Sergey Golubev / Profile

Newdigital

Friends

3916

Requests

Outgoing

Sergey Golubev

Sergey Golubev

Comment to topic Informações e Dicas Relacionadas ao Terminal MetaTrader 5

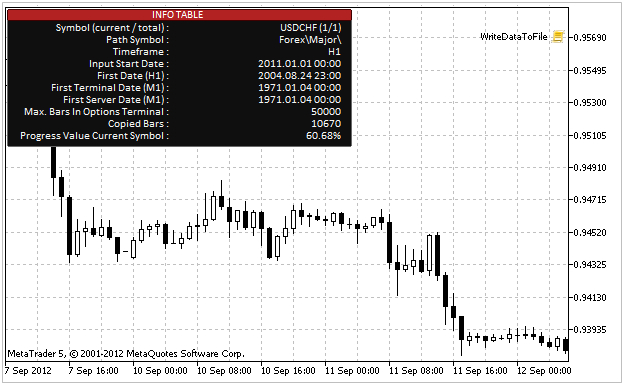

Como preparar cotações do MetaTrader 5 para outros aplicativos Introdução 1. Tópicos abordados 2. Formato de dados 3. Parâmetros externos do programa 4. Verificação dos parâmetros inseridos pelo

Sergey Golubev

Sergey Golubev

Comment to topic Informações e Dicas Relacionadas ao Terminal MetaTrader 5

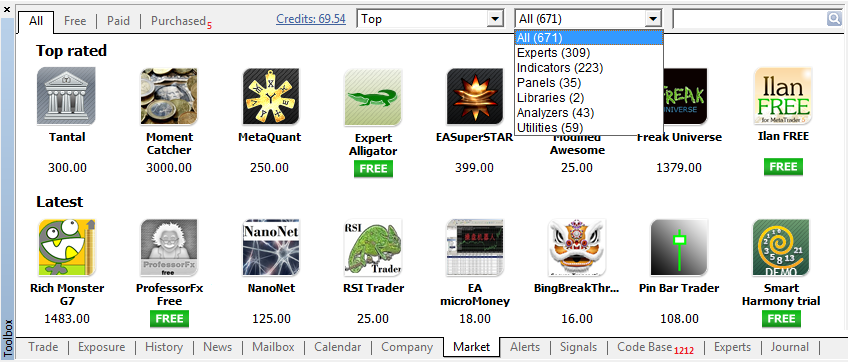

Como comprar um robô de negociação na AppStore do MetaTrader? Agora você também pode usar robôs de negociação e quaisquer indicadores técnicos com o MetaTrader 5. Você apenas precisa executar o

Sergey Golubev

Sergey Golubev

Comment to topic Algo Interesante

Por qué es el mercado de MQL5 el mejor lugar para vender estrategias de trading e indicadores técnicos Hemos creado el mercado MQL5 para ayudar a las programadores de Expert Advisors e indicadores a

Sergey Golubev

Sergey Golubev

Comment to topic Algo Interesante

Cómo publicar un producto en el Mercado El servicio del Mercado ofrece oportunidades únicas para los programadores de sistemas analíticos y robots de trading. Ahora sus programas van directamente a

Sergey Golubev

Sergey Golubev

Comment to topic Algo Interesante

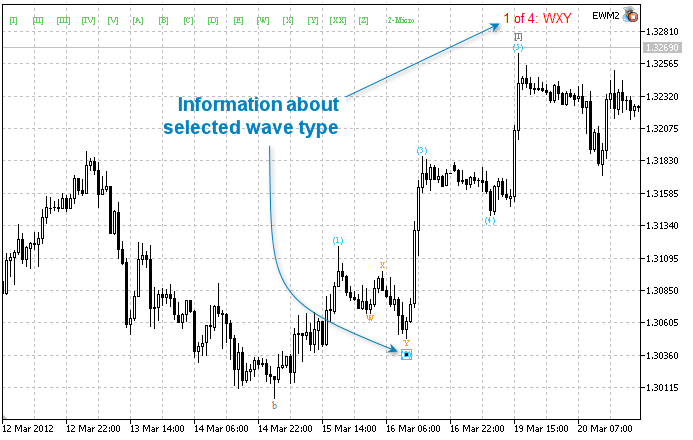

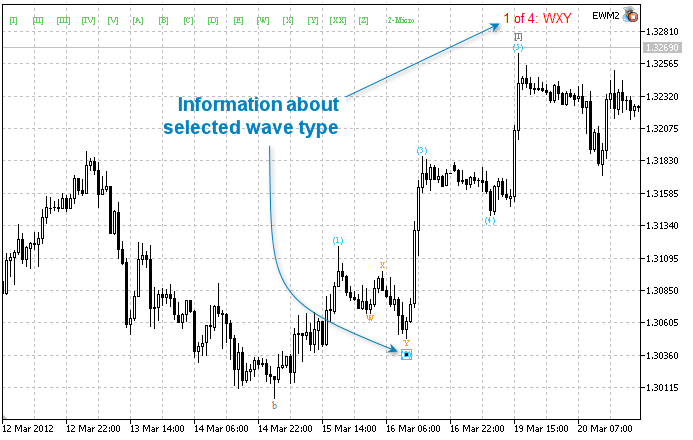

AutoElliottWaveMaker - La herramienta de MetaTrader 5 para el análisis semi-automático de los ondas de Elliott El artículo "La implementación del análisis automático de ondas de Elliott en MQL5" trata

Sergey Golubev

Sergey Golubev

Comment to topic Algo Interesante

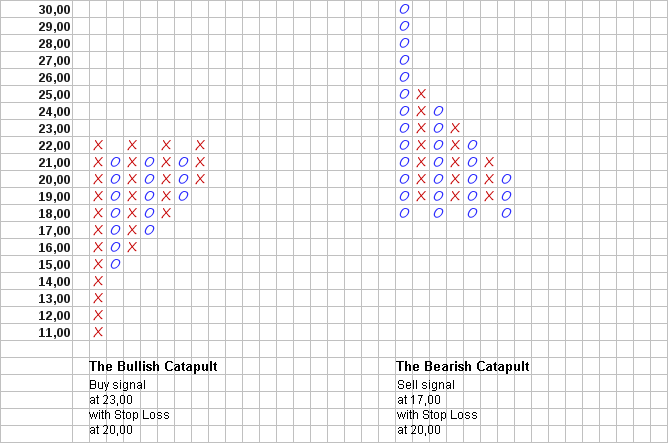

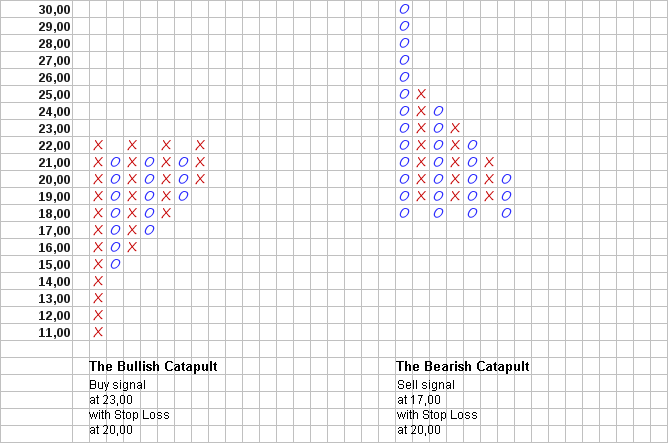

La última cruzada Hay por defecto tres formas de presentación del precio de un instrumento disponibles en el terminal de Meta Trader 5 (así como en Meta Trader 4 ): barras, velas y líneas

Sergey Golubev

Sergey Golubev

Comment to topic Algo Interesante

Proteger el código MQL5 Protección con contraseña, generadores de claves, límites de tiempo, licencias remotas y técnicas de encriptación de claves de licencia de EA avanzadas La mayoría de

Sergey Golubev

Sergey Golubev

Comment to topic Algo Interesante

Trademinator 3: El auge de las máquinas de trading Erase una vez en un lejano foro ( MQL5 ) dos artículos: "Algoritmos genéticos, ¡es fácil!" por joo y " Dr. Tradelove... " por me , fueron publicados

Sergey Golubev

Житель Липецка после споров о событиях на Украине покусал бойцовую собаку

Подробнее: http://www.rosbalt.ru/federal/2014/03/12/1243358.html

Подробнее: http://www.rosbalt.ru/federal/2014/03/12/1243358.html

Sergey Golubev

Sergey Golubev

Comment to topic Something Interesting to Read March 2014

The Wave Principle by Ralph Nelson Elliott The Elliott Wave Principle is a form of technical analysis that some traders use to analyze financial market cycles and forecast market trends by identifying

Sergey Golubev

Sergey Golubev

Comment to topic Informações e Dicas Relacionadas ao Terminal MetaTrader 5

Redes neurais: Da teoria à prática Atualmente, todo negociador já deve ter ouvido falar sobre redes neurais e sabe como é interessante utilizá-las. A maioria acredita que as pessoas que sabem lidar

Sergey Golubev

Sergey Golubev

Comment to topic Informações e Dicas Relacionadas ao Terminal MetaTrader 5

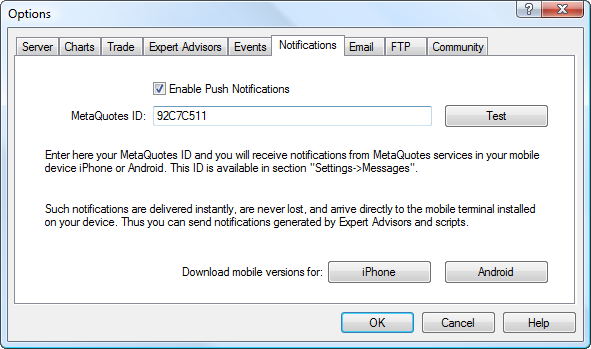

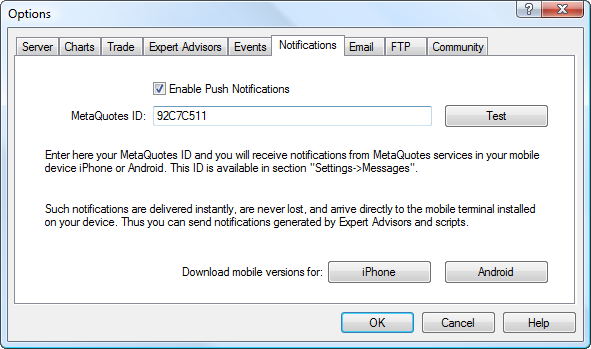

Metaquotes ID no terminal móvel Metatrader Aparelhos com Android e iOS oferecem muitos recursos que sequer conhecemos. Um desses recursos são as notificações do tipo push que permitem recebermos

Sergey Golubev

Sergey Golubev

Comment to topic How to Start with Metatrader 5

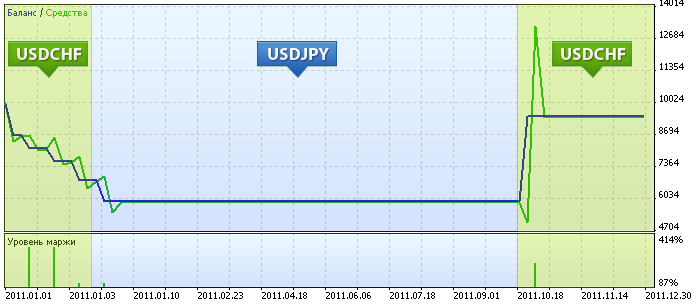

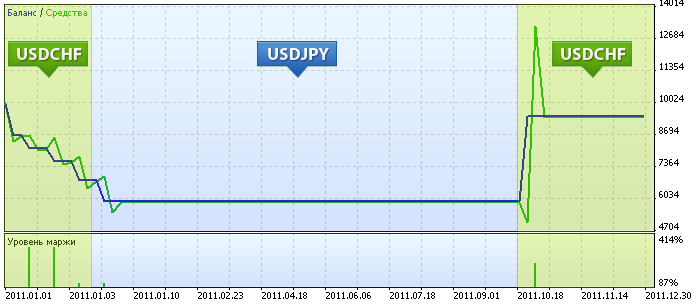

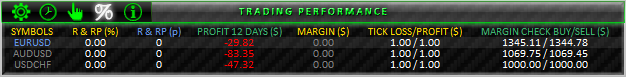

The other good artricle which may be good to read : ======== Limitless Opportunities with MetaTrader 5 and MQL5 Introduction 1. Trading System Conditions 2. External Parameters 3. Parameter

Sergey Golubev

Sergey Golubev

Comment to topic Informações e Dicas Relacionadas ao Terminal MetaTrader 5

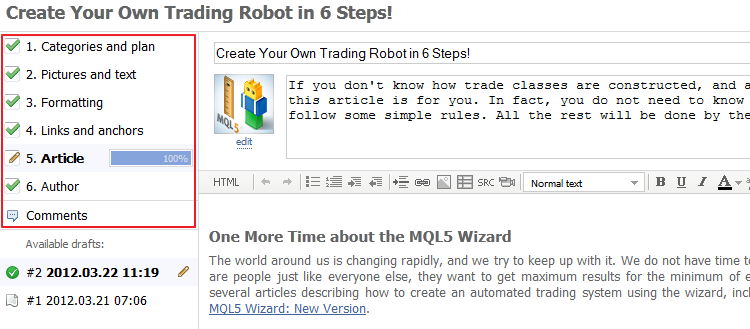

Novo sistema de publicação de artigo em MQL5.community Uma contribuição enorme à popularidade das linguagens MQL4 e MQL5 fizeram pelos numerosos artigos, na maioria escritos por você - por traders e

Sergey Golubev

shared author's Victor article

Kernel Density Estimation of the Unknown Probability Density Function

The article deals with the creation of a program allowing to estimate the kernel density of the unknown probability density function. Kernel Density Estimation method has been chosen for executing the task. The article contains source codes of the method software implementation, examples of its use and illustrations.

Sergey Golubev

Sergey Golubev

Comment to topic Informações e Dicas Relacionadas ao Terminal MetaTrader 5

Fundamentos de estatística O que é estatística? Aqui está a definição encontrada na Wikipédia: "Estatística é o estudo da coleta, organização, análise, interpretação e apresentação de dados". (

Sergey Golubev

Sergey Golubev

Comment to topic Informações e Dicas Relacionadas ao Terminal MetaTrader 5

Quem é quem na MQL5.community? O website MQL5.com se lembra de todas as suas conquistas! Quantos dos seus tópicos são épicos, quão popular são os seus artigos e quantas vezes seus programas na base do

Sergey Golubev

Renat Fatkhullin - MetaQuotes

Сегодня пройдем планку в 200 000 зарегистрированных пользователей...

https://www.mql5.com/ru/wall

https://www.mql5.com/ru/wall

1

Sergey Golubev

Sergey Golubev

Comment to topic 报刊评论

离岸人民币∶人民币交易者的首选 星期三, 三月 12 2014, 05:04 GMT 中国是世界上第二大经济体以及全球市场活动的重要参与者,但其汇率制度却异常严格。中国对人民币汇率的监管措施非常多,人民币几乎是不可自由兑换的,因此三种不同的代理机制应运而生∶可交付离岸人民币CNH、跨境贸易人民币CNT和不可交付离岸人民币期货NDF。

: