Evgeniy Scherbina / Perfil

- Información

|

10+ años

experiencia

|

28

productos

|

607

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

Below is the picture of how it may look like. I am still thinking of what could be done. I hope I can publish it this week.

It is going to be based on the same data as the advisor "QuantumPip", but it will be a free indicator, not an advisor by itself. Some users like to see how trading decisions were made.

If you have any comments or suggestions, you are invited to comment here or you can write to me via the messages.

To address this issue, you may consider implementing the following strategies:

- **Educational Materials**: Develop educational materials or presentations that explain the concepts of overfitting, generalization, and the importance of future performance in a simple and accessible way.

- **Comparative Analysis**: Compare the performance of overfit models and properly trained models on real-world data to demonstrate the impact of overfitting on future performance.

- **Risk Assessment**: Discuss the risks associated with overfitting and the potential consequences of basing decisions solely on visually appealing historical charts.

- **Engagement**: Encourage customer engagement by involving them in the model evaluation process and demonstrating the value of robust, generalizable models over visually appealing but overfit models.

Neural networks open possibilities. However, too many users these days do not understand the possibilities.

Neural networks learn prices, fluctuations, patterns... In fact, whatever you feed into a neural network (really - whatever!!), it will learn it. Can I feed random prices? Yes! Can I feed random prices of random symbols? Yes! Can I feed bullshit? Yes! It will learn it.

It will learn it. It is not a problem. The problem arises from learning too much.

Why this post? Because too many users buy bad strategies that show an incredible growth in the historical chart. Too many users do not buy good strategies because they think that a mediocre historical chart will not allow them to make a profit on Forex. Good strategies fall into oblivion, that is to the bottom of the ranking system, which is based on greed and not on analysis or credibility.

So what? Make a real live signal, run it for half a year and show a profit with your good strategy. Prove that it works. Yes, this is what I tried. And they still don't buy, because they found hundreds of strategies that show an incredible growth (from 1k to 1 trillion in several years, literally) in the nice historical chart.

Why this post? I do not want to be a liar. I do not want to sell nice historical charts.

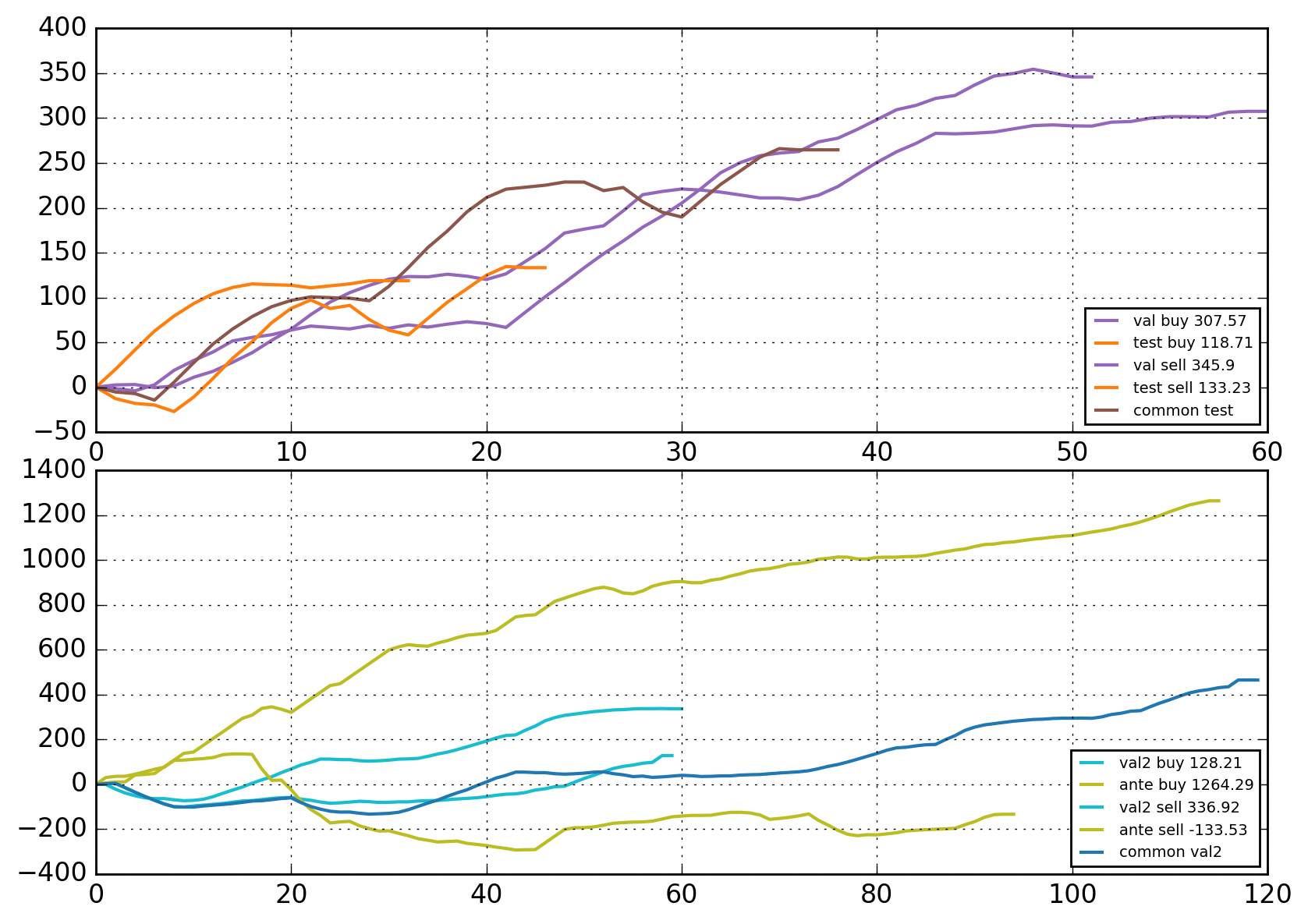

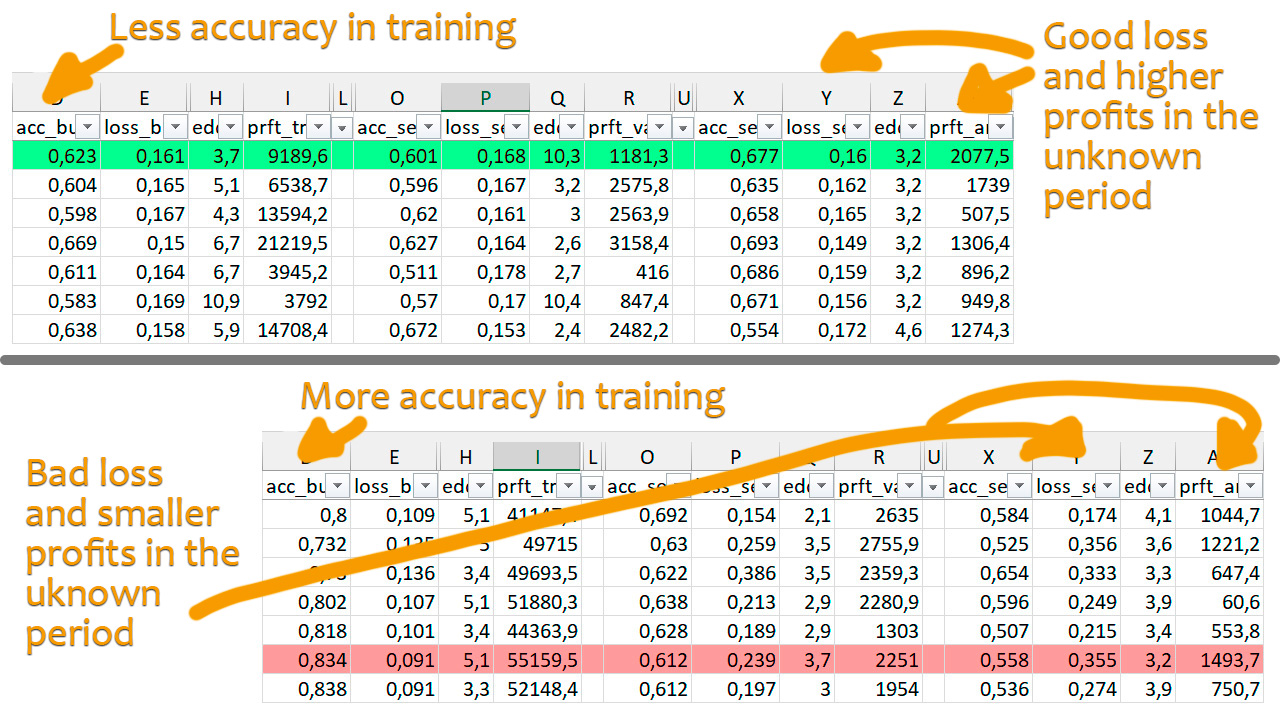

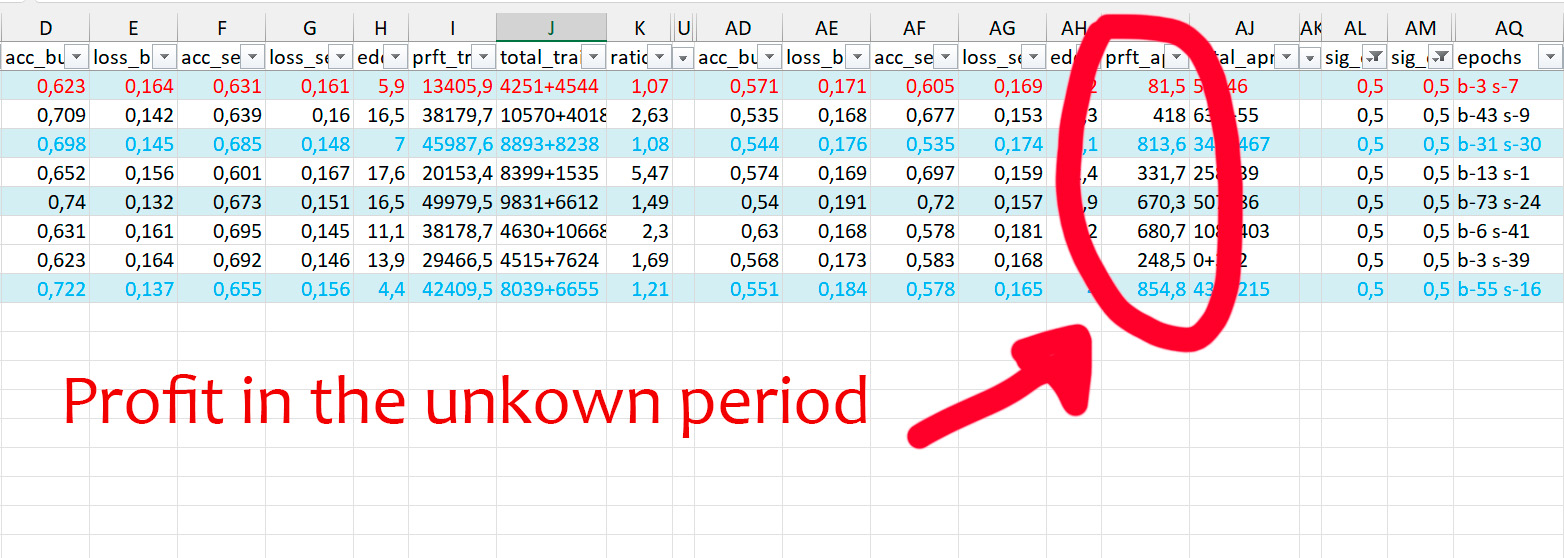

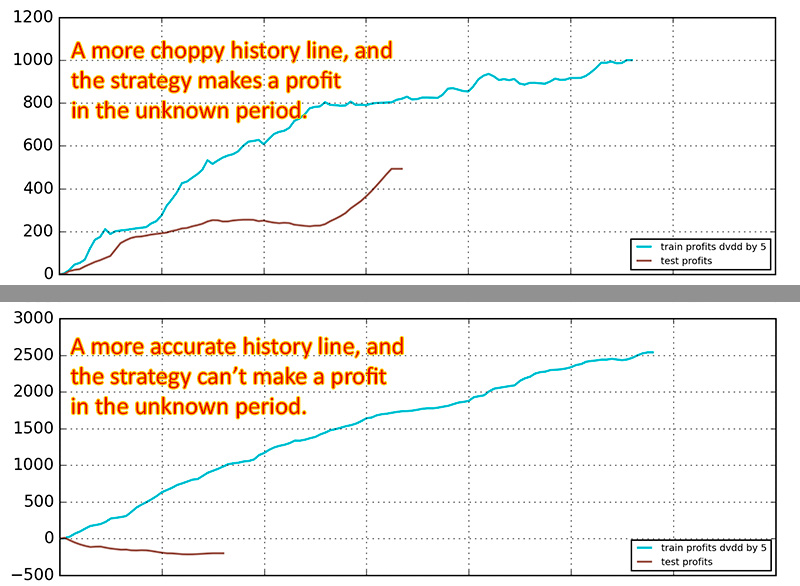

This new strategy "Intraday Rush" shows several levels of accuracy in the training. These levels are defined by the property "Trading pattern". The "reliable" level has a much higher chance to win in the unknown period. While the "ultimate" level, despite the mind-blowing profitability in history, has a much worse chance of winning in the unknown period. This is it. I have written it. I have explained it.

Does the market never repeat itself? Is it true that, from this standpoint, an absolutely unprofitable strategy in history should have the best chance to win in the unknown period? Maybe yes!!!

This is what I think. History has some valuable patterns. A good strategy should try to learn the very basic pattern-like moves from history. Therefore, it should demonstrate profitability in any long period running for at least a year. A good strategy should have drawdowns and wrong trades leading to frustration in some periods. And it should win in other periods. This is what makes a good strategy.

Sometimes users do not want a profit on Forex. They want to buy a hope at this particular moment of their lives and be happy for a few days with that false hope. Yes, I understand it. Switch to the "ultimate" level, this is your false hope. Some users can't stop believing that a nice historical pic will not lead to a profit in the unknown period. Yes, I understand this, too.

Why this post? After months or even years of playing around with so many "nice" strategies out there, come back and read this post again. And switch to the "reliable" trading pattern of "Intraday Rush".

It is going to be the same logic, but you will be able to choose between daily and hourly trading. 2h-timeframe has 12 times more trades than daily. It also bring more flexibility of course, because the advisor can react to market fluctuations much faster.

The indicator "IRush" will also be updated! So stay tuned! The new update will be published no later than next week!

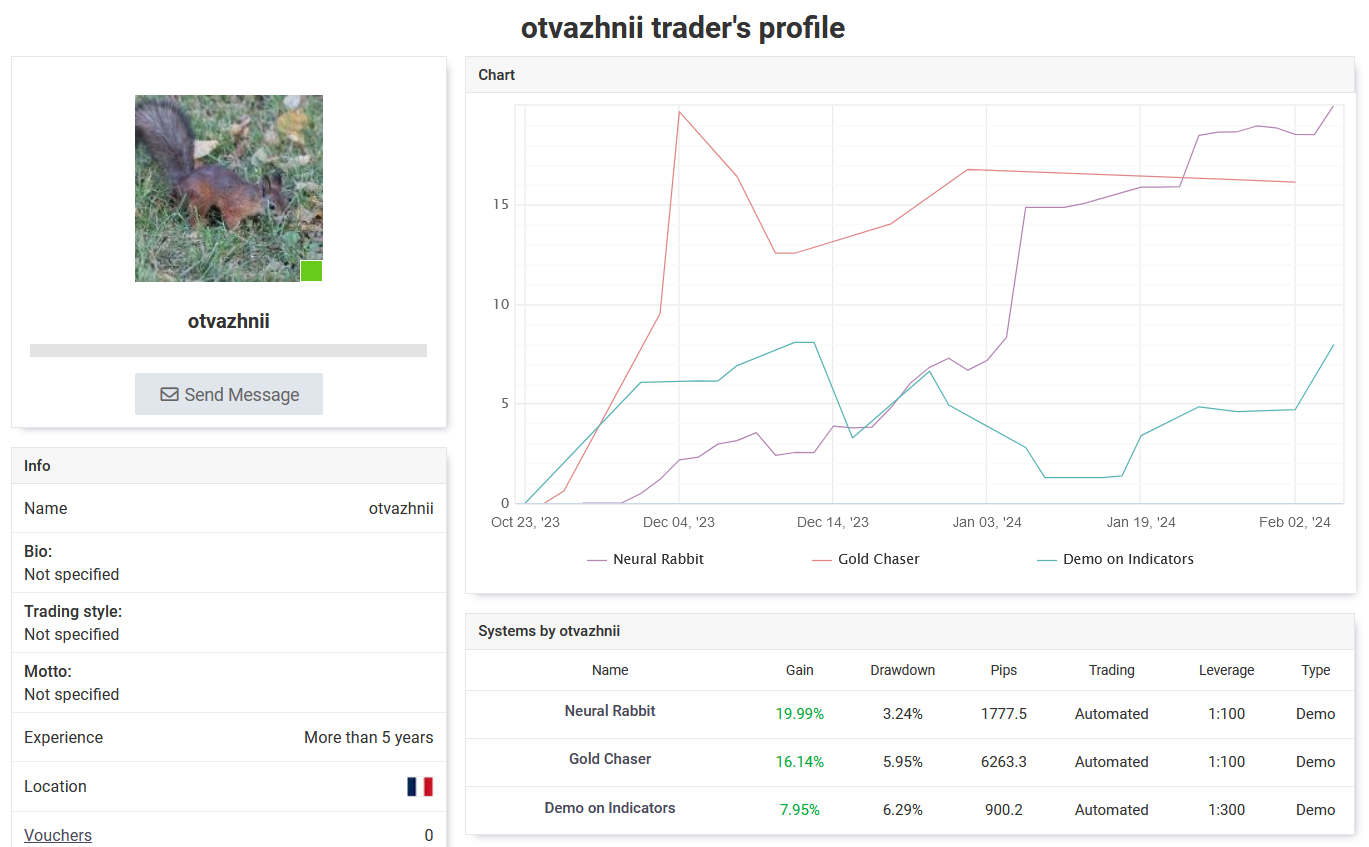

myfxbook.com/members/otvazhnii

It has all my best strategies - Neural Rabbit, Gold Chaser etc - updated live. More strategies will be added in the very near future. All in one chart, it is so easy to compare!

If you want to drill down into details, it has lots of nice diagrams and piecharts. Profit per month, missed profit and more. Go check it out!

Intraday Rush 95$ down from 385$

Neural Rabbit 85$ down from 215$

Tokyo 85$ down from 215$

Merry Christmas and Happy New Year!!

End of Year Sale!!

Limited Time Only!!

https://www.mql5.com/en/blogs/post/754992

Hurry up! This offer will not be available forever!

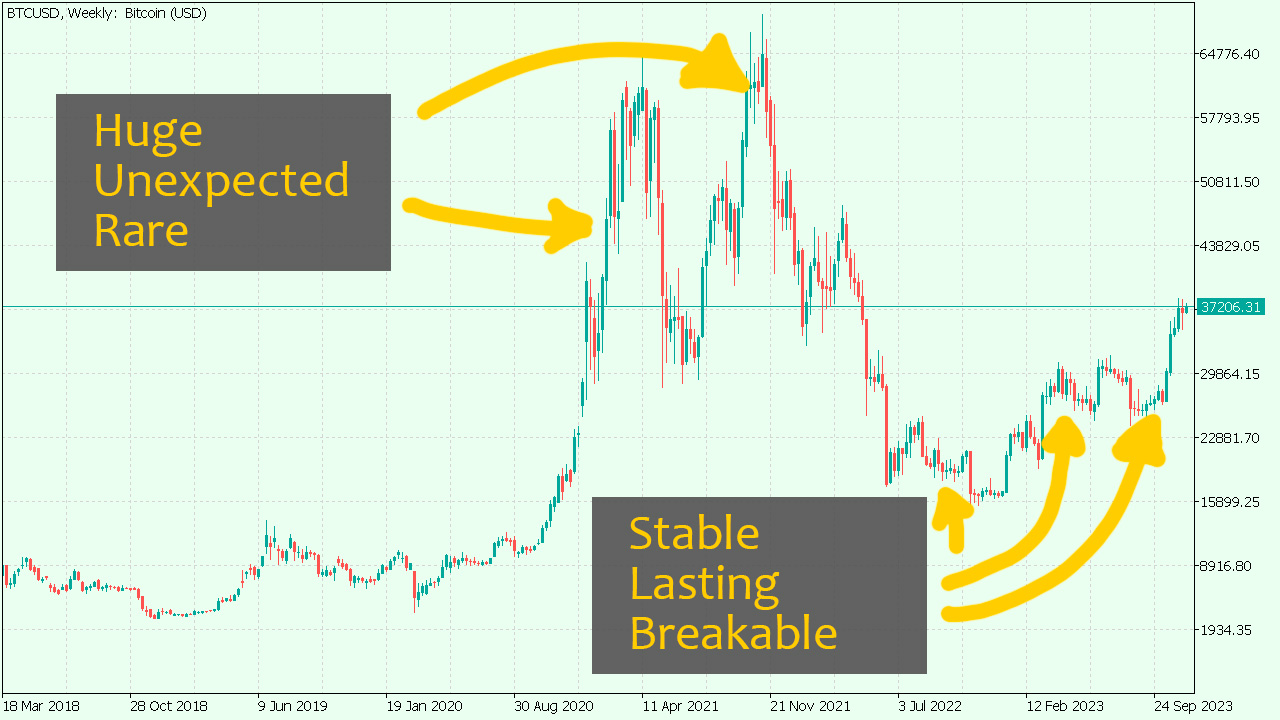

Bitcoin is not easy. Nor it is like other symbols. It seems like Bitcoin was nothing before 2013. It started growing exponentially about 10 years ago from nothing to something everyone desperately needed.

As there is no reliable history, I suggest to myself I should better turn to the 8-hour chart. Thus, I will still have 2 options. First, waiting for a big move up or down like it was in 2013, and then later in 2020, and then again in 2021 to the highest peak of 65K in Autumn of 2021. And then a huge fall to below 25K in 2022. And second, I can still trade in seemingly ever-lasting flat channels, like those in the second half of 2022 and then several times in 2023.

It will be a different approach, overall. It will be different from anything. Previously, I thought Gold was different from the major symbols. Gold pushes huge swaying moves. A Gold move feels like a trend almost every day. But Bitcoin is different from Gold, which is different from the major symbols.

I am going to do a million tests (as usual) for Bitcoin in the 8-hour chart to check if it is a good approach. My best hope I will be able to integrate this symbol to the advisor "Gold Chaser" in December, and it will work as one solid and even more reliable strategy.

The "Gold Chaser" expert advisor trades in fully automated mode these 4 symbols: XAUUSD (Gold), XAGUSD (Silver), BTCUSD (Bitcoin), and XBRUSD (Brent Oil). I am going to add other cryptocurrencies and/or stock exhange indices in the near future. Possibilities of the "non-major" symbols really differ from what you are accustomed to with the usual set of symbols. First of all, gold moves very quickly. Like major symbols, gold reacts to political events, important economic events and speeches of VIP

These huge flat moves by Gold are like nothing else. It is hard to find a flat and yet profitable pattern like this in any other symbol. So why isn't there a good strategy to take on this profitability of wide and flat moves? Well, there is soon going to be a fully automatic strategy to trade Gold and probably other metals and commodities! Stay tuned! It's close. Maybe even as close as the next week!

The "Intraday Rush" Expert Advisor trades several symbols simultaneously in automatic mode: AUDUSD, EURUSD, GBPUSD, USDCAD, USDCHF, and USDJPY. The advisor uses a modified version of the popular indicator RSI (Relative Strength Index) to make open and close trading decisions. You can download a free indicator IRush , used by this advisor, to visualize trading. The one major difference of this advisor is that it can check its trading decisions several times during the day. If the market condition

My new indicator IRush shows: no way. GBPUSD daily is completely red right now. So it is bound to fall.

Friday, most likely, British GDP data will be negative. Bloomberg says: Friday negative GDP will be the mark of a starting recession.

So, it has not been a recession thus far? GBPUSD breaching 1.21 and not yet a recession?

My forecast is that it can try to continue the up move next week. And then it will fall back. I do not think it can break the 1.21 support level, but GBPUSD will be pinned to it because Britain may be going into a recession.

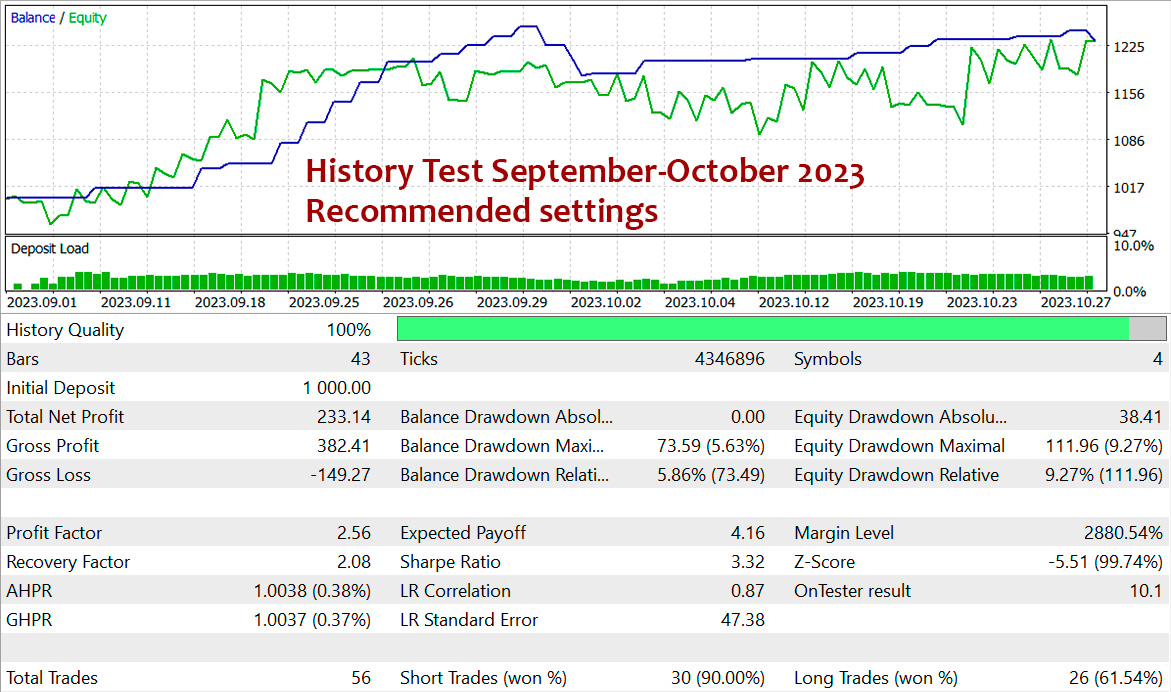

If the advisor had not had this error, it would have performed better than the current live signal shows. We can see it now in the history tests - for both default settings and recommended settings. What we see in the picture of the recommended settings is that the balance dropped at the beginning of October, but then it recovered by the end of October. It did not happen in the live signal because the advisor mishandled some of the trades.

Now the error has been fixed, and I am sure it can recover in the month of November.

Indicator IRush uses a modified version of a popular indicator RSI (Relative Strength Index) to look for entries on a daily chart or lower. The indicator has been set up and tested with the major symbols: AUDUSD, EURUSD, GBPUSD, USDCAD, USDCHF, and USDJPY. An automated trading with this indicator is implemented in the expert advisor Intraday Rush . This expert advisor can open, trail and close its trades. Check it out, it may be exactly what you are looking for! A Correct Reading of IRush The

USD Rate Decision September 20, and

GBP Rate Decision September 21

The previous important event "Euro Rate Decision" was, as they say, counter-intuitive. Usually, a higher interest rate is good for the currency, so there should have been an up move in EURUSD. It did not happen because if they still need to increase the interest rate, it is because they fear an inflation-induced recession. Luckily for EUR-buyers, the US Fed may think likewise. And the traders will react likewise on Wednesday. I really do not think the EURozone is performing worse than the USD-zone. So I am betting on an up move for EURUSD.

GBP is different. Great Britain is in trouble because it has been in trouble. Tories cut off the nice ties with the EURozone, but have never given anything in return. Migrants are still coming. China is still crushing. Boris Johnson is still funny. My bet is GBP will continue falling.

I am posting these pics with different daily moving averages because I am reflecting on how they can help tell good moves from bad moves for the algorithm of "Neural Rabbit". As we can see in this pic, even if I believe the down move will roll back very soon, a short trade could have made a decent profit thus far after both crossings. So maybe it is a good idea to integrate an MA filter before training (not after of course) so that it can help distinguish what a move is. It would trade very differently, but it would substantially decrease the amount of possible trades. So most probably I will add 2 options to choose from - with filter and without it. And it will total to 4 different options because we now have a "Training By_Accuracy" and a "Training By_Loss"... I am reflecting on it because it is my best strategy so far.

If a strategy makes 7 good decisions out of 10, it is 70% of accuracy. Good? Bad! It is bad if the loss is high because any bad forecast may be so bad that it will eat away all hopes for profitability. Therefore, it is the strategy with training by loss that is capable to handle well the unknown period, even though its history result may be thinly over the satisfactory level.

And this is what my newest strategy "Neural Rabbit" is about.

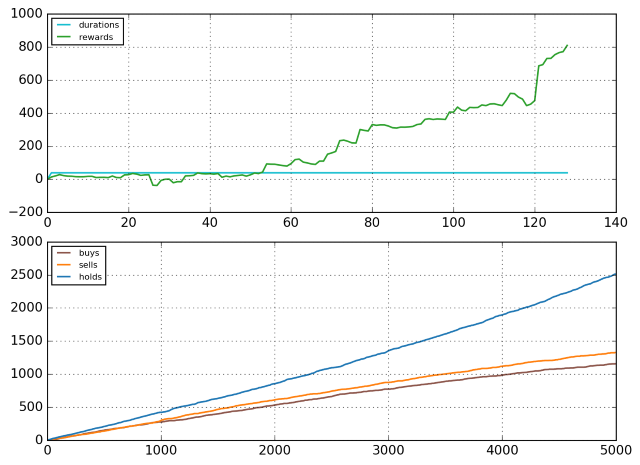

Below are 2 pictures - one is training and the other is validation with a small part of test data (the profile does not allow 2 pictures so it is only the training, check the Comments section of "Fast Neurons" for the second picture). It is good, I did it! I am going to put it on the signal starting next week. If it shows no bugs I will publish it as an update to the strategy of "Fast Neurons". It is going to be the first strategy on the mql5 market, which uses the "actor-critic" technique in Reinforcement Learning (specifically "Advantage Actor Critic" or A2C).

And then, a complicated technique should at least outperform simpler techniques, otherwise it is useless. Alright, I will try to understand why they insist on using the log function for probabilities just to make sure it does not overcomplicate things. If I get through, this will be my most advanced and sophisticated system for Forex trading yet.

All of this is being added to my strategies right now. "New York" is currently the most advanced strategy which balances wins and loses. "Multiq" combines data from multiple symbols to train a single neural network. And the ever-lasting "Excelsior" uses 2 competing neural networks. Check them out!

I am also working over a strategy for intraday trading, which will include 4 charts - monthly, weekly, daily, and 6-hourly! I am thinking to call it "Fast Neurons", check it out soon, too!