's Consumer Confidence Index and the Richmond Manufacturing Index. This, along with speeches by influential FOMC members, will drive the USD.

Piyush Lalsingh Ratnu

XAUUSD co-relations:

USDJPY 1000P +

Expected Impact on XAUUSD:

$30 (-) | 🔻$3396-3366 zone ideal

XAUUSD net crash witnessed today:

🔻$3396-3348 ($50)

🔺RT + $3349-3369 achieved

XAUUSD back to the opening price gap observed at early morning today $3369-3366 zone.

As suggested by me since last week, BUY LOWS, avoid SHORTS.

09 June: $3290 LOW | BUY

11 June: $3320 LOW | BUY

13 June $3380 LOW | BUY

17 June: $3366 LOW | BUY

20 June: $3339 LOW | BUY

XAUUSD:

HIGH $3396 achieved today.

ALL BUY POSITIONS proved correct.

Short positions at above mentioned lows proved a LOSS making deal, resulting in high DD.

XAUUSD CURRENT MARKET PRICE: $3369

USDJPY 1000P +

Expected Impact on XAUUSD:

$30 (-) | 🔻$3396-3366 zone ideal

XAUUSD net crash witnessed today:

🔻$3396-3348 ($50)

🔺RT + $3349-3369 achieved

XAUUSD back to the opening price gap observed at early morning today $3369-3366 zone.

As suggested by me since last week, BUY LOWS, avoid SHORTS.

09 June: $3290 LOW | BUY

11 June: $3320 LOW | BUY

13 June $3380 LOW | BUY

17 June: $3366 LOW | BUY

20 June: $3339 LOW | BUY

XAUUSD:

HIGH $3396 achieved today.

ALL BUY POSITIONS proved correct.

Short positions at above mentioned lows proved a LOSS making deal, resulting in high DD.

XAUUSD CURRENT MARKET PRICE: $3369

Piyush Lalsingh Ratnu

XAUUSD

🔻$3333

🔺$3393

on radar

Avoid BIG LOTS

USD S 95

USDJPY 800P+

DXY - RT +

US10YT -

🔻$3333

🔺$3393

on radar

Avoid BIG LOTS

USD S 95

USDJPY 800P+

DXY - RT +

US10YT -

Piyush Lalsingh Ratnu

The US Treasury Yields🔻 have come down sharply. There is a support near current levels which if broken can drag the yields further lower in the coming days. The US PCE data release today will be important to watch. A lower PCE number can drag the yields below their support. The German Yields have declined sharply contrary to our expectation. They have to hold above their immediate support to keep alive our bullish view.

The price action in the next few days is going to be important. The 10Yr GoI remains lower and stable. The view remains bearish to see more fall from here.

🟢Impact on XAUUSD: +

The price action in the next few days is going to be important. The 10Yr GoI remains lower and stable. The view remains bearish to see more fall from here.

🟢Impact on XAUUSD: +

Piyush Lalsingh Ratnu

🔺The Euro has risen past 1.13 again and if sustained can head towards 1.15-1.16 levels.

EURJPY continues to trade within the 165-160 region.

🔻USDJPY has been coming off and can fall towards 142 or even 140 before halting.

🔻AUDUSD is declining within the 0.650-0.635 range.

🔻Pound is headed towards 1.36 again.

🔻The USDCNY below 7.21, can get dragged towards 7.175-7.150. The USDINR can dip within its 85.75-84.75 range.

⚡️US Personal Income and US PCE data releases are scheduled today.

EURJPY continues to trade within the 165-160 region.

🔻USDJPY has been coming off and can fall towards 142 or even 140 before halting.

🔻AUDUSD is declining within the 0.650-0.635 range.

🔻Pound is headed towards 1.36 again.

🔻The USDCNY below 7.21, can get dragged towards 7.175-7.150. The USDINR can dip within its 85.75-84.75 range.

⚡️US Personal Income and US PCE data releases are scheduled today.

Piyush Lalsingh Ratnu

THIS IS NOT MY WAR - Mr. Trump

In the geopolitics front, the image of the US got dented a bit further after United States (US) President Donald Trump commented on his two-hour phone call with Vladimir Putin on ending the impasse in Ukraine. President Trump said that negotiations would start immediately, though if they break down again, the US would back away from any further efforts and negotiations. Trump said there were "some big egos involved," and without progress, "I'm just going to back away," repeating a warning that he could abandon the process and concluded with "This is not my war," Reuters reports.

That statement suggests that the US President make a complete U-turn, as it was one of his campaign promises, to end the war in his first 100 days. Now that President Trump seems unable to resolve the situation, it looks like Trump will rather pull out and walk away from it.

Impact: XAUUSD + + +

In the geopolitics front, the image of the US got dented a bit further after United States (US) President Donald Trump commented on his two-hour phone call with Vladimir Putin on ending the impasse in Ukraine. President Trump said that negotiations would start immediately, though if they break down again, the US would back away from any further efforts and negotiations. Trump said there were "some big egos involved," and without progress, "I'm just going to back away," repeating a warning that he could abandon the process and concluded with "This is not my war," Reuters reports.

That statement suggests that the US President make a complete U-turn, as it was one of his campaign promises, to end the war in his first 100 days. Now that President Trump seems unable to resolve the situation, it looks like Trump will rather pull out and walk away from it.

Impact: XAUUSD + + +

Piyush Lalsingh Ratnu

Gold (XAU/USD) prices are surging on Tuesday, buoyed by broad-based US Dollar weakness and renewed concerns over the United States’ fiscal health following Friday’s Moody’s downgrade of US sovereign debt.

The safe-haven metal is extending its rally from Monday, supported by deteriorating growth prospects for the world’s largest economy. Gold bulls are now eyeing the key psychological threshold of $3,300, with the metal up 1.51% to trade near $3,280 at the time of writing.

While gains have been somewhat tempered by a rebound in US Treasury Yields and a mutual reduction in tariffs between the US and China, shifting global trade dynamics and persistent policy uncertainty continue to provide a supportive backdrop for bullion.

Looking ahead, Wednesday’s House of Representatives vote on President Donald Trump’s “One Big Beautiful” tax bill, along with evolving expectations for Federal Reserve policy, are expected to play a pivotal role in shaping short-term Gold price action.

The safe-haven metal is extending its rally from Monday, supported by deteriorating growth prospects for the world’s largest economy. Gold bulls are now eyeing the key psychological threshold of $3,300, with the metal up 1.51% to trade near $3,280 at the time of writing.

While gains have been somewhat tempered by a rebound in US Treasury Yields and a mutual reduction in tariffs between the US and China, shifting global trade dynamics and persistent policy uncertainty continue to provide a supportive backdrop for bullion.

Looking ahead, Wednesday’s House of Representatives vote on President Donald Trump’s “One Big Beautiful” tax bill, along with evolving expectations for Federal Reserve policy, are expected to play a pivotal role in shaping short-term Gold price action.

Piyush Lalsingh Ratnu

🔻WHY XAUUSD price dived down/crashed?

Gold price (XAU/USD) remains under some selling pressure for the third successive day and drops to a two-week low, around the $3,230-$3,229 ($3232 price zone, projected by us yesterday) area during the Asian session on Thursday.

US President Donald Trump's remarks earlier today add to the recent optimism over the potential de-escalation of the US-China trade war and turn out to be a key factor driving flows away from the safe-haven precious metal.

Furthermore, the US Dollar (USD) is looking to build on its gains registered over the past two days and exert additional downward pressure on the commodity.

The intraday downfall in the Gold price could further be attributed to some technical selling following a breakdown below the $3,265-3,260 pivotal support.

Any meaningful USD appreciation, however, seems elusive amid rising bets for more aggressive policy easing by the Federal Reserve (Fed), bolstered by the surprise contraction in US GDP and signs of easing inflationary pressure.

🟡This could act as a tailwind for the non-yielding yellow metal, warranting caution before positioning for an extension of the retracement slide from the $3,500 mark, or the all-time peak.

Gold price (XAU/USD) remains under some selling pressure for the third successive day and drops to a two-week low, around the $3,230-$3,229 ($3232 price zone, projected by us yesterday) area during the Asian session on Thursday.

US President Donald Trump's remarks earlier today add to the recent optimism over the potential de-escalation of the US-China trade war and turn out to be a key factor driving flows away from the safe-haven precious metal.

Furthermore, the US Dollar (USD) is looking to build on its gains registered over the past two days and exert additional downward pressure on the commodity.

The intraday downfall in the Gold price could further be attributed to some technical selling following a breakdown below the $3,265-3,260 pivotal support.

Any meaningful USD appreciation, however, seems elusive amid rising bets for more aggressive policy easing by the Federal Reserve (Fed), bolstered by the surprise contraction in US GDP and signs of easing inflationary pressure.

🟡This could act as a tailwind for the non-yielding yellow metal, warranting caution before positioning for an extension of the retracement slide from the $3,500 mark, or the all-time peak.

: