Daniel Stein / Profile

- Information

|

12+ years

experience

|

32

products

|

2033

demo versions

|

|

9

jobs

|

0

signals

|

0

subscribers

|

Founder

at

Stein Investments

Stein Investments – Professional Trading Tools & Market Insights

At Stein Investments, we provide cutting-edge data analytics to help traders make informed decisions and maximize their trading potential.

Our exclusive tools, such as FX Volume, offer unique retail trading sentiment insights, while FX Power and IX Power allow precise analysis of currency and market trends.

We don’t just provide tools—we also educate.

On our YouTube channel ( www.youtube.com/@SteinInvestments ), you’ll find:

• In-depth product tutorials to help you master our indicators

• Daily Morning Briefings, analyzing the latest market trends

• Proven trading strategies to enhance your performance

• Step-by-step guides on how to combine our tools effectively

📌 Explore more and become part of our thriving trading community:

👉 Stein Investments Central Page: https://www.mql5.com/en/blogs/post/755375

At Stein Investments, we provide cutting-edge data analytics to help traders make informed decisions and maximize their trading potential.

Our exclusive tools, such as FX Volume, offer unique retail trading sentiment insights, while FX Power and IX Power allow precise analysis of currency and market trends.

We don’t just provide tools—we also educate.

On our YouTube channel ( www.youtube.com/@SteinInvestments ), you’ll find:

• In-depth product tutorials to help you master our indicators

• Daily Morning Briefings, analyzing the latest market trends

• Proven trading strategies to enhance your performance

• Step-by-step guides on how to combine our tools effectively

📌 Explore more and become part of our thriving trading community:

👉 Stein Investments Central Page: https://www.mql5.com/en/blogs/post/755375

Daniel Stein

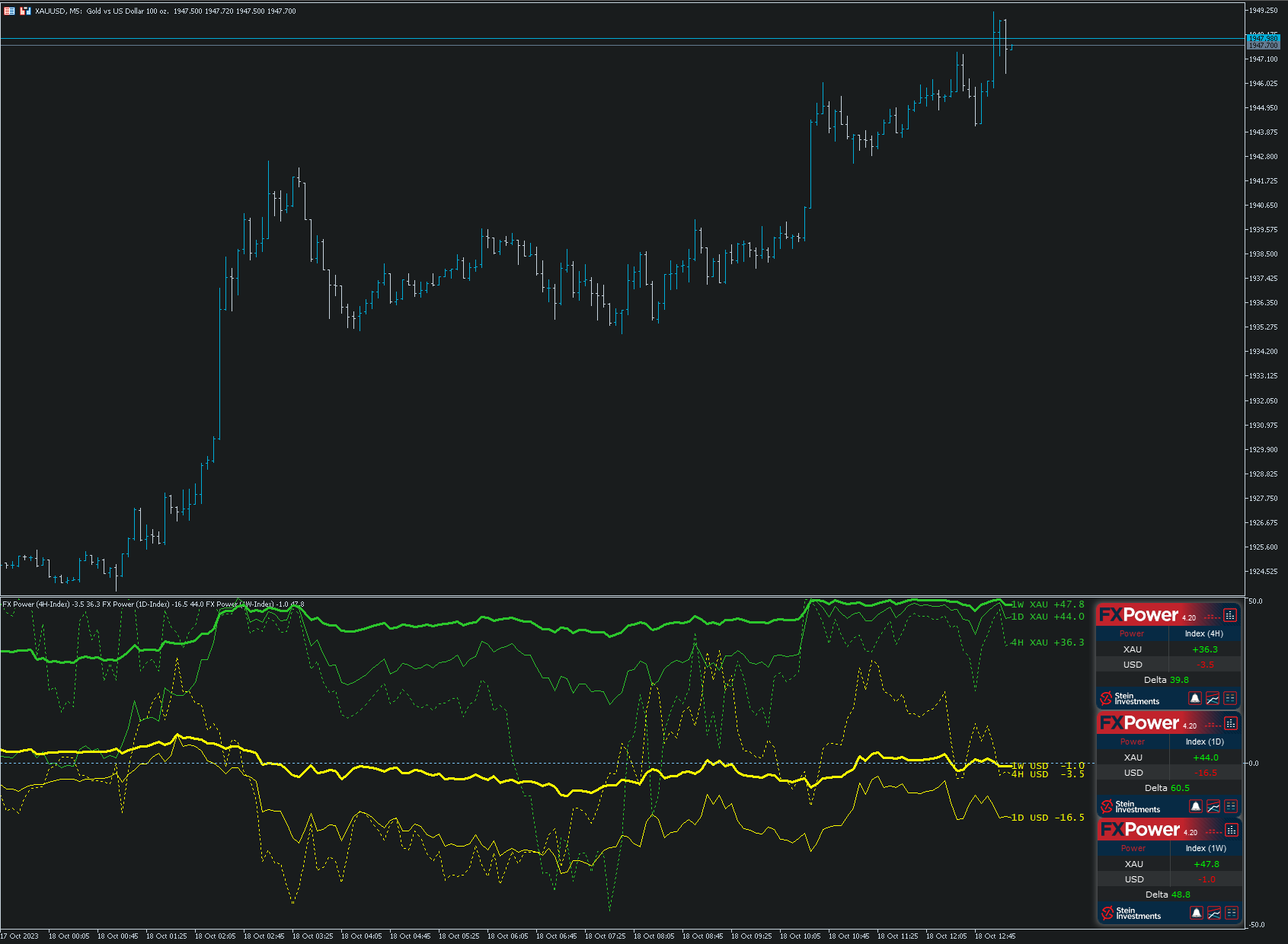

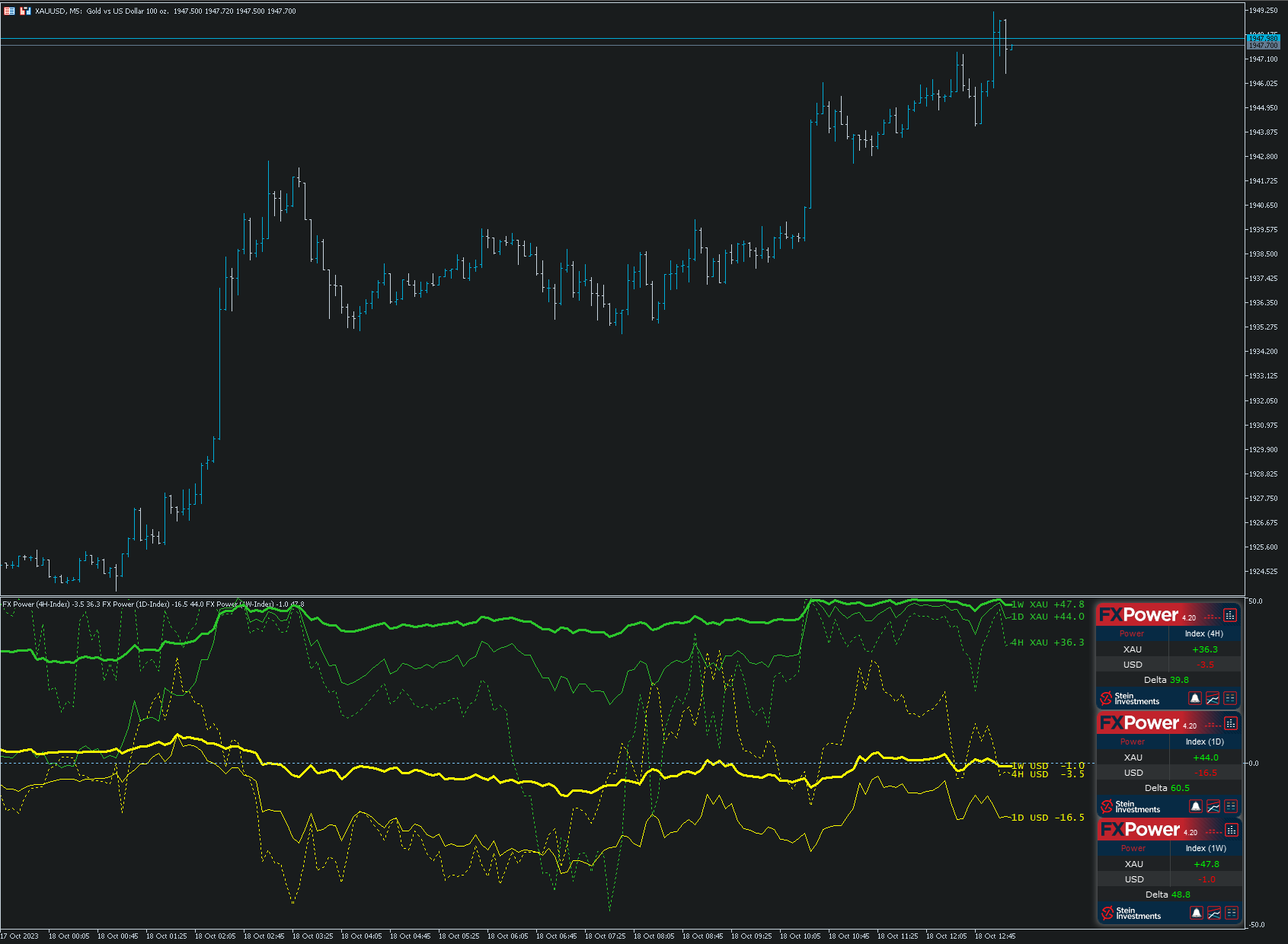

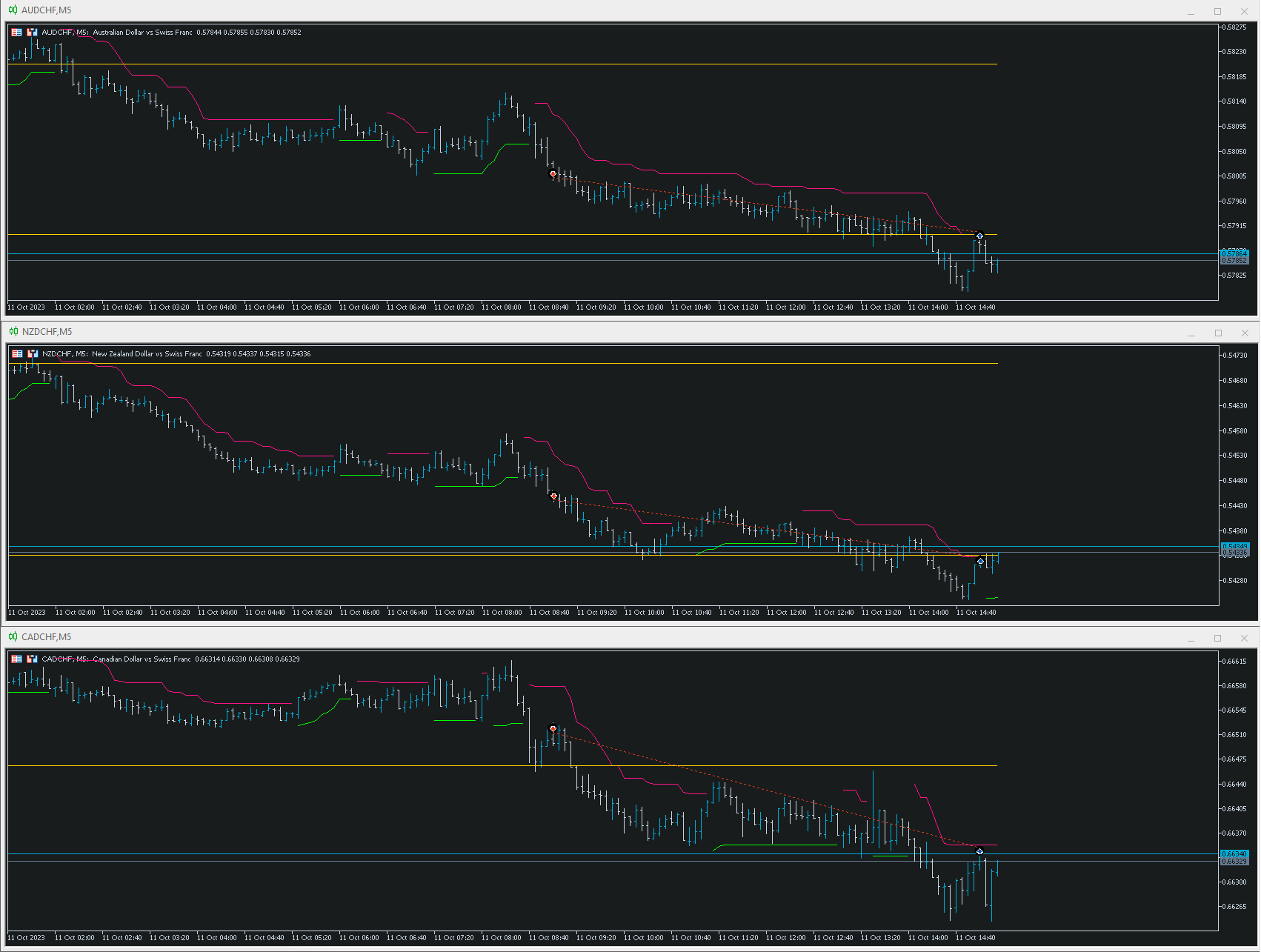

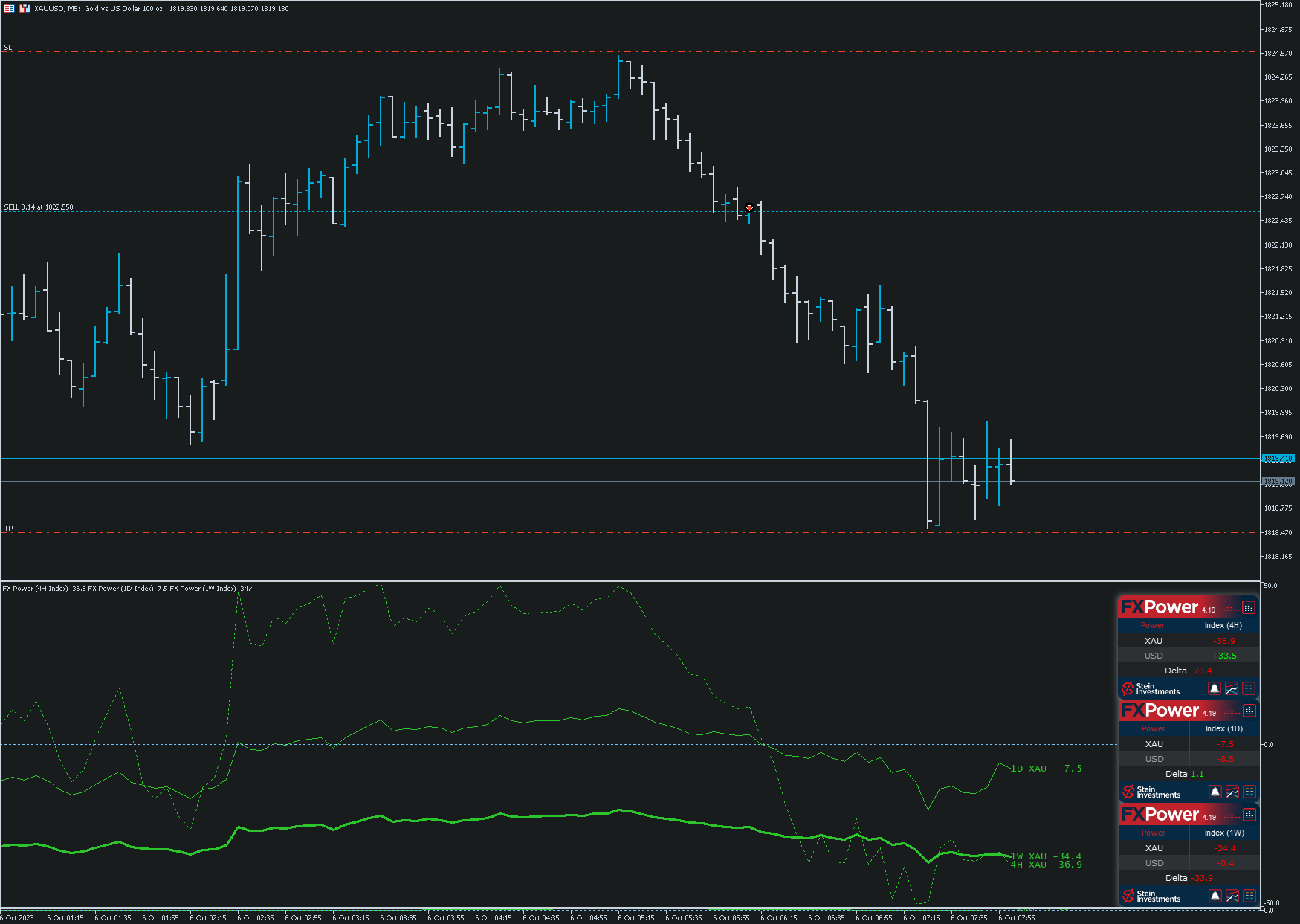

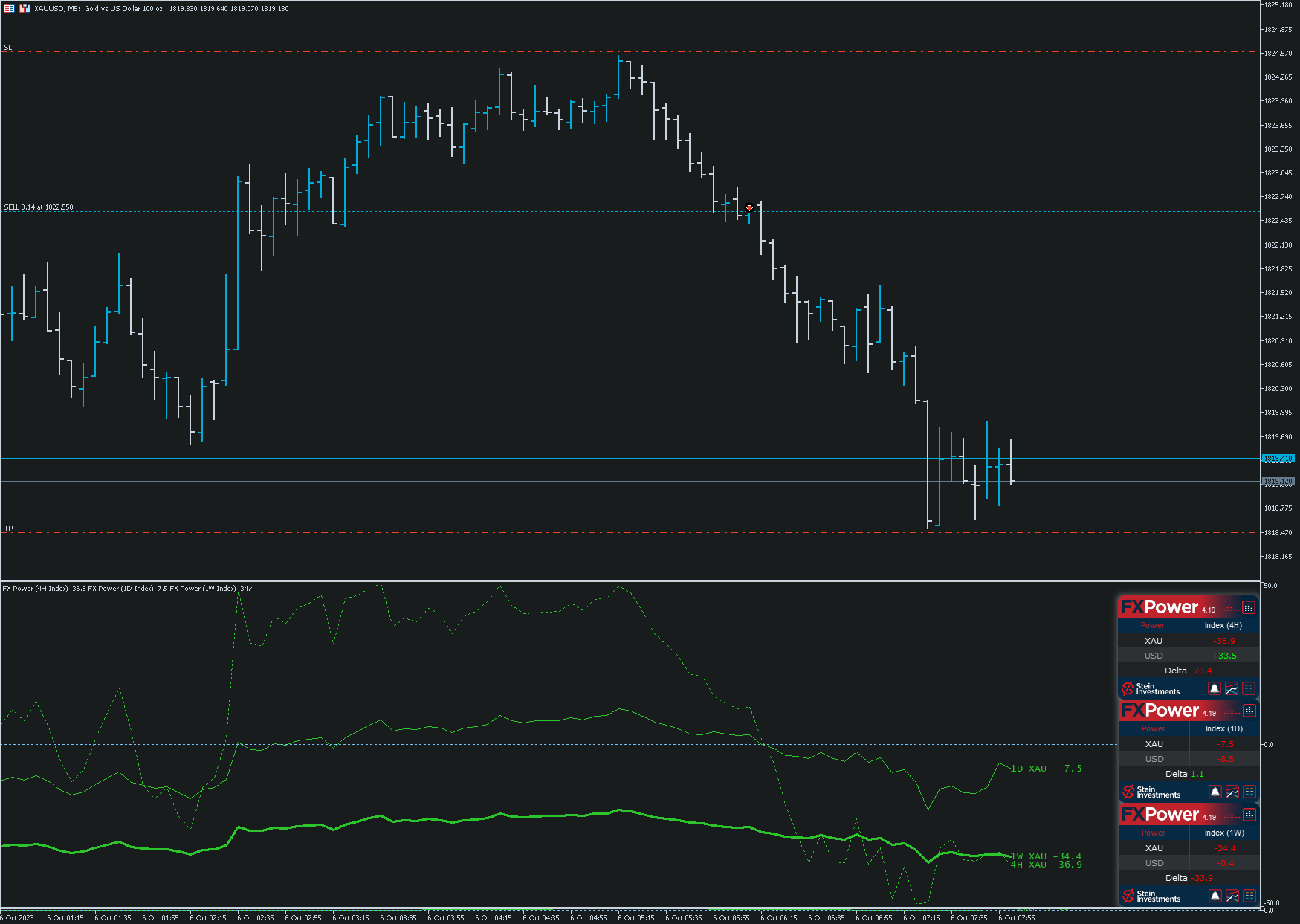

What a wonderful breakout setup on GOLD. I seriously need to check my GOLD chart more often.

Get more details about the Breakout Strategy at https://www.mql5.com/en/blogs/post/754377

All the best and have fun trading

Daniel

Get more details about the Breakout Strategy at https://www.mql5.com/en/blogs/post/754377

All the best and have fun trading

Daniel

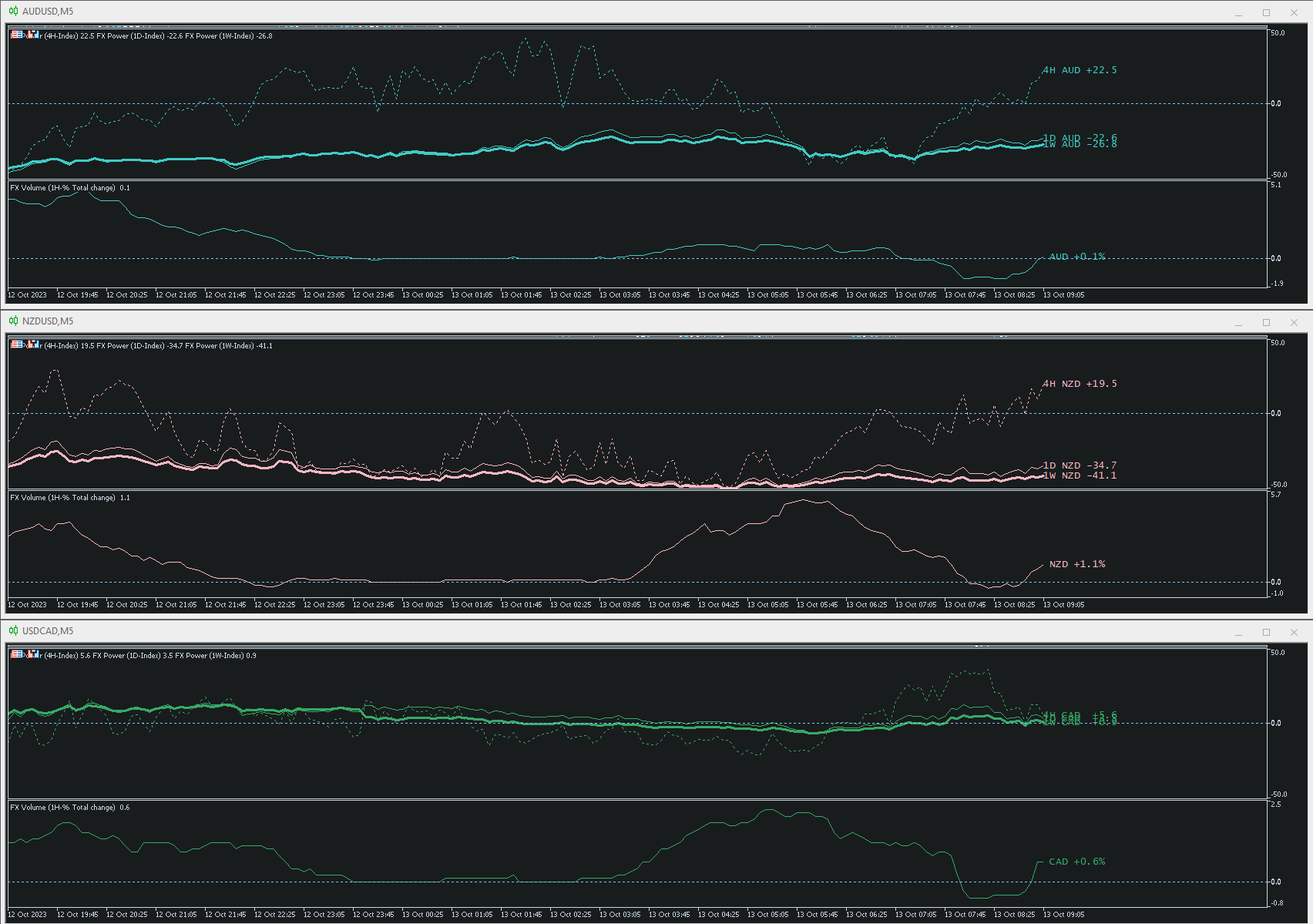

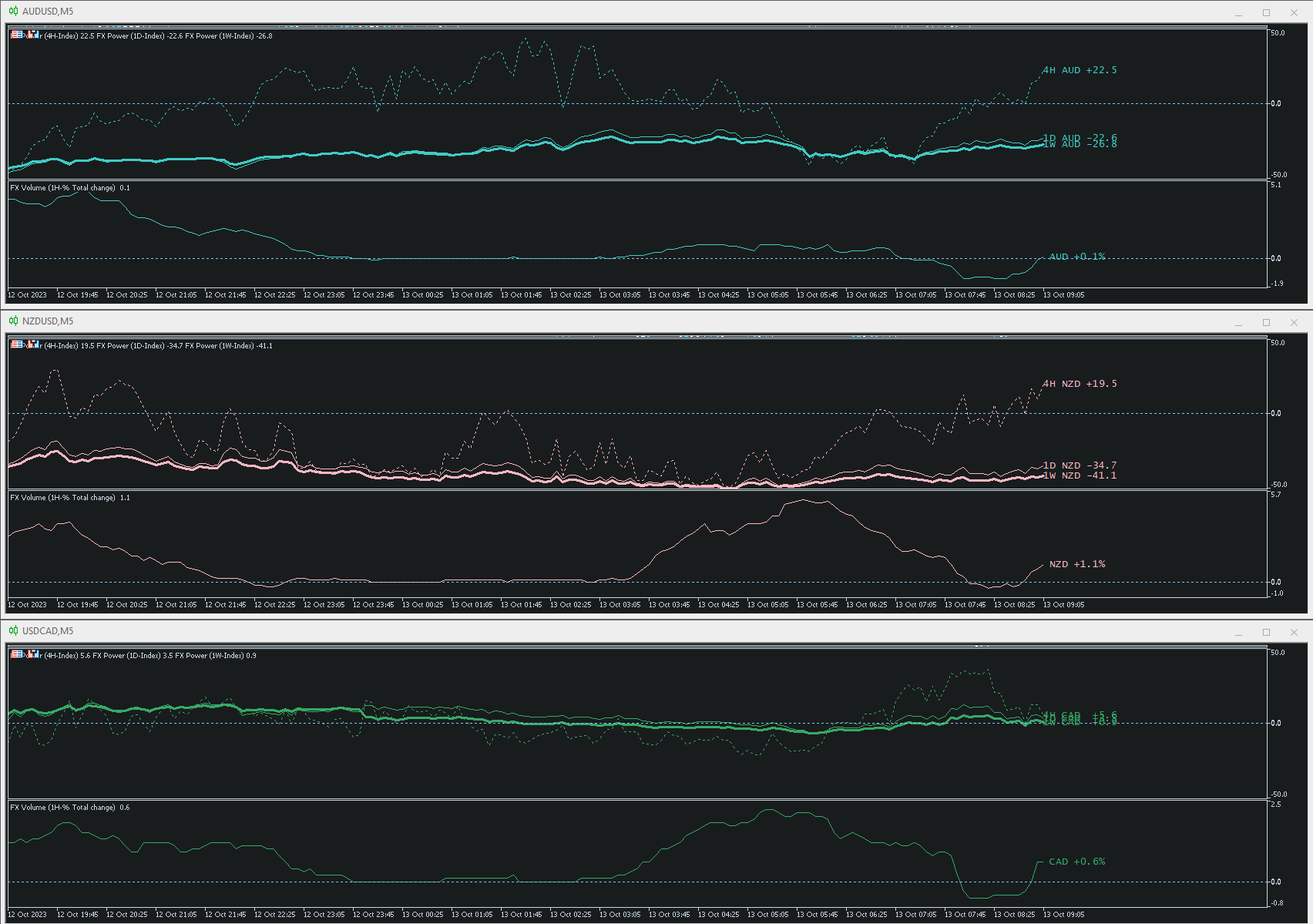

Daniel Stein

Get more details about this screenshot

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

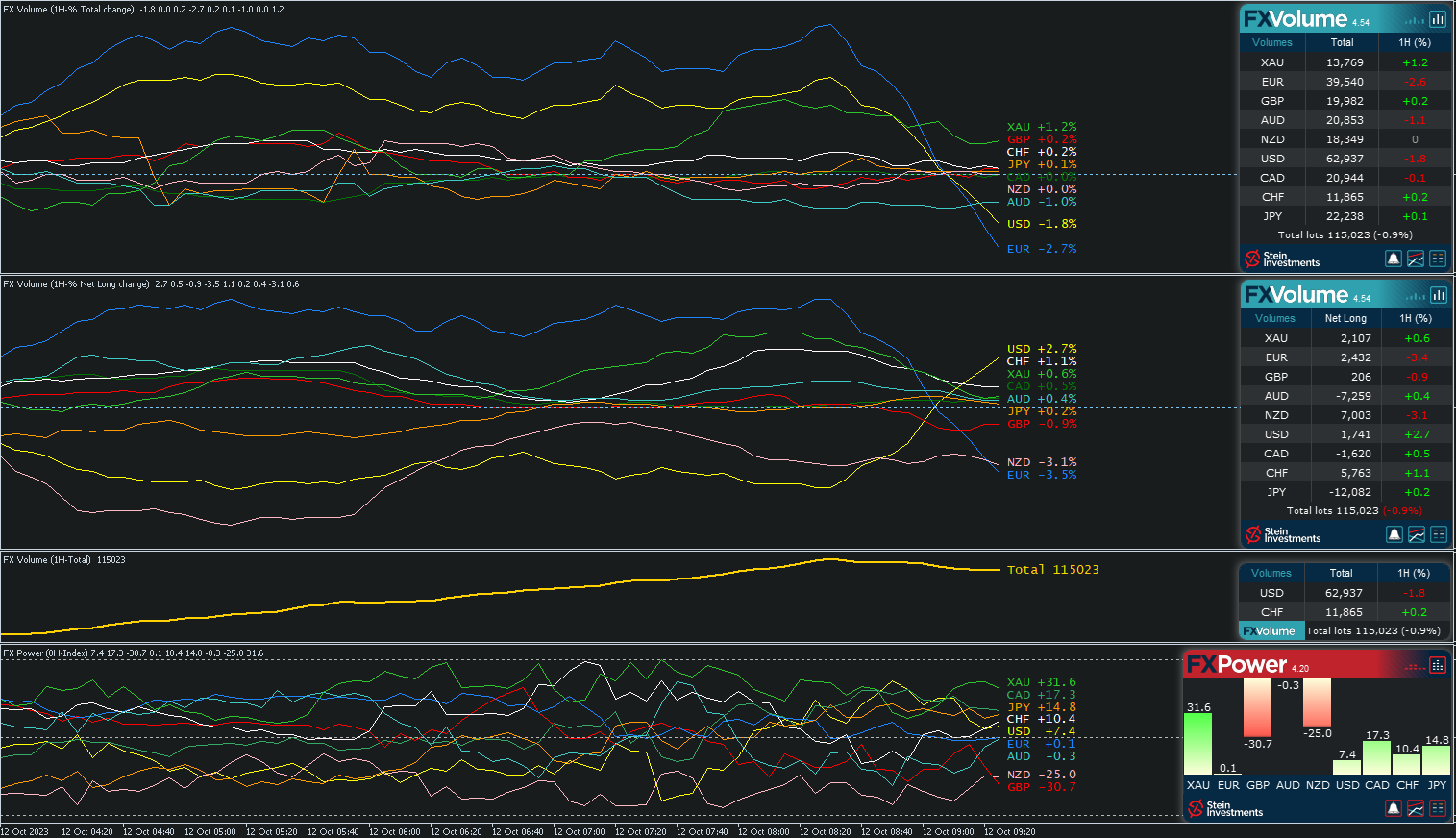

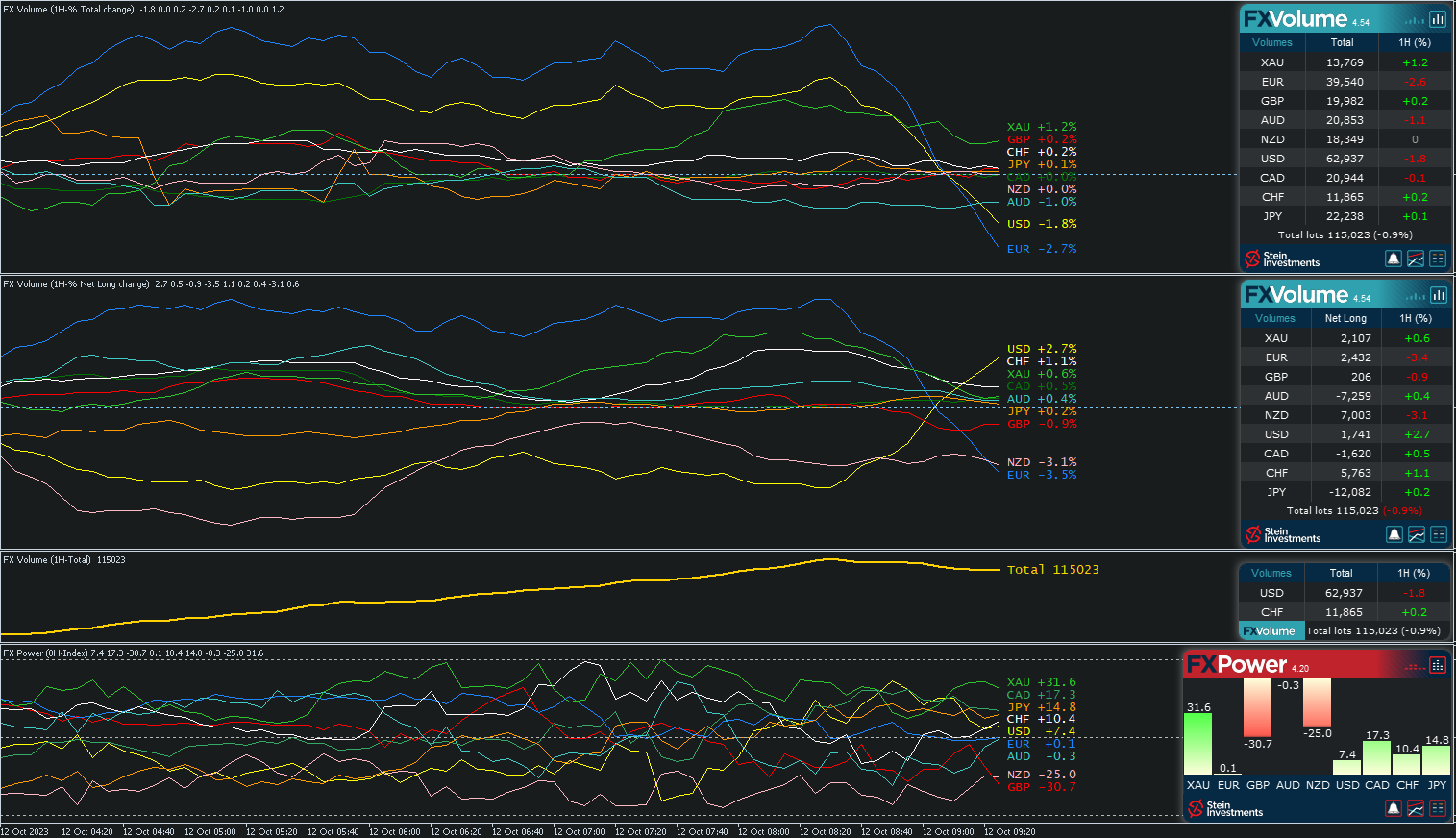

Daniel Stein

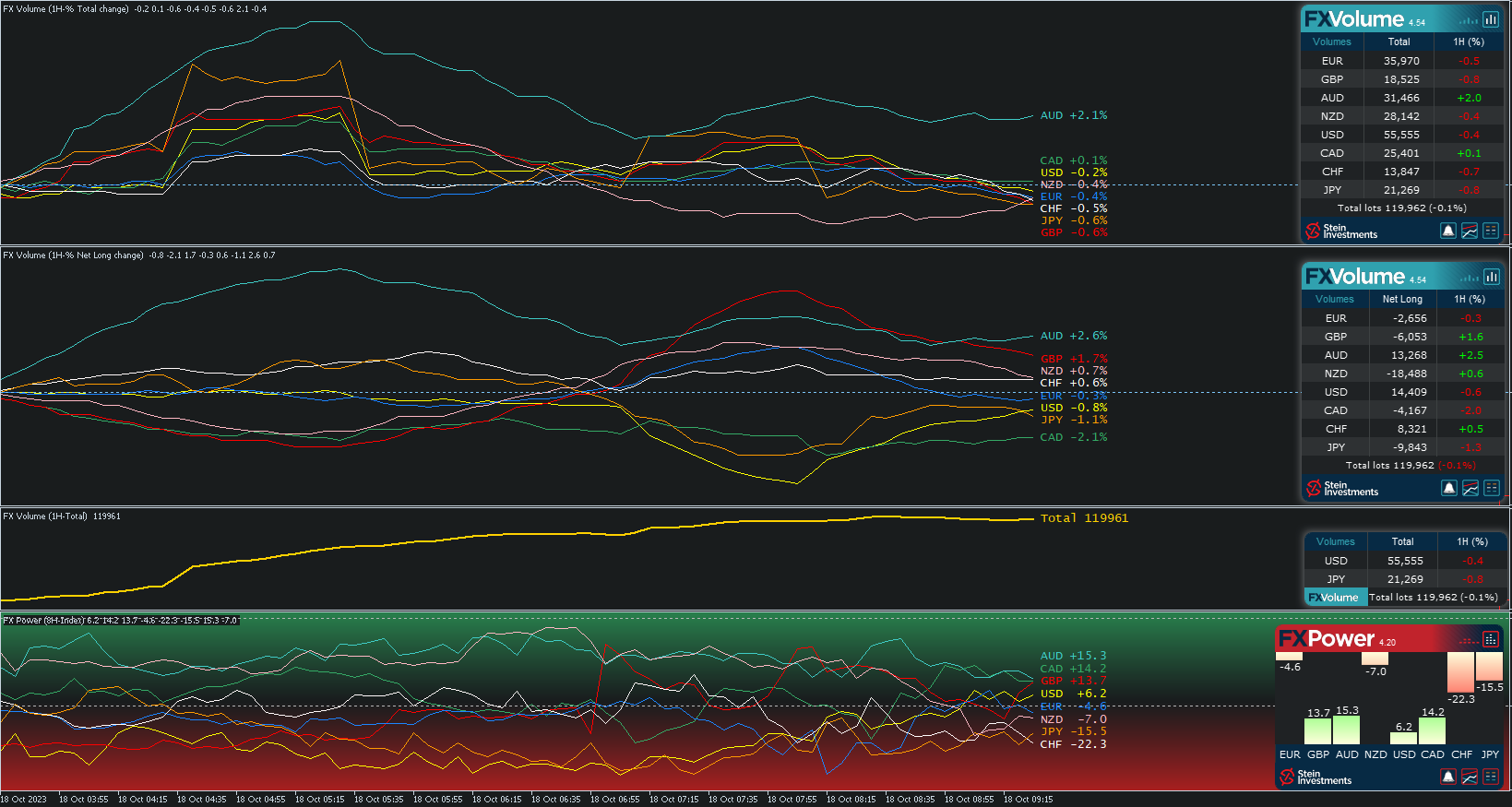

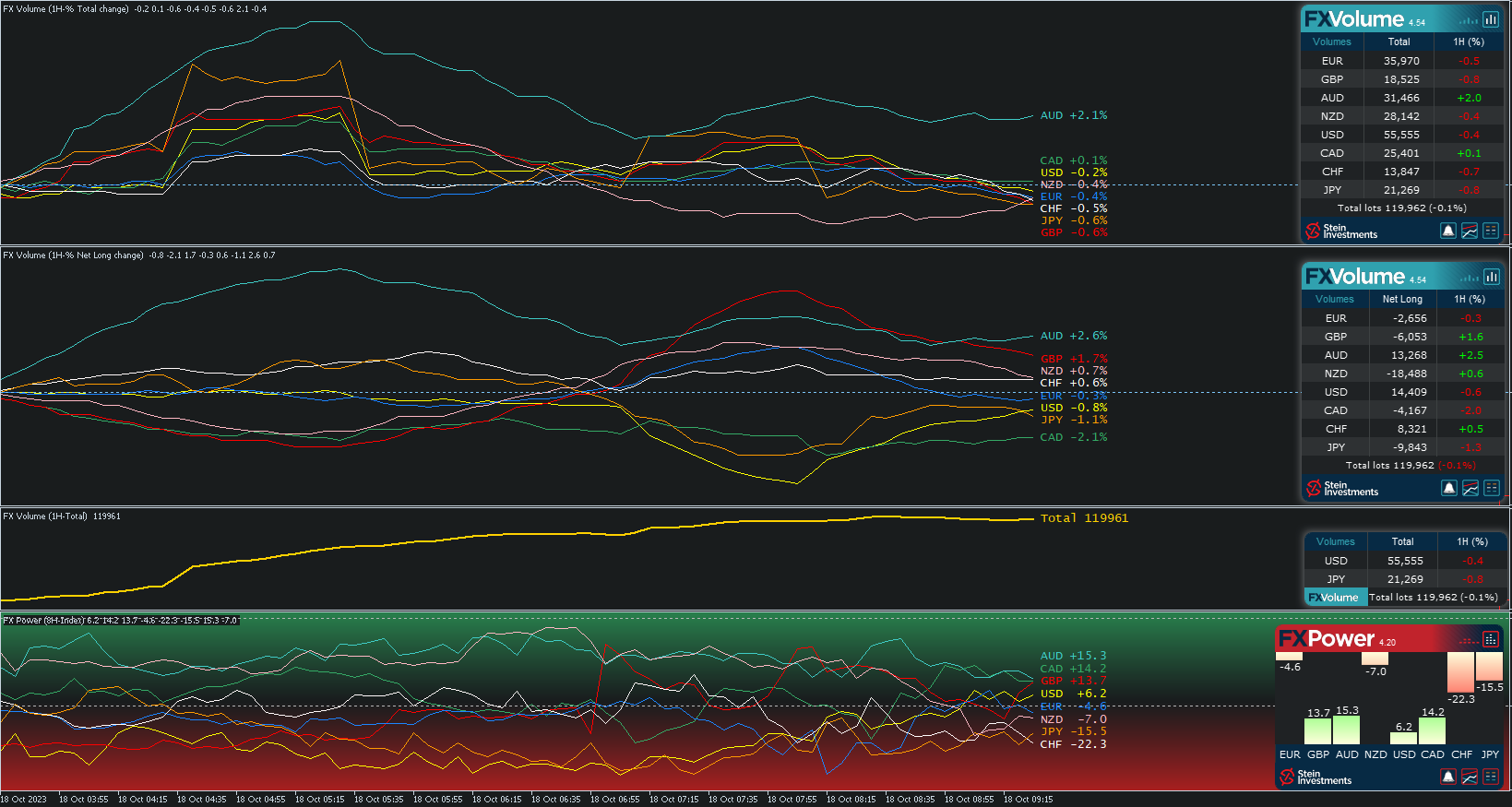

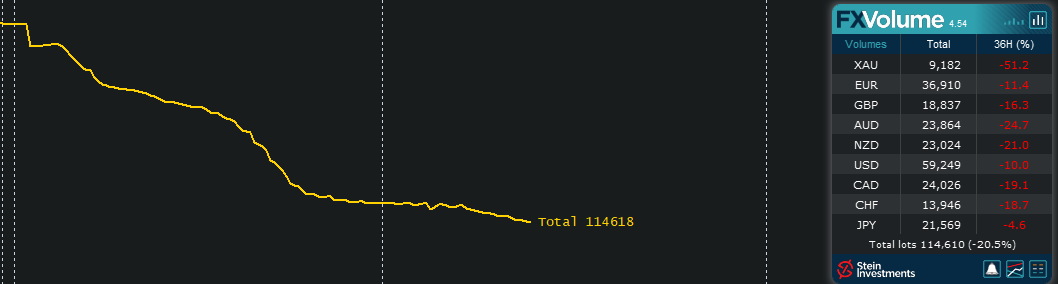

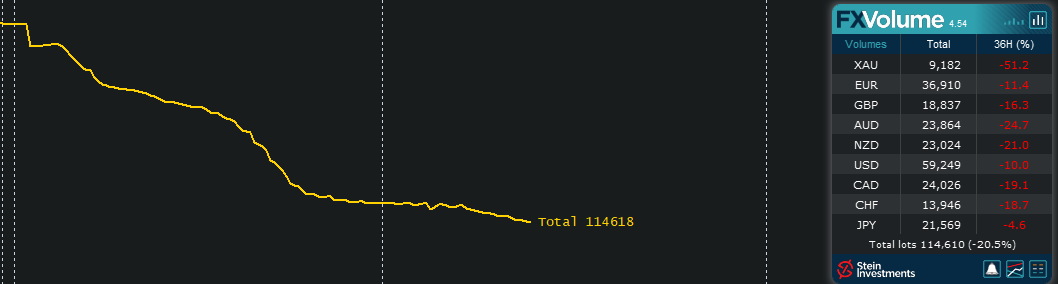

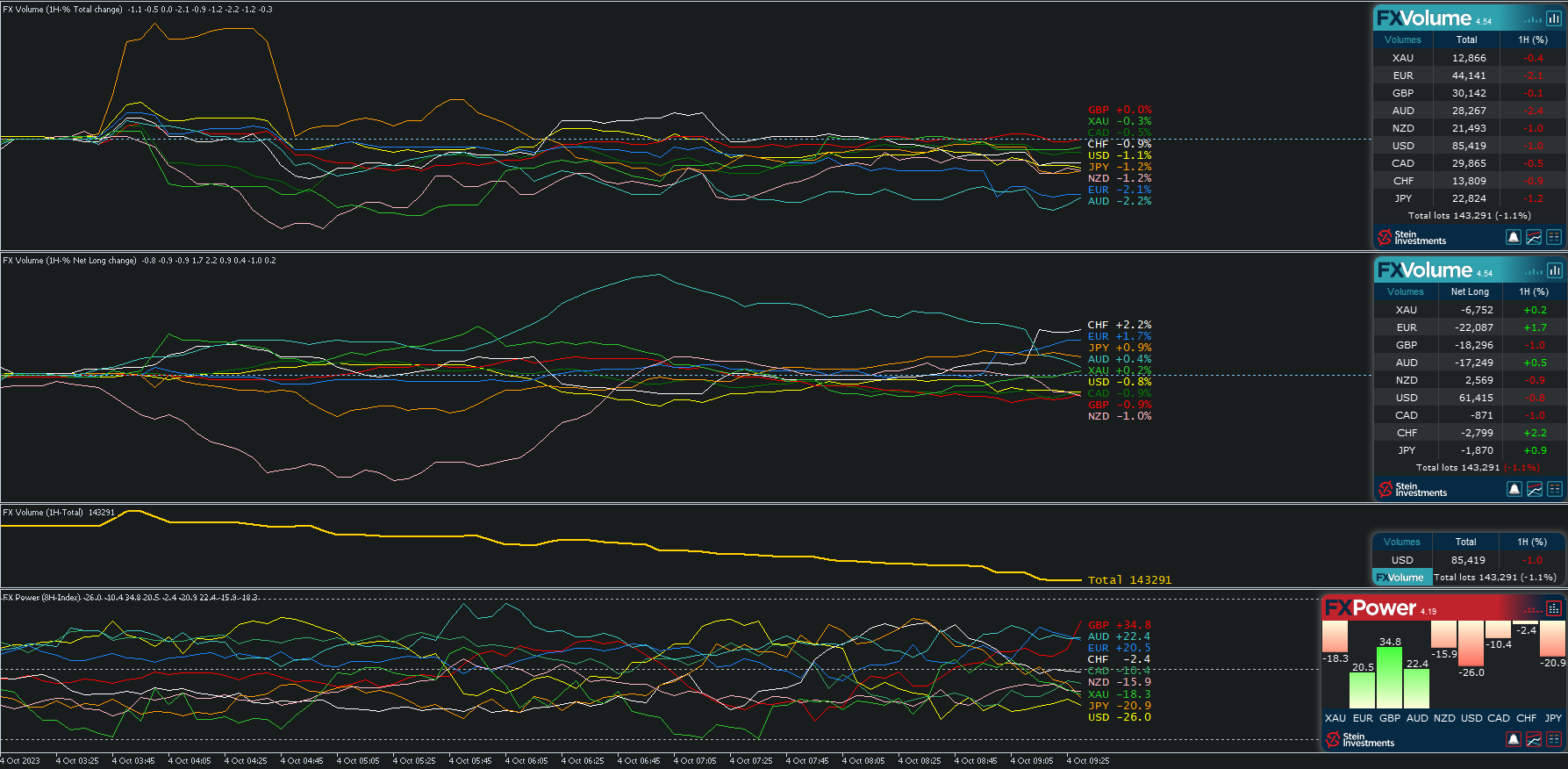

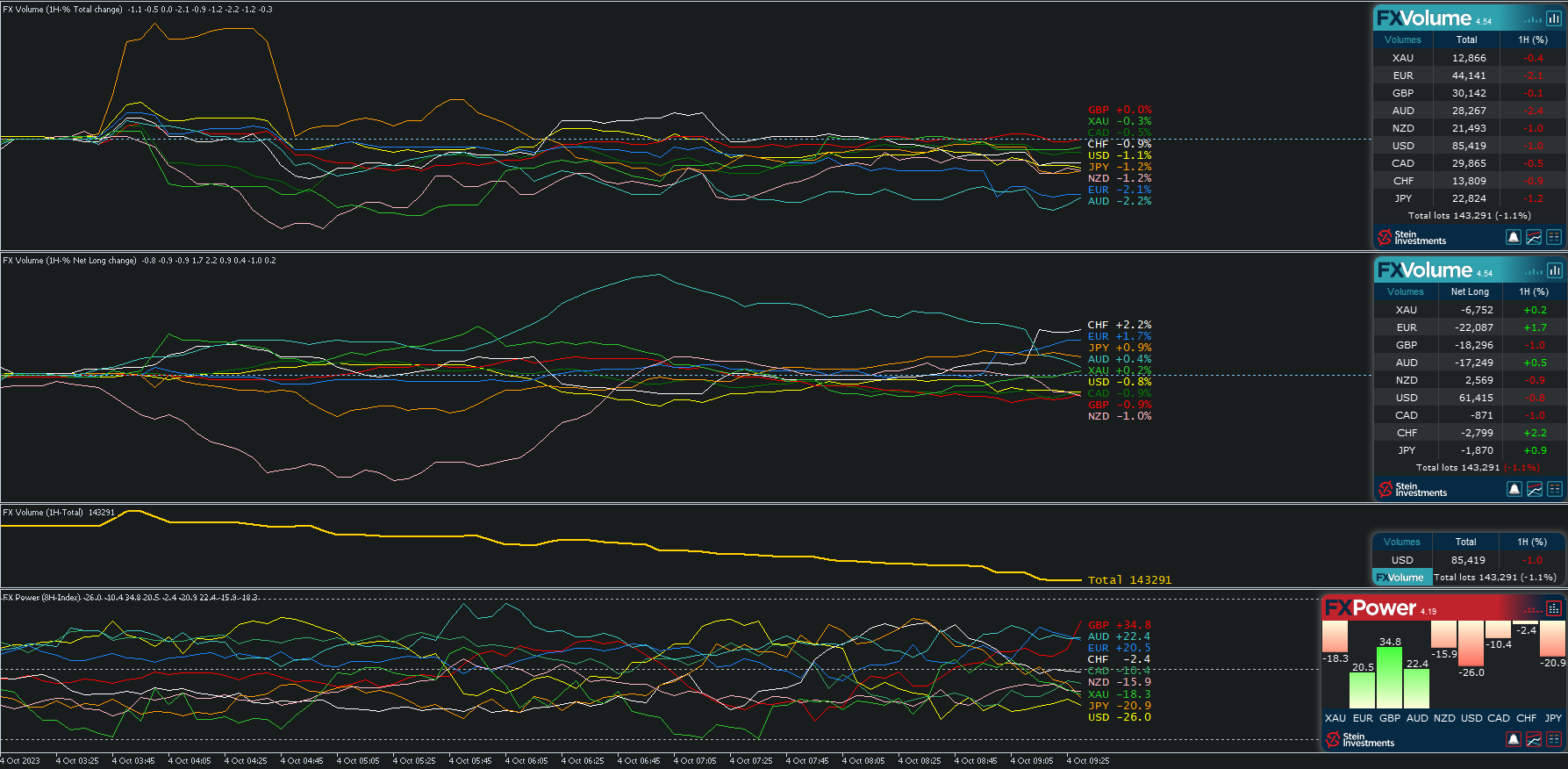

Update on Today's Morning Briefing

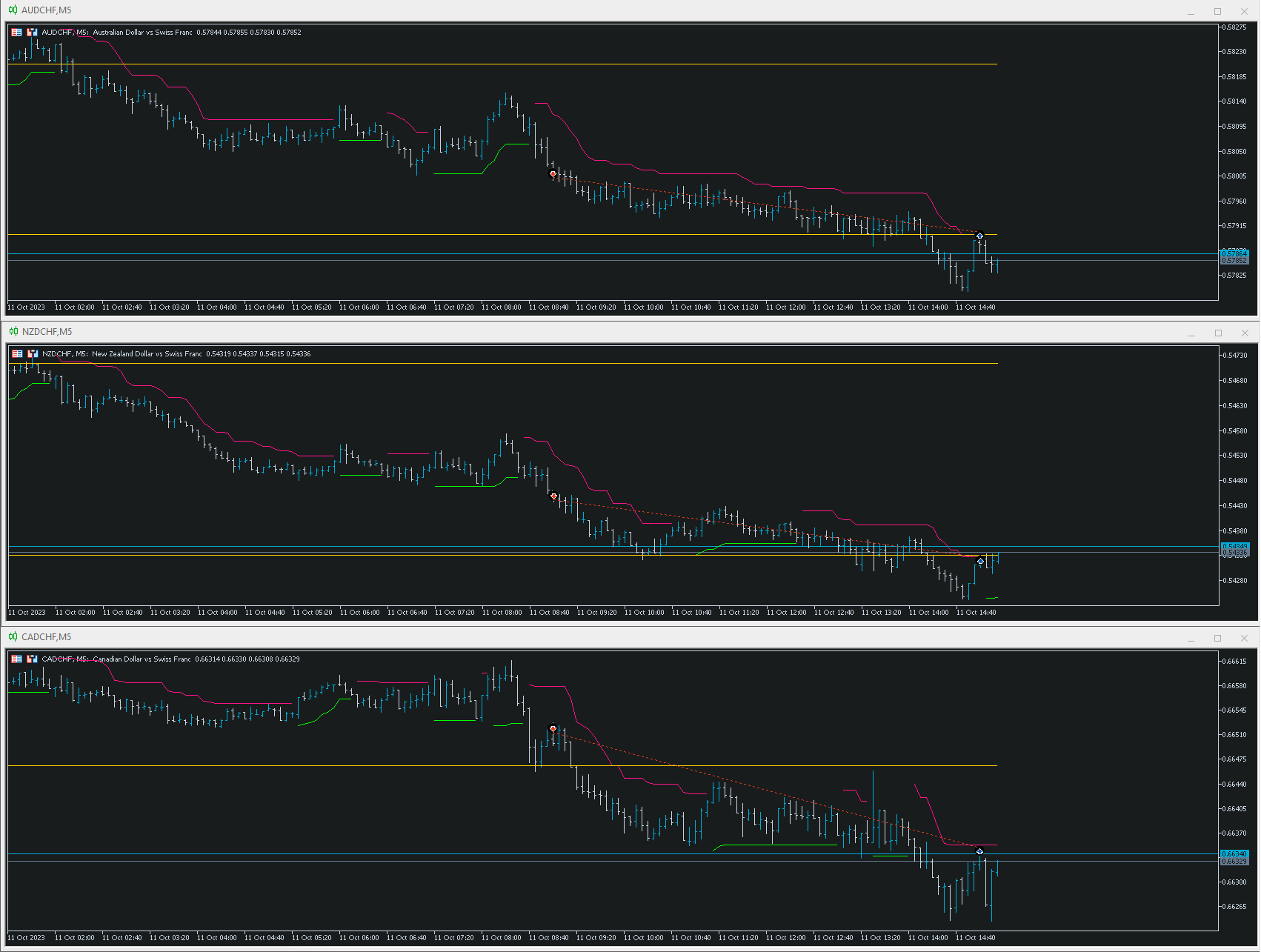

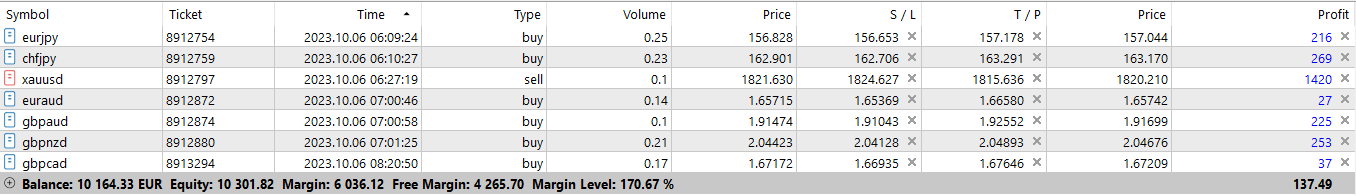

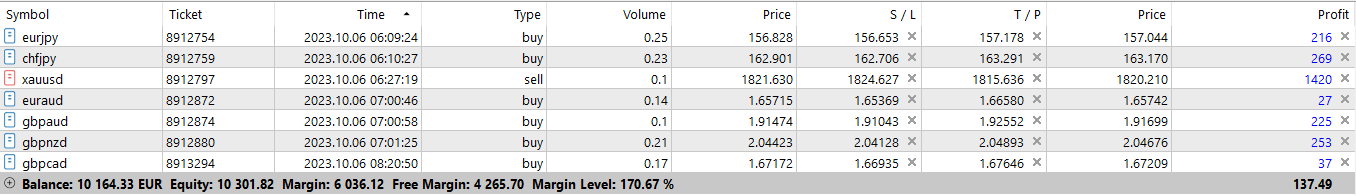

These are my currently running trades following our Breakout Strategy.

And luckily, the total market volume stabilizes. 🥳

Get more details about the Breakout Strategy at https://www.mql5.com/en/blogs/post/754377

There is currently a 25% discount on the long-term subscriptions of FX Power NG and FX Volume.

Even without this discount, you’ll have your investment back in no time following our Breakout Strategy. 💪

All the best and have fun trading

Daniel

These are my currently running trades following our Breakout Strategy.

And luckily, the total market volume stabilizes. 🥳

Get more details about the Breakout Strategy at https://www.mql5.com/en/blogs/post/754377

There is currently a 25% discount on the long-term subscriptions of FX Power NG and FX Volume.

Even without this discount, you’ll have your investment back in no time following our Breakout Strategy. 💪

All the best and have fun trading

Daniel

Daniel Stein

Get more details about this screenshot

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

If you like to know how to trade those breakouts, we recommend having a look at our Breakout Strategy at https://www.mql5.com/en/blogs/post/754377

Daniel Stein

Get more details about this screenshot

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

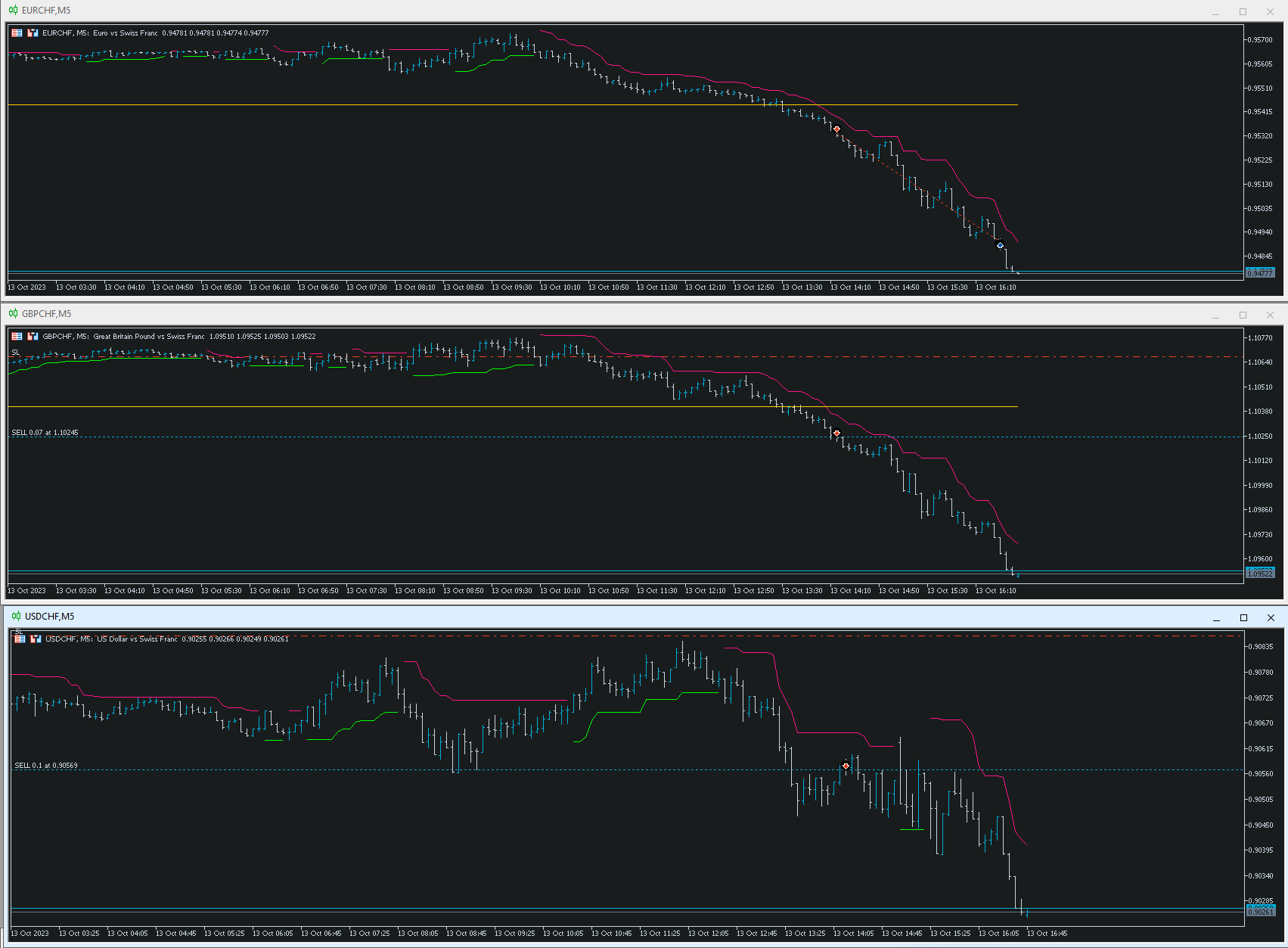

⚠️ Update on today’s Morning Briefing ⚠️

That was a challenging trading day, but we managed to get some profits anyway. 💪

As written this morning, I took the CHF Sell setup in the early morning and kept the positions the entire day.

Three of them got stopped out (-3R), but the other trades covered that easily.

So, all in all, we’ll close that day with +2R of profit, which is pretty cool considering today's circumstances, and the outstanding “volatility” of the CHF pairs. 😉

Get more details about the Breakout Strategy at https://www.mql5.com/en/blogs/post/754377

There is currently a 25% discount on the long-term subscriptions of FX Power NG and FX Volume. Even without this discount, you’ll have your investment back in no time following our Breakout Strategy. 💪

All the best and have fun trading

Daniel

That was a challenging trading day, but we managed to get some profits anyway. 💪

As written this morning, I took the CHF Sell setup in the early morning and kept the positions the entire day.

Three of them got stopped out (-3R), but the other trades covered that easily.

So, all in all, we’ll close that day with +2R of profit, which is pretty cool considering today's circumstances, and the outstanding “volatility” of the CHF pairs. 😉

Get more details about the Breakout Strategy at https://www.mql5.com/en/blogs/post/754377

There is currently a 25% discount on the long-term subscriptions of FX Power NG and FX Volume. Even without this discount, you’ll have your investment back in no time following our Breakout Strategy. 💪

All the best and have fun trading

Daniel

Daniel Stein

Get more details about this screenshot

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

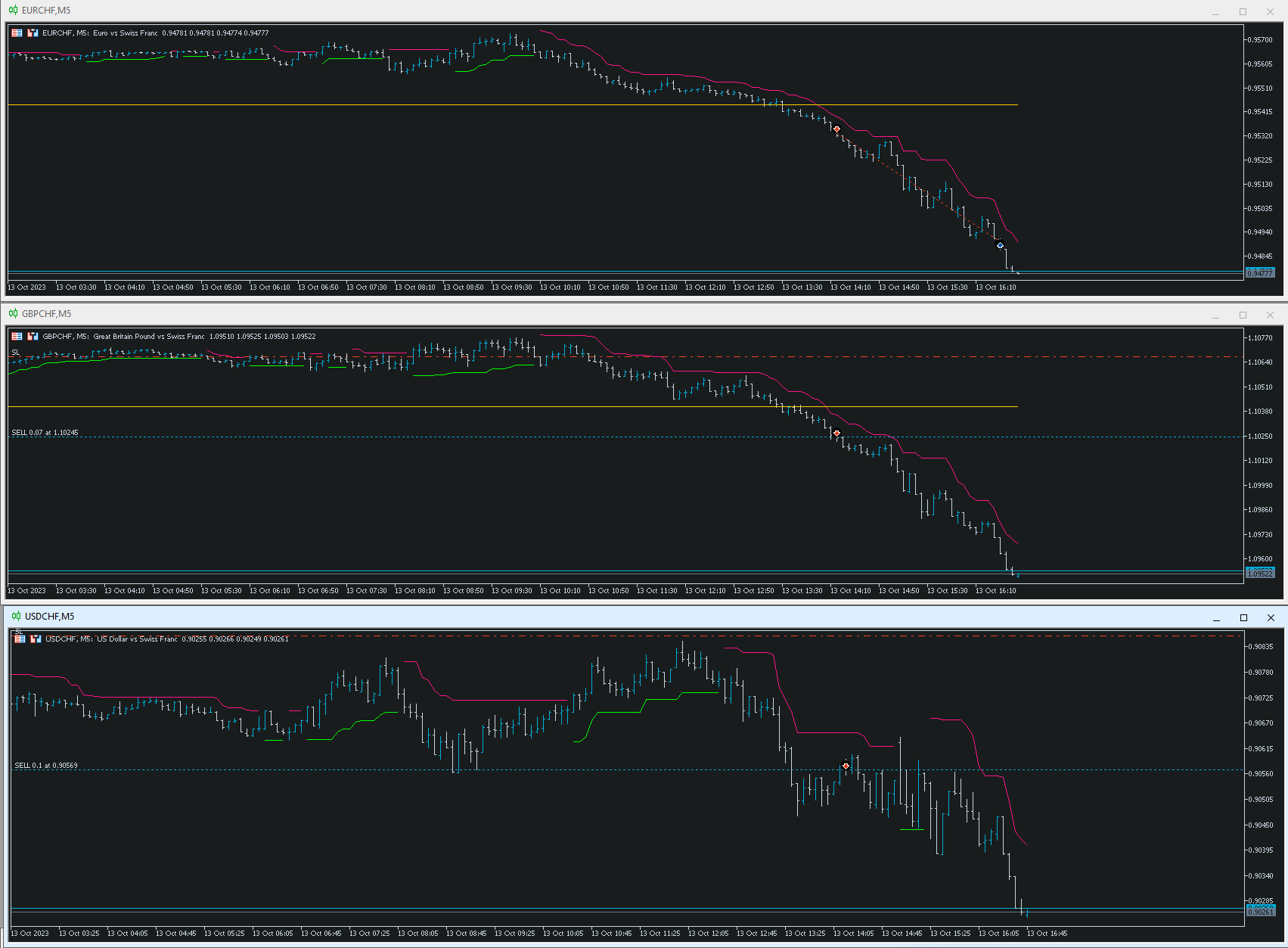

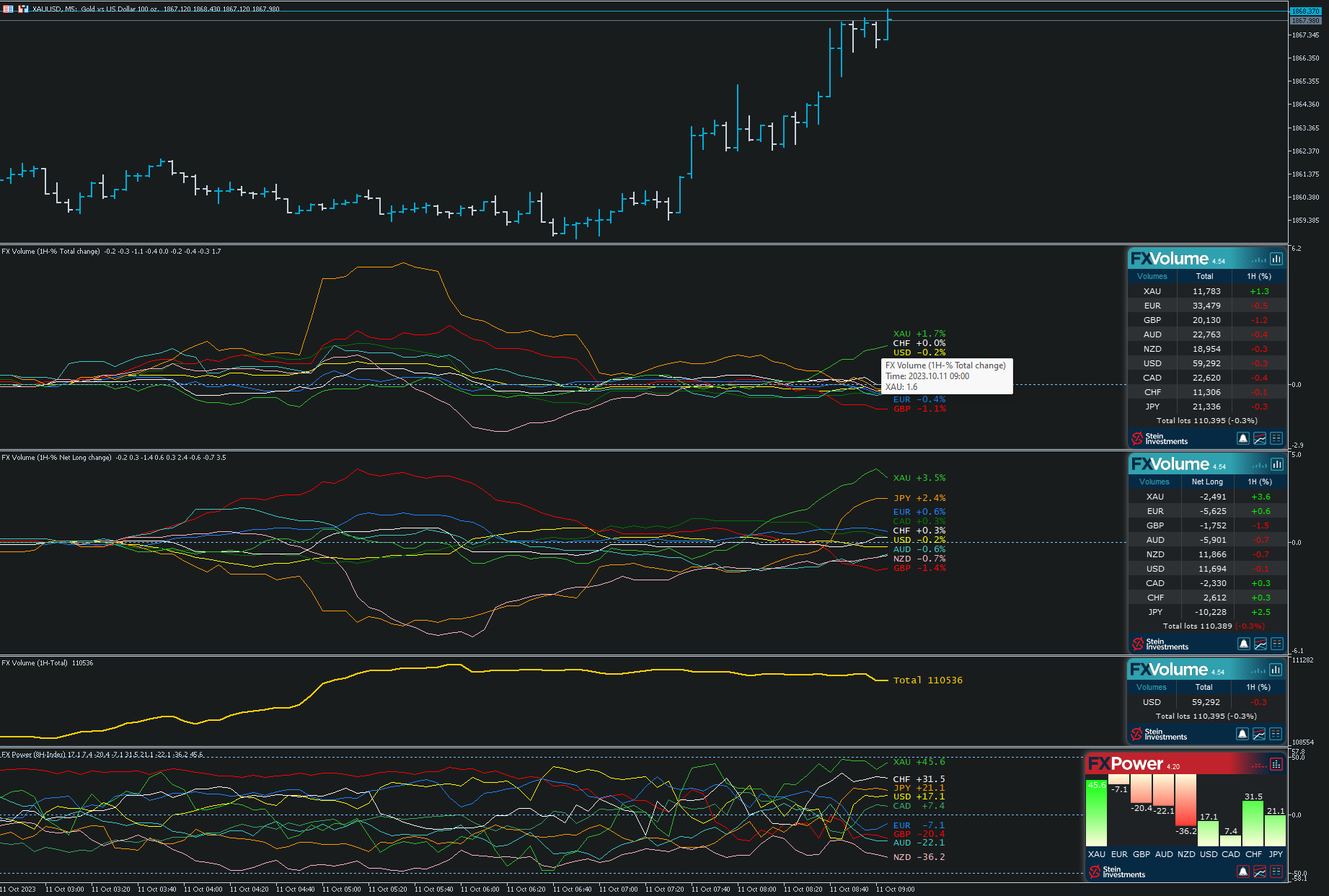

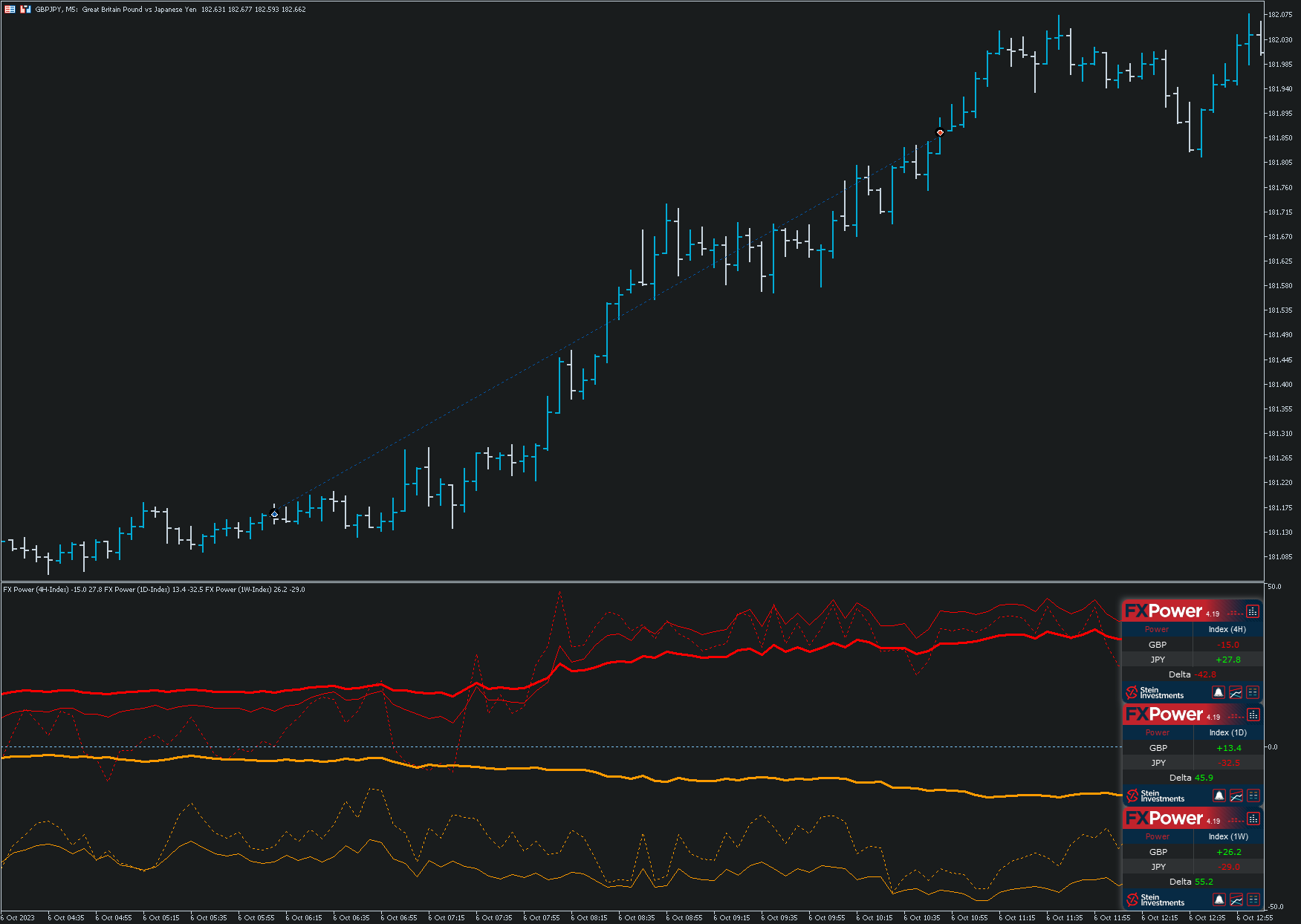

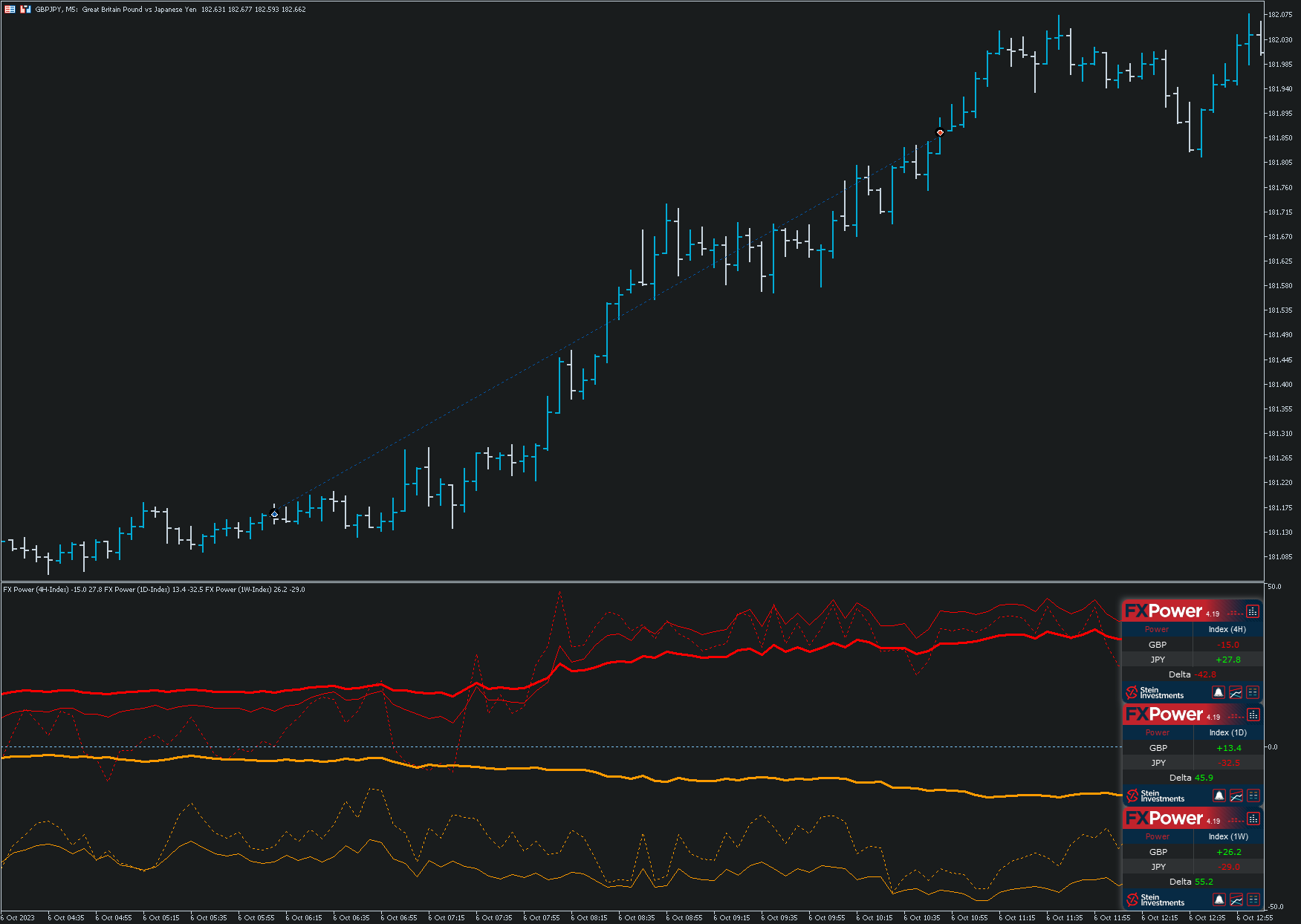

⚠️ Update on today’s Morning Briefing ⚠️

Wow! What an awesome trading day with tons of opportunities. 🤩

As written in the Morning Briefing, there has been a Breakout Setup on the CHF pairs, which we traded with 6 pairs.

Around 12 GMT+1 there was another setup on the GBP pairs, and right now, there is another one running for the JPY pairs.

That’s plenty of opportunities to let your account grow. 👍

Get more details about the Breakout Strategy at https://www.mql5.com/en/blogs/post/754377

There is currently a 25% discount on the long-term subscriptions of FX Power NG and FX Volume. Even without this discount, you’ll have your investment back in no time following our Breakout Strategy. 💪

All the best and have fun trading

Daniel

Wow! What an awesome trading day with tons of opportunities. 🤩

As written in the Morning Briefing, there has been a Breakout Setup on the CHF pairs, which we traded with 6 pairs.

Around 12 GMT+1 there was another setup on the GBP pairs, and right now, there is another one running for the JPY pairs.

That’s plenty of opportunities to let your account grow. 👍

Get more details about the Breakout Strategy at https://www.mql5.com/en/blogs/post/754377

There is currently a 25% discount on the long-term subscriptions of FX Power NG and FX Volume. Even without this discount, you’ll have your investment back in no time following our Breakout Strategy. 💪

All the best and have fun trading

Daniel

Daniel Stein

Get more details about this screenshot

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

If you like to know how to trade those breakouts, we recommend having a look at our Breakout Strategy at https://www.mql5.com/en/blogs/post/754377

Daniel Stein

Dear friends and followers of Stein Investments,

We'd like to thank all of you for your awesome support and loyalty for so many years now.

That's why we prepared a special offer for our long-term users, as seen in the illustration.

Get the latest versions of our awesome trading tools at the lowest possible price and enjoy trading with our outstanding strategies.

MT4: https://www.mql5.com/en/market/mt4/indicator?filter=Stein%20Investments

MT5: https://www.mql5.com/en/market/mt5/indicator?filter=Stein%20Investments

Have a wonderful day, everyone

Daniel & Alain

We'd like to thank all of you for your awesome support and loyalty for so many years now.

That's why we prepared a special offer for our long-term users, as seen in the illustration.

Get the latest versions of our awesome trading tools at the lowest possible price and enjoy trading with our outstanding strategies.

MT4: https://www.mql5.com/en/market/mt4/indicator?filter=Stein%20Investments

MT5: https://www.mql5.com/en/market/mt5/indicator?filter=Stein%20Investments

Have a wonderful day, everyone

Daniel & Alain

Daniel Stein

Dear users of FX Power NG,

We’re deeply thankful for all the wonderful feedback you sent us in private. 🙏

Since we are still at the very beginning of a product career with FX Power NG, we would be happy if you shared your experiences in the form of a product review.

Authentic customer feedback would greatly support our work. 💪

This is just a request and perfectly ok if you don't want to comment publicly. 🙂

All the best and have fun trading with FX Power NG.

Daniel & Alain

We’re deeply thankful for all the wonderful feedback you sent us in private. 🙏

Since we are still at the very beginning of a product career with FX Power NG, we would be happy if you shared your experiences in the form of a product review.

Authentic customer feedback would greatly support our work. 💪

This is just a request and perfectly ok if you don't want to comment publicly. 🙂

All the best and have fun trading with FX Power NG.

Daniel & Alain

Daniel Stein

If you like to know how to trade those breakouts, we recommend having a look at our Breakout Strategy at https://www.mql5.com/en/blogs/post/754377

Daniel Stein

Finally, we need to get some feedback from your side because we post many things, and don't know if this is of interest to you.

So we started a poll on our Telegram News Channel where you can decide

a) what you are interested in

b) and in which form you prefer to get your information

There are several choices possible, so please make use of it.

The more people answer, the better our future content will suit your interests.

Here you go: https://t.me/STEIN_INVESTMENTS_NEWS/862

Thanks in advance and all the best

Daniel

So we started a poll on our Telegram News Channel where you can decide

a) what you are interested in

b) and in which form you prefer to get your information

There are several choices possible, so please make use of it.

The more people answer, the better our future content will suit your interests.

Here you go: https://t.me/STEIN_INVESTMENTS_NEWS/862

Thanks in advance and all the best

Daniel

Daniel Stein

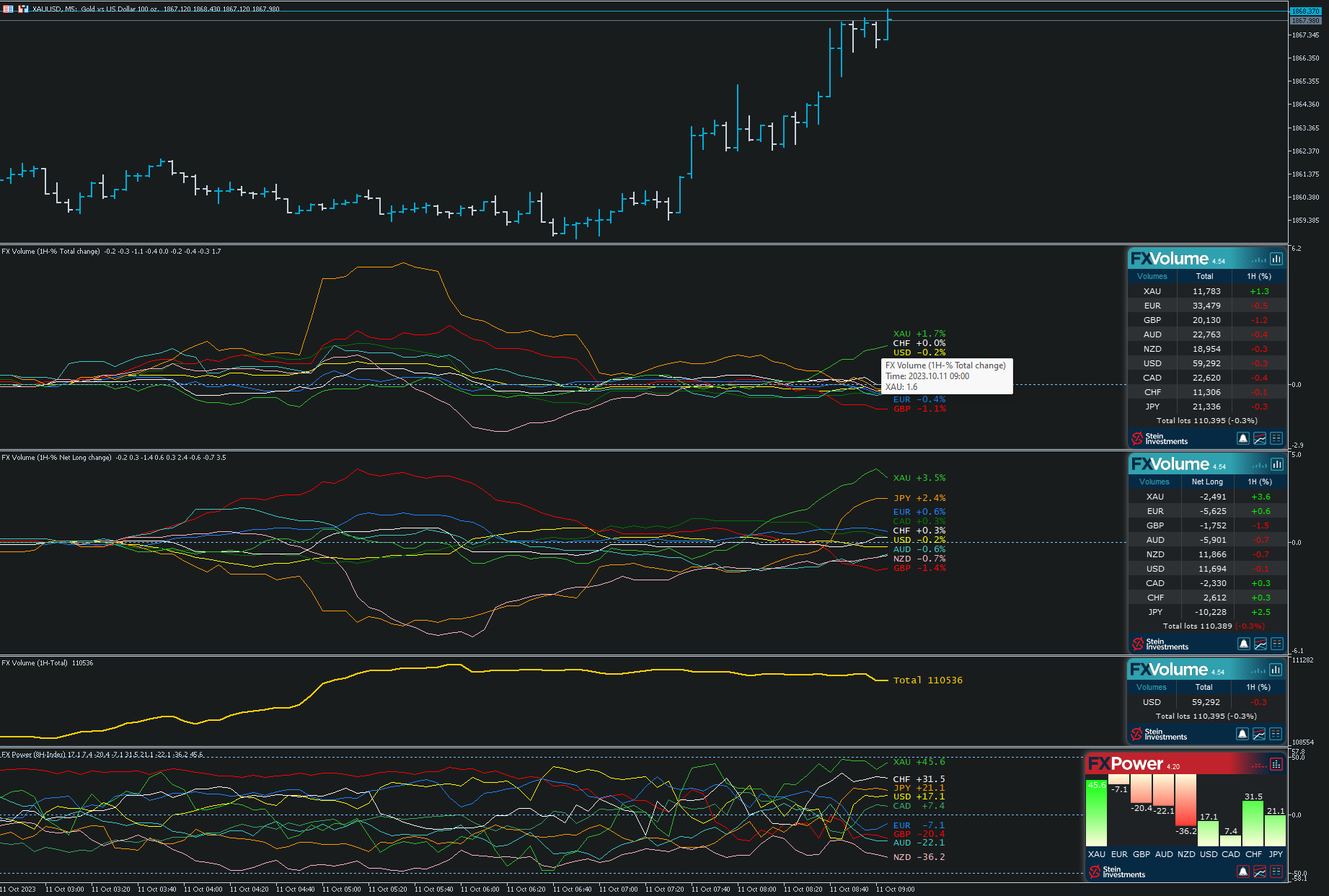

⚠️ Stein Investments Morning Briefing ⚠️

Good morning everyone,

The past few days, I've been very busy testing our manual trading strategies in the morning and working with Alain on the next SIEA updates in the afternoon.

That's been plenty of work, but the results are not just promising, they are outstanding, in both aspects, manual, and automated trading.

Our breakout strategy (https://www.mql5.com/en/blogs/post/754377) provides so many trading opportunities every single day, that you almost can't handle all of them.

Of course, not every single trade works out, but the sum of all trades provides serious profits, and one could work with, i.e. a basket close if a specific profit target has been reached.

I'll dive further into this strategy, and it's countless opportunities during the next weeks. It makes great fun, and checking your charts once every hour is easy and comfortable for full-time and part-time traders.

Attached you'll find an overview of my currently running positions this morning.

The best part is there is almost NO drawdown at all if you split the risk across so many different pairs.

And if you're happy with the achieved profits, close all trades now, and you're done for the day.

Getting 1-2% every single day will accumulate to a severe account growth in a week, a month, a year.

So if not yet done, get FX Power NG, and study our super easy Breakout Strategy at https://www.mql5.com/en/blogs/post/754377

Good morning everyone,

The past few days, I've been very busy testing our manual trading strategies in the morning and working with Alain on the next SIEA updates in the afternoon.

That's been plenty of work, but the results are not just promising, they are outstanding, in both aspects, manual, and automated trading.

Our breakout strategy (https://www.mql5.com/en/blogs/post/754377) provides so many trading opportunities every single day, that you almost can't handle all of them.

Of course, not every single trade works out, but the sum of all trades provides serious profits, and one could work with, i.e. a basket close if a specific profit target has been reached.

I'll dive further into this strategy, and it's countless opportunities during the next weeks. It makes great fun, and checking your charts once every hour is easy and comfortable for full-time and part-time traders.

Attached you'll find an overview of my currently running positions this morning.

The best part is there is almost NO drawdown at all if you split the risk across so many different pairs.

And if you're happy with the achieved profits, close all trades now, and you're done for the day.

Getting 1-2% every single day will accumulate to a severe account growth in a week, a month, a year.

So if not yet done, get FX Power NG, and study our super easy Breakout Strategy at https://www.mql5.com/en/blogs/post/754377

[Deleted]

2023.10.06

Hi, I am enjoying your daily briefings.

Just one question regarding the screenshot.

I see the floating profit is '137.49', but the sum of all of the values in the profit column is much greater. Could you please explain, perhaps I am misunderstanding something?

Just one question regarding the screenshot.

I see the floating profit is '137.49', but the sum of all of the values in the profit column is much greater. Could you please explain, perhaps I am misunderstanding something?

Daniel Stein

2023.10.06

Hi Thabit, the profit is in pips, not in currency. The total sum in currency is written bold at the bottom. Hence, the difference. You can switch between the profit views with a right-click in your trading history window.

Daniel Stein

What a wonderful morning to go for a walk with the dogs. 😊

Get more details about the Dog Walk Strategy at https://www.mql5.com/en/blogs/post/754240

Get more details about the Dog Walk Strategy at https://www.mql5.com/en/blogs/post/754240

Daniel Stein

Get more details about this screenshot

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

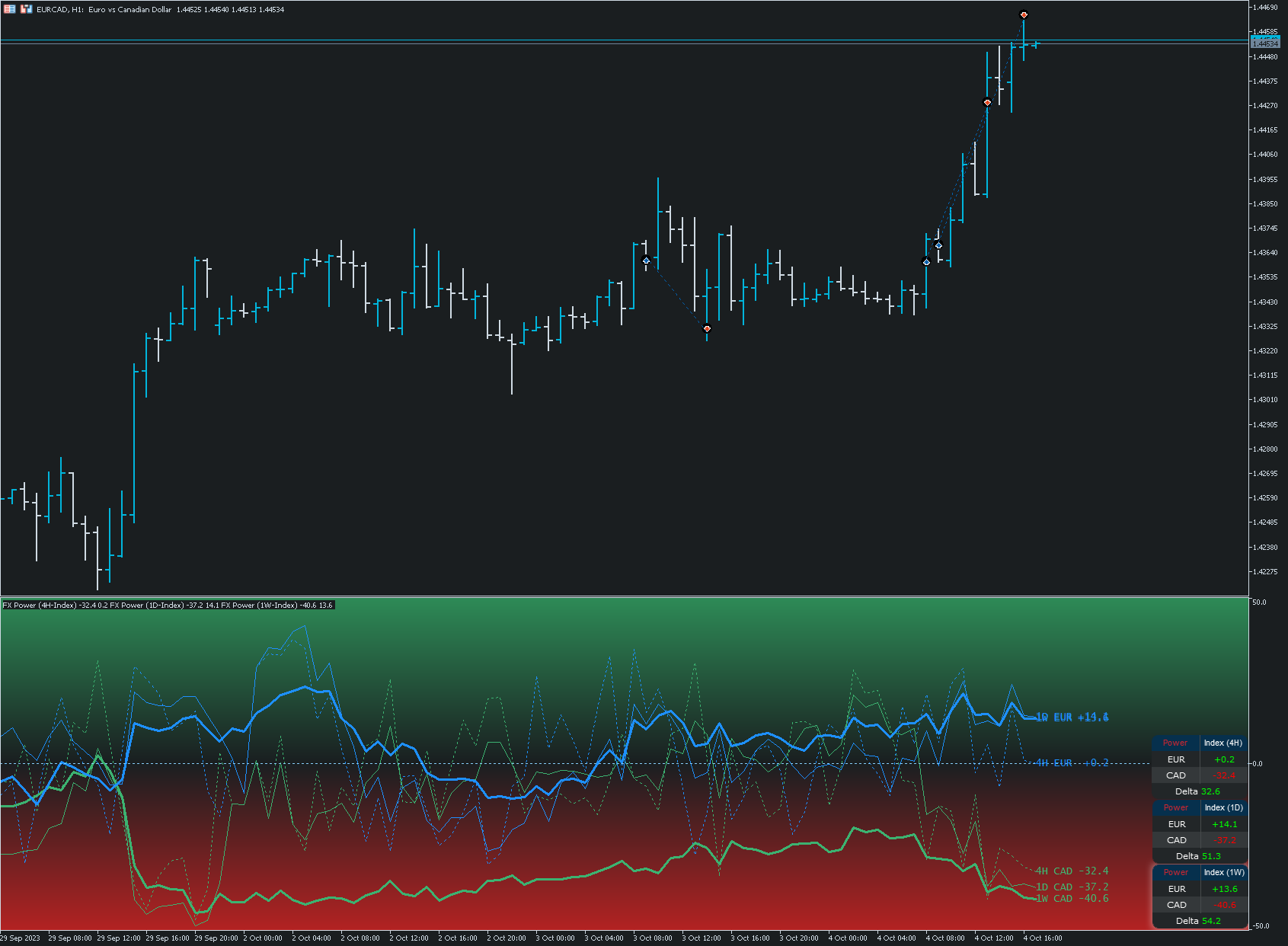

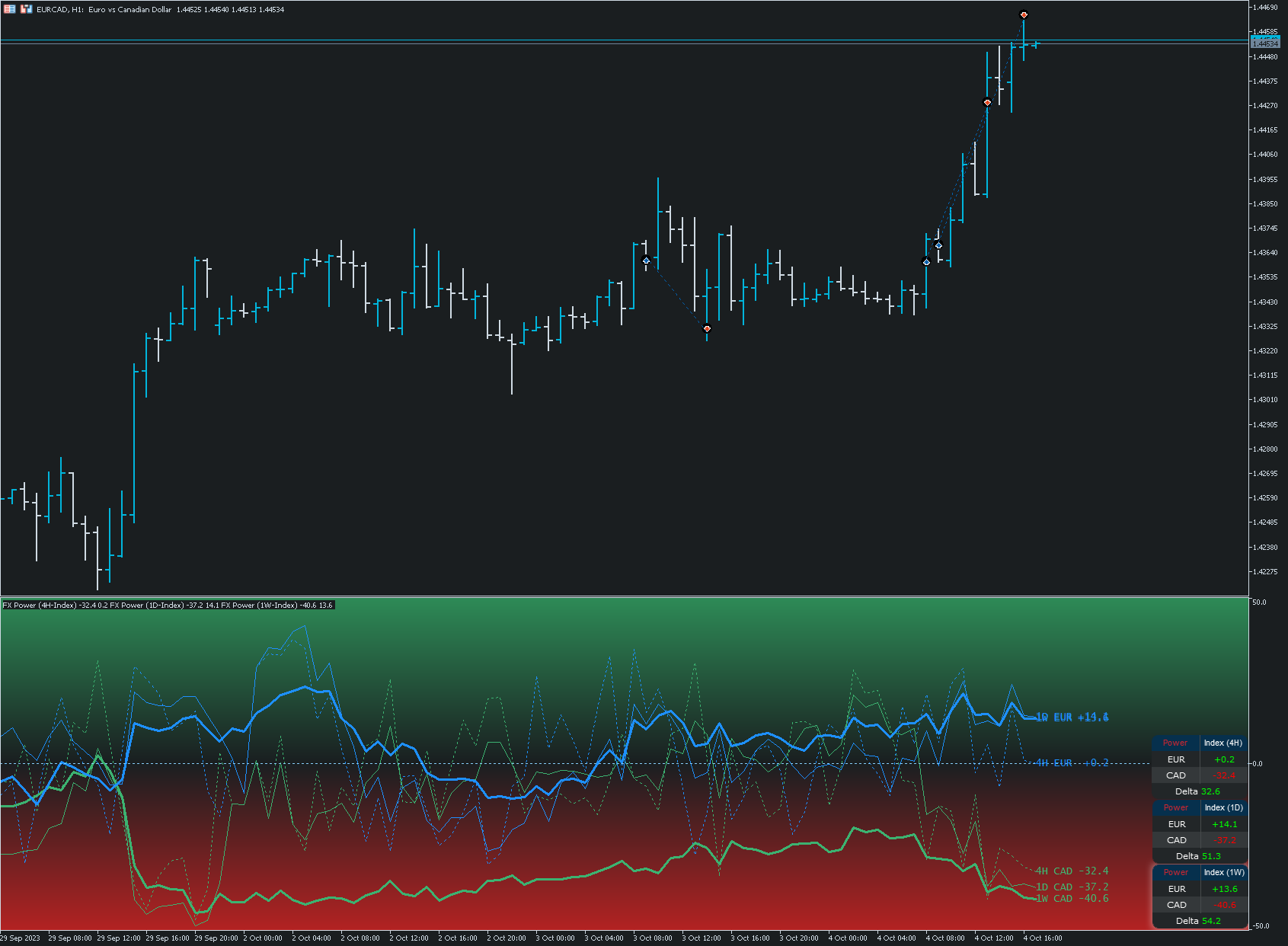

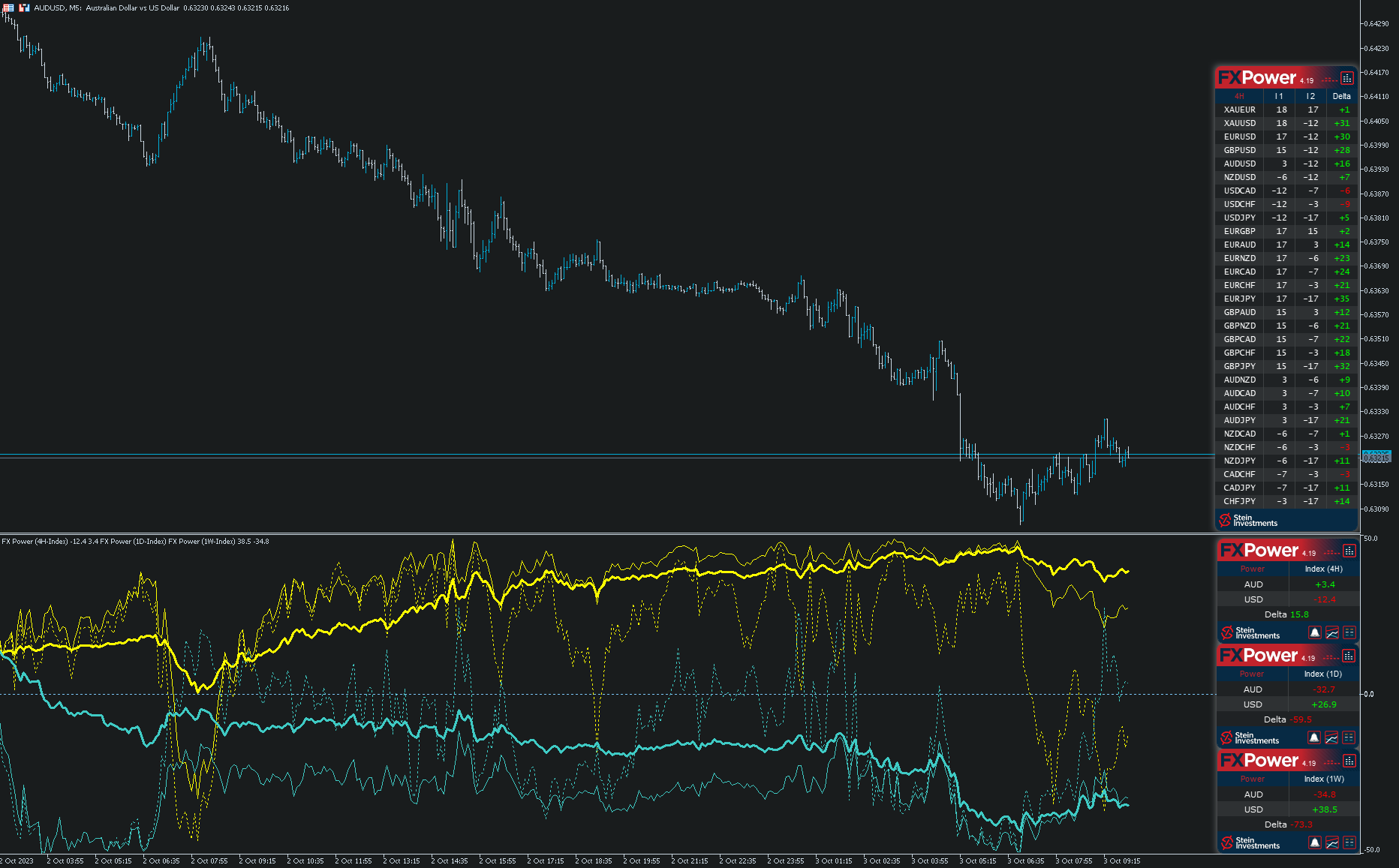

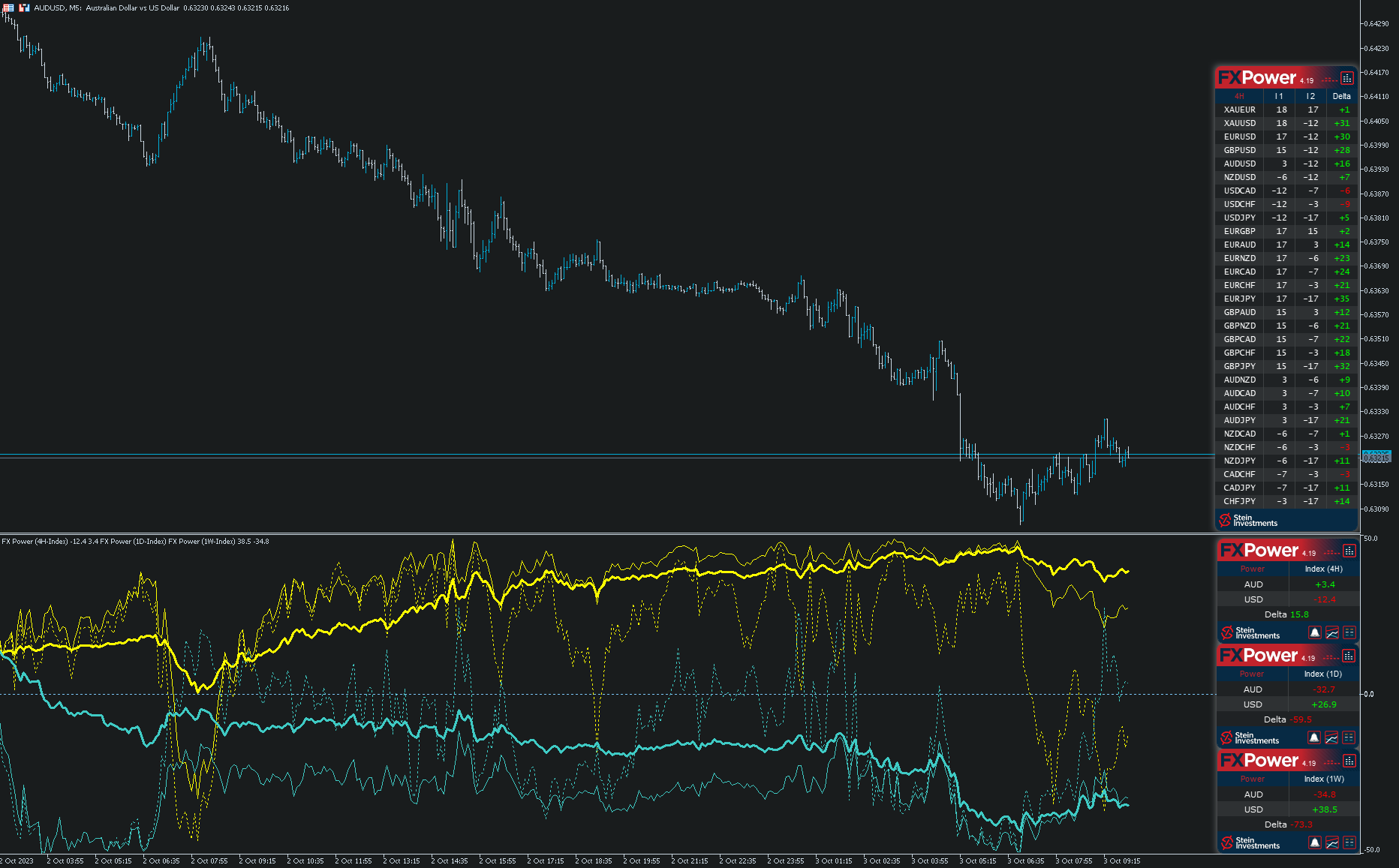

The weakness of the AUD provided some great opportunities during the tonight's Asian session and even before against the USD.

If you like to know how to trade those breakouts, we recommend having a look at our Breakout Strategy at https://www.mql5.com/en/blogs/post/754377

The big benefit of this strategy is that it suits intraday traders on M5 as well as part-time traders on H1.

All the best and have a great day, everyone

Daniel

If you like to know how to trade those breakouts, we recommend having a look at our Breakout Strategy at https://www.mql5.com/en/blogs/post/754377

The big benefit of this strategy is that it suits intraday traders on M5 as well as part-time traders on H1.

All the best and have a great day, everyone

Daniel

Daniel Stein

A very popular approach in our trading community is to combine different FX power analyses. This allows you to determine the trends of individual currencies and when to enter them best...

Share on social networks · 7

6195

18

: