Tarea técnica

READ CAREFULLY And if you have done 50 projects before then apply others i will reject

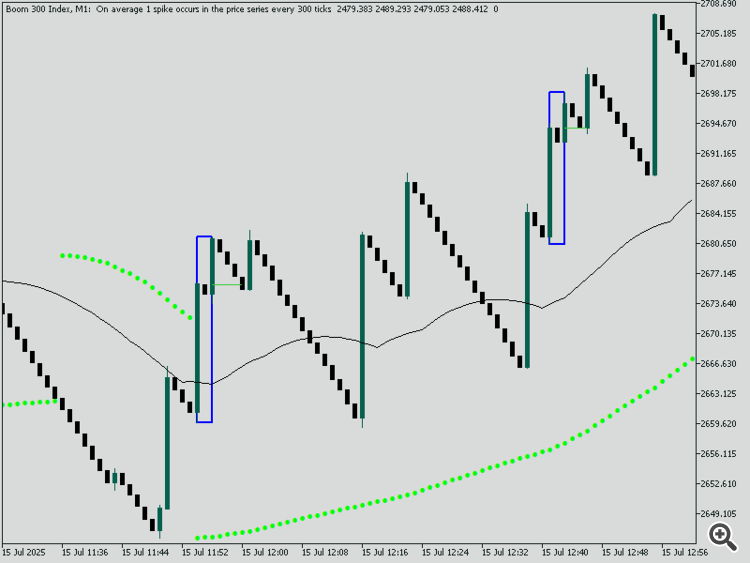

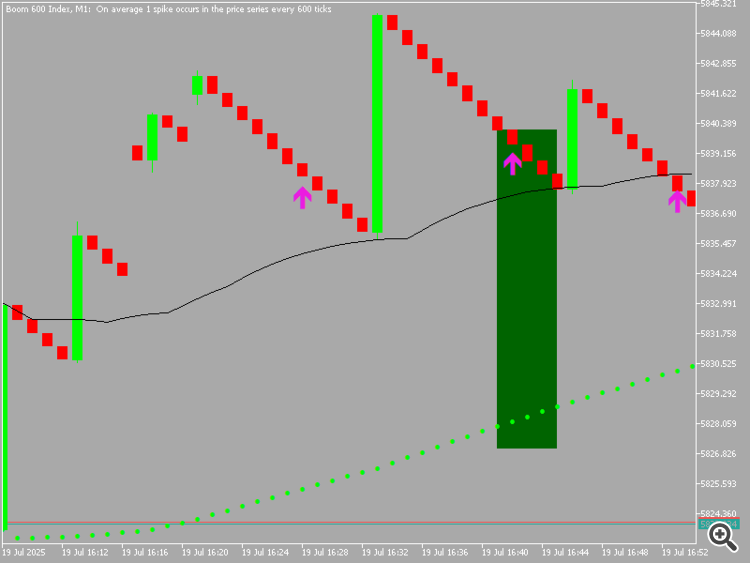

🔺 BUY Signal (Boom Market)

✅ Pattern Formation (Spike-Based Buy Setup)

-

First Spike: Large bullish spike candle.

-

Mitigation Candle: Small bearish candle inside or partially inside the bullish spike.

-

Second Spike: Another bullish spike that follows the mitigation.

-

When price returns back to the zone of the mitigation candle, a BUY signal arrow is drawn.

🔹 Mitigation Line:

Draw horizontal line at open/close of the mitigation candle.

-

Must be toggleable ( true/false ) in inputs.

-

Color: Green for Buy setups.

-

Label: “Mitigation Zone”.

📊 Confirmation Conditions for RSI ARROW SIGNAL (All Must Be True to Display Arrow)

These conditions must be met for RSI-based Buy arrow to appear:

-

✅ Price is above the 50 EMA

-

✅ Parabolic SAR dots are below price

-

✅ RSI is below 30 (oversold) or value selected in input

🔧 Inputs should allow:

-

Custom RSI level (default 30 for Buy)

-

Toggle ON/OFF for RSI signal display

-

Toggle ON/OFF for SAR and EMA confirmations

-

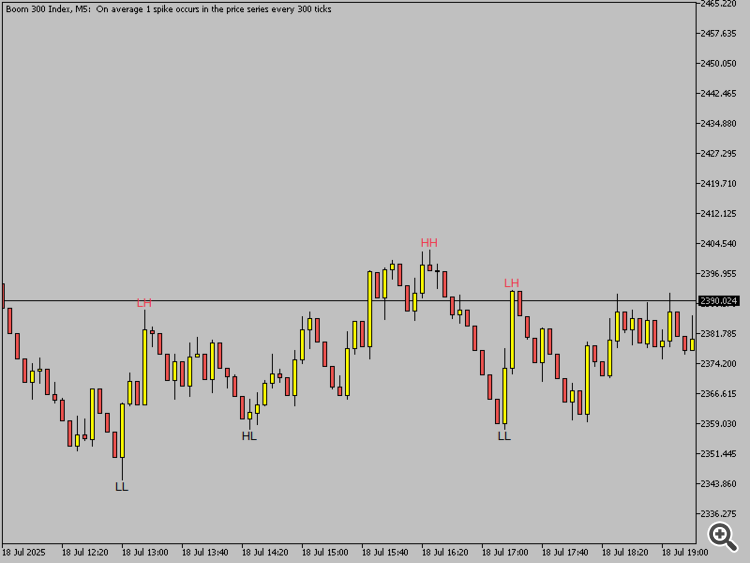

📈 ZigZag Structure Logic (Common to Both Buy/Sell)

Include advanced structure detection via ZigZag:

-

Draw HH, HL, LH, LL based on ZigZag points

-

Color-coded structure levels:

-

Green = Bullish (Buy direction)

-

Red = Bearish (Sell direction)

-

-

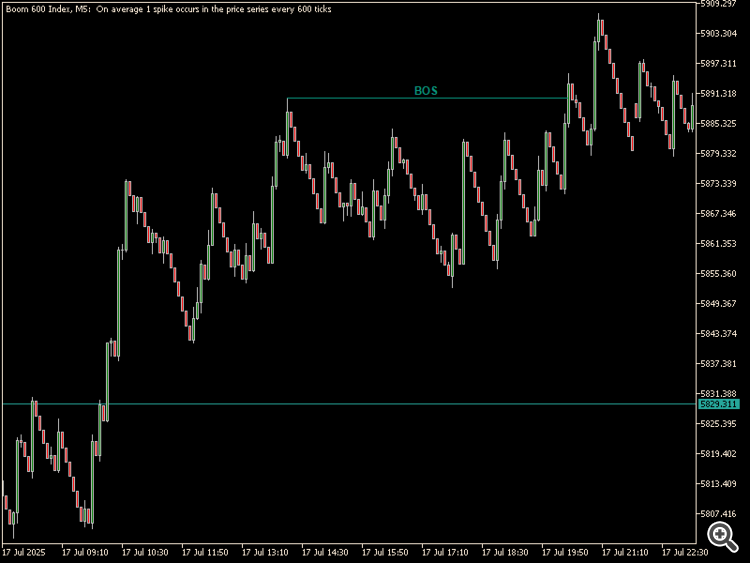

Break of Structure (BOS):

-

Price breaks above HH → Bullish BOS

-

Price breaks below LL → Bearish BOS

-

-

-

Change of Character (CHOCH):

-

Toggle for BOS / CHOCH ON/OFF

-

Toggle structure text ON/OFF

-

Font size and color selectors

-

Distance from price (vertical offset)

🧭 Dashboard (For Both Buy/Sell)

Positioned top-left or custom (user-defined), small and clean panel showing:

| 📋 Parameter | 🟢 BUY / 🔴 SELL Logic |

|---|---|

| Symbol Name | Current chart symbol |

| Last Signal Count | Number of last valid signals |

| Trend (Highs/Lows) | HH/HL = Buy, LH/LL = Sell |

| CHOCH / BOS | Bullish or Bearish |

| EMA Trend | Price above/below 50 EMA |

| RSI Condition | RSI < 30 or RSI > 70 |

| Mitigation Signal | Yes/No (if zone formed and price returned) |

📌 Each block must be color-coded, with green for bullish/buy, and red for bearish/sell.

🕹️ Dashboard Inputs:

-

Show/hide each row

-

Enable/disable dashboard

-

Font color and background color

-

Corner location (TL/TR/BL/BR)

⚙️ General Inputs (Full Control):

| Feature | Input Parameter |

|---|---|

| Enable RSI Signals | true/false |

| RSI Level for Buy | Default 30 |

| RSI Level for Sell | Default 70 |

| Enable Mitigation Logic | true/false |

| Show Mitigation Lines | true/false |

| Enable ZigZag Structure | true/false |

| Show BOS/CHOCH Labels | true/false |

| Enable Dashboard | true/false and eqh and eql option also |

Summary of Signal Triggers

| Type | Conditions Met |

|---|---|

| BUY Arrow | Mitigation Buy Pattern detected (if enabled) OR RSI confirmation (if enabled), AND all RSI conditions met (SAR below, EMA above, RSI < 30) |

| SELL Arrow | Mitigation Sell Pattern detected (if enabled) OR RSI confirmation (SAR above, EMA below, RSI > 70) |

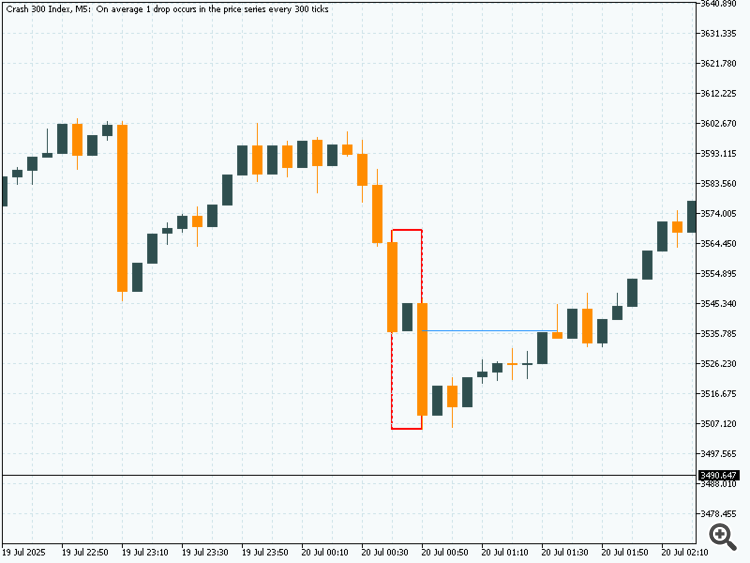

🔻 SELL Signal (Crash Market)

✅ Pattern Formation (Spike-Based Sell Setup)

-

First Spike: Large bearish spike candle.

-

Mitigation Candle: Small bullish candle inside or partially inside the bearish spike.

-

Second Spike: Another bearish spike follows the mitigation candle.

-

When price returns back to the zone of the mitigation candle, a SELL signal arrow is drawn.

🔸 Mitigation Line:

Draw a horizontal line at open/close of the mitigation candle.

-

Must be toggleable ( true/false ) in inputs.

-

Color: Red for Sell setups.

-

Label: “Mitigation Zone”.

📉 Confirmation Conditions for RSI ARROW SIGNAL (All Must Be True to Display Arrow)

These conditions must be met for RSI-based Sell arrow to appear:

-

✅ Price is below the 50 EMA

-

✅ Parabolic SAR dots are above price

-

✅ RSI is above 70 (overbought) or value selected in input

🔧 Inputs should allow:

-

Custom RSI level (default 70 for Sell)

-

Toggle ON/OFF for RSI signal display

-

Toggle ON/OFF for SAR and EMA confirmations

-

📈 ZigZag Structure Logic (Common to Both Buy/Sell)

Use ZigZag to detect and draw structure:

-

Draw LL, LH, HL, HH from ZigZag swings

-

Color-coded structure levels:

-

Red = Bearish (Sell direction)

-

Green = Bullish (Buy direction)

-

-

Break of Structure (BOS):

-

Price breaks below LL → Bearish BOS

-

Price breaks above HH → Bullish BOS

-

-

Change of Character (CHOCH):

-

In uptrend: price breaks previous HL → Bearish CHOCH

-

In downtrend: price breaks previous LH → Bullish CHOCH

-

⚙️ Inputs Must Include:

-

Toggle BOS / CHOCH ON/OFF

-

Toggle structure text ON/OFF

-

Font size, line width, and color options

-

Vertical offset from price

🧭 Dashboard (For Both Buy/Sell)

Positioned in any user-defined corner (e.g., top-left), a clean panel showing:

| 📋 Parameter | 🔻 SELL Logic Description |

|---|---|

| Symbol Name | Current chart symbol |

| Last Signal Count | Number of last valid Sell signals |

| Trend (Highs/Lows) | LH/LL = Downtrend |

| CHOCH / BOS | Bearish CHOCH/BOS |

| EMA Trend | Price below 50 EMA |

| RSI Condition | RSI > 70 (or custom) |

| Mitigation Signal | Yes/No (if price reentered zone) |

🧩 Color Themes:

-

Red highlights for Sell, with neutral or black/white text

-

Each section of the dashboard is toggleable

📌 Inputs for Dashboard:

-

Enable/disable dashboard

-

Font style, size

-

Color theme (background/foreground)

-

Show/hide specific rows

⚙️ General Inputs (Full Control):

| Feature | Input Parameter |

|---|---|

| Enable RSI Signals | true/false |

| RSI Level for Sell | Default 70 |

| RSI Level for Buy | Default 30 |

| Enable Mitigation Logic | true/false |

| Show Mitigation Lines | true/false |

| Enable ZigZag Structure | true/false |

| Show BOS/CHOCH Labels | true/false |

| Enable Dashboard | true/false ENABLE DISABLE EQH EQL |

🎯 Summary of SELL Signal Trigger

| Type | Conditions Met |

|---|---|

| SELL Arrow | Mitigation Sell Pattern detected (if enabled) OR RSI confirmation (if enabled), AND all RSI conditions met (SAR above, EMA below, RSI > 70) |